The Elephant in the Room &

Weekly Market Review for March 10th 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

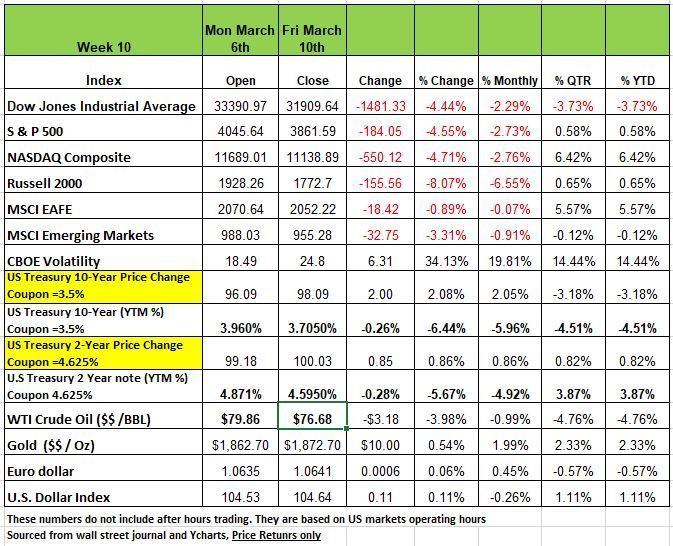

All four of the major indices fell significantly last week. The declines range from -8.07% from the Russell 2000, -4.71% NASDAQ, the S&P 500 -4.55%, and the DOW -4.44%. This brings the DOW to a -3.73% YTD, and the Russell and S&P both on the cusp of turning negative for the year. While the NASDAQ is +6.42% YTD it also has the most exposure to technology which may suffer the most on the heels of last week’s SVB collapse. We’ll get into this more later.

Last week’s decline began with Chair Fed Powell’s testimony to the senate finance committee stating that the most-recent economic data was stronger than originally forecast, suggesting interest rates will rise beyond what was anticipated. "If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes," Hinting that if the CPI numbers due this Tuesday 3/14 were hotter than expect a higher interest rate would be required.

The street was anticipating another 25 bps but quickly moved to 50 bps during his testimony. The February jobs numbers did come in stronger than expected.

Nonfarm payrolls rose by 311,000 last month, the US Labor Department said, well above the 225,000 jobs increase expected in a survey compiled by Bloomberg.

Private payrolls rose by 265,000 in February, surpassing the increase of 215,000 private jobs expected. The unemployment rate ticked up to 3.6% in February from 3.4% in January, but that came as the participation rate rose and the size of the labor force expanded. Meaning, more Americans are now being forced to reenter the workforce.

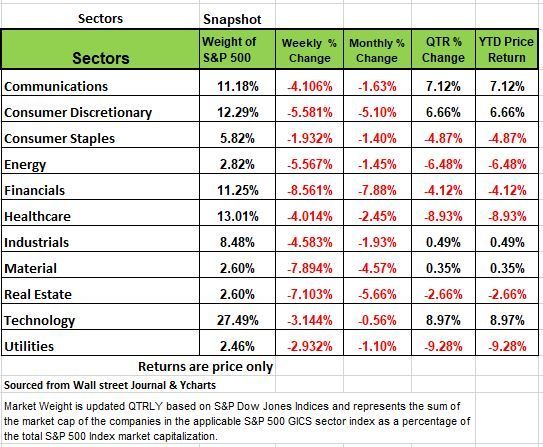

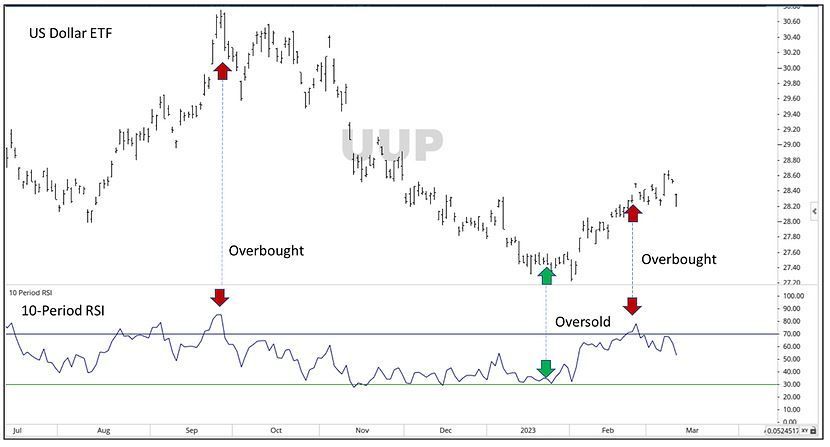

All of the S&P 500's sectors fell this week, led by the financial sector that slid -8.5% amid the collapse of Silicon Valley Bank. Followed by Materials dropped -7.6%, real estate was down -7%, consumer discretionary lost -5.6% and energy lost -5.3%.

Shares of SVB Financial Group plunged 63% this week. Which sent fear throughout the markets and leaving many depositors in fear of their money’s safety. YTD only 5 of the 11 sectors are in the black.

Treasury yields dropped significantly last week in a volatile market. On Tuesday, Fed Chair Jerome Powell said the Fed could speed up rate increases given stronger-than-expected economic data to start the year and raise rates more than expected as it wrestles with high inflation. Following the comments, the market changed its expectations for the most likely outcome at the Fed’s March meeting from a single-rate hike to a double-rate hike. Powell also told Congress that the journey back to the Fed’s 2% inflation target “has a long way to go and is likely to be bumpy.”

The two-year Treasury yield topped 5% on the news, reaching its highest level since 2007. The two-year yield also reached a full percentage point above the 10- year yield, the largest yield-curve inversion since 1981. An inverted yield curve, especially this deeply, is typically seen as a negative sign for future economic growth. Treasury yields then sharply reversed course later in the week. Yields fell in a flight to safety on news that SVB Financial Group, parent of Silicon Valley Bank, would need to raise capital after deposits fled the bank and the company sold a substantial portion of its investment portfolio at a loss. The news tempered bets that the Fed will speed up rate increases

The Elephant in the Room

Back in 2001 and again in 2008 investors and the media said that no one saw the economic trouble coming. But in 2008 several investment professionals did in fact see the writing on the wall, such as investors Michael Burry and Steve Eisman both of “The Big Short”, fame saw the obvious.

Last week collapse of Silicon Valley Bank, which is the 2nd largest collapse in U.S. history, behind Washington Mutual back in 2008, was also something no one saw coming and many are stating that it is just a one-off event. Seems like we heard that before back in 08 with Bear Sterns and Washington Mutual.

The collapse of SVB came quickly, within 48 hours, as panic induced by the very venture capital community that SVB had served and nurtured quickly withdrew its funds and ended the bank’s 40-year-run.” Something spooked the community and the health of the bank; we don’t believe it was just one issue but know that the bank was vulnerable for several reasons.

Events like this raise fear in the minds of the public, the depositors. So, let’s look at one of the issues.

Banks need to put its deposits to work, it cannot loan out all of its capital so it typically puts excess capital in to safe securities such as treasuries. Most banks do not get runs on them like SBV, so when a bank needs liquidity, it typically needs to borrow funds from another bank or the Fed (usually collateralized – normally by the bank’s bond portfolio). If the bank has reached its lending line, it must sell bonds from its portfolio.

In January of 2022, bonds had low coupon rates, the 10 yr. Treasury was 1.375% yields were 1.99% and had been like this for the better part of the last decade. The Fed, kept interest rates near zero since the 2008 crisis and then raised rates quickly, the fastest hiking spree since the early 1980s. Most economist and financial professionals did not think that the fed would make it this far. However, because interest rates were so low for so long, banks had to buy longer duration (maturity) bonds. When interest rates increase, longer duration bonds with lower coupons are the most sensitive and suffer larger price depreciation than do shorter term bonds. So that $1000 bond purchased in January of 2022 is worth $717.44 when interest rates hit 5%, a $282.55 loss per bond. SBV had about $117 billion in these treasuries out of the total $211 Billion of its assets. Now added to this equation is the run, demand for withdrawals from depositors. The bank had to take a hit almost 30% on its treasuries to satisfy the liquidity need. This put too much stress on the bank and caused its collapse.

Now the question becomes is SVB a one off situation, we are not sure but we do not believe that SVB is a loner when it comes to the value of their bond portfolios. Every banks Bond portfolio has suffered significantly o the last 12 months. For those of you that had a 60 /40 portfolio mix going into 2022 you know how much of a beating you took. But treasuries are safe if held to maturity, the question now becomes how many banks will need to liquidate their bond portfolio for cash.

If most banks have this bond problem, why aren’t there more bank solvency issues? To protect bank earnings and capital from tumbling when interest rates rise, thirty or so years ago, the accounting profession and the bank regulators set up a “Held to Maturity” classification for bank bond portfolios. Bankers could elect to put bonds in that designation, or into a separate pool called “Available for Sale.” Bonds in the former classification don’t have to be marked to market (i.e., from the purchase price, these bonds amortize or accumulate toward the maturity value). The logic is, since they are “Held to Maturity,” market prices do not matter until they need to liquidate.

Bonds in the” Available for Sale” account are regularly marked to market prices. The one caveat is that a bank cannot not “sell” a single bond from the “Held to Maturity” account. If it did, the entire “Held to Maturity” pool would have to be marked to market.

Most of the bonds in that classification were longer-term in nature (because they had a little yield when purchased during the Fed’s zero interest rate regime). As rates have dramatically risen over the past year, the market value of those bonds tanked. Remember there is an inverse relationship to Bond prices and yield. So, in SVB’s case, the losses in the “Held to Maturity” portfolio were enough to deplete its capital and cause its insolvency.

Likely, most banks would suffer a significant depletion of capital, if not insolvency, if their “Held to Maturity” bond portfolios were marked to market. The truth is, in today’s interest rate world, there is much less capital supporting the bank than what is shown on their balance sheets.

But, like any corporation, the institution survives if it has enough liquidity to continue operations. Nevertheless, this is what poor Fed policy has done to the banking system. When there is a singular goal (2% inflation) that is pursued without regard to the health of the entire system, there must be a consequence. The danger, today, is that there could be similar such runs on other small/medium sized institutions; If more loans default, or another rumor surfaces depositors especially those with more than $250K in deposits (the FDIC insurance limit) can easily become jittery, and wonder if their bank will be next. Source Economist Bob Barone PhD

The Fixed Income Problem

We have address the issues of having artificially low interest rates for over a decade a number of times in our newsletters. The problem with SVB last week is just one of the problems that comes from bad decisions over a long period of time.

If you have money in High-yield ETFS or mutual funds, beware. Junk bonds that were financed at low, fixed rates will eventually mature shortly, and weak issuers that cannot afford to refinance at higher rates will default.

High-yield defaults were delayed over the last several years as bonds were financed at low, fixed rates

The typical cycle has been delayed because of the artificially suppressed rates, but if the economy is struggling with high rates and weak GDP growth, could result in the highest default rates of all time.

There is a lack of experience among younger investors with a rising-rate environment which fuels the danger in high-yield debt. According to Jeffrey Gundlach there is a significant rise in defaults with CCC loans, which are floating-rate bonds, and interest rates on them have been ratcheting up as the Fed has raised rates.

Lending standards are going up, and defaults are just starting to rise. If you have any of these high yield fixed income vehicles, you might want to reconsider how much you have in them. These Portfolios vehicles need to upgrade in credit quality of their portfolios, if not too late.

Warnings about the rising federal deficit.

We are finally getting to a moment of awareness on the Federal deficit and just how out of control it is. The Social Security trustees have warned its system will run out of money in the next nine years, and that forecast does not include a recession. The problem with Social Security must be addressed by 2028. One of the major causes of the Social Security problem is more due to a shift in our culture over the past 50 years. Fewer younger Americans are having families or starting later in life and having fewer children. This means that the system cannot support itself just from a population perspective. In addition, medical advances are allowing people to live longer and that is also putting a strain in the system.

Getting back to the budget the Federal government has unfunded liabilities are 10 times GDP and deficits have gone from 4% to 6% of GDP each year since the 1970s. This is a problem and if we think we are invincible we may get a very painful lesson handed to us

The debt ceiling debate will end as it always does with the sides “yelling at each other” as it always does and then the problem will be avoided until the next time.

This is a big problem; it is no longer your grandchildren’s problem. It is our problem. Our Generation will feel the consequences of irresponsible politicians.

The fiscal responses to recessions have worsened the problems with the deficit. In the 1990s, there was no fiscal cost to the response to the recession; but in this century, the costs have been profound, as shown in the graphic below:

Federal interest payments were below $1 trillion until the pandemic, now they’ve “exploded.” As the Fed raises rates, those payments will go straight vertical. Last weeks failure of SBV sent investors to Treasuries, prior to Friday the yield on the 2 year was close to 5%, then fear spiked demand and sent Treasury prices up and yields down as of this writing the 2 year is now 4.33% almost a 70-basis point drop.

A Technical Perspective

Last week’s decline was mostly driven by financial stocks. The Financials sector, which had previously been one of the higher ranked US sectors, on a risk adjusted basis, experienced “whoosh” in volatility. According to the Canterbury Volatility Index, Financials went from CVI 80 to CVI 103 in a matter of four days. That is quite the spike.

Equally surprising, the S&P 500’s largest market sector, Information Technology, did not experience the same rise in volatility. Last year, technology stocks had the highest level of volatility. Heading into this year, volatility for the tech sector index had declined from CVI 195 (in November 2022) to CVI 126, which is a significant, positive development. Even with last week’s broad market decline, the CVI of the technology sector did not increase. Given large weighting in several indexes, that is a good sign for the broad markets, specifically the Nasdaq and S&P 500.

Look at the chart below, which shows the Technology sector ETF (XLK). Currently, the sector is (1) sitting on horizontal support, (2) above its 200-day moving average, and (3) has declining volatility, which was stagnant last week.

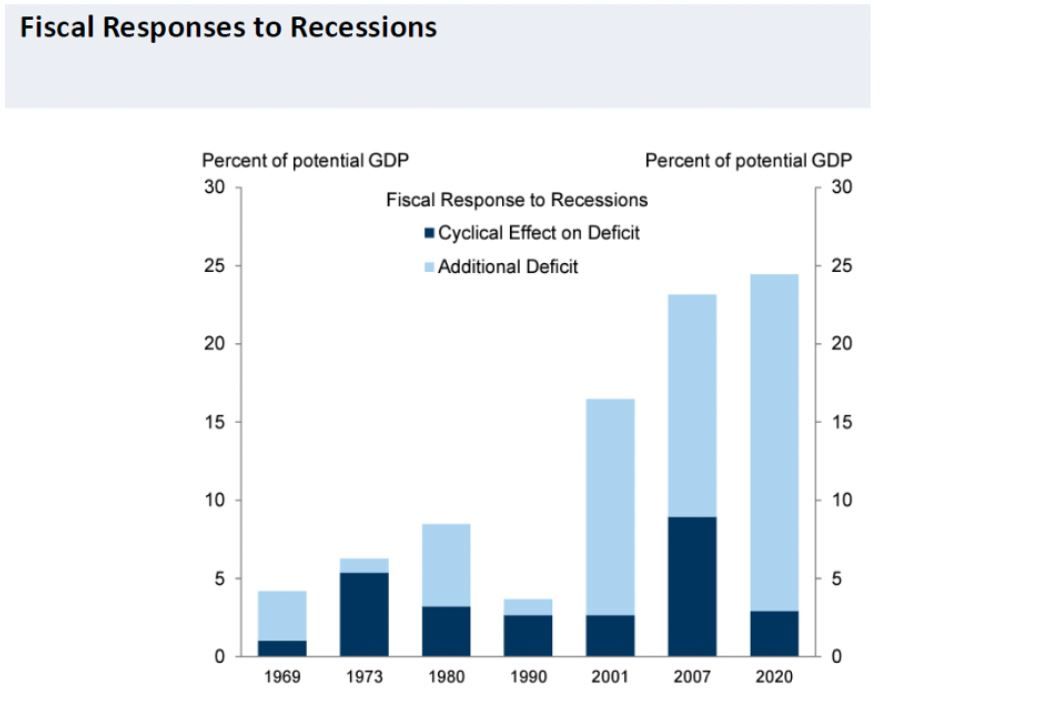

International stocks continue to lead the equity markets on a risk adjusted basis. This has been a theme all year and particularly true for most European stocks. Part of international equity strength comes from US Dollar weakness. An international stock or ETF’s return comes as a function of (1) performance and (2) currency exchange. A weak dollar contributes positively to an international stock or ETF.

The chart below shows the US Dollar. The lower half of the chart shows the Dollar’s RSI (relative strength index which measures overbought and oversold conditions).

When the RSI line rises above the upper blue line, the Dollar is overbought. When it dips below the lower green line, it is oversold. You can see that prior to 2023, the Dollar had been near oversold conditions for a while. Then, in late February, become oversold. Now, the Dollar is experiencing a sell-off in the short-term. A weak dollar bodes well for international equities.

The market saw volatility last week, and more importantly, saw some rotation. When it comes to experiencing market fluctuations, the first step is to not become emotional and attempt to make short-term, sometimes irrational decisions, when dealing with an irrational market. Do not want to panic sell when the markets become emotional, nor do you want to panic buy something that could be seen as a falling knife. Stocks tend to trend. A stock that has been dropping is likely to continue its decline.

It is also important to pay attention to market rotations. As securities ebb and flow together, some will begin to show more favorable characteristics. While markets declined, technology stocks showed positive relative strength. International equities continue to show strength.

If volatility continues to climb, and prices drop, more “defensive” sectors or asset classes (like inverse securities) will rise in rankings lists. A security like Inverse Real Estate has been highly ranked recently and has performed well during a declining market.

The most important aspect of dealing with volatility is maintaining a consistent portfolio management philosophy. It is important to adapt your portfolio’s holdings to deal with new and existing market conditions. As volatility rises or falls, the portfolio should adjust to make diversification more effective. The goal is to maintain consistent portfolio volatility, limit the number of portfolio “outlier days” in order to move in concert with everchanging market environments- bull or bear. Source Brandon Bischoff

The Week Ahead

When a major financial event like the collapse of SVB happen fear tends to control the markets. There was a lot of work being done over the weekend to determine how to fix the problem. Depositors are said to be protected by the Treasury, even though FDIC insurance is capped at $250K per same titled account. So, most of the exposure is with businesses that hold more in those account to meet payroll and operating expenses. As the situation continues to unfold and the markets get more clarity so will the direction of the market.

CPI and retail sales are on the economic calendar, along with the European Central Bank’s monetary policy statement. If Tuesday’s U.S. consumer inflation numbers stay stubbornly high it opens the door for more aggressive rates hikes, even with last week’s stunning developments in the financial sector. U.S. producer prices will be released the next day along with retail sales, which will also impact Fed policy as consumer spending has ramped up this year.

Still, some believe recent economic strength can be attributed to seasonality, and disinflation and slowing growth may return. Other U.S. events of note include regional manufacturing surveys, consumer sentiment, and earnings from transportation bellwether FedEx. Overseas, the ECB has been playing catchup relative to the U.S. and is set to raise rates by 50bps on Thursday, with the terminal rate now estimated above 4%.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/