Small Business Optimism; Inflation Narrative & Other Economic News for the Week Ending June 11th 2021

Week in Review

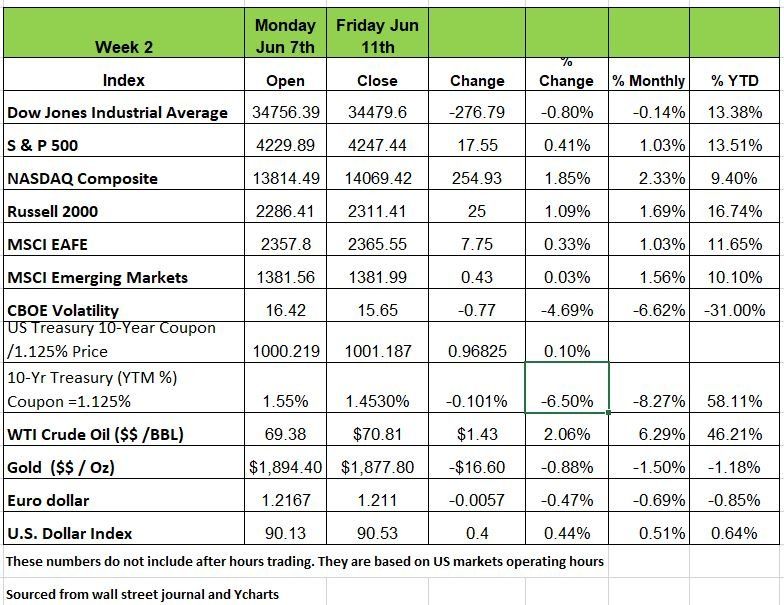

The S&P500 closed at a new all-time high, and tech and small caps outperformed in a mostly positive week for the major indices, with the Dow being the only Index down for the week by 80 basis points.

Surprisingly the markets held their own despite a higher-than-expected inflation reading for the month of May. The Consumer Price Index increased by 0.6% month-over-month and by 5% from a year ago.

Traders sold the inflation news with cyclicals and value stocks falling for the week as some investors chalked up the higher reading to base effects and transitory supply chain issues. Crude oil closed above $70/barrel, the first time in nearly 3 years as inventories dwindled. More evidence of consumers paying off debt emerged as U.S. consumer credit and lending for April both came in well below expectations.

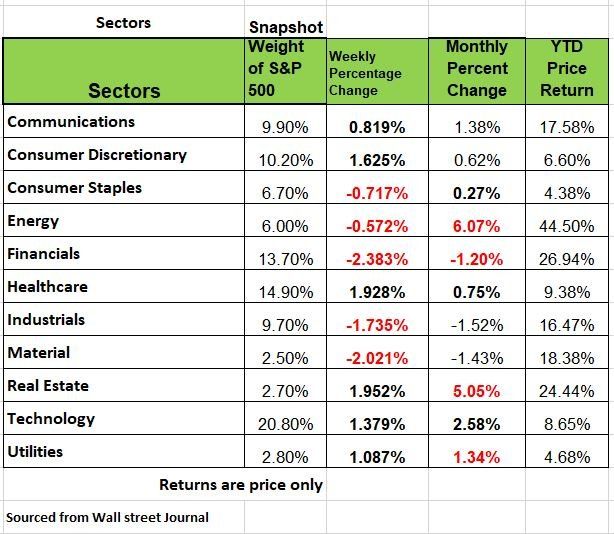

Sector performance was mixed, with 5 of the 11 sectors in negative territory financials (-2.3%) taking the biggest hit on falling rates and materials and Industrials were both down -2.03% & -1.73% respectively (commodity-influenced)

The labor situation remains the focus, with April job openings reaching a high of 9.3 million according to the JOLTS report. Jobless claims fell yet again to 376,000, inching closer to pre-pandemic levels near 220,000. The prospect of a dreaded wage-price spiral looms as U.S. wages rose 0.7% in April and 0.5% in May. We believe that a lot of fraud is involved in these numbers as companies are not firing people if they cannot get enough help.

Treasury yields fell last week on the longer end of the yield curve, while economic data released last week pointed to a continued recovery in the labor market.

Small business optimism off slightly, but labor demand on fire

What the number are telling us, is that Washington is making things very difficult for the small business owner. Many businesses, struggled or shuttered over the last 15 months and now that they have an opportunity to save their livelihood, they’re struggling because they can’t find employees to hire.

The latest NFIB (National Federation of Independent Businesses) Small Business Optimism Index edged down 0.2 points in May to 99.6, the first decline in four months, the consensus was 101.0. Why is this important? Because it is showing some uncertainty about the near-term growth outlook.

While most of other index components improved or held steady, job openings and hiring hit highs, a positive sign for job growth going forward. But the majority share of respondents who think the economy will improve in the next six months slid to -26%. Not a great sign considering investment decisions are based on one’s confidence.

The hiring trend should continue at a gradual decline, we think a lower unemployment rate in 2nd Half 2021, once the government subsidy ends. But for the time being, the disappointing re-engagement of the labor force, is causing labor shortages for most businesses. 57% of NFIB respondents reported difficulty finding qualified applicants. In fact, labor quality topped the list of small businesses largest challenge.

This tightened labor market condition has led to faster worker compensation growth. 8% of companies viewed their inventories as too low, reflecting strong demand and shortage in product supply. The demand/supply imbalance led to increased price pressures, 40% of businesses, the most since 1981, raising their selling prices, and 43% planning further hikes in the coming months.

Over the past year, inflation concerns increased for small business, but still trails significantly, the issues of labor quality, taxes, and government regulation.

U.S. Inflation Is Highest in 13 Years as Prices Surge 5%

The rapid rise in consumer prices in May reflected a surge in demand and shortages of labor and materials.

Does this headline concern you? This was the headline on Fridays’ Wall Street Journal. Consumer prices rising in May by 5% from a year ago. The bond market responded by raising the price of the 10 yr. Treasury (dropping the yield by 12 basis points. Causing yields to drop. Yes, Prices did increase YOY, why because a year ago companies were dumping their inventories at discount prices. In addition, production ceased.

But the news leaves that information out back in 2008 inflation peaked at 5.5% a year later it was -2.0%

We think we may see something similar in 2022

The catalyst for the current narrative was that the price changes in May’s CPI were heavily skewed to those sectors that were most heavily impacted by the pandemic (leisure/hospitality, travel…) and that the categories of prices that have historically been highly correlated with underlying inflation were much more subdued. But that doesn’t really create enough sizzle in the media.

Yes, Supply changes and demand are also contributing to the problem, those sitting on the couch are actually hurting themselves because their lack of engagement is costing them more at the register. Source: https://www.wsj.com/articles/us-inflation-consumer-price-index-may-2021-11623288303

Record job openings and tighter labor market conditions

The number of job openings surged 12.0% in April to 9.286 million, a new record high. The biggest gains were in accommodation and food service, other services, and durable goods manufacturing.

Layoffs fell to a new record low. The combination of more job openings and fewer layoffs indicates a significant increase in labor demand. But hires barely budged, up just 1.1% to 6.075 million, amid ongoing labor supply constraints, including child care options, lingering health concerns, and extended unemployment benefits.

The number of unemployed per job opening slid to 1.06, its lowest level since February 2020, indicating that a lot of the labor market slack that was created during the recession has been eliminated. Tightening labor market conditions are raising worker confidence, as evidenced by the jump in the quit rate to 2.7%, a record high.

Trade deficit narrows

The trade deficit narrowed by $6.1 billion in April to $68.9 billion, a three month low, and about in line with the consensus of $69.0 billion.

Exports rose 1.1%, led by civilian aircraft, crude oil, and nonmonetary gold. Imports fell 1.4%, led by consumer goods and vehicles. Despite the narrowing in April, the 12-month total trade deficit widened to $771.1 billion, the biggest gap since October 2006.

The gaps with most major trading regions widened. Net exports are projected to be a small drag on real GDP growth in Q2, which is currently tracking at a 9.4% annualized rate in the GDP Now Mode

Banks to Companies: No More Deposits, Please

Some banks, awash in deposits, are encouraging corporate clients to spend the cash on their businesses or move it elsewhere

U.S. companies are holding on to billions of dollars in cash. Their banks aren’t sure what to do with it.

When the coronavirus pandemic hit last year, corporate executives rushed to raise money. Banks have been holding that cash ever since, and because companies are reluctant to borrow from them, they can’t turn it into income-generating loans. That has weighed on banks’ profit margins, and some have started pushing corporate customers to spend the cash on their businesses or move it elsewhere.

Bankers say they thought the improving economy would reduce companies’ desire for holding cash, but deposit inflows have continued in recent weeks. Chief financial officers and treasurers, many still wary of the pandemic’s impact, say they aren’t ready for big changes, even if they earn little or nothing on their deposits. Source:https://www.wsj.com/articles/banks-to-companies-no-more-deposits-please-11623238200?mod=hp_lead_pos5

After Credit Cards, Which Debt Should You Pay?

Auto and personal loans may be next on the list for Americans to paid down credit-card debt during the pandemic. Stimulus money, mortgage forbearance and the pause in federal student loans have helped Americans pay down high-interest credit-card debt. Now, some are wondering what is the smartest debt to pay off next.

Americans paid off $82.9 billion of credit-card debt in 2020, according to an analysis of TransUnion and Federal Reserve data by WalletHub.com, a consumer-finance website. The first quarter of 2021, credit-card balances dropped by $49 billion, not a bad number for families.

Traditionally Financial advisers encouraged borrowers to pay down debts starting with the highest interest, which is usually credit cards. This seems like a no brainer, but the next step is to look at your credit report and clean it up. Look to see where the highest debt balances may be. You credit score is based on your debt credit ratio. If you have a home with PMI insurance, you need to pay that down as much as possible, regardless of the interest rate of your mortgage. PMI can add up to a lot of money each year and once your equity is above 20% of the value of your home, you need to contact the mortgage lender and have that expense removed from your payments. In addition, you will raise your credit score. A higher credit score will give you a lower interest rate with future purchases Be disciplined about your finances, limit your credit cards charges so you do not get back in the habit of carrying high balances. Source: https://www.wsj.com/articles/after-credit-cards-which-debt-should-you-pay-11621519201

Jobless claims continue to recede

Initial claims for unemployment insurance fell 9,000 last week, down in eight of the past nine weeks, to 376,000, another pandemic low, although slightly above the consensus of 370,000. The four-week average of claims slid to 402,500, also the lowest level since March 2020. The trend suggests fewer layoffs, as labor demand has strengthened. But we don’t think layoffs are happening mostly because local government officials are not doing their job. Many people are taking jobs for a few weeks, enough to qualify for benefits and then quitting. State agencies are not checking the validity of these claims.

The total number or claims (including state and federal) fell 95,000 to 15.3 million. Of those, 11.6 million were pandemic-related federal assistance claims which expire on September 6, with half of the states ending those benefits before then. This will give us a better picture of how many people are sitting on the couch and how much is lost to fraud. https://www.wsj.com/articles/the-great-american-rip-off-11623448884

Other important constraints include child care options, health concerns, and mismatches by skill, industry, location, etc. As some of these constraints ease over the coming months, labor shortages should moderate as well.

Our Week Ahead

All eyes will be on the Federal Reserve policy meeting this week. According to a Reuters poll, economists think the Fed isn’t likely to announce a tapering strategy for bond purchases until August or September and won’t start reducing monthly purchases until early next year.

The Fed is currently buying $80 billion/month in Treasuries and $40 billion/month in mortgage-backed securities. We Expect more push back at the press conference about inflation being “temporary” after last week’s CPI numbers, even though Treasury yields took it in stride and in fact declined. U.S. retail sales and producer prices headline a busy Tuesday, along with the Empire State Manufacturing Index and the U.S industrial production report.

Later in the week comes the U.S. Philly Fed Manufacturing Index, as well as unemployment claims which are projected to fall yet again. Overseas we’ll see industrial production numbers from the EU, unemployment rates in the UK and Australia, and inflation checks from the EU and Canada. The week finishes up with a monetary policy update from Japan and retail sales in the UK

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/