A Rolling Recession &

Market Review from the

weekending February 10th 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

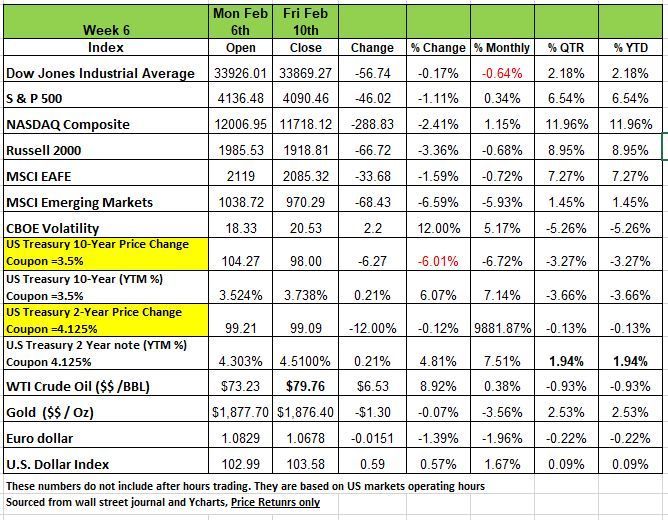

U.S. equities pulled back from recent highs, accompanied by a spike in volatility as rising interest rates weighed on investor sentiment. The Russell 2000 Index slumped -3.5%, while the Nasdaq Composite fell -2.4% and the S&P500 dropped -1% and the DOW basically flat with a -.17% decline.

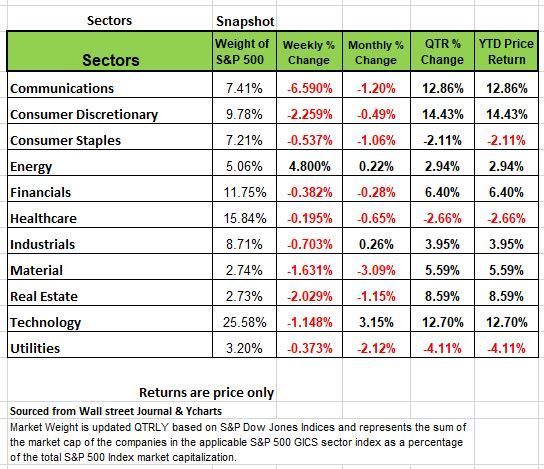

Ten of 11 S&P500 sectors finished lower, with Communication services had the largest percentage drop, falling -6.6%, after shares of Alphabet Inc. plunged on fears of losing ground to rival Microsoft in artificial intelligence technology. This was followed by a -2.2% slip in consumer discretionary, a -2% decline in real estate and a -1.7% drop in materials. All other sectors also declined, except for energy, which rose +5%.

In a speech last Tuesday, Fed Chair Powell didn’t express a more hawkish tone after January’s surprisingly strong jobs report but acknowledged that it will take time to bring down inflation. The implication that interest rates will likely stay higher for longer sent equity markets on a volatile ride and ultimately lower for the week.

U.S. exports fell in December as global economic activity slowed, and the overall trade deficit rose 12.2% in 2022 to nearly $1T.

U.S. consumer sentiment increased modestly in February despite an uptick in one-year inflation expectations. Federal Reserve data showed that consumer credit rose in December by the smallest amount in two years as interest rates climbed, but a Bank of America report revealed an uptick in post-Christmas spending, boosted by the resilient labor market.

Lastly Adding to investors' concerns, corporate earnings have been coming in mixed, with some companies issuing downbeat guidance while others have warned they are preparing for possible recession.

Last week the Treasury held its auction on the 10 yr. note and 30 yr. bond. The coupon on the 10 yr. dropped from 4.125% to 3.5%. Since then, yields have risen (prices dropped) as investors have expectations of more interest rate hikes form the Federal reserve.

The previous week’s jobs data, which we have concerns about led investors to believe that further rate hikes may be necessary to cool down inflation, causing Treasury yields to rise significantly on Monday the 6th. This speculation was supported throughout the week by comments from Fed Chairman Powell, along with other Fed officials. On Tuesday, confirmed that further rate hikes will be necessary and that the Fed is committed to bringing down inflation. Four more Fed officials on Wednesday made comments that implied the final target rate from the Fed may be higher than expected or the time frame to fight inflation may be longer than expected.

Friday’s higher than expected U. of Mich. Sentiment reading contributed to the speculation of rate increases and Treasury yields rose significantly again (prices dropped) . The market implied Fed Funds Rate after the July 2023 meeting increased from 5.0% to 5.2% over the course of the week.

Oil prices also rose 9% over the course of the week as the earthquakes in Turkey disrupted supply from the region as well as Russia announcing a -500k drop in output in retaliation against western energy sanctions. In addition, demand concerns with optimism that China will be reopening from lockdowns.

Overseas, Eurozone retail sales fell -2.7% in December, while investor confidence improved as recession expectations moderated. Germany’s industrial production fell more than forecast in December, but a jump in large factory orders stoked hopes of avoiding a more serious slowdown.

In the UK, economic growth was flat in Q4 2022, narrowly evading a technical recession, but shrank 0.5% in December. The Bank of England indicated another rate hike is likely in March, citing inflation risks. Australia’s central bank raised its cash rate 25bps and leaned towards a more hawkish policy going forward.

The Japanese yen initially climbed but tempered gains after reports surfaced that Kazuo Ueda, who was not involved in the ultra-low rates policy of the last decade, would be named the Bank of Japan’s next governor in April.

Economy

As of the writing of this article Monday Feb 13 we are all waiting for the news on CPI, which is being released on Tuesday morning, so readers of this will have already gotten the news.

For investors, it’s also important to take a longer-term view amidst choppy economic data and position portfolios for the eventual return to a slow-growth and low-inflation economy.

All eyes will be focused on January’s inflation data. After a string of months of promising disinflation progress, January CPI may show a bounce in headline inflation which we think would be due to higher energy prices and persistent owners' equivalent rent inflation. We discussed this is past articles as it accounts for 30% of the overall inflation calculation.

A hot inflation report for January might be a surprise to some investors, but it we are not sure it should be. The M2 measure of the money supply surged more than 40% in the two years ending in February 2022 and part of that overflow is still in the system and generating extra inflation.

Many analysts have been touting a 1.8% annualized rate of increase in consumer prices during the last three months of 2022, but these revised numbers are now showing that the CPI climbed at a 3.3% annual rate in the fourth quarter. Why the consumer is driving prices since demand is still high.

“Core” inflation, which excludes volatile food and energy prices, were previously reported as up at a relatively moderate 3.1% rate in the last three months of the year; now that’s been revised up to a 4.3% pace. Manheim used vehicles Value index last week showed that used car prices also spiked in January, breaking a trend of sharply falling auction prices and warning of a turn in one of the major contributors to core inflation.

While the data may signal some plateauing in used car disinflation (flat no movement) in the coming months, higher auto inventories and bloated dealers’ margins in the context of softening consumer demand still point to a need for further declines in new and hopefully used vehicle prices.

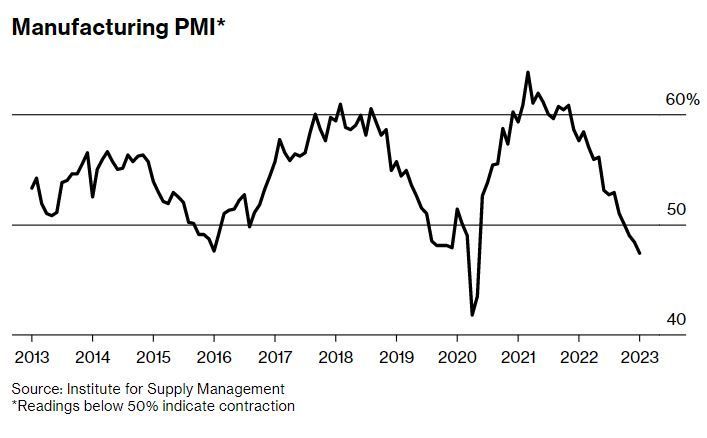

As economist continue gathering evidence on a broad weakening of economic growth and inflation, one would think that the Fed will reverse course. But betting on that may not be wise. Pricing indicators from the manufacturing and services PMI surveys have declined sharply since mid-2022, down to a combined value of 56 from a peak of 85 last March. We think the disinflationary wave has room to run, but progress won’t be linear and inflation data in the very near term could plateau or even turn higher.

A Rolling Recession

What is a hard landing of the economy? The term has been thrown around by the media for several months. So, what does the phrase really mean? Well, it’s a full-blown recession, one when millions of jobs are lost, people struggle to find work, earn an income or meet financial obligations. Historically this is what happened when the U.S. entered an economic recession such as the 1930’s the 1970’s and the 2008 recession. And a soft landing? Well. that’s when the economy slows to a nice, steady pace without decimating the labor market as inflation comes down.

But in this new age of memes and attention-grabbing phrases there’s a new economic term being tossed around. It’s called a rolling recession, and it’s a bit of a hybrid of the two above mentioned.

It’s defined when one industry suffers a contraction, then another industry, but the economy overall never suffers greatly, and the job markets holds up pending the sector.

Industries and sectors will theoretically take turns going through economic cycles, instead of the entire economy declining all at once.

This framework, however, doesn’t quite explain everything that’s going on with this puzzling post-pandemic economy, but now it may be as good a description as any since the government gave out trillions of dollars and the Federal Reserve began its rapid increase of interest rates in March of 2022. For the more optimistic, agenda driven economist, it gives the possibility that the economy will survive its worst bout of inflation since the 1970s without having to endure a significant contraction. But we do not necessarily agree with this theory simply because we do not have a siloed economic system. Our system impacts all sectors. If the cost of lumber goes up so does the cost of housing and furniture, medical care goes up so does the cost of insurance and that impacts profits at companies. Just because one sector or industry is impact first it does not mean others are immune to the damage. We learned that in 2008 when the housing market /bubble collapsed and found out how hard it was to get credit with financial institutions also being exposed. There is a lot of debt out there and with the cost of debt rising it will impact corporate profits.

New Privately Owned Housing Units Started

The first industry to take a hit, in a rising interest rate environment, is housing, the sector most susceptible to the Fed’s rate increases. The industry was especially vulnerable this time around because of the rapid surge in home prices during the pandemic when people flocked to areas with more open space. This demand already put homebuying out of reach for many Americans. Then we also have the housing related industries such as furniture, remodeling industries. Housing starts are a key economic indicator, as key gauge of construction activity, it fell for a fourth straight month in December and was down for the year as a whole, the first annual drop since 2009.

Manufacturing PMI*

Next came manufacturing. A widely watched index of factory production

declined for five months straight through January 2023. Among the culprits: cooling demand for US exports and consumers who are no longer locked down shifting their spending from goods like

Peloton bikes and personal computers to services, such as restaurant meals and vacations. 3M Co., the maker of everything from Post-it notes to touchscreen displays, said last month that it plans to cut about 2,500 manufacturing jobs.

Tech Sector

Tech companies that prospered during the pandemic had access to cheap and abundant cash are now reducing staff in response to weaker sales and falling ad revenue. In addition, these companies are now required to run much tighter operations with the cost of capital that much higher. The industry announced job cuts of more than 97,000 last year and is on pace to top that in 2023, with 67,000 positions eliminated since Jan. 1, according to a Bloomberg tally. When we put all of this together, we get a deceleration in economic activity and a peak of inflation but no significant widespread downturn.

Remember consumers are the backbone of our economy, and while things seem difficult for many spending is still happening enough to justify some economist to keep faith in the U.S. consumers resiliency. Of course, we have a concern about the accuracy of the data we read. We are not sure how much compromise is at work as we discussed in last week’s newsletter that the jobs report seems to be quite a bit inflated.

The average consumer was squeezed last year by higher prices for gas, eggs and everything else, they didn’t buckle, but the signs are becoming more apparent that the stress is starting to show its cracks Savings built up during the pandemic and the boost to incomes from the government are just about gone.

So, what’s in store this time? We don’t have a crystal ball but know this bad decision lead to bad outcomes, some come quickly and some take time to real its ugly head. As a country we made a number of very bad decisions during the pandemic and think we will see significant broad-based challenges by mid-year 2023. We have an economic system that is integrated once sector impacts another and always had.

Are we in a Rolling recession? Possibly for a while as all recessions start as one but eventually things catch up and converge, the question of how bad it will be is the unknown. Source Bloomberg https://www.bloomberg.com/news/articles/2023-02-09/what-is-a-rolling-recession-us-could-escape-economic-pain

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

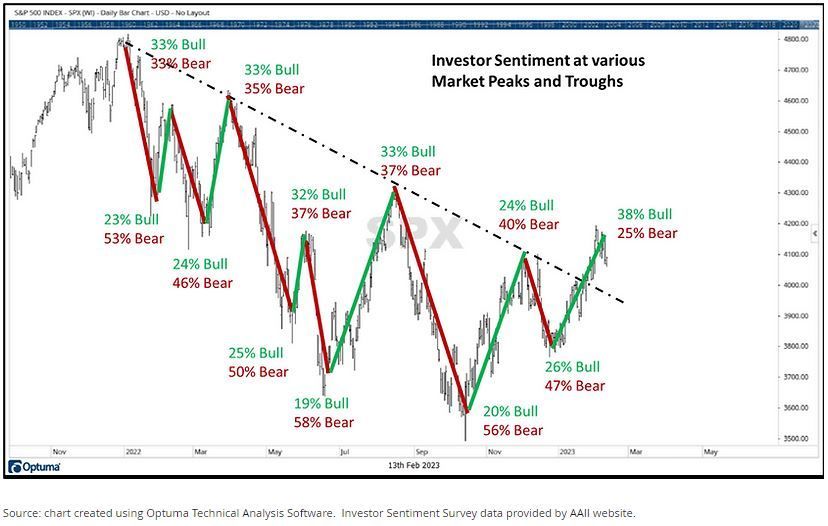

According to the Investor Sentiment Survey, which is produced by the American Association of Individual Investors, current market sentiment now favors the bulls over the bears. This is the first time that this has occurred since March 31st, 2022. The most recent survey, produced on February 8th, indicated that 37.5% of investors were bullish on the market, 25% were bearish, and 37.5% were neutral.

The Investor Sentiment Survey dates back to 1987. Historically, bullish sentiment has averaged 37.5%, which is what the survey showed last week. Surprisingly, the 37.5% bullish reading is the largest since December 30th, 2021. Could the Bulls be back in town?

It is important to point out that the sentiment survey is seen as a “contrarian” indicator. Meaning investors typically feel more bullish near peaks, and more bearish near low points. During the bear market that began last year, that was largely true.

The chart below shows the percentage of both bullish and bearish investors at various peaks and troughs. You can see at the troughs, bearish sentiment was very high, while at peaks, bullish sentiment would rise.

Now, bullish sentiment has surpassed bearish sentiment, with the highest reading since December of 2021. Bearish sentiment is also at its lowest reading since November of 2021. Although this survey is generally considered a contrarian indicator, this reading comes at a time when the market appears to have broken out of its downward stairstep pattern. Which is the most positive investors have felt about the markets since the bear market began last year.

Remember Markets are driven by the law of supply & demand, which in part is is in turn driven by the emotions. But another large part that influences market movement are computers or as we like to say auto pilot. Money deposited into 401K plans that drive index and mutual funds to buy stocks. Most people (investors have no clue what they are investing in just that they put money away for retirement which is place in the markets.

However the sentiment survey showed, people tend to feel more pessimistic near a low point, and a higher level of optimism near a high point. But the markets tend to do what most would least expect.

This is the first time in a long time where investor sentiment favors the bulls. Even though investor sentiment is typically a countertrend indicator, keep in mind that bullish sentiment is nowhere near an excessive level that would indicate there is “too much” optimism. Bullish sentiment right now is just at its historical average.

Bearish sentiment was very high all throughout last year, sometimes exceeding 50% or more. Based on what we know today, this is a positive development. It doesn’t mean these characteristics will still be in place next week or in six months, but for right now, it looks like there is not much logic behind the market upward movement. Source Brandon Bischoff

The Week Ahead

Inflation will dominate the headlines this week, with U.S. CPI arriving on Tuesday the 14th, followed by UK CPI on Wednesday and U.S. PPI on Thursday. We expect a week of mixed interpretations on the data and a lot of sizzle in the headlines.

With the jobs market still interpreted as extremely tight, the Fed may have to hold rates higher for longer to get inflation down to its desired target.

U.S. consumer prices are anticipated to have increased 0.5% MoM in January, but to have slowed to +6.2% YoY from 6.5% previously. A hotter-than-expected report would likely see the U.S. dollar continue its recent recovery.

After declining for two straight months, U.S. retail sales are forecast to have picked up steam in January, despite rising gasoline prices. Other events of note include manufacturing surveys from the New York and Philadelphia regions, industrial production figures, and housing starts. Internationally, given the weaker pound and strong earnings, British CPI has probably not slowed significantly. GDP updates from Japan and the EU round out a light overseas calendar.

January retail sales as well as the industrial production index for the month are among the reports expected this Wednesday, followed by the final reading on the January producer price index as well as building permits and housing starts on Thursday. The January import price index and the index of leading economic indicators will round out the week on Friday

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/