Economic Outlook

Week Ending Oct 2, 2020

Week in Review

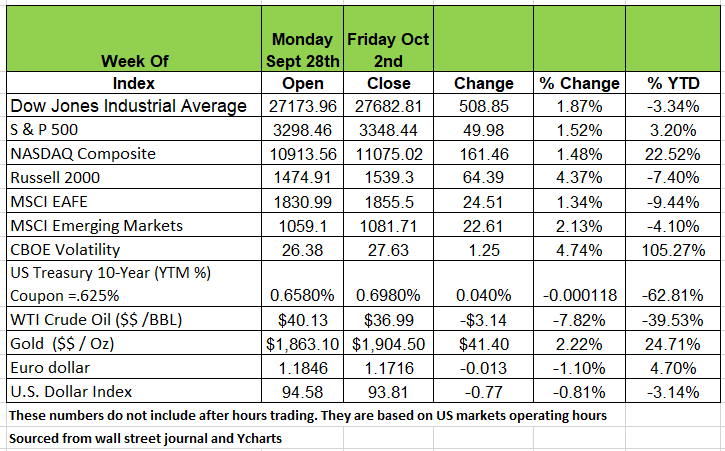

Last week marked the close of the month as well as the 3rd quarter. All of the major indices closed the week and the Quarter in positive territory. However, for the month of September all of the major indices

were down with the NASDAQ having the largest decline of 5.12%

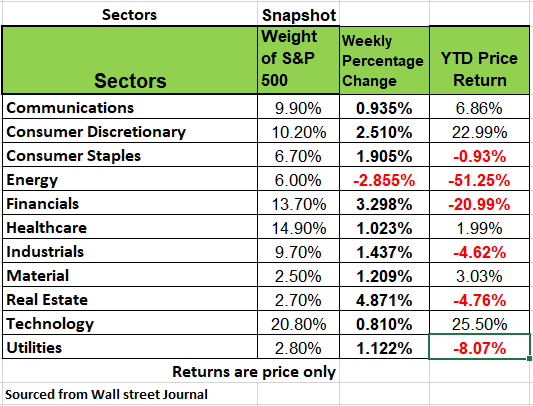

Energy was the only sector the be in negative territory last week, which was down -2.855%. The sector has been hit hardest by the COVID-19 pandemic as price only losses are -51.25% YTD. The usage of fuel, by the airlines, cars and municipal busses have slowed production, and usage significantly. This sector may take some time to rebound until the population returns to its travel habits, both in commuting to work and traveling within the country and abroad. Of the 11 sectors 5 have seen positive price returns while 6 are in negative territory for the year

Economy and Market

When we look deeper into the performance of the 11 sectors of the market /economy we can see that 2 specific sectors have driven the indices. Technology and Consumer Discretionary. Technology we know has been mostly driven by Amazon, Apple, Zoom and several others. Consumer Discretionary however includes a number of diverse businesses from Apparel Manufacturing to Travel services. We know that travel, restaurants, resorts, and most of the business in this category have been hit hardest by the economic situation. So why has this sector performed so well? It also includes; home improvement, residential construction, used cars and furniture, fixtures and appliances. With so many people not going out to dine on a regular basis or vacation. We have seen that the savings rate in the country has risen. Not all of the savings came from those that received the additional $600 / week from the government. With so many people stuck at home, that kept their jobs and income stream, they reduced expenses and shifted their spending into their homes, renovating and redecorating. This however will not go on forever and at that point we will see a flattening in the spending habits and unless that spending is diverted elsewhere we will see more layoffs and see the worse of this recession.

Unemployment

Personal income fell -2.7% in August. Still, consumer spending rose 1.0% M/M. What Gives?

The economy is still very much all about employment. While the official U3 unemployment rate (those actively seeking jobs, U6 includes those discouraged or underemployed) fell to 7.9% from 8.4%, the underlying data was, “ugly”

With Disney and the airlines announcing that the temporary furloughs would become permanent. Employment data continues to be the most reliable indicators of the real state of the economy. Don’t be fooled by the unemployment rate. August numbers indicate a lower unemployment rate (7.9% vs. 8.4% for July). However, eighty percent of the fall in that rate was due to a contraction in the labor force participation rate (the percentage of the population that are working or looking for work). A falling participation rate occurs when the unemployed get discouraged and stop looking because they can’t find jobs. As a result, the denominator is smaller, so, if there were the same number of jobs as in the previous month, the employment rate would rise and the unemployment rate would fall despite the fact that no net new jobs were created. Source Bob Barone FourStar inhouse economist

GDP forecast

The National Association of Economist released information on their forecast of the economy for Q4 and for 2021. The prior estimated rate of growth for Q4 was expected to be 6.8% as released in June. The Oct -Dec annual rate is not projected at a 4.9% annual rate. In all the economy is expected to contract in 2020 by 4.3%. The outlook for 2021 was lowered to 3.6% from 4.8%, which was forecasted in June as well. Source Marketwatch https://www.marketwatch.com/story/economists-growing-less-optimistic-about-outlook-for-u-s-economy-11601874520?mod=home-page

Qualified Plans

Every 6 years the DOL (Department of Labor) requires plan sponsors to restate the plan documents for their 401K plans. This restatement is done to bring all plan documents current and address any changes made by law over the last 6 years. If your company sponsors a 401K plan for employees, 2020 marks the end of the 6th year since the last change. However, you have 18 months to bring your document current. The deadline would be July 31st 2022. We bring this to your attention now because the current economic situation which may make it difficult for certain businesses to maintain the commitment of specific contributions, such as some safe harbor provisions. It may be a good time to reevaluate your plan and economic situation to insure you are capable of making the required employer contribution. The change notice to employees must be distributed by Dec 1 of 2020.

What is your relationship with money? We all have one.

Over the next several weeks we will address a few fundamental aspects of behavioral economics. These are biases that affect people’s financial decisions, and long-term financial goals. We all have them so we hope that this provides you with some insight into your own behavior or the behavior of someone you know.

Fundamentals of Behavioral economics

Money is fungible.

Below are 3 situations, as you read them make a mental note of what you do.

Situation 1:

Mr. and Mrs. Jones have saved $50,000 toward their dream vacation home. They hope to buy the home in five years. Currently The money earns 1.0% in a money market account. They also just bought another car for $30,000 which they financed with a three-year car loan at 6%.”

Can you spot the flaw in their behavior?

Well, Mr. and Mrs. Jones have effectively borrowed $30,000 at 6% and are reinvesting it at 1.0%, structurally locking in losses of 5%.

Situation 2:

Imagine that you have decided to go to the movie theater tonight and you purchased a ticket in advance for $20. As you enter the theater, you discover that you have lost the ticket. The ticket office tells you they keep no records so you will have to purchase a new ticket to see the movie. Would you still pay $20 for another ticket? Yes or No

Situation 3:

Let’s change the same situation slightly. You have decided to go to the movie theater tonight and the ticket is again $20. As you enter the theater, you discover that have lost a $20 bill on the way. Would you still pay $20 for a ticket for the movie? Yes or No

Of the 200 participants took part in this experiment. In the first case, 46% replied “Yes”, they would buy another ticket and 54% replied “No.” Perhaps the 54% felt that they didn’t want to pay twice.

However, in the second case, 88% of the same group said, “Yes,” they would buy another ticket and only 12% chose “No.”

Why so different?

Mental accounting is the set of “cognitive operations used by individuals and households to organize, evaluate, and keep track of financial activities." such as the money’s origin and intended use, rather than thinking of it in terms of the “bottom line” as in formal accounting.

The concept was developed by University of Chicago economist Richard H. Thaler, it contends that this bias makes an individual prone to irrational decision-making in their spending and investment behavior. When we say “Money is Fungible” we mean that any dollar is exchangeable and substitutable for any other dollar, no matter its source or how it was obtained.

Here are a few other examples can you relate, or perhaps know someone that operates this way.

A person will purchase a product on sale, putting it on a high interest credit card and pay it off over time. By the time they pay if off the purchase, they have spent more with interest than the actual full retail price and wipe out all of the savings they think they had from the sale.

A person receives a tax refund and goes to Las Vegas to gamble. He places bets that he would not ordinarily place because he feels this was found money. Not a real loss.

All individuals should value a dollar the same whether it is earned through work or given to them as a gift/bonus. People frequently violate the fungibility principle, especially in a windfall situation. Such as a tax refund. Getting a check from the IRS is generally regarded as "found money," something extra that the recipient often feels free to spend on a discretionary item. But in fact, the money rightfully belonged to the individual in the first place, as the word "refund" implies, and is mainly a restoration of money (in this case, an over-payment of tax), not a gift.

Play Money often thought of as money you can afford to lose under this notion an individual will view some arbitrary amount of money and feel comfortable squandering it or behaving more reckless with it. You see a lot of this when it comes to gambling or vacations. It’s fun money.

At first glance, this has the makings of sensible decision-making. It seems prudent to clearly delineate between money that matters and money that doesn’t. The problem, of course, is that “money you can afford to lose” is purely a mental creation

But true financial rationality dictates never putting money somewhere that it will likely to be lost, and that no amount of mental maneuvering would make this an acceptable fate for any amount of money in your possession.

Safety Money this is just the opposite of “Play Money”. True to the mental accounting fallacy, this is the money people regard as “money they need.” Consequently, these funds are handled with the prudence and care befitting of money one expects to pay a mortgage, fund a retirement account or other serious financial obligations.

In reality, this is the way that all of a person’s money should be treated. There is no dividing line between money that matters (safety capital) and money you can afford to lose (risk capital). Any dividing line you honor is nothing more than a misleading mental illusion.

All humans possess built-in mental “handicaps” that poison our personal decision-making. So how can we avoid this trap? Its not hard, but involves some discipline. First you need to get organized and create a written annual budget and long-term financial plan. Stop keeping everything in your head. The goal here is to translate your mental notes into something physical and tangible. This will help you on a weekly, monthly and yearly basis to see the flaws in your spending behavior. Be especially disciplined of your credit card purchases and interest payments.

Finally communicate with your partner or a close friend or professional. One of the biggest problems we have as human beings when it comes to money is, we treat the subject likes its taboo. Some may be embarrassed that they are asking for help and should know better. Some of the mostly highly educated people make financial mistakes and over the course of the next several weeks we will explore others.