Is Economic Data Compromised? A spike in Life Insurance Claims

& Other Economic News for the Week Ending February 4th 2022

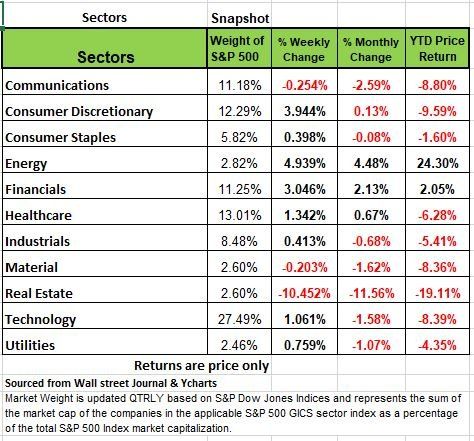

Another volatile week but the markets inched out modest gains. The week also included the end of January which was not kind to investors especially those invested in Index Funds the Dow ended January with -3.32% loss the S&P -5.26, the NASDAQ -8.98% and the Russell -9.66%. However, The S & P 500 index rose 1.55% by weeks end, marking its largest weekly percentage gain of 2022 so far, this led by the energy, consumer discretionary, and the financial sectors. 8 of the 11 sectors were in the black for the week Real Estate sector posted a -10.42% drop over the previous week

The gains came most from industry heavyweights, Google AMD and UPS. As we have discussed in previous post a cap weight index is influenced by a handful of companies and as evidence the rally came to a halt on Thursday as FB (Face Book/Meta Platforms) dropped 26% the largest one day drop of any U.S. Company in history.

Friday, the Labor Department reported nonfarm payrolls rose by 467,000 in January, well above the increase of 125,000 jobs expected in a survey compiled by Bloomberg, while December payrolls had a large upward revision to a 510,000 increase. The unemployment rate ticked up to 4% in January from 3.9% in December, versus an expectation for no change, but the labor force participation rate rose to 62.2% from 61.9%.

The yield on the benchmark 10-year Treasury note (T-note) closed trading on Friday at 1.91% up 14 basis points from the previous week and up 26% since 12/31/2022.

Yields on shorter maturities have risen more than on intermediate maturities. The yield spread between the U.S. 2-year T-note and the 10-year T-note was 60 basis points on 1/31/22, well below its 30-year average spread of 116 basis points as of the same date, according to Bloomberg.

S&P reported that global bond issuance rose 5.6% year-over-year to $9 trillion in 2021, according to AsiaMarkets.com. S&P expects bond issuance in 2022 to contract by about 2%. Investment-grade companies rushed to sell debt in January 2022 out of concern the Fed may raise rates, which many pundits believe could begin as soon as March 2022.

Data from Refinitiv indicates that investment-grade firms ended up raising $532 billion globally, the most for a January since 2000, according to Reuters. Investors should prepare for some additional volatility in the bond market if interest rates, bond yields, and perhaps inflation, trend higher.

Economic Climate

If you read much of the news published by the media you are probably thinking things are not too bad, with the exception of inflation, which we have mentioned in past newsletter we fell most of it is a self inflicted, by people not using the government funds provided to them during the pandemic responsibly. But as you will read later in this post we feel that there are many underlying cracks in our economic foundation and this gives us pause to think how to best handle your money.

Pay Check Protection

The paycheck Protection Program cost taxpayers over $800 Billion Dollars and this does not include any of the other funds allocated by the CARES Act.

We already know how much fraud was involved with the Pandemic Assistance programs, Hundreds of people set up fictious companies and took millions of dollars from the taxpayers to buy everything from Fancy cars to Yachts and homes. But aside from the fraud we are also finding legitimate business owners pushing the boundaries of integrity.

One new analysis found that only about a quarter of the money spent by the program paid wages that would have otherwise been lost, partly because the government loosened the rules for how businesses could use the money as the pandemic dragged on. Because many businesses remained healthy enough to survive without the program, another analysis found, the looser rules meant the Paycheck Protection Program ended up subsidizing business owners more than their workers.

“Jobs and businesses are two separate things,” said David Autor, an economics professor at the Massachusetts Institute of Technology who led a 10-member team that studied the program. “We tried to figure out, ‘Where did the money go?’ — and it turns out it didn’t primarily go to workers who would have lost jobs. It went to business owners and their shareholders and their creditors.”

Compromised Economic Data

Is the truth so hard to live with? It seems like politics have infiltrated our economic system, but it did not just happen. It’s been going on for about 10 years and the one area that our citizens should rely on is a non-partisan independent arm of the government. It appears that both the Federal Reserve and the Bureau of Labor Statistics have been compromised.

Let’s take a look at the data from last week. The financial markets were stunned by the huge rise in net new jobs in both the Establishment (Payroll) Survey (+467K; consensus forecast +125K), a monthly survey of businesses, and the Household Survey (+1.2 million), a similar survey of individual households. This was especially surprising given the weakening economic data that has shown up since Thanksgiving of 2021, the fact that ADP, the nation’s largest payroll processor, reported two days earlier that it estimated -301K fewer payrolls in January than in December, and that absenteeism spiked to 9% of the workforce in January due to Omicron.

But the January data contained BLS’s annual benchmark revisions. These are one time and permanent revisions to the employment data for 2021 and they significantly upwardly revised the population and labor force levels. So as a result, because those two series were estimated to be higher, then, voila, employment must have been higher too! Really!!

So how do they do this? The BLS uses a “Concurrent Seasonal Adjustment” process which re-estimates seasonal adjustment factors each month. That’s right they get to go back and redo the numbers. As the year progresses, the seasonally adjusted numbers are changed for each month, BLS only reports updated/revised data for the prior month. It isn’t until the benchmark revisions are issued in February that the public sees the entire story. How forthcoming is that?

We think your should be careful on what information you may be basing your decision on.

In looking at the data 3 of the months in 2021 were revised by more than120% and four other months by more than 27%. Thus, relying on this data, when first published, might be hazardous to one’s view of the strength of the economy. This appears to be the case for January’s SA headline employment data. (One should note that these estimates of employment, in and of themselves, do not add a single dollar to the GDP. They are only meant as a measure of the health of the labor market.)

We do recognize that seasonality exists. But the pandemic isn’t seasonal and events caused by the pandemic over the last 2 years distorts the seasonal factors which result solely from a statistical process. The absentee spike in January, for example, isn’t likely to reoccur next January. Thus, the resulting seasonally adjusted (SA) data is misleading.

So how do we know this? Because the BLS does publish their raw data (Not Seasonally Adjusted (NSA)), but, most of the time, the financial media ignores it. Looking at that NSA data for January 2022, we find that the actual change (NSA) in the Establishment (Payroll) Survey between December and January was -2.824 million!! You read that right! This data comes from Table B-1 of BLS’s The Employment Situation – January 2022. https://www.bls.gov/news.release/pdf/empsit.pdf

Compare that to the +467K SA number that the markets locked in on, a difference of -3.29 million! We didn’t see a single mention of this in the media.

We know that the pandemic has caused significant changes in behavior which are temporary (“transitory!”) and that the statistical process of seasonal adjustment considers these temporary behavior patterns as permanent, thus distorting the seasonally adjusted data. For example, the Omicron variant sidelined 9% of the workforce in January, i.e., absenteeism (2% is normal). We, along with many economic commentators, believed that this would negatively impact January’s employment surveys. The largely negative NSA data appears to attest to that.

Furthermore, in the January data release, we also find that the workweek declined from 34.8 hours in November to 34.7 in December and to 34.5 hours in January (i.e., apparently the result of people being absent from work). Rosenberg Research estimates that accounting for the shortened workweek would change the SA +467K headline number to -400K! Source Bob Barone PhD Economist

HOUSING

US housing demand continues to outstrip supply. In December, the number of single-family homes for sale reached a 30-year low. Moreover, the median length of time between when homes were listed and sold continued to shorten. While higher interest rates may challenge affordability, robust demand against persistently low inventory may still drive double-digit housing price appreciation in 2022.

Life Insurance Claims at all time highs

The pandemic has disrupted life significantly and an odd statistic is emerging over the last two years. Life insurance companies base many of their decisions on the law of large numbers. Meaning that they have so much data that they can make predictions on just about anything concerning one’s life. However, over the last two years much of their outcomes have come as a surprise. In 2020 the industry saw an increase in death by more than 15% and last year those numbers kept increasing. Some companies have seen increases of up to 40% since 2019. Those numbers are massive. In an industry that relies on these numbers to be able to pay claims a 5% increase would be substantial and cause some investigating. But a 40% increase is almost statistically impossible. Much of the concern is focused on the age of these policy holders. Its not like they are all over the age of 70. Many of the increases are been seen in younger adults who would have been considered healthy individuals (meaning not having any medical issues such as cancer).

While it may take a while to gather enough information to understand why a large increase happened in such a short time period. Life insurance companies are adapting and revising their risk models, this also means revising prices, so if you have not already purchased Life insurance for your family expect rates to increase significantly over the next year or two. Source https://www.reuters.com/business/life-insurers-adapt-pandemic-risk-models-after-claims-jump-2022-01-13/

The Week Ahead

All eyes are likely to remain on the Fed for the foreseeable future. The next release date for the Consumer Price Index is 2/10/22. Bloomberg’s consensus estimates for January from the economists it surveys is 7.3% on a trailing 12-month basis. If accurate, that would be above the 7.0% rate posted in December 2021, which already sits at its highest level in 40 years, according to data from the Bureau of Labor Statistics. The direction of inflation in the coming months will likely play a significant role in determining how much the Fed hikes rates and when. Many believe the Fed is already behind the inflation curve. A decent amount of air was let of the so-called bubbles permeating the stock and bond markets in January 2022.

The bond market will absorb 10-year and 30-year Treasury auctions on the heels of yields rising to their highest levels in 2+ years. Other reports of note in the U.S. include consumer credit, trade balance, and consumer sentiment closes out the week. Earnings releases of note include Pfizer, Peloton, Disney, and Uber. On the international agenda, the spotlight will shine on the UK, with Q4 2021 GDP anticipated to have stagnated due to omicron restrictions. December’s unexpected dive in retail sales may have dented growth in what was shaping up to be a strong quarter

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/