& Other Economic News for the Week Ending

As the Russian invasion of Ukraine entered its second week, it continued to send reverberations through global financial markets. All of the major indices finished down with the NASDAQ having the largest decline of -2.78%

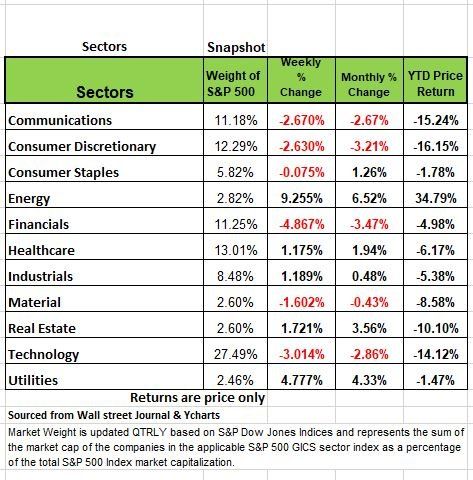

The impact from the conflict sent commodity prices soaring, namely oil which was launched to its highest level in 10 years and gained more in one week since the 1975 oil crisis. As a result, energy was the top-performing sector of the S&P 500 with a weekly gain of 9.2%, outperforming the next best performing sector (utilities) by almost double.

The utilities sector advanced 4.8% this week with gains fueled by heightened demand for natural gas and disruption in alternative sources of energy in Europe.

Despite evidence from last week's data on pending and new home sales that the housing market is beginning to cool, the real estate sector carved out a 1.7% gain.

Industrials had modest gains this week, up 1.1%, as advances in the defense industry compensated for the sizeable losses across the airlines.

As geopolitical pressures mount, the flight-to-safety drove risk-averse investors to the US Treasury market, driving yields significantly lower. With banking profits closely aligned with interest rates, the near-term outlook for a US rate hike was overshadowed by the move into safe havens and a 30-basis point decline in the 10-yr yield. Source: http://www.mtnewswires.com

Federal Reserve Chairman Jerome Powell testified to the Senate Finance Committee last week, and stated he would support a quarter-percentage-point rate hike at the Fed’s March 15-16 meeting. This would be the Fed’s first-rate increase since 2018. Do you remember what happened to the markets back then? The economy was healthy, not as fragile as it is now and we witnessed extreme volatility with all of the indices down the S&P 500 index closed the year -7%

However, we do need to give Powell some credit as he also said that the Fed will need to tread carefully given Russia’s recent invasion of Ukraine and its uncertain impact on the U.S. economy. (You can see how much gas prices have increased) While media believes that his comments all but end speculation that the Fed would raise interest rates by 0.50% at the March meeting as many pundits forecasted d after the last inflation numbers came in hotter than expected, a larger rate hike was not exactly ruled out for future meetings if inflation doesn’t stabilize. This will stress the markets

Climate

It seems like the Federal Reserve has been thrown a lot of curve balls lately. In just the past few years, the Fed has battled one crisis after another. Since 2020, it has had to navigate the COVID-19 pandemic, global supply-chain bottlenecks, an unexpected surge in inflation, and now a war, which has driven the price of crude oil above the $120 per barrel mark.

Even though the unemployment rate stood at 4.0% in January 2022, the U.S. had 10.93 million job openings in December 2021, this from the Bureau of Labor Statistics. We know that the unemployment rate is low because so many people that were in the workforce in 2019 had left and not return yet, so these number while attractive may not show the entire picture

The goal of the Federal Reserve’s monetary policy is simple, “to foster economic conditions that achieve both stable prices and maximum sustainable employment,” according to the Federal Reserve Bank of Chicago. There is still a lot of work to be done on these two fronts

The Federal Reserve has a tougher road to navigate with respect to setting monetary policy following Russia’s invasion of Ukraine. A wrong move could stall the economy.

A Look back at February

Stock Market

The S&P 500 Index (“index”) closed February 2022 at 4,373.94, down -3.14% for the month and -8.23% for the year. The Dow was down -3.53% for the month and 6.73% for the year. The NASADQ passed the “Correction Territory marker with a -12.1% YTD price return. Only the Russell 2000 had a positive gain in Feb with a +.97% return.

The price of WTI Crude oil jumped 11.78% for the month and is up +30.84% on the year. The 10 year treasury yield passed 2% briefly and then settled back but is up 16.64% YTD. Keep in mind that the coupon changed and moved to 1.875% at auction since yields were so high.

Economically only one of the 11 major sectors that comprise the index was up on a total return basis. That was Energy, up 7.57% for the month and 26.54% on the year. Communication Services performed the worst dropping -6.54% on the month and -12.92% on the year. The worst performers were consumer discretionary and Real; estate posting -13% drops for the year.

Bond Market

The yield on the benchmark 10-year Treasury note (T-note) closed trading on 2/28/22 at 1.83%, up five basis points (bps) from its 1.78% close on 1/31/22.

We think that bond prices moving forward will likely be influenced most by the direction of inflation and how aggressive the Fed gets with respect to tightening its monetary policy. Some economists and pundits believe the Fed is already behind the inflation curve and we have stated in the past that the Fed has kept rates too low for too long and playing catch up is never good. The last thing that investors want to see is the Fed chasing after inflation, by making too many rate hikes. The media has quoted various pundits as making anywhere from 3 to 7 hikes in 2022. No one really knows and while Powell testified to the senate finance committee earlier this week, he did state he would support a .25bps increase and when asked by Senator Richard Shelby, Powell said he is committed to doing whatever it will take to slow inflation, underscoring the Fed's high-risk challenge in raising interest rates enough to stem price increases without tipping the economy into another recession.

The recent invasion of Ukraine by Russia gives the Fed one more thing to be concerned. A good deal of capital has already flowed into the bond market seeking a safe haven, this in response to the invasion. As a result, bond yields have backed up some despite inflation spiking higher. Remember when prices go up yields drop and vice versa.

The 1.83% month-end closing yield on the 10- year T-note was actually down 17 basis points from its 2.01 high on Feb 25th. That is a big move for one week.

The key takeaway in the current climate is to expect elevated levels of volatility in the securities markets over the foreseeable future. The silver lining is that investors have dealt with multiple headwinds like these before, especially war. The decline in the number of COVID-19 cases is encouraging. While we are not out of the woods yet, any progress toward fully reopening the U.S. economy is most welcome. Everything in economics is based on the behavior of the consumer Stay tuned!

Stock Markets Usually Go Up, But Sometimes, They Vanish

Many investors believe that financial markets are permanent and that profit is assured if you only hold stocks long enough. But that is just a false narrative provided by the industry, based on MPT developed by Harry Markowitz. However older generations in Argentina, Chile, Egypt, Germany, Greece, Japan, Portugal and Spain, can tell you that governments can slam markets, shut and keep them shut for a long time. The NYSE close in July of 1914 and did not open until mid-December of that year due to the outbreak of WWI. During the events of 9/11 U.S. markets were closed for 4 days, It never open on Sept 11th since the planes hit before the markets opened, it reopened on Sept 17th one week later and all major indices dropped between 11%-16%.

While Russia was less than 0.5% of total global stock-market capitalization and under 4% of aggregate emerging-market value as of Dec. 31, according to MSCI. It may not seem like much in a well balance portfolio but for now that money is lost. If you held ETF’s focused on Russia that is a bigger problem

That is why we advocate knowing what is in your portfolio, what are the underlying holdings if you have Funds that hold stocks.

Do you know what’s in your portfolio? If you’re like most you probably hold a number of Index and ETF funds and one category might be international and emerging markets. When Russian companies are very often part of those diversified funds

This week, the stock market shut down in Moscow, and Russian shares collapsed on other exchanges, including in London and New York. Exchange-traded funds specializing in Russian stocks are down 90% or more from their highs, which was shortly before the invasion of Ukraine—but, as of Friday, most of them are also frozen.

Here is a fact of financial life that most investors forget or just don’t know, financial markets are not always liquid or continuous. They can dry up, and sometimes even die.

Of course, the Federal Reserve and other central banks have flooded investors with cheap money for more than a decade. So it’s easy to imagine that government policy will always prop up markets. Sometimes, it destroys them.

Fear Factor

One of the biggest challenges we have right now managing the fear factor. Financial Armageddon as some put it. Many in the press have started the conversation of the possibility of a nuclear war or another conflict referred to as the China scenario. A nuclear war is not going to happen, so get that thought out of your head, just because some sensational motivated journalist discussed the remote possibility of it, doesn’t mean it will your odds of being struck by lightning are higher

China has always wanted control of Taiwan. We know that. So, what if China uses the mayhem from the Russia /Ukraine situation to make a move. Obviously, this would create even more uncertainty and mayhem, but China is more involved in global finance than Russia.

The West's response to Russia has not gone unnoticed, but many fear that even if China doesn't invade, it may preemptively sell its roughly $1.1 trillion in US government debt to avoid financial retaliation. The fear is that this will cause US interest rates to soar and the US economy to suffer. As usual, the media will never let an opportunity of scaring the public to go without some effort regardless of how remote a possibility it may be. Let’s think about that

We should recognize that interest rates are a function of economic fundamentals and expectations about the future, not who is buying and selling how much Treasury debt on any particular day. However, the buying and selling Treasuries, does impact the yield on those specific bonds only.

If China sells its Treasury debt, it's going to end up getting dollars in return. That is still the world currency. What will it do with those dollars? Swap them for a different currency? Ok which one? Maybe Euros. Then whomever it swaps with will have the dollars. What will they do with those dollars? Well, whoever gets the dollars would likely turn around and buy US bonds. The result? A few days or volatility.

In addition the US debt that China owns is more problematic for China than it is for the US. Moreover, if China sells US debt because it fears sanctions, then it will likely sell European debt as well. In the end, it's not the US that has a problematic conundrum. China invading Taiwan would be a horrible event. But the fear of China hurting our economy by selling our debt is overblown. The biggest problem the U.S. does have, is the U.S. itself. The Fed once independent has become politicized in its decision making. As we have discussed in previous newsletters, The U.S. needs to go back to being a “Long Game” player and not letting the leaders of our country cow to the media, on misinformation.

We do think that China will eventually make a play on Taiwan but first China will need to stockpile a whole lot of commodities, most agriculture related commodities.

The Week Ahead

Uncertainty is only mounting, and with the spike in commodity prices, global central banks’ mission to curtail inflation becomes increasingly more difficult. While the ECB meets on Thursday, the focus remains on Ukraine. Little progress has been made in talks with Russia. Europe’s central bank has alluded to a more hawkish shift since their last engagement, but current events complicate the outlook.

European equities were hammered last week, now 14% below their January highs. In the U.S., the final inflation update before the Fed’s March 16 meeting is expected to show consumer prices rising 0.8% since January and nearly 8% YoY. A 50bps rate increase would seem unlikely given the international situation, most traders are pricing in a 95% probability of a 25bps hike.

Also on the calendar are the JOLTS job openings report and 10- and 30-year Treasury auctions. The week wraps up with February’s consumer sentiment numbers.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/