On Course for an Economic Collision & Other Economic News

for the Week Ending May 20th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Volatile trading swings continued last week after stocks climbed 2.02% Tuesday on positive economic data. Retail sales for April increased month-over-month. However, the information was not accounting for the increase as a result of higher prices from inflation and the markets did a 180 degree turn on Wednesday and continued downward through the end of the week.

This would be the 7th consecutive week that the markets had negative returns. This behavior is a clear indication that the markets are in turmoil, a lack of confidence in economic conditions and concerns of the economy. For those readers of our newsletter, we have been warning of this since the middle of 4th Qtr. of last year.

All of this is a consequence for poor decisions of free money, irresponsible consumer behavior and the Federal Reserve, artificially suppressed interest rates for 12 years. It looks like it has finally caught up with us.

The narrative of the economy still being strong is misleading, this is mostly due to political reasons since we have mid-term elections this November. But the markets are not motivated by a political agenda.

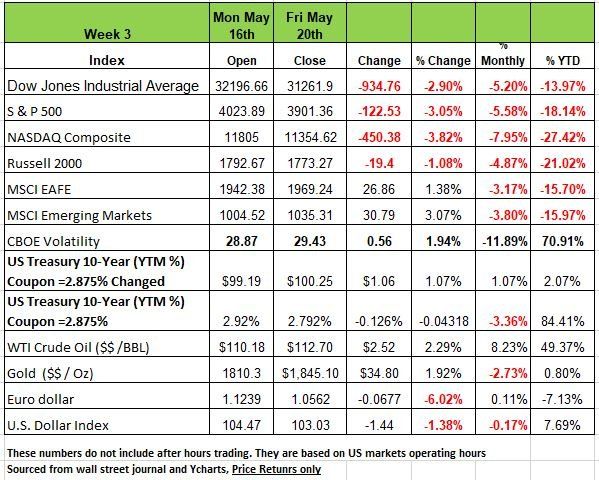

All of the major indices were in the red last week with the NASDAQ having the largest decline of -3.82% followed by the S&P with a -3.05% (it actually passed the bear market metric of -20% but rebounded before close on Friday) the DOW -2.9% and the Russell 2000 -1.08%. If you look at the chart, below take note of the monthly returns and the year-to-date returns. This is a sign that the market is not confident in the economy moving forward. Many are not thinking of when a recession will hit, this is inevitable but how deep it will be.

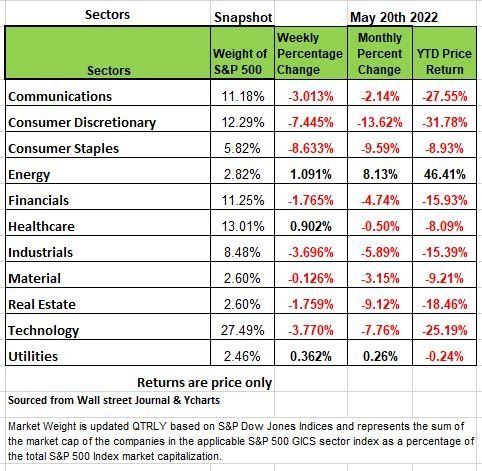

Eight of 11 S&P500 sectors were negative, with consumer staples and discretionary plummeting -8.6% & -7.4% respectively. All of this came after a slew of concerning retail earnings reports by both Walmart and Target. Target slide more than 25% last week over these concerns and weighed heavily on investors that this giants’ problems is just the tip of the iceberg. Energy was up 1.09% Healthcare .9% and utilities .36%. The rest of the sectors declines varied between -.12% and -3.77%

Treasury yields edged lower as financial conditions continued to tighten and credit spreads widened. Federal Chairman Powell stated that “Restoring price stability is an unconditional need. It is something we have to do,” and that he needs to “see inflation coming down in a convincing way” before the Fed stops raising interest rates. Kansas City Fed President Esther George echoed those sentiments, saying the recent selling in equity markets will not dissuade the Fed from using half-point interest-rate hikes to bring down inflation.

Economic data released last week showed mortgage applications fell 10.6% in April compared to the prior year and 14% from March as the recent climb in mortgage rates weighed on demand.

In the most recent sign of a tight labor market, continuing claims, or the number of people receiving unemployment benefits, were 1.3 million as of May 7, which was the lowest level since 1969. But keep in mind that many Americans have not yet re-entered the labor market and much like 2008 when the market collapsed many will go back to work with retirement savings erased by the huge decline.

Across the Atlantic, England’s inflation soared 9% YoY in April, pressuring the government to add fiscal measures on top of central bank actions. A shrinking labor force and flagging retail sales added to UK woes. The European Commission sharply cut its 2022 growth forecast, while the ECB minutes uncovered divergence on how fast to tighten monetary policy. Finally, skyrocketing energy prices pushed German PPI to the biggest increase on record, up 33.5% YoY in April. Even excluding fuel, the index jumped 16.3%.

The Fed is Set Up For a Collision

Do you remember this grade school math problem? If two trains are heading towards each other at different speeds, when will they collide? Well, this problem seems to be playing out in the Federal Reserve’s execution of its monetary policy. As we look at the situation the aggressive tightening of money supply with rising interest rates represents one train and the other is represented by a rapidly declining U.S. economy. The collision or point of impact a recession, now how long will it take?

The dual mandate of the Federal reserve is to achieve full employment and price stability. Historically, the Fed changed the fed funds rate in response to changes in the unemployment rate and changes in inflation

Simply adding up these changes (flipping the sign for unemployment) has tracked well with changes in Fed policy. This relationship has held over several decades and through both tightening and loosening of monetary policy. The chart below shows the historical relationship

The Change in the Unemployment Rate and Change in Inflation Historically Track Changes in Fed Policy

However, over the past year there has been a notable departure in this practice. The steep drop in unemployment and self-inflicted acceleration in inflation was addressed by a slow politically driven Fed. This response failure by the Fed can be attributed to several factors, 1) the unique nature of the pandemic and shutting down the economy, 2) the Fed’s updated policy strategy of tightening money supply and raising interest rates simultaneously so quickly after inserting trillions of dollars into the system. And last cowing to the inflation narrative. The result is that the Fed, as it now acknowledges, is badly behind the curve and “expeditiously” moving ahead with 50 basis point hikes to both keep inflation expectations in check and protect its reputation. We think its reputation is already compromised for now.

However, inflation is now decelerating March’s M-O-M number was basically flat, this week we will get a look at Aprils number and believe it will be below consensus. The pace in the unemployment rate is vague as the publish numbers show a decline, they are excluding several million American that have not reentered the workforce from the pandemic exodus. So, the question now becomes if the drop in portfolio values coupled with higher prices on food and rent will send Americans back into the workforce faster than they want, this is yet to be seen.

We believe that had the Fed followed its monetary philosophy as seen in the chart above, the fed funds rate would be around 2.5 percent by now and the Fed would be able to start pulling back on rate hikes.

But they are behind the curve and we think that they fed will not reach its terminal rate of 3.5% our fear is not if a recession will hit but how deep it will be and how difficult it will be to get out of it.

If the Fed continues to pursue its terminal rate it will increase the risk of overshooting its objective and cause a financial

As the Fed continues to hike rates, we will likely find ourselves experiencing the effects of an increasingly restrictive monetary policy. Back in 2008 the Great Recession credit markets were tightened, consumers had credit limits reduced. With many Americans now building balances on their credit lines and corporations paying more interest on debt, continued rate hikes by the Fed will increase the risk of it overshooting its objective, causing a financial catastrophe and deepening the recession. I guess only time will tell. Source https://www.guggenheiminvestments.com/perspectives/macroeconomic-research/fed-aggressiveness-sets-up-2023-collision

What the Fed Can and Can Not Control

We want to make something clear the Fed has no control over the supply of goods/services. If people do not want to work to produce good or provide services, then the cost of those goods rise in price until the consumer has no need for them. It only has influence over demand via the influence that interest rates have on demand (higher cost of money) and the impact of money supply on the financial markets. The biggest concern we have, is that supply issues continue to push inflation to higher levels, because of events like total city lockdowns in China, and rising oil and food prices due to real or perceived shortages from the Russia/Ukraine conflict.

As a result, in order for the Fed to achieve its 2% inflation target, it would have to impact the 80% of the economy that is not energy or food based. Economist David Rosenberg believes this would require a deep recession (-3% GDP contraction) and a rise in the unemployment rate to 7%. Under those conditions, expect a significantly market decline a really bad “Bear Market.”

Optimistic Scenario

The best-case scenario is that the supply side continues to heal we think that there is evidence that it is doing so. The most recent data for order backlogs from the Institute for Supply Management’s (ISM) monthly manufacturing survey shows a sharp falloff, indicating an easing in the supply chain. https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/april/

In addition, freight volumes have fallen back to “normal” levels as we see in the Cass Freight Volume Index. https://www.cassinfo.com/freight-audit-payment/cass-transportation-indexes/april-2022#freight with the release of the index: “After a nearly two-year cycle of surging freight volumes, the freight cycle has downshifted with a thud.”

Auto production rose +3.9% in April, indicating that the chip shortages that closed assembly plants have eased. The number of ships at anchor off California ports recently fell to 29, the lowest number since last August.

We note that multi-family building continued at a healthy pace (+22.5% Y/Y) which should soften the rise in rents as the year progresses. Remember rent has a 30% weight in the calculation of inflation

Perhaps the Fed will address these inflation trends publicly and become less hawkish.

The flip side is the not So Optimistic Scenario

This scenario may not be as likely until the recession presents its ugly head in concurrent and lagging indicators. But the oncoming recession is a reality. Here’s why we believe it:

- Incomes are not keeping up with inflation. Regardless of what the media is saying. Real Average Weekly Earnings are down more than -4% Y/Y and that causes lower income families to have to divert spending from discretionary items toward necessities, as told to markets by the WMT and TGT Q1 results. WMT said that nominal purchases of grocery and health care items (i.e., staples) rose. Both companies stated that they expected sales of discretionary items to be lower for the rest of the year. In addition, the purchases of those Staple items have shift from brand names to generic/store brands. So, it is clear the budgets of their shoppers (lower and middle income) have been impacted. Both of these companies cut its full year profit guidance, which sent markets down -3.5% to -4.5% on Wednesday alone. This smacked investors in the head that the reality of “RECESSION” was more plausible than expected.

- The market downtrend isn’t new. It’s been percolating for several months, just either not recognized or not believed by media pundits. Last week we mentioned the change in tone in Fed Chair Powell economic outlook, now that he has been reappointed, he is shooting straight and not posturing for political reasons. His assessment has gone from Soft to Softish to there will be some pain

- In looking at the monthly change in real GDP, there hasn’t been a positive month since October and that was because so much was pulled forward due to “supply issues” and the holiday season. But the media and financial pundits continue to push how “strong” the economy has been. Keep in mind that markets ignored the -1.4% Q1 real GDP info because the decline didn’t come directly from consumption. But with WMT and TGT, markets are now changing their tune. A run of this many months without a positive GDP number has never occurred without resulting in recession.

- One of the surest signs of trouble ahead for consumption occurs when, when consumers max out their credit cards. In April, revolving credit rose at a 21% annual rate after rising at a 14% rate in March and a 10% rate in February. This is a sure sign along with reduced/depleted savings that consumers are feeling the pain. They free money sent to so many Americans, created a behavior that now has to be changed. The next concern will be the default rate on these cards

- Lastly, there is the rest of the world. Europe is grappling with Russia’s aggression, but what caught our eye was what has happened in China since the Zero-Covid city lockdowns. The situation seen for April is extraordinary for China with both manufacturing and services shrinking significantly. In addition, Japan reported a negative real GDP for Q1. With the world’s largest economies in, or on, the brink of recession, and with the value of the dollar strengthening against the currencies of these areas, the demand for U.S. exports is sure to fall. (More expensive for those economies) Keep in mind that exports are items produced in the U.S. If such sales are falling, it means lower production (lower GDP) and that directly impacts jobs and income.

Courtesy of Bob Barone Ph’D Economist

The Week Ahead

The narrative has quickly shifted from stagflation to recession. Last week’s data clearly demonstrated the extent to which inflation is affecting the U.S. economy and the vulnerability of corporate profits. This week's the economic calendar may present additional evidence of economic anxieties, beginning with May U.S. and global flash PMIs on Tuesday. Forecasts for slight monthly decreases in the manufacturing and services sectors may prove to be overly optimistic.

On Wednesday minutes from the recent Fed meeting merit attention but may have a muted impact, given the multitude of recent speeches by FOMC members confirming a likely half-point rate increase in June.

The second estimate of U.S. Q1 GDP on Thursday is not expected to change materially. Friday’s busy docket include the PCE Price Index, as investors search for any sign of peak inflation. Other U.S. events include new and pending home sales, durable goods orders, personal income and spending, and the trade balance. Overseas, Australian elections over the weekend may influence the Asian market open.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/