The Cause of Bad Decisions & Other Economic News

for the

Week Ending June 4th 2021

Markets cheered the Thursday (June 3) release of state Initial Unemployment Claims (ICs) as the headline number of +385K breached the 400K level for the first time since March 2020. Unfortunately, 385K is the Seasonally Adjusted number, and the pandemic, shutdowns, vaccines, and re-openings are anything but seasonal. The more reliable data increased from +419K (week of May 22) to +425K (week of May 27). Not a lot, but the wrong direction, especially in the face of vaccines and re-openings. We continue to wonder how claims are increasing when employers cannot find enough help.

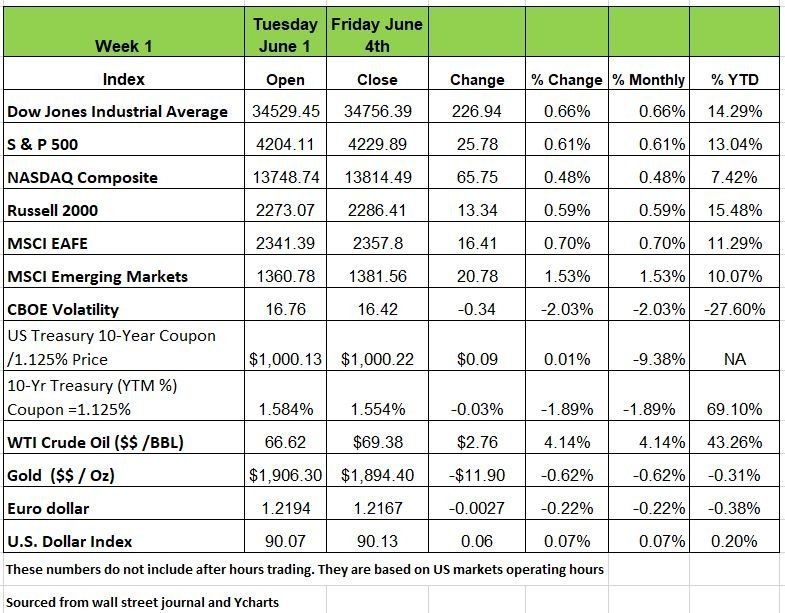

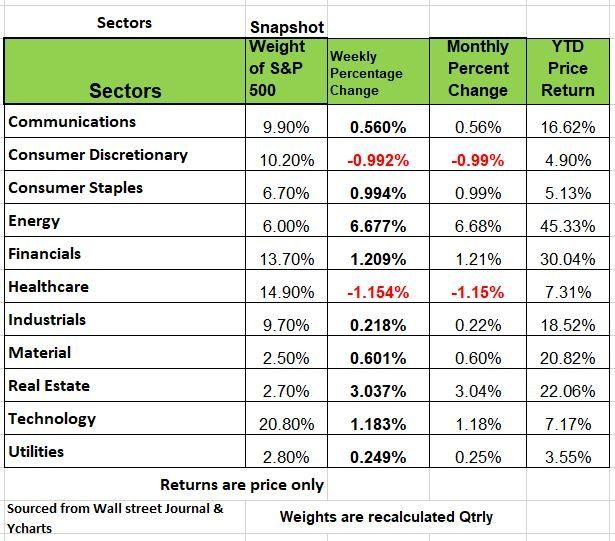

Stocks ended higher by less than 1% for the week after economic data, including labor numbers that showed somewhat steady progress. 9 of 11 sectors advanced, as energy stocks jumped nearly 7% and real estate rose 3%, while healthcare and consumer discretionary lagged.

The May ISM Services PMI hit the highest reading in the series’ history at 64, while the ISM Manufacturing PMI increased to 61.2 from 60.7 in despite worker shortages.

Oil prices recorded back-to-back 4%+ weekly gains after OPEC agreed to continue gradually easing production cuts, with output boosts scheduled for July. Outside the U.S., Eurozone inflation accelerated to 2% YoY in May as manufacturing PMIs hit a record high of 63.1, while weakness in the Euro could be an indication that rising costs are now affecting the bloc’s economies.

U.S. Treasury bonds were mixed last week. Treasury yields on the short end of the curve finished higher, while longer-term maturities finished lower during holiday-shortened week.

The week wrapped up with longer-dated Treasury yields falling as investors digested a weaker-than-expected jobs report. Nonfarm payrolls increased 559,000 in May, well short of the consensus expectation of 675,000. Despite missing the headline number, other indications point to the continued recovery of the labor market. Nearly half the states have cut overly generous jobless benefits, the unemployment rate dropped to 5.8% in May versus 6.1% in April, and average hourly earnings are up 2.0% versus a year ago.

The recovery from the COVID-19 pandemic rolls on as more states and companies head towards reopening. Banks are back. Data provided by U.S. News & World Report indicates that approximately 80% of states are in the process of reopening their economies, but many still enforce some restrictions. A recent survey of 231 human resource leaders by the Conference Board found that 72% of companies believe that employees will be able to return to the workplace over the next five months, according to USA TODAY. Nearly eight out of 10 respondents expect 10% or more of their workers to be allowed to work remotely at least three days a week after the pandemic subsides.

The Federal Deposit Insurance Corporation (FDIC) announced that U.S. commercial banks and savings institutions insured by the FDIC reported aggregate net income totaling $76.8 billion in Q1'21, up $17.3 billion (29.1%) from Q4'20 and up $58.3 billion (315.3%) from Q1'20 (COVID-19 onset), according to its own release. Having the banks on solid footing is good for the economy.

What is causing you to make bad decisions

Daniel Kahneman may be considered the father of Behavioral Economics. He was awarded the Nobel prize in Economics in 2002 for this work with Amos Tversky. In their research they basically rejected the notion of the “rational actor” and instead mapped the myriad errors people make due to predictable biases and behavioral tendencies. When you think about the fact that economist assumed that people made rational decision for years was an accepted theory, is crazy. In his latest book “Noise A Flaw in Human Judgment” Kahneman investigates how noise may be the most common cause of bad decision making. So, what is Noise? Noise is variability, a wide dispersion of “correct” answers. When judgements have a correct answer, bias is the average error. Noise is the variability of the error.

Kahneman distinguishes three sources of noise. The easiest example is judges passing sentences. Some judges are more severe than other judges would rule on the same cases. That’s level noise.

Another source of variability is how one judge’s decisions might change during different mental states, or from hearing a case in the morning versus the afternoon. We call that occasion noise.

Probably the most important source of variability is that people just see the world differently—that’s pattern noise. Judges view different criminals differently. One of them would be more severe in case A, and the other would be more severe in case B. We are not aware of it, because we can’t look inside people’s heads. This does not just apply to Judges, Physicians, Financial professionals and investors all are impacted by “Noise”

Noise is unwanted variability; it is variability in judgements that should be identical. Federal judges are supposed to be interchangeable.

Noise is easier to measure than Bias as he puts it different economic forecasters will be noisy. A year or two later the correct answer will be seen.

The best way to make better decisions according to Kahneman is Decision hygiene

Decision hygiene is very similar to disciplined thinking. One way to discipline your thinking is independence—making sure that if you’re consulting different people, they are independent of each other. Or if you are looking at different characteristics of an investment, that you evaluate them independently of each other. Source: https://www.barrons.com/articles/economist-daniel-kahneman-says-noise-is-wrecking-your-judgment-heres-why-and-what-to-do-about-it-51622228892?mod=hp_LEADSUPP_1

Narrative

There is no shortage of people making comparisons between this recovery and those of the past as if it’s apples-to-apples. Comparing job growth today to job growth after the 2008-2009 financial meltdown or in GDP growth is insane. Most of this narrative is driven in an effort to make the case that government spending is working and creating economic growth. Let’s be really clear on this; there is nothing normal about the current economy. The things our government has done during the past year are unprecedented. Never in our history has our government spent so much money needlessly to support so many people. This ranges from the additional unemployment subsidy to the $1400 tax refund. So, using normal economic metrics to explain things makes no sense – these things have never happened before.

Normal economic downturns are called “recessions.” @ Qtrs of negative GDP. They are a result of poor decision making. Growth phases are called “recoveries.” 2 Qtrs of positive GDP. And the combination of these ups and downs are referred to “business cycles.”

This has not been a normal business cycle. The ceasing of our economy was government driven, the recession, was all of 2 months and the return of growth in the past year has not been a typical recovery. It was artificially propped up by the Federal Government.

Comparing this situation to 2008, 2001 or to the 1980’s, makes little sense. Trying to compare the current rebound to historical events minimizes the pain that COVID-related and government mandated economic shutdowns have caused. Just asak the small business owner that lost his life savings that he sank into his business that no longer exist. But what is still unclear is the long-term damage all this spending will have on the U.S in the future. So perhaps thinking we are out of the woods may be just a little premature.

May’s Jobs Report Misses Expectations as Signs of Labor Shortage Peek Through

May was another disappointing month with the employment report. While nonfarm payrolls increased by 559,000 last month, it was far from a significant gain. Economists expected a higher increase of at least 650,000. Despite supercharged demand across the economy, it marked the second straight month of underwhelming hiring. Highlighting a recovering U.S. economy plagued by labor shortages.

Details of the report underline the problem. Wage inflation unexpectedly sped up and labor-force participation surprisingly slipped—falling participation is one reason for the reduction in the unemployment rate.

The reasons employers are having difficulty hiring are clear. Enhanced unemployment benefits have made it harder for employers to fill many jobs. There is no incentive for many people to get off the couch. The unemployment benefits equate to a little over $30,000 /year. Many employers are forced to pay much more than what would be considered competitive wage, just to stay in business. But that is one part of the equation, most households have two working parents and as we have discussed in the past women seem to be the ones forced to monitor their children that are under the age of 14. School closures have been the cause of this outcome. Other more older workers have left the work force and some are sitting out because of pandemic concerns. Source https://www.barrons.com/articles/wage-inflation-labor-shortage-51622847601?mod=hp_LEAD_1

How to Talk Retirement Savings With Your Spouse

We all have financial biases; they stem from how we were raised to our experiences in life around money. When markets turn a bit volatile, its hard enough for one person to manage those flawed influences that impact our decisions, let alone a second person (your spouse).

If one partner is more comfortable holding a high percentage of long-term savings in stocks, more than the other, problems can arise. When you retire, you go from having an income from work to spending from your portfolio, this can exacerbate anxiety during stock market declines

Back in 2008 when stocks plummeted a lot of stressed was placed on couples, one wanted to get out of the market and the other wanted to buy more shares. There were many “I told you so” arguments over who was right. Most couplers have a tangible difference in risk tolerance. While asset allocation is an important part of portfolio development, people need to understand exactly what is inside their portfolios, especially if a portfolio is made up of Index, ETF and Mutual funds. These are products that hold a variety of securities with various levels of volatility. If you’re approaching retirement age the first thing you and your partner need to do is communicate, get on the same page. Make sure you have a financial plan for retirement, don’t shoot from the hip. Stick to a budget. Second make sure your portfolio is designed to throw off income, that’s right dividend and interest payments will reduce your need to liquidate securities. Having a portfolio that is all based on appreciation of value of securities may be fine when you’re young but not in retirement. There’s too much risk of loss if you have to liquidate during a down market Make the adjustments, make sure your advisor is working to preserve your retirement not increasing value, which leads to higher fees. Source: https://www.wsj.com/articles/how-to-talk-retirement-savings-with-your-spouse-11622107800

Potential problem

The U.S. Drought Monitor indicates that nearly two-thirds of the western U.S. is suffering from the worst drought conditions in the last 20 years, according to Bloomberg. Farmers, cities and power suppliers are “scrambling” for water. In the first four months of 2021, only 1.7 million acre-feet of water melted off California’s mountains, well below the typical 8 million acre-feet. In 2020, drought conditions cost the nation $4.5 billion, according to the U.S. National Centers for Environmental Information. These conditions increase the risk of more fire damage on the West Coast.

Our Week Ahead

Since the 10-year Treasury yield rally began in August 2020, there have been two main consolidation periods. The first came just below 1%, from November 2020 to early January 2021. The second began in April 2021 and continues with the yield currently near 1.56%. What might be the next catalyst for a move in interest rates? Last week the Federal Reserve said that it plans to start selling its portfolio of corporate bonds and exchange-traded funds that it bought during the pandemic, but that is not expected to influence the market much. At the end of April, the Fed only owned $13.8 billion in bonds and bond ETFs. Recent economic data has been encouraging, but not so strong that the Fed would consider tapering its bond buying just yet. The next Fed meeting is scheduled for June 15-16. This week offers an update on U.S. inflation along with 10-year and 30-year bond auctions, all of which could produce interest rate volatility. The latest consumer credit report comes out this afternoon, the U.S. trade balance on Tuesday, and consumer sentiment on Friday. Overseas announcements include German factory orders, revised Eurozone GDP, China’s CPI report, and monetary policy statements from the ECB and Canada. The week closes with day 1 of the G7 meetings in London, where Treasury Secretary Yellen looks for support to rewrite international tax rules.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/