Anatomy of a Crisis

Market Review from week ending March 24th, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

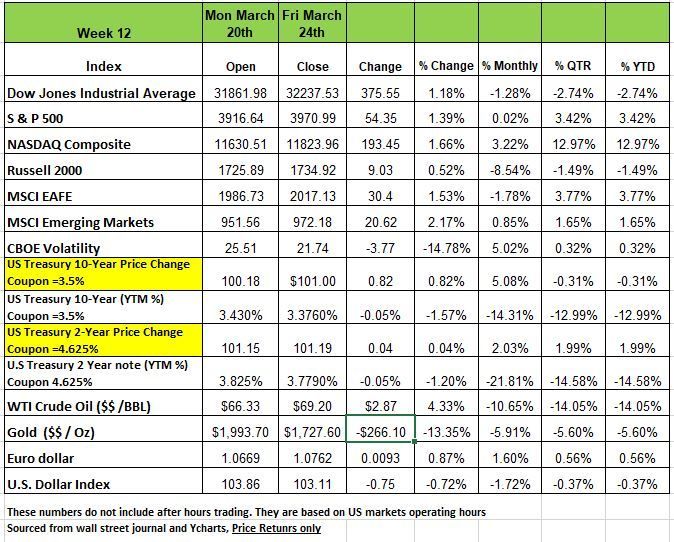

All of the major indices were up last week with the NASDAQ posting 1.66% increase followed by the S&P with 1.39% the DOW with 1.18% and the Russell 2000 with .52%

Much of the upward movement was led by the communication services and energy sectors, as comments from the Federal Reserve's Federal Open Market Committee sparked hopes for a slower pace of rate increases.

The weekly climb came as the US central bank's Federal Open Market Committee on Wednesday raised its benchmark lending rate by 25 basis points, as expected, and reaffirmed its 2023 median rate outlook at 5.1%. However at the same time Powell was holding his press conference Treasury Secretary Yellen testified in front of the Senate Appropriations Committee and commented that not all bank depositors would be insured.

This sent the markets into a nosedive right before closing. The following day she walked back her remarks which gave some relief to investors.

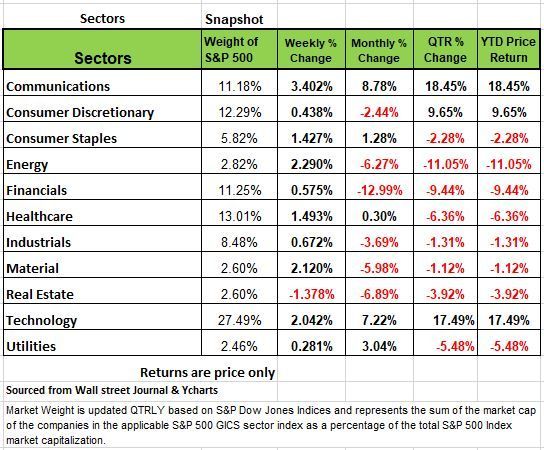

By sector, only Utilities were in the red, communication services had the largest percent increase of the week, up 3.4%, followed by a 2.3% climb in energy, a 2.1% rise in materials and a 2.0% increase in technology. Other modest gainers included health care 1.49%, consumer staples 1.42%, industrials 0.67%, financials 0.57% and consumer discretionary 0.43%.

Inflation is no longer headlining the news it has now shifted to the back burner as the banking crisis and its potential second and third level effects on the economy dominate the headlines. The focus has abruptly shifted from how high the Fed’s terminal rate will be to how quickly they may have to cut rates to prevent financial instability. The FOMC raised the target range for the federal funds rate by 25 bps to 4.75—5.00% in what markets interpreted to be a “dovish” hike. The FOMC removed the reference to “ongoing” hikes in its statement and instead wrote that, “additional policy firming may be appropriate.” We are finding ourselves at a point where everyone is trying to interpret Chairman Powell comments based on the tone of his voice to his body language.

This interpretation may just be a sign that we are so desperate and fearful that we are now making assessments based on subjective observations.

U.S. Treasury yields tumbled after the Fed raised rates and the markets got with conflicting messages by Yellen mid-week who held a separate conference at the same time as Powell. The two-year Treasury note yield ended the week near 3.78% after having peaked above 5% at the beginning of March making it the fastest drop in the last 15 years. This is happening because money is flowing to the treasuries for safety driving yield down. Fear and lack of confidence are signs we are in for a rough ride.

Consensus FOMC projections point to a peak rate of 5.1%, but there is considerable conflict as some Fed officials see rates going even higher to combat stubbornly elevated inflation and the strong labor market. However, fed funds futures are forecasting rate cuts starting as early as June. This seems like the markets are challenging the Fed.

In other news, U.S. flash PMIs surged in March as demand improved and new orders expanded, further complicating the Fed’s battle to bring inflation down. A dip in mortgage rates strengthened February’s U.S. housing numbers. New home sales rose 1.1% MoM, while existing home sales jumped 14.5% despite a very low supply.

Internationally, after UBS agreed to buy Credit Suisse earlier in the week, concerns spread to other European banks. ECB President Lagarde tried to reassure investors but shares of Deutsche Bank sank Friday as its credit default swaps unexpectedly jumped. The Bank of England raised rates by 25bps after UK inflation reversed recent declines, expanding to +10.4% YoY in February. Germany’s manufacturing PMI plunged to a nearly 3-year low in March, while the broader Eurozone saw services continue to compensate for lagging industrial performance. Finally, Japan’s core consumer inflation slowed in February largely due to government energy subsidies, as high food and necessities costs persisted.

Anatomy of a Crisis

Nothing falls apart over night, it just may become known and surprise you over night. For example, eating one Big Mac does not put your health at risk but eat one for every meal and eventually it will have consequences. The financial challenges we are experiencing did not just start with Silicon Valley Bank, nor did it begin in 2008, it started years 25 years earlier, back in 1998, when the Glass-Steagall Act a depression era rule was broken. This happened with the merger of the Citi group bank and Travelers insurance company, creating a financial conglomerate.

This merger had a significant impact on the industry, because it plainly violated the Depression-era Glass-Steagall Act, which separated commercial and investment banking and barred banks from owning insurers. The rule was created for a reason, based on the lessons learned. But dealmakers had been chipping away at Glass-Steagall for several years, and once repealed it now allowed commercial banks to extend into investment banking activities. It was here that all of the deals started to happen and the formation of the monster banks.

A week after the Citi-Travelers deal, the merger between Nations Bank of Charlotte and BankAmerica of San Francisco was announced to create what is now Bank of America. This was the final nail into the coffin of another guiding principle of post-Depression financial regulation, which fractionalized the system with strict rules against inter-state banking. Prior to the change, Banks and insurers were regulated at the state level and required mostly to stay in state. This system was unlike other developed countries. Most of these institutions were far too small to create a systemic crisis if they failed, everything was spread out. The scale meant that it wasn’t too expensive to provide insurance for depositors, or for examiners to spot if something was going wrong.

We admit there was a need for expanding or changing the banking system back them, companies such a GM or GE were so big that no one bank could address their needs especially on loans, since loans could only be made as a percentage of deposits. No one bank could attract enough depositors to service a large company. So, the US started following a lead set in Europe, where banks had long operated as “financial supermarkets,” and each country was dominated by a few huge champions.

Within days of the BofA and Citi deals, the merger of Union Bank of Switzerland and Swiss Bank Corp. to create what is now UBS was completed. These behemoths didn’t fare well during the Great Financial Crisis, as many had filled their books with toxic US mortgage debt. From 2010, their continuing difficulties created an acute crisis in EU sovereign debt. Bulking the banks up to giant size, was thought to deliver economies of scale and greater profitability, but instead it led to a collapse in confidence in the entire sector. In the excitement of 1998, European banks traded at five times book, while US banks topped three. The Lehman collapse brought them down to below their book value, where the European banks have remained ever since. The crisis that emerged over the last few weeks has now dragged US banks back below their book value.

In the wake of the Global Financial Crisis (GFC), politicians thrashed out watered-down versions of the Depression-era rules. Instead of Glass-Steagall, there was the “Volcker Rule” named after the former Fed chairman Paul Volcker, who was advised the Obama administration at the time. It aimed to stop deposit-holding institutions from proprietary trading or investing in or sponsoring hedge funds or private equity. Unfortunately, It became very complicated and has since been diluted.

In the UK, Sir John Vickers headed a commission that spearheaded the concept of “ring-fencing” requiring retail banks to be kept separate from corporate and investment banking under the same roof. The Basel III agreement required banks to be more capitalized.

In the US, the Dodd-Frank legislation forced any bank with assets above $50 billion to undergo extra scrutiny and regulation. That threshold was raised to $250 billion in 2018, which spurred several banks whose assets had been just below the old threshold to embark on a big expansion. Silicon Valley Bank was just one of them.

After the last couple of weeks, it’s fair to say that the post-GFC attempt to fix the mistakes of 1998have failed. Glass-Steagall had few political defenders by the time of its repeal, mostly because the politicians did not fully comprehend the foundation behind the law and insight to understanding the ramifications of another financial collapse.

Resurrecting Glass-Steagall isn’t going to be easy and that alone will not fix the problem. We live in a different world now and the way we transact has changed dramatically since the 1930’s. Splitting banks into smaller units that can be allowed to fail also needs to happen and will come with some pain. Something politicians think they can avoid but cannot. Smooshing banks together proved much harder and less profitable than projected, and the implementation risks in breaking them up will not only be challenging but financially dangerous. But the only other solution seems to be broader government nationalization of the industry. This seems to go against the core fundamental concept of a free capitalized economic system.

There was an opportunity back in 2008 to clean the system but unfortunately most politicians seem to be more concerned about band aid solutions so that they can “kick the can down thew road” to the next administration, which just allows for the problem to grow and get more out of hand. We want to be very clear that piecing together an adequate new model that restores the good parts of the Glass Steagall act will be nothing short of difficult and tedious, which could establish a new system that nobody has thought through. Which is what happened in 1998. Any new set of regulations is going to require compromises, and must be based on the technicalities of banking, rather than ideology. What are the chances of a good and open political debate leading to a durable model like the one of the 1930s? In this political environment, we think highly unlikely.

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

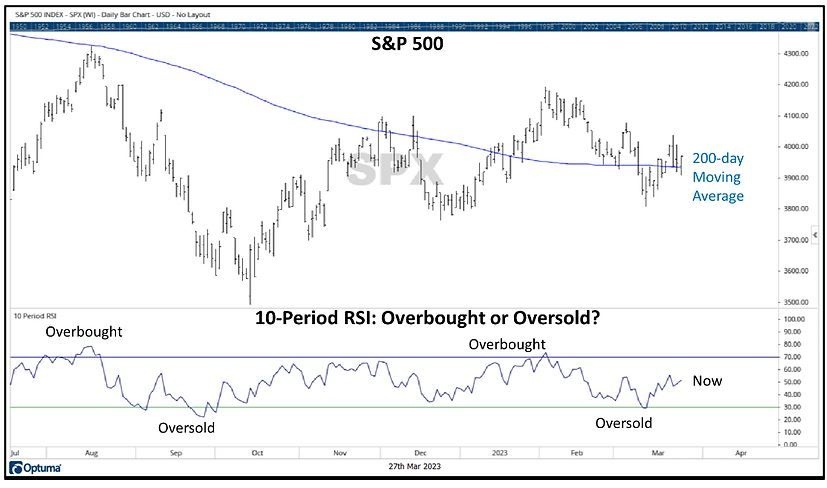

The S&P 500 continues to hover around its 200-day moving average. Moving averages can often act as points of support or resistance. The S&P 500 broke above and rallied above its 200-day moving average, in January of 2023 for the first time in 12 months. It remained above the moving average for a few weeks, before the index dropped below that mark temporarily, then bounced back above the threshold last week.

The chart below shows the S&P 500 index, its 200-day moving average. The lower half of the chart shows the overbought/oversold conditions for the S&P 500. When the blue line crosses above the top horizontal line, the index’s price has gone up too fast (“overbought”). When the blue line crosses the bottom horizontal line, it means that the price has dropped too fast and is now “oversold.” Markets typically correct at these points

Market Rotations

The technology-related sectors (Info Tech & Communications) continue to lead the other nine US S&P 500 sectors in risk-adjusted relative strength. Financials’ and Real Estate round out the bottom of the sector rankings.

From a global perspective, European stocks are still leading the domestic equities on a risk-adjusted relative strength basis. The news relative to Credit Suisse caused a scare in many European indexes. Now, it is starting to look increasingly likely that this was just a one-day blip. Both the EAFE index and Euro Stoxx 50 index have returned to the price levels that they were at prior to the Credit Suisse news breaking.

It is no secret that bonds had struggled mightily in 2022. Long-term bonds, 20-year treasuries, are currently in a sideways trading range, with a lot of overhead supply to overcome. There are a lot more investors that have wanted to get out of bonds than those who wanted to buy them. Looking at the Treasury Bond ETF (TLT), the fund has trended sideways for the last few months. This follows a significant, -40% peak-to-trough decline that began back in 2020.

Overhead resistance is a “psychological” point of contention for investors. At the point of resistance, individuals may think “now is my time to get out before another decline.” At a point of support, the opposite occurs, and investors consider the pricing level as a potential entry point.

The Week Ahead

This week the main economic event will be the Fed’s preferred inflation gauge on Friday. Last month’s core PCE index ticked up to 4.7% YoY, but with consumer spending expected to have slowed in February, the Fed will be looking for a drop in price growth. Australia, Germany, and the Eurozone will also release consumer inflation figures during the week. In the U.S., other events on the calendar include consumer confidence, the final reading of Q4 2022 GDP, trade balance figures, and pending home sales. Overseas, Germany’s business and consumer sentiment along with China’s PMIs round out the economic docket.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/