Has Housing Peaked? Would unemployed Americans commit Fraud? & Other Economic News for the Week Ending May 28th 2021

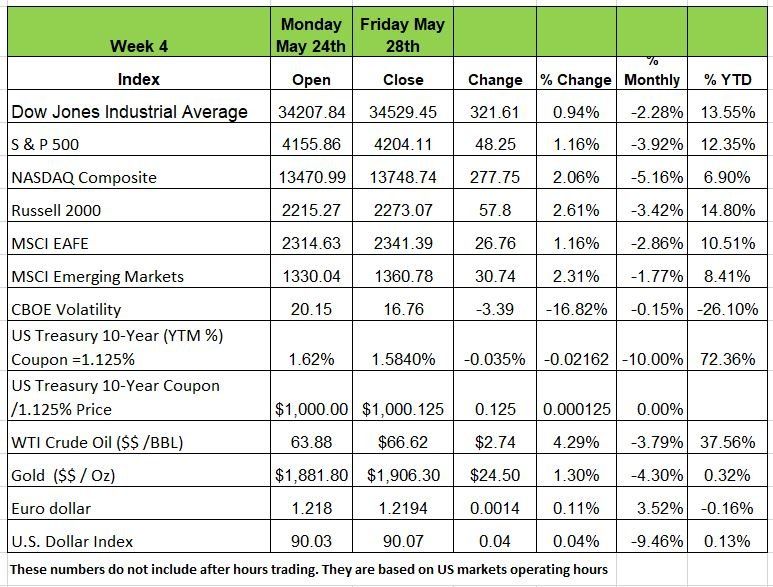

Last Friday marked the end of the week as well as the end of the month. All of the major indices up for the week but all of them were down for the month (on a price only basis). The NASDAQ and the Russell 2000 led the week with prices returns of +2% but also had the largest decline in value for the month with the NASDAQ down more than -5%

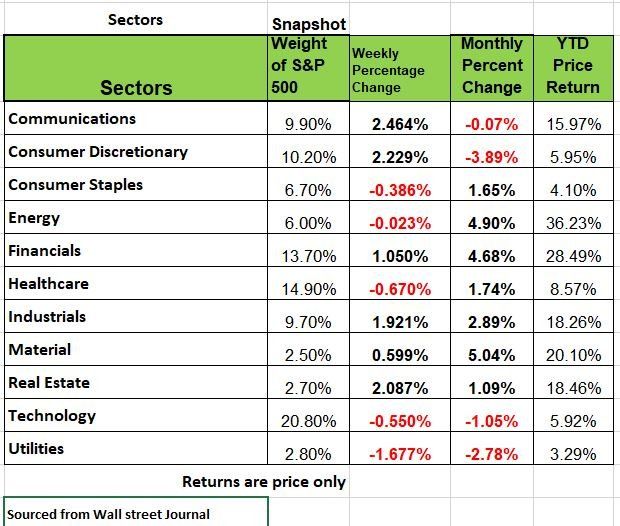

5 of the 11 sectors were in the red for the week, with technology and Utilities having the largest price declines for both the week and the month. The leading sectors were in Energy +4.9% Financials +4.68% and Materials +5.04% for the month. Consumer Discretionary took a hit, dropping -3.89% as spending driven by government helicopter money ran out.

Marco View

All the economic numbers that have been shared by the media are in a way very misleading. Typically, when we see economic numbers, they are presented month over month and more importantly Year over Year. Last year, when the pandemic shut the economy down the initial plan was for two weeks, this would theoretically slow/stop the spread of the virus. But being that this happened in mid-March of 2020 (Spring time) American took the two weeks as a sign of free vacation. Here in Chicago people stormed the lake front in droves, forcing the mayor to shut everything down and put blockade’s up throughout all of the parks and us police to prevent entrance. Non-essential businesses shuttered. There was no need to ordering new inventory. But the two weeks turned into several months. Manufacturing liquidated what they did have in inventory by lowering prices (products on shelves means money sitting idle). Make sense? So, when we got all of the information on inflation, production etc., those number were based on extremely low levels. In addition, Many Americans received Unemployment in addition to an additional $600 a week (not month) in Federal support. For many Americans, they made more money not working than they did when employed.

Fast forward to present day, personal income dropped in April by -13% MoM. But consider that income in March rose 21% from another round of Government give-a-ways, it’s no surprise. But what most do not realize is that the debt is owed, by the tax payer. The tab right now is $225,310 per taxpayer. Source https://usdebtclock.org/ Not something that will be repaid anytime soon so that number will continue to rise, as that number rises the value of the U.S. dollar will probably fall. What will happen once the government stops supplementing people to stay at home. Spending will slow and we will begin to worry.

Has Housing Peaked?

Back in 2006 the peak of the housing bubble the household ownership of residential real estate was $26.5 Trillion. Last month the number was $35.8 trillion, +$9 trillion more, this according to Rosenberg research. The Case-Shiller National Home Price Index rose +1.6% M/M in March (latest data), up +13.0% Y/Y, but the six-month trend is +17.7%. It will probably continue at that pace, in April and May. (This info is lagging data). If you’re on the selling side this seems like great news. But demand is wanning, mostly from lack of supply and a spike in materials due to shortages.

The University of Michigan survey puts home buying intentions at a 38-year low, and the Conference Board’s home-buying sub-index for May showed the steepest decline in the index’s history. This could be due to a number of issues, such as many people feel like home ownership has out priced them.

But what does all this have to do with a macro view of economics?

Current GDP is just over $22 trillion/year consumption accounts for $15 trillion of that number. If home prices fall 10% because of falling demand, that would remove $3.6 trillion from household balance sheets and put the median price of an existing home back to where it was in August 2020. Meaning that many recent purchasers will probably have over paid for their homes.

A fall of 17% removes $6.1 trillion from those balance sheets sending prices back to May 2020 levels. Meaning, when households feel poorer, they don’t consume as much! They save more. A a reduction of $500 billion (3.3% reduction in consumption) would send the economy back into recession. Then the downward spiral begins.

Labor Markets

The markets liked the weekly state unemployment report, released on Thursday (May 27), showed a fall in Initial Unemployment Claims (ICs) of -38K on a Seasonally Adjusted (SA) basis. We feel that the SA process distorts the true data, as the pandemic, lockdowns, reopening’s etc. are anything but seasonal. The Seasonally Unadjusted (NSA) data did fall from +455K to +420K. The ICs of both state and the special Pandemic Unemployment Assistance (PUA) programs, don’t seem to make much sense to us.

PUA ICs are barely moving, consistently around +100K for the last several weeks (+94K week of May 23). They were +95K the week of May 16 and +102K the week of May 1. Remember, ICs represent “new” layoffs. The combined PUA and state ICs are +514K, still deep in what economist would consider recessionary territory. The pre-pandemic “normal” was +200K. One must wonder how this can be? Companies are complaining that they cannot find enough workers. If you were operating a business, would you be laying offs employees if you needed to hire more people to service your business needs? We don’t think so. We believe that there is a lot of fraud in the system and that many municipalities are not doing their due diligence to verify the accuracy/validity of these claims. Eventually this money will need to be paid back and that means the majority of business owners will be stuck footing the bill.

When we Look at Continuing Unemployment Claims (CCs), those receiving benefits for more than one week, we find that 15.8 million (data as of week ending May 8) receiving a state or federal unemployment check. (Pre-pandemic “normal” was two million).

We realize that some unemployment may be due to lack of child-care, as we mentioned last week women suffered the most from the shut down since schools were closed/ went to online learning one parent had to monitor their children and take care of them since school was usually the baby sitter for those under high school age.

We also acknowledge that fear of contracting the virus, thanks to the media is playing a role in the CC’s numbers. But with so little progress in the reduction of the numbers, we can only conclude that the main culprit is the overgenerous federal unemployment subsidies.

We hope that eventually the pool of available labor will return to work; they just aren’t incentivized to do so now. They know that job openings are at record highs and they know that once the virus disappears or the benefits expire, they won’t have much of a choice. Since nearly half the states are in the process of eliminating these benefits and they expire in early September, we believe there will be real progress in these number beginning in Q3 and accelerating into Q4.

Inflation

“Reopening is Inflation’s Cure, Not Cause.” The title of an article in the Wall Street Journal by Jason Thomas, clearly identified that the inflation we are seeing is due to manufacturing being caught off guard. Fearful of a repeat of 2008 financial crisis manufacturers cut inventory, output and conserved cash.

But unlike any other recession in history the Federal Government stepped in and gave people money to spend. So, they did. Used cars are a prime example with price hikes occurring due to shortages of semiconductor chips sidelining new autos and rental car companies scrambling due to depleted fleets and surging demand. Mr. Thomas is correct. Reopening is increasing production and when supply catches up to demand, price increases will stop, and, in some cases (like car rentals), price decreases will most likely occur. The Media is concerned with one thing only creating enough “Noise” to distract you give you pause to make unsound decisions.

Week Ahead

This shortened week kicks off with inflation updates from the Eurozone, along with the Reserve Bank of Australia’s interest rate statement.

Tuesday brings European and U.S. Manufacturing PMIs, as well as the OPEC-JMMC meetings where oil production numbers will be in focus.

This past Friday, President Biden laid out a $6 trillion fiscal 2022 budget proposal, which is likely to stir up debates lasting through the summer and possibly longer. The end of the week includes labor reports and the U.S. ISM Services PMI.

We’ll see if jobless claims fall under 400,000since the pandemic started but we doubt it? Analysts anticipate 670,000 jobs to have been created in May after April’s surprise drop in non-farm payrolls, The U.S. unemployment rate is expected to tick down under 6%, steady progress but still a long way away from where the Fed would consider any major monetary policy changes.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/