It's all in the Sizzle, The Delta Variant & more Economic News

for the

Week Ending July 23rd 2021

Week in Review

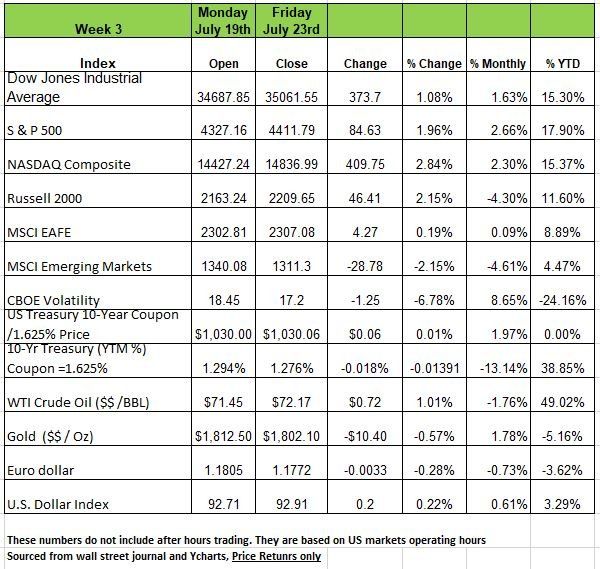

Last Monday the Markets started the week off with a 2% downward slide, giving many investors pause that perhaps this market is way over valued, but by weeks end, new highs we set and all four of the major indices were in the black with the NASDAQ leading the pack with a 2.84% price gain for the week. What caused such a shift? News of the spread of the COIVD Delta variant spread throughout Wall Street as the fear of another economic shutdown loomed over investors, but this is earning season and by Tuesday, the markets gained back much of Mondays decline and picked up steam for the remainder of the week.

The Olympics started in Japan to a very limited audience, more fires impact both Canada and the west coast, but more importantly the declining water levels on the west coast are affecting farmers who are forced to reduce their crops by at least one third in many areas of California. For those wondering this is an indicator that food prices are going to continue to rise throughout the year.

Crude oil eked out a small advance after a volatile week, initially falling with risk flows, OPEC production increases, and the first U.S. inventory rise in 9 weeks before rallying into the weekend.

European equities climbed to record highs after the ECB tweaked its forward guidance, tying inflation closer to interest rates in a move seen as producing more accommodative policy for longer. Eurozone manufacturing and services PMIs came in above expectations, while June’s producer prices in Germany rose 1.3% m/m, in line with forecasts. In Australia, the RBA decided to reduce its bond buying come September, as the labor market showed improvement despite a potential contraction in Q3 GDP. Finally, shares of many U.S.-listed Chinese companies fell sharply on Friday after authorities stepped up restrictions on the private education industry and increased scrutiny on overseas listings.

Treasury yields were down moderately among medium term bonds but otherwise unchanged as investors weighed the impact of rising COVID-19 cases on the economy. On Monday, yields dropped significantly as the 10-year yield hit its lowest level since February as concern over the Delta variant would have on reopening economies. Treasury Yields rebounded moderately on Tuesday and again on Wednesday as investors fears over the Delta variant waned. The decline in Treasury yields for the last week has shown that investors may not believe that inflation is the biggest problem facing the U.S. economy and instead are worried about slowing growth.

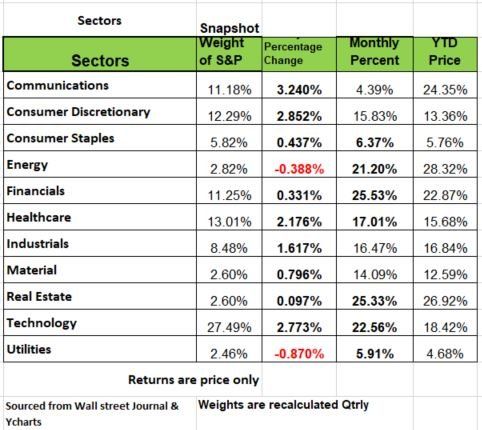

9 of the 11 sectors were in the black last week with only Energy and Utilities showing prices declines. Energy was down -.38% after an agreement was reached by OPEC to increase production and Utilities were down -.87% . While gas prices are up, expect higher production from U.S. fracking companies so supplies should be back soon.

If it doesn’t sizzle, it won’t sell!

It seems there are only a handful of items that the media will talk about of late, Inflation seems to be top on the list. Just about every news outlet has some headline addressing inflation. If you have read any of our past articles, we have addressed some of the reasons for increase, such as the base effect. So, what exactly is the difference between systemic and transitory inflation. Some “experts’ on TV are giving the public information that is out of context. Such as wages going up and companies being force to give signing bonuses. While that may be true in some parts of the country it does not apply nationwide. In the states that have ended the Federal supplement, unemployment dropped significantly. There is a downward trend in these states -21.7% compared to the states still allowing for the supplement with a -2.5% . This data was from May 15th thru July 3. Unfortunately, the continuing claims are still north of 12 MM. Most of this is related to the leisure sector, hospitality and travel and in states like NYC, Chicago, S.F. LA and SD.

But getting back on topic inflation is a confusing topic, even within the field of economics. Yes, prices have gone up, but gone up from what was a lower number a year ago and while month over month numbers are up the long view trajectory of inflation does not appear to have the legs the media is headlining. Much of what we try to figure out is consumer behavior, because in the end it’s the consumer that is driving the demand. With the extra money in their pockets, we are seeing more spending in discretionary items more than in staples. In addition, much of the last few MoM inflation numbers was cause by the rise in Oil prices. Oil is up over 49.02% for the year but if you remember Oil was selling at a negative number last May.

Housing

The housing arena was showing promising numbers, but not nationwide. While starts rose dramatically in June, most of this was in the West and South; the Northeast & Midwest is another story as starts fell significantly. The price of Lumber (fell from $1,686/thousand board feet on May 6, to $536 on July 15, but closed at $647 on Friday, July 23 – a 62% retreat). Looking again at inflation this is not systemic. On the other hand, new home permits, a better barometer of future activity, fell -5.1% M/M (June), down three months in a row and in four of the last five. This could be a function of high lumber prices back in May. The consensus estimate for permits was high by nearly 100K units, leading us to believe that the coming softness isn’t yet in the price.

Delta Variant

If the Inflation narrative hasn’t gotten you depressed, the media still has another topic in its pocket. The Delta Variant of the virus that shut the world[GW1] down is on the rampage. We don’t yet appear to be completely out of the woods when it comes to the pandemic. This more contagious Delta variant has significantly pushed-up new infections and hospitalizations, especially among the lower vaccinated populations. While it doesn’t appear that business lockdowns are will happen anything soon, we probably won’t see how effective the vaccinations are until flu season.

Los Angeles, has reimposed mask requirements. But, even without mandates on businesses, it is inevitable that the rising concern over the spread of infection will negatively impact the economy, especially with consumption of services first as consumers hunker down once more.

Adapting to challenges

If there is anything constant in business it is that the entrepreneur knows how to adapt. With many people opting to stay at home and live off the governments allowance, they will soon find that there is a consequence for their behavior. There are a couple consequences of the federal supplemental unemployment program:

Its presence has caused upward wage adjustments for those sectors that pay the lowest (minimum) wages. Such sectors do not comprise a huge percentage of total employment, so perhaps that is why the Atlanta Fed’s wage tracker is behaving as it is. The politicians apparently stumbled upon the uplift in the low wage sector caused by the supplemental program; perhaps this method will be used in the future to push up the minimum wage, but we think it will recede quickly.

Service sectors have now developed strategies to cope with the scarcity of employees. For example, automated ordering at restaurants is bringing more efficiency to operations.

The hotel industry, we are seeing some chains offering lower prices for multiple day stays if the client opts for no daily room cleaning/maid service. This reduces the hotel’s need for its cleaning staff. A long-term consequence of the supplemental unemployment program is that the employee intense service industries may not return to their pre-pandemic employment levels.

Since the Fed has emphasized its employment mandate for this cycle, such a development may keep the Fed on the sidelines for longer than markets currently anticipate.

While the program may have pushed up starting wages in some service industries, long-term, there may be fewer employment opportunities in that space.

The Week Ahead

The calendar this week is packed, with plenty of potential market-moving events on tap, from tech earnings to the Fed meeting to key economic releases. Expect discussions to accelerate amongst Fed officials as to when to start reducing asset purchases and how quickly to taper them, although a final decision is not expected until later in the summer. Their remarks will come ahead of the first look at Q2 GDP on Thursday where 8.5% growth is anticipated, the second-fastest pace since 1983 and exceeded only by last summer’s strong rebound. U.S. consumer confidence and durable goods reports will drop on Tuesday, and inflation data trickles in from Australia, Canada, and Germany midweek. Will the tech giants continue to dominate equity flows? Tesla, Apple, Microsoft, Google, Facebook, PayPal, and Amazon all report earnings this week. The week and the month close with a bang on Friday, with the release of the U.S. Core PCE Price Index, Chicago PMI, GDP updates from Germany and Canada, and China’s manufacturing PMI.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/