The Employment Paradox, More Inflation & Other Economic News

for the Week Ending July 30th 2021

Don’t throw out your masks just yet! Mask mandates are now a reality in many parts of the country. That can’t be good for economic growth in Q3. The first pass at Q2 GDP came in light, with growth of +6.5%, the consensus was north of 8%. Despite that disappointment, markets seemed to like the number.

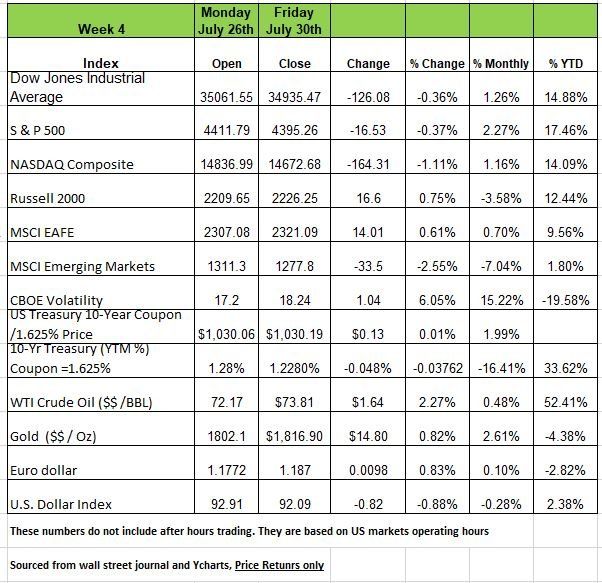

U.S. equities had a tumultuous week but ended largely intact. Investors weighed mixed earnings reports, percolating inflation figures, and rising COVID-19 cases attributed to the Delta variant. 3 of the 4 major indices were down with the Nasdaq Composite slipping -1% after Amazon’s first EPS miss in 3 years. The Dow and S&P500 finished slightly lower just under ½ of a percent, but still in all time high territory The Russell 2000 and the S&P500 Equal-Weight Index both gained ground as value outperformed growth.

Seven of 11 S&P sectors advanced as commodities rebounded, with basic materials rising almost 3% and energy posting nearly 2% gains, while consumer discretionary, technology and communications each fell around 1%.

The U.S. GDP report highlighted how much the economy is struggling to readjust to the new normal. Second quarter growth accelerated by a robust 6.5%, but well below estimates of 8.4%, as some sectors are held back by supply constraints, while others stress to recover from the pandemic

Treasury yields dropped slightly over the course of the week (prices rose, yields fell) as the Federal Reserve met and kept its target range for the fed-funds rate between 0 and 0.25%. Investors think that the central bank will keep rates unchanged and asset purchases will remain at $120 billion/ month. Fed officials will continue to monitor whether the economy has progressed enough for tapering of future bond purchases.

Fed Chair Powell said that they still have not agreed on timing of raising interest rates but that it was still a ways off. He also reiterated that the recent high inflation readings were tied to the sectors of the economy that reflect reopening and price pressures do not appear to be spreading to other areas of the economy.

The Employment Paradox

If we haven’t given you enough commentary on jobless market perhaps this segment will give you a different perspective.

One question so many are asking is “Why are there plenty of jobs and still so much unemployment”? It’s one of the most vexing paradoxes of the pandemic is the high level of unemployed and the abundance of unfilled jobs throughout the country. Basic economics taught us that huge demand cannot exist simultaneously with and excess of supply. We have seen this with products and one would think the same application holds for humans. At some point the supply and demand curve should cross on the graph, but it’s not and this seems to be a bit of a conundrum in this environment. While there are many theories, ranging from the lack of affordable child care, to fear of the virus to the generous unemployment subsidy from the fed, the bottom line is that Americans are not motivated to get back to work.

Another theory is what labor economist refer to as the “reservation wage” it’s the minimum paycheck someone would accept for a new position. It is actually a gauge that the NY Fed tracks. Its is latest survey in march the mean annual reservation wage was $71,403 a surprisingly high number to lure someone into a new job that is up 15.66% from a year earlier. Again, during period of high unemployment, the reservation wage would be much lower not higher, but this anomaly can also be that, so many are out of work or left the workforce that they have used the pandemic to reevaluate their life work priorities. Maybe many Americans are learning to be living with less and trying to find that work/life balance. Perhaps we will find the answer in a few months. https://www.barrons.com/articles/us-unemployment-labor-shortage-fed-51627664723?mod=hp_LEAD_1_B_3

Inflation

The idea that the inflation we are currently experiencing is somehow “systemic” is still playing well in the financial media. At the press conference after the last Fed meeting (July 27-28), Chair Powell, while vague on dates and determinants of Fed policy actions going forward, was insistent (and consistent) that the Fed still sees the current inflationary bout as “transient.”

On Friday, July 30, the Fed’s most closely watched inflation indicator, the Personal Consumption Expenditure (PCE) price deflator was reported as +0.5%, slightly lower than the +0.6% consensus expectation. The “core” reading (less food and energy) was +0.4%. On a Y/Y basis, headline was +4.0% with “core” at 3.5%. As indicated above, this is the Fed’s primary inflation guide.

Our analysis indicates that the four-month spike in the PCE index is, indeed, transient. From an economic growth point of view, the ending of the moratoriums on rent, mortgage payments and payments on student loans can only be a negative. Where people spend their money will be on paying down debt.

CA’s employment data has rapidly deteriorated. The State accounts for approximately 15% of the country GDP. We don’t know why just yet it may be because of the Delta Variant of the drought effecting crops but its pretty clear that economic growth will be severely impacted.

Economic future

There is a lot of data out there that convinces us that GDP growth will be flat over the next six months. First remember that the increase in GNP was mostly due to a rise in prices, YOY, production was not a major contributor to GNP and while we know that these increases in prices were due to supply issues, we need production to keep the economic wheel turning

Housing: looks to have peaked. Remember, despite levels, if M/M data are lower, growth is slowing.

But this could also be an inventory issue,

New Home Sales for June were 676K down about -12.1% from the 769K May numbers initially reported however the revised numbers came in at 724K). The consensus estimates, of course, use the latest available data thought that a 3.5% rise from 769K to 796K was in the target but as it turns out an overly optimistic number

Existing Home Sales, while slightly higher in June at 5.86 million units (annual rate) than in May (5.78 million), still represented a -26% fall for the last six months. The reason, as everyone knows, has mainly to do with rapidly rising prices with median prices up +23.4% Y/Y and at a hellish +38.0% annual rate over the last six months.

As a result, mortgage loan applications are off -21% in 2021.

Construction: Both residential and non-residential construction are negative M/M with non-residential looking to be in a recession of its own.

Supply Bottlenecks: Indications of supply delay times and backlog data from the latest regional Federal Reserve Banks (KC, Richmond, Philly, NY, and Dallas) show significant easing in the supply chains.

Moratoriums: The eviction moratorium supposedly expired on Saturday, July 31. There are eight million renters (15% of the total) that are behind on rent and 1.55 million mortgagees (2.9% of active mortgages) are delinquent. Payments on student loans, too, have not been required for some time.

Let’s consider the best possible outcome: mortgages get extended payment terms, and renters are required to pay increased rent until the back rent is repaid (no evictions). In both cases, consumers are left with fewer net dollars than they had when the moratoriums were in effect, as they have to begin again to make mortgage and (higher) rent payments. This certainly can’t be a positive for the economic growth scenario.

Delta-Variant: We noted at the top of this blog that mask requirements have been re-imposed on a significant portion of the population. The accompanying map shows the U.S. regions most impacted. This is just another negative for economic growth going forward (but perhaps a positive for Amazon!).

Source: Bob Barone

There’s an unemployment cliff coming. More than 7.5 million may fall off or find a job

So, while the Federal unemployment programs is poised to end Sept. 6. It doesn’t appear Congress will extend them again. This means that roughly 7.5 million people will either go back to work or lose benefits entirely, not including Fraud.

Those eligible to continue collecting state unemployment insurance might receive weekly payments past Labor Day. They would get $300 less per week. While the media will start fueling misinformation that millions of jobless Americans will lose Covid-era income support in about a month’s time.

There doesn’t seem to be an urgency among federal lawmakers to extend pandemic benefit programs past Labor Day, the official cutoff date. Many think that the government should put a large portion of the population on the payroll

There’s almost nobody talking about extending the benefits in Washington. Yes, Millions of jobless Americans are poised lose the extra $300/week benefit but that will hopefully motivate many to accept a less than perfect job and become a productive member of society. There will be a few cases of those that will not find work as some parts of the country have lost significant jobs becasue of business closures, but one can always reinvent themselves and adapt to the situation.

The data and trends are signifying a much slower 2nd half of 2021, and how the markets will react to this is anyone’s guess. We do think along with many others that the valuation of the markets right now is extremely high and we feel a pull back is inevitable, especially when Government spending allowance is gone.

The states that have opted out of the Federal Governments subsidy have made greater strides in reducing the unemployment rate and with just over a month left until the end of the subsidy, the next 30 days will give us a clearer picture of where the economy is heading. We do believe that many of the numbers may be distorted because of Fraud and from those that decided to retire but are taking the benefits with little to no intention of returning to work. The chart below shows the states that opted out of the Feds support and how they are doing with bringing people back to work

With the Federal supplement the average person has received $641/week with the supplement or some $31.2K a year, according to Labor Department data. (Payments from each state vary significantly— from a low of $177 a week in Louisiana to $504 a week in Massachusetts, on average, of course the cost-of-living range is drastically different as well. Source: https://www.cnbc.com/2021/08/01/an-unemployment-cliff-is-coming-more-than-7point5-million-may-fall-off.html

Week Ahead

Labor market headlines will remain in focus after the Fed’s comments, and with jobless claims stubbornly stuck at the 400,000 level, investors will welcome additional data this week with the U.S. ADP employment report on Wednesday, followed by the monthly non-farm payrolls report on Friday. Keep in mind that 400,000 IC number is recessionary territory, not recovery

U.S. ISM PMIs will also refresh, with manufacturing on Monday, followed by services on Wednesday. Two more global central bank meetings await. The RBA may reverse its recent tapering plans amid continued lockdowns in Australia, while the BOE will consider hot inflation figures and a surprise drop in new UK coronavirus cases.

While many of the big names have already reported, Q2 earnings season is only halfway over, and with S&P500 YoY revenues up a record 21% and earnings up 86%, expectations for Q3 and Q4 are building.

Major economic reports (related consensus forecasts, prior data) for the upcoming week include Monday: July Final Markit US Manufacturing PMI (63.1, 63.1), June Construction Spending MoM (0.4%, -0.3%), July ISM Manufacturing (60.8, 60.6); Tuesday: July Factory Orders (1.0%, 1.7%), June Final Durable Goods Orders (n/a, 0.8%); Wednesday: July 30 MBA Mortgage Applications (n/a, 5.7%), July ADP Employment Change (650k, 692k); Thursday: June Trade Balance (-$74.0b, -$71.2b), July 31 Initial Jobless Claims (380k, 400k); Friday: July Change in Nonfarm Payrolls (858k, 850k), July Unemployment Rate (5.7%, 5.9%).

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/