Market Chaos, the "Fed's" Fault and more Economic news

for the Week Ending May 13th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

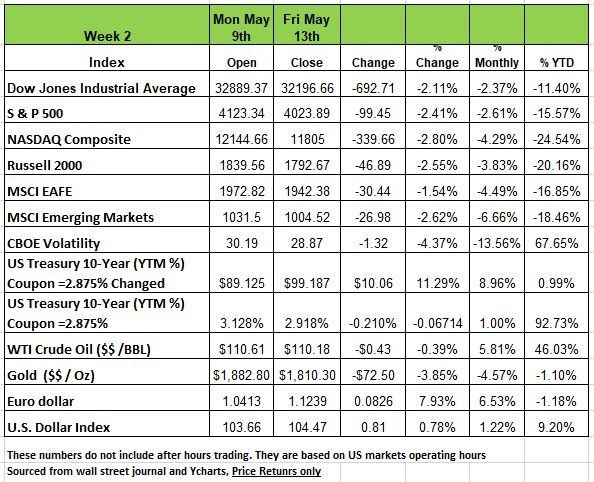

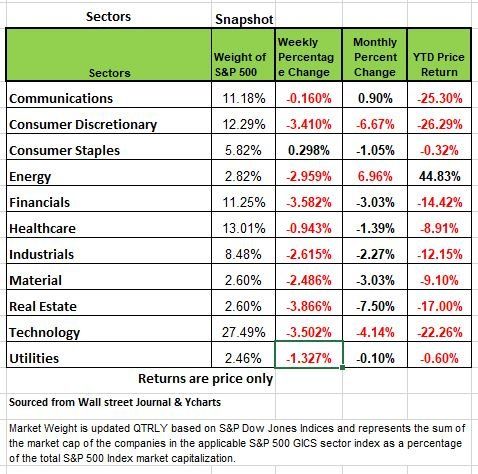

Volatility is a word that you should get very comfortable with and also understand that it is a two-way street. Just because the markets have up days like last Friday does not mean that stability is here. Last week all the major indices were down more than 2% with the NASDAQ having the largest decline of -2.8%followed by the Russell 2000 with a -2.55% and the S&P close behind with -2.55% and the DOW with a -2/11%. These huge swings make investors nervous and many are seeking some safety unfortunately right now with the Fixed income market equally as volatile the only safe haven is cash but that is being diluted by inflation, at least temporarily. Consumer Staples was the only sector to show a positive increase last week with mere .30% price return. On Thursday, Jerome Powell was reaffirmed by the Senate for a second four-year term. In his prepared remarks, Powell encouraged Americans that the process of taming inflation down to 2% will require more pain to come but will ultimately be less severe than if no action were taken. We will talk more bout his later

The coupon on the 10-Year treasury was marked at 2.875 a full percentage point up from the previous auction. This is still shy of the 3% that the treasury was hitting the previous week. Many Bond holders have seen as much decline in their portfolio values as bonds with lower coupons have dropped leaving investors confused as fixed income has historically been negatively correlated to equities, not this time around. High uncertainty regarding the rate of inflation made the prior week’s CPI and PPI economic reports of particular interest for financial markets. The news was not favorable. The CPI registered an increase of 8.3% from the prior year period with “core” prices, those which exclude food and energy, rising 0.6%. The report was lower than March’s 8.5% reading, but still came in ahead of consensus and showing no indication of inflation being transitory.

Some thrive on Chaos

Professional trader love volatility. The more volatile the markets are the more potential there is for many to make a lot of money. But keep in mind this just applies to professional traders, the rare and limited breed of investors that have sophisticated tools to assist them in making large volume trades with smaller profits margins. This can be a very thrilling and addicting process, but most investors do NOT fit into this profile. Most investors want stability, secure and incremental growth in capital appreciation. But this year has been anything but stable and we do not think it will be stable for the rest of the year.

The current environment and all of its economic issues are self-inflicted which has coincided with elevated inflation and an aggressive monetary policy and a slowing business environment.

Investors may need to rethink what it means to be diversified, particularly if the Fed continues to make mistakes that lead to bigger problems

An environment of higher inflation may not be bad for active managers as opposed to passive strategies. The key to navigating equity markets will be to balance earnings potential with valuation, this is not the time for speculative growth and buying overpriced securities because of momentum.

The current economic volatility has translated into interest rate volatility, which has destabilized capital market volatility. As yields move higher multiples will be pushed lower. (Interest rates are used to calculated future cash flows to present value)

In this type of environment, identifying the sectors and industries which stand to benefit from the broader macroeconomic environment will be key – we like industrials, materials, consumer staples and healthcare.

Markets will remain bouncy as uncertainty around the Fed’s ability to correct the bad decisions and policies of the last decade. In these volatile environments you should ask your self if you can stomach large swings and if holding a higher percentage of cash seems like a wiser move for the next few months.

Blame it On the Fed!

As we have penned in the past all economic downturns are the results of bad decision making, not poor Bad. As mentioned above we are now likely to see major up days in the markets when the economic news is ugly. Does that make sense? Yes, in a way

Last Friday, the University of Michigan’s Consumer Sentiment Index was released and they were not pretty. The index is now sitting near the lows of the 2008 Great Recession. One would think that markets would fall when the data is that poor. But for today’s politically driven Fed, bad economic news implies that the recession is closing in, and in a big election year that means the Fed will not be able to execute its publicly announced interest rate plan.

Remember the Fed has a poor track record in guiding the economy to a “soft landing” once it starts a rate-hiking cycle (three soft landings in 14 tightening cycles; i.e., 11 recessions), the worse the incoming data, the more likely it will be that the Fed modifies the level of its “terminal” interest rate of 3%.

As mentioned earlier, last Thursday, Powell was finally “confirmed” by the Senate as Fed Chair for another term. Guess what? he finally started to “shoot straight” with the American public, stating that he thought that the process of crushing inflation would “include some pain”! This is the first indication of what we think will be his changing view of the economy as the year progresses. Keep in mind pain is lost jobs, unemployment increases.

The Media’s Fixation

As readers of our newsletter know we dislike the media, they’re irresponsible and only interested in sensationalizing information. Inflation is constantly in the headlines, on news broadcasts, and generally the go to topic of the media. The media is just fixated on it, especially the Y/Y change in the Consumer Price Index (CPI). And yes, it is high, the data that came out last Wednesday (May 11), that April’s inflation on a Y/Y basis had declined from its 8.5% level in March. But because it only fell to 8.3% when Wall Street expected 8.1%, the “inflation narrative” was reinforced and is scaring Americans. Now again keep in mind that these numbers are still distorted. Simply because of the math. If we compared prices today to prices in 2019 inflation is running at 3.95% annually. But that does not have enough teeth for the media.

In addition, there wasn’t any mention at least that we could find of the rapid fall in the monthly change in the CPI MoM %. The M/M inflation rate fell from a 1.2 pct. point change in March to a 0.3 pct. point change in April. We haven’t seen that small of a monthly change since last August, and before that, December 2020. Here is a “thought experiment.”

What would the Y/Y change in the CPI be in December 2022 if the change in the CPI were to stay steady at 0.3 pct. points per month? It would be 5.5% if the rate of inflation would be at 0.2 pct. points per month (4.7%) and 0.1 pct. points (3.9%).

If we do some surgery and stripped out food, airline and new car prices, April’s CPI was flat; and if rents are excluded, it was down -0.1%. This is little comfort to those with tight budgets but remember this is a self-inflicted wound. But the point is we are seeing the beginning of prices wane

The same seems to be a similar story for the Producer Price Index (PPI), an index of the cost of business inputs. While up 0.5% in April, like the CPI, we haven’t seen prices rise this slowly since last September, and before that, December 2020.

So, despite the media rants and the ongoing “inflation” narrative, both CPI and PPI were “tame” relative to those of the recent past and they were in keeping with the view that we expressed in past blogs that the inflation numbers would be falling as the year progressed. We wouldn’t be all that surprised if we saw the lower prediction of Y/Y inflation at 3.9%. But the media will find something else to scare you about

The data we are seeing coming in seems to be validating our view of a weakening economy. We have penned in previous newsletters that real (inflation adjusted) weekly take home pay is negative on a Y/Y basis (-4%). Blackrock did a study, which showed that U.S. labor costs have been falling. Not rising like the media has been stating. So, it isn’t any wonder that corporate profits reached another all-time high.

Some pundits have expressed opinions that businesses have been price “gouging,” i.e., raising prices faster than costs, simply because “inflation” is on everyone’s mind, so price increases are “expected.” We don’t think many of those prices will stick for long once consumers cut back.

Wall Street doesn’t think that consumers will cut back because Uncle Sam sent free money for the last couple of years and that money is available to buoy consumption. But that money is long gone.

The savings rate has now plunged below its pre-pandemic level to 6.6% so all that “free money” looks to have been spent. In addition, the consumption from March and April, was boosted by record breaking increases in consumer credit. This won’t continue as credit limits are approached.

Lastly, mortgage refinancing has often been the source of consumer funding for big ticket items, especially over the last 12 years with artificially suppressed interest rates. This was especially true as home prices rose while the Fed held down interest rates. People leveraged, just like in 2008. But, with the rise in interest rates, that funding source, has disappeared. So based on all we have just shared there doesn’t appear to be many other places where consumers can easily access credit. Our conclusion, we believe a significant slowdown in consumption will soon show up in the numbers. Demand will drop and prices in some areas will revert to their mean Source Bob Barone Ph’D Economist.

China has a big problem and so do investors in Global Bond Funds

Asia’s junk-bond market has shrunk drastically and new debt issuance has slowed to a trickle. Once the place to be for yield-seeking global investors Asian debt is not looking so healthy.

Things change quickly, less than 18 months ago, the dollar-bond market for noninvestment grade companies from China to Indonesia was booming. It neared $300 billion in size, thanks in large part to numerous bond sales by Chinese property developers such as China Evergrande Group.

Now everything is out of whack in Asia for example in 2019 over $72 billion of debt was issued so far YTD only $2 billion has been raised.

A spate of defaults and a massive selloff has resulted in big losses for investors, erasing more than $100 billion in value from one widely watched bond index. The total market value of Asian high-yield bonds—excluding defaulted debt—is now about $184 billion, according to data from Bloomberg and Barclays Research. The default rate will continue to increase as companies like Evergrande fail to meet debt obligation on vacant cities that have been developed at light speed. This will eventually translate to a global problem and may impact outsource manufacturing done in China. Source https://www.wsj.com/articles/a-100-billion-comedown-soaring-defaults-shrink-asias-junk-bond-market-11652693402?mod=lead_feature_below_a_pos1

The Week Ahead

With the S&P down nearly 20% from its peak and the Nasdaq off to its worst yearly start on record, investors are searching for signs of capitulation. Sentiment has been bearish for weeks, and volatility has remained stubbornly high but without the signs of panic typically seen near lows (see tweet here). The unrelenting interest rate ascent has slowed, but weak seasonality and technical trends are poised to be market headwinds. This week a busy economic calendar looms along with another series of Fed appearances. In the U.S., the consumer will be in focus with April’s retail sales report on Tuesday and earnings releases from retail giants Walmart, Home Depot, and Target throughout the week. The beleaguered housing market will deliver updates with the NAHB Index on Tuesday, housing starts on Wednesday, and existing home sales Thursday. Industrial production and manufacturing accounts from the New York and Philadelphia regions round out the U.S. docket. Overseas, the EU kicks off today with economic forecasts, while in Britain the BOE testifies before Parliament on inflation and the economic outlook. Midweek, UK CPI takes center stage with employment figures and retail sales to follow, while the Eurozone will feature revised Q1 GDP and inflation data. China issues retail sales and industrial production numbers, expected to have deteriorated due to lockdowns.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/