Consequence of Passive Investing & Other Economic News

for the

Week Ending August 6th 2021

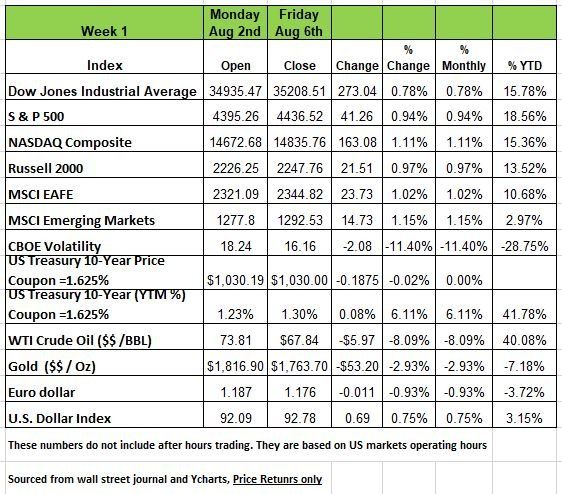

Last Week U.S. equities managed modest gains all the major indices had close to a 1% gain for the week with the Dow showing the lowest at .78% and the NASDAQ showing the highest at 1.11% Both the DOW and the S & P 500 closed at new record highs.

We saw strong jobs data with more than 900,000 jobs added to the workforce, this number led to the possibility that the Fed will be tapering asset purchases sooner rather than later.

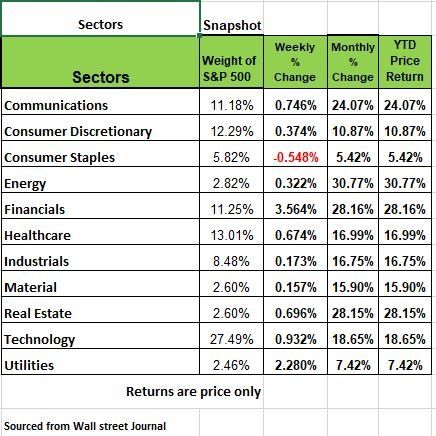

Ten of 11 S&P sectors finished positive, with consumer staples being the only sector with negative price returns. Utilities rose 2.28% and we had a 3.5% increase in financials.

U.S. Treasury yields rallied after non-farm payrolls jumped by 943,000 in July, beating expectations. The unemployment rate dropped to 5.4%, and average hourly earnings lifted 0.4% for the month and are up 4% from a year ago. Even more encouragingly, the labor force participation rate ticked up to 61.7% and the underemployment rate (U6) receded to 9.2% from 9.8%.

This overshadowed the ADP report, which indicated that private sector job growth slowed much more than expected in July.

New Unemployment claims fell to 385,000, while continuing claims dropped to a pandemic-era low below 3 million. However, this number excludes the PUA, unemployment assistance for the gig workers (1099 employee) there are still over 9 million individuals collecting these benefits. So it is hard to determine if frauds is a contributor to this number or that people are not finding enough work. Several Fed governors along with Senator Joe Manchin opined that the U.S. Central Bank should start trimming bond buying within the next few months and be prepared to raise interest rates in 2022.

Long term Consequences of Passive Investing

Passive investing has revolutionized the way people participate in the equity markets and obtain exposure to various financial markets. The introduction of index funds goes back to the 1970s and more recently the popularity of ETF’s (exchange-traded funds) has provided a cost-effective way for individual to participate in the financial markets without the need to really pay attention to where their money is going.

These low-cost investment vehicles have been beneficial to many investors, in fact passive investing has become the primary investment vehicle of choice for many. Within the past decade, the flows into passive investment vehicles have grown significantly, since 2016 the annual flow out of active managed funds has been over $300 billion /year and more than $500 billion a year flow into these passive investment vehicles. This has led to the rise of financial heavyweights Vanguard and Blackrock.

However, while it is rational at the moment for one to argue, rise of passive to be beneficial for investors, may come at great cost in the long run.

Ultra-low fees, simplicity, tax-advantages (via ETFs) and of course better returns relative to actively managed funds seems like a logical strategy. Most financial advisory firms have extensively incorporated the use of index funds in recent

years, a change which has only been sped up by the ease of justifying the superior performance and lower cost to clients. It has become increasingly difficult to recommend the use of active managers in a world where fees and performance are so heavily scrutinized.

But there are fundamental issues with passive investing with an increasing number of potential downsides which most financial advisors, let alone investors are not aware or are ignorant of.

The general theory behind passive investing stems from the efficient market hypothesis, which theorizes that current prices of securities reflect all available information (i.e. the market is efficient), and thus active managers are not able to beat the market if they are using publicly available information. The theory of passive, assumes investors only wish to partake in the movement of asset prices and thus will hold the market portfolio, consisting of all securities within an entire investible universe (both public and private, which in itself is of course impossible).

First of all, passive investing is not passive. By definition, passive is accepting or allowing what happens without a response or resistance. So passive is only passive if it is not buying or selling. Just holding assets. But because of the constant inflow of money into these funds, passive investments vehicles (PIV) need to be continuingly buying securities & since these funds are fully invested at all times, they cannot be truly passive.

In addition, the stocks of an index, often changes, take the S&P 500 index for instance, companies in this index come and go usually at the bottom of the list, so depending on the funds strategy they are probably selling off positions usually at a loss, when the stock is no longer part of the index & replacing them with new companies.

But another more important issue exists, the underlying securities in these strategies. Last year more than 20% of the companies listed on the S&P 500 were considered zombie companies, meaning that these companies barely made enough money to pay the interest on their debt, no principal. So, think of this, if you invested in an S&P 500 index fund 20% of that investment went to more than 100 unstable companies. In addition, the shareholders with voting rights of the companies in an index is becoming heavily weighted to these heavy weight index companies like Vanguard and Blackrock. So, when Pepsi and Coke for instance are owned in large part by the same organization the incentive to compete with one another which eventually leads to higher prices and slower economic growth.

Passive Investment Vehicles drive up the price of stocks, it’s simple only so many shares of a particular company exist. So, let’s just look at the S&P 500 index. There are multiple S&P index funds for example, so all these funds have to buy shares of each company when monies are deposited into the fund, hence these funds usually pay more per share since they are creating the demand. The purchase of securities in these funds are not based on fundamental valuations, it is based on the function of money flowing into the fund. So, by its very nature, Passive investment vehicles are a self-enforcing momentum strategy, not a passive strategy

This becomes particularly important with Passive Investment Vehicles tracking bond indices. Bond indices were created to give investors an “idea” of the yield for a particular basket of bonds, of which the yields of the underlying bonds within that index are weighted by their market price, meaning the yields on the bonds with the highest value are given the biggest weighting & vice-versa.

So as interest rates change the corresponding price of bonds change, hence the most expensive bonds will see their share in the index grow even though their yields are falling. For an aging population having a large portion of their assets in these instruments is not a good thing.

Perhaps the most prominent hazard facing investors in these index funds are the participants themselves. Baby boomers who are quickly approaching or already in retirement are the largest participants of these funds. So, as retirees begin pulling money out at faster rate than the smaller generations behind them, the expected outflow will far exceed the inflow & hence the opposite result will occur as the strategy goes from buying to selling. Source Chris Yates

Boomers’ Retirement Objectives change

Covid has changed our society in many ways. Many people have re-evaluated their priorities and how they see the future. In a recent survey of 2,567 baby boomers (about 2,200 of whom are not retired) 52% of those not currently retired are worried COVID-19 has made such an impact on their lives that they’ll never be able to fully do so. Much of this includes small business owners whose business have suffered financially from the pandemic.

The poll analyzed Boomers’ retirement plans as well as their non-negotiables for when the time comes to retire.

Prior to COVID-19, 56% of all Boomers polled said their top non-negotiable for retirement was maintaining their financial stability and independence—this has now dropped to just 35% with the impact of the pandemic, meaning this is now less of a priority.

Saving money has taken a backseat to family. The new top priority for retirement after COVID-19 is spending lots of time with family and grandchildren (43%).

Next in line for non-negotiables included maintaining an active lifestyle (34%) and being able to travel (30%). A quarter of respondents also said living close to family and friends is another retirement must-have.

It’s no wonder over four in 10 respondents want to spend more time with their families and 25% want to live closer to them, as over half (53%) of Boomers surveyed said the biggest impact the pandemic had on them was not being able to spend as much time with their loved ones. The list below shows how the pandemic has changed priorities. Source: https://401kspecialistmag.com/over-half-of-non-retired-boomers-fear-never-retiring-due-to-pandemic/

Top Ways COVID-19 Changed Boomer Lifestyles

Had to cut back on entertainment and/or activities: 53%

Had to spend less time with children/grandchildren: 53%

Traveled less than wanted to: 44%

Had to financially support other family members: 41%

Hours at work were reduced: 39%

Lost a job: 34%

Had to work remotely: 25%

Had adult children move back home: 18%

Top Non Negotiables

Spending lots of time with family/grandchildren: 43%

Maintaining financial stability and independence: 35%

Maintaining an active lifestyle: 34%

Being able to travel: 30%

Living close to family and friends: 25%

Continuing to learn new things: 23%

Living close to a fitness center/gym: 20%

Start my own business: 12%

A new home: 10%

Start a passion project: 8%

Give back to my community: 7%

What the Data is telling us

Despite Friday’s (August 6) employment report, we are still of the view that Q3 and Q4 U.S. GDP growth will disappoint. The consensus estimate for Q3 growth is +7%, and it is +5% for Q4. The data, however, are trending down, not up – Q2 GDP growth was 6.5% - so, slower means a number lower than that.

June Construction Expenditures grew +0.1% M/M on a nominal dollar basis. When adjusting for inflation, they were -0.6%. Residential construction is up, and it appears that the U.S. has a significant housing “shortage” after preferences dramatically changed during the pandemic for more space and more suburban living. Hence, the housing price spike. Non-Residential construction (building and plant) fell -0.9% M/M in June. They were -6.6% Y/Y, and are down five months in a row. These continue to be recessionary numbers.

Mortgage applications for purchase are down -22% since year’s end, with July’s level back to the May 2020 pandemic low.

The 3-month trend in New Home Sales is -64% (annual rate); and Building Permits are off -32%. The University of Michigan’s July Consumer Sentiment Survey put home buying intentions at a 40-year low.

Auto sales, too, are tanking (you can place the blame on semiconductors, but that doesn’t matter – sales are sales). M/M sales look like this: May: -7.5%; June -9.9%; July -4.5%. At a 14.7 million annual rate, auto sales are the lowest since July 2020, near the recession’s bottom. U of M’s survey last month also showed auto buying intentions in the tank (Same for major appliances!)

We also note that in last Friday’s employment report, the Retail Sector both lost jobs (-5.5K) and showed a reduced workweek

Inflation

Despite the media hype on wages, real average hourly earnings fell -1.7% Y/Y in June. Combined with a +0.3% increase in the average workweek, the result is a -1.4% Y/Y decrease in real average weekly earnings. In previous newsletter we have referred to the Atlanta’s Fed’s Wage Tracker which has been telling the same story, i.e., the aggregate data does not show any significant wage inflation.

Housing appears to be in short supply. We think this condition will persist due to changes in housing preferences, the long construction lead time, and the huge disincentive caused by the rapidly rising home prices. While we still believe that most of the current increase in consumer prices (i.e., inflation), is “transient,” because of the newly minted housing “shortage,” we believe “rents” may be an exception, and that we may see some significant “rent” inflation. The year-long eviction moratorium and suppression of rent payments is another tail wind for such an outcome, as landlords have borne a disproportionate economic burden. And now, the “eviction” moratorium has once again been extended by the Biden Administration despite a Supreme Court decision to the contrary. So, there is going to be significant upward pressure on rents which will accelerate when the moratoriums are eventually removed.

When is too Big too Big?

Back in 2008 the financial crisis brought on a new philosophy “Too Big to Fail” in which the Federal Government had to bail out a number of financial institutions as a result of bad decisions. Large corporations became the bad guy and the over extended homeowner became the victim. But things have changed a bit over the last decade. Now it’s the Government.

In an ideal world, analysts and investors wouldn't have to spend much time, thinking about changes in government policy. In that world, government – spending, taxes, & regulation – would be consistent and not have too much of an impact on markets and businesses

Unfortunately, that world is one of long ago. Government has become WAY too big. As a result, we spend more time than we should trying to figure out what the government is going to do next and how it will affect businesses.

Three major issues related to government policy are now looming large among investors' concerns.

First, when is the Federal Reserve going to start tapering quantitative easing (QE)? This one is probably the easiest to answer among the three, with Fed policymakers recently going on record suggesting the Fed will announce a tapering of QE by the end of this year and actual tapering will begin in January 2022. Given our thoughts of continued solid economic growth and inflation leveling off, we think the Fed will conclude tapering by the end of 2022. This will allow the Fed will start considering rate hikes by 2023.

The second

issue centers around fiscal policy. The so-called infrastructure bill, which is likely to pass very soon, if it hasn't already in the past several hours. Although sometimes touted by politicians and the media as $1 trillion that is fully paid for without tax hikes, the Congressional Budget Office recently scored it as raising discretionary spending by $415 billion in the next ten years while lifting budget deficits by a total of $256 billion, which means it's not fully paid for.

The third and last question is whether we're going to have another COVID shutdown again. While the probability is low. We think a shutdown would be perceived by the country as a step backward at a time when the politicians in control of the White House, Congress, and the Senate, trying to pass key legislation would not be beneficial the Presidents Administration. In addition, too many businesses have struggled needs employees and the country cannot afford to keep paying people to stay out of work.

The Week Ahead

After last week’s spike in interest rates (see tweet here), this week’s economic calendar has the potential to accelerate or put the brakes on that trend. Monday provides another piece of the employment puzzle with the U.S. JOLTS Job Openings report. The July U.S. inflation indicators are expected to show cooling with CPI on Wednesday and PPI on Thursday. Auctions for 10-year and 30-year Treasuries also add potential rate volatility to the mix. The international calendar is fairly benign, with the early part of the week bringing sentiment numbers from Australia and the Eurozone. On Thursday UK preliminary GDP will be released, and Q2 growth of 4.8% is anticipated to reverse the previous quarter’s contraction. Bitcoin rallied late last week as negotiators of the $1 trillion bipartisan infrastructure bill indicated a potential compromise over tougher tax enforcement of cryptocurrency transactions, but traders will be mindful of additional oversight possibilities.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/