Economic Outlook

Week Ending Sept 25th 2020

Market recap

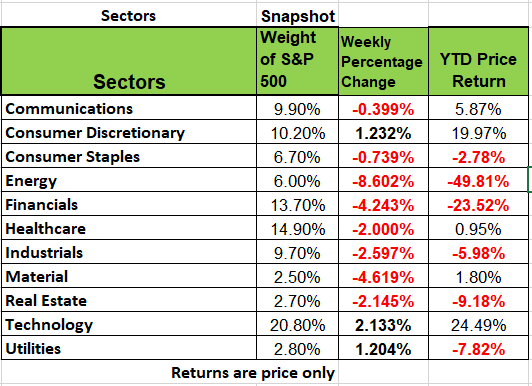

Another volatile week in the markets end Sept 25th 3 of the 11 sectors were in positive territory as the week came to an end. Consumer discretionary and Utilities closed up just over 1.2%. While technology ended the week 2.13% up. Global risk remained under pressure as more cases of COVID-19 surged in Europe. Washington failed to advance stimulus talks, driving the S&P500 lower for the fourth consecutive week, but closing down just .63%

Bank of America’s fund flow report showed investors yanked $ 25.8 billion from U.S. equity funds in the week ending Friday, this illustrates how jittery investors have become with the upcoming Presidential election. Friday’s modest rise helped the Nasdaq Composite finish the week up 1.23%, contrasting with Russell-2000 losses just above - 4%.

Treasury yields dropped over the course of the week on increased Covid concerns in Europe and comments from the Federal Reserve. Cases in the United Kingdom, France and Spain have been picking up, prompting London Mayor discuss new restrictions aimed to slow the spread of the virus.

Week ahead

· This week investors await the monthly jobs report due out on Friday Oct 2.

· China’s manufacturing data and US Goods trade balance, and wholesale is due out Tuesday.

· Pending Home sales are expected to slip a little

· Thursday jobless claims and ISM manufacturing numbers are looking to remain steady. however, keep an eye on the price component of the PMI for inflationary tones.

· Culminating the week will be the NFP (non-farm payroll) report, and its symbol of the labor market may become a rising topic in the Presidential race.

The Walking Dead of the Corporate World

It sounds like a good headline as we enter October and approach Halloween, but these Zombie’s have nothing to do with the celebration but be aware you should be afraid of them, financially that is. Barron’s had an interesting article on the rise of Zombie companies due to the pandemic. In short, Zombie companies are indebted businesses that, although generating cash, to cover running costs, fixed costs (wages, rates, rent) they only have enough funds to service the interest on their loans, but not the debt itself.

As such they generally depend on banks (creditors) for their continued existence, effectively putting them on never-ending life support. Many times, these companies are part of a portfolio in a mutual or index fund simply because they are in a sector that the fund is over diversifying within.

Here is a five-step blueprint for identifying them:

•1) They can’t cover their interest costs twice over with last year’s pretax earnings.

•2) Their “return on common equity spread,” the gap between their return on equity and their cost of equity, is lower than 4 percentage points.

3) Their one-year sales growth is below 3%.

•4) Their three-year average sales growth is below 3%.

•5) And their “Altman Z-Score” (a measure of liquidity, solvency, and profitability that is sometimes used to predict bankruptcy filings) is below 1.8.

https://www.barrons.com/articles/how-to-recognize-the-growing-ranks-of-zombie-companies-51601088940

ATTOM Data Solutions reported that 53,621 U.S. single family homes and condos were flipped in Q2'20, representing 6.7% of all home sales during the quarter, according to its own release. The gross profit on the typical flip nationwide was $67,902, up from $61,900 in Q2'19. The $67,902 profit translated into a 41.3% return on investment when compared to the acquisition price of the home, up from 40.4% in Q2'19

U.S. families’ income and wealth rose in the years heading into the coronavirus pandemic, with those in lower-income and lower-wealth categories reaping relatively large gains, the Federal Reserve said in a report on household finances. As property and stock prices increased, households’ median net worth, or wealth, rose 18% to $121,700 from 2016 to 2019, according to the Fed’s Survey of Consumer Finances. The report is produced every three years. Median household income—the level at which half are above and half are below—rose 5% to $58,600, before taxes and adjusted for inflation. The rise in incomes came as the economy grew 2.5% a year on average, inflation remained low and the unemployment rate fell. The data suggest households were on a relatively solid financial footing headed into the coronavirus pandemic. https://www.wsj.com/articles/household-wealth-broadly-rose-in-years-leading-up-to-pandemic-fed-report-concludes-11601309146

Last Tuesday, Fed Chairman Jerome Powell testified before congress and said another fiscal stimulus would be important to aid the economy. This contributed to the chatter that the U.S. economic recovery has plateaued without additional fiscal response. While many industries struggle (restaurants, health clubs for example) providing economic support will not help if consumers do not support their local businesses and the additional debt will just have long term effects on America.

Global PMI reports came in largely mixed with European services figures missing estimates and sliding in August, while both U.S. and European manufacturing slightly exceeded expectations.

Domestic housing remains robust, supported by artificially suppressed interest rates.

The weekly unemployment claims remained elevated at 870k, slightly higher than last week’s, while U.S. durable goods orders came in lower, albeit with the prior month’s revised slightly higher.

Commerce Department’s measure of personal income was 4.9% higher than in February, as government transfer payments - which the US borrowed from future taxes - more than fully offset declines in wages and salaries. Think about that for a moment. Even with the end of special unemployment bonus payments, there is likely more money in people’s pockets today than there would have been had the pandemic never happened! Right now, any weakness in the economy is coming from the fact that many sectors (especially service-type activities) remain shut down or lightly used.