Economic Outlook

Week Ending Oct 9, 2020

Week in Review

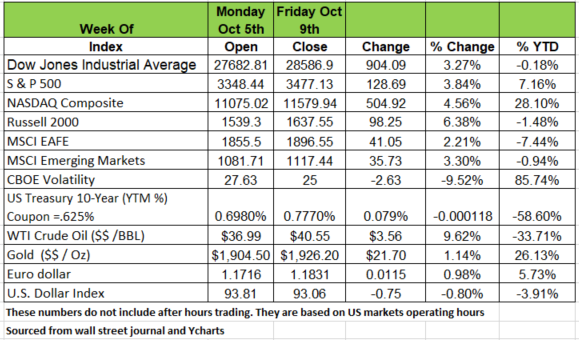

Not a bad week for all of the indices in the market for the week ending Friday Oct 9th. The DJIA closed the week up 904.09 or 3.27%. while the Russell 2000 closed the week up 6.38%

The DXY US Dollar Index dropped ¾%, while U.S. government bond yields rose last week, with longer-term yields rising more than shorter-term yields, on hopes for fresh stimulus to boost the U.S. economy. Yields rose sharply on Monday but reversed on Tuesday after President Trump said he was postponing stimulus talks until after the election. Data from the Fed has confirmed that the economy has stalled so the pressure to release another stimulus is high. While all 11 sectors all finished the week in positive territory a stimulus will really be nothing more than a band-aide on a severely wounded economy until consumer behavior returns to a place of confidence and safety from this virus

The Economy and Employment

Employment has been and will remain the key to a recovery of the economy. Without the creation of jobs, we are going to have some challenges. Right now there is a rise in “permanent” job loses. (excerpt from the Fed minutes:

“The participants judged it as less likely for future job gains to continue at their recent pace, because a greater share of the remaining layoffs might become permanent.”).

At the beginning of the pandemic and during the initial shutdown, the media experts kept saying that most of the layoffs were seen as “temporary.” Remember how many people were considered furloughed? But the reality is that the return to “normal” is anything but imminent. The latest data point on the St. Louis Fed shows 3.8 million permanent job losses.

In addition, the data for state Initial Claims (ICs) new layoffs have been at or above 800,000 since early August (nine weeks in a row) after having fallen pretty consistently from their April peak. Please note, these are new claims which parallel new layoffs. When the Pandemic Unemployment Assistance (PUA) ICs are added in, there were an unfathomable 1.26 million new unemployment claims the week ended October 3rd. (And that didn’t include the announcements from Disney or the airlines of their cutbacks.) Besides new layoffs, state unemployment data show 10.6 million Continuing Claims (CCs) and 25.6 million when the PUA program is added in.).

The weekly Department of Labor (DOL) news release of state and PUA unemployment data on Thursday, October 8th was accompanied by this technical note:

In response to recommendations resulting from an internal review of state operations, the state of California has announced a two week pause in its processing of initial claims for unemployment insurance benefits. The state will use this time to reduce its claims processing backlog and implement fraud prevention technology. Recognizing that the pause will likely result in significant week to week swings in initial claims for California and the nation unrelated to any changes in economic conditions, California’s initial claims published in the UI Claims News Release will reflect the level reported during the last week prior to the pause.

So, the state of CA is overwhelmed with initial claims, being that it has the largest economy in the U.S. and it’s pausing its operations in order to catch up??, if claims continue at the rate of 800K per week how will CA ever catch up. Source Bob Barone FourStar in house economist

The Economy & The Market

Don’t confuse a good market with a healthy economy. While one may argue that “if things were bad, they would be reflected in the markets, especially since the markets are usual forward indicators of what’s to come. But we don’t live in that world right now and many things don’t really make a lot of sense.

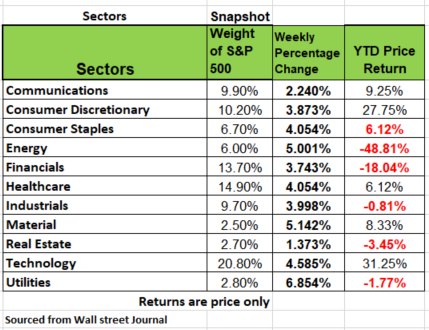

If you take a look at the U.S. sectors 5 of the 11 are in negative territory for the year. Unemployment is rising, bankruptcies are at all-time highs. This is not just from big companies like GNC, California Pizza Kitchen, Neiman Marcus or Hertz, many small business owners have closed shop including smaller commercial real estate owners. The streets of Chicago and New York are desolate during the day, especially in the business districts and we are seeing a second wave of cases throughout Europe and parts of the U.S., 34 states so far.

GDP dropped at the steepest rate since the great Depression of 1930’s. Then Q3 GDP rate spiked at the highest rate since WWII. The rebound was due in part for 3 reasons; One was a shift in activity to businesses were deemed essential or found new and efficient ways of getting things done, the second was the actual reopening of the economy, restaurants, Health clubs and retail stores. But the biggest contributor to the spike was the governments first foray into universal basic income. Between the $1200 tax refund and the additional $600 weekly stimulus on top of the state unemployment benefits. Pre-pandemic many people that did not have enough money to buy bigger ticket items, were swallowing up those items and making home improvements & repairs thinking their furlough was temporary.

Now that money is gone and the temporary furlough is more permanent.

So, are the market overly optimistic? Markets usually price in future earnings and performance (growth)

Does the market have a glass half full mentality?

You can find a number of economists that take the same data and draw significantly different conclusions, so let’s try to piece some of this together ourselves and come to our own conclusion/prediction.

The Fed’s September minutes that were released the week of October 4th, basically concluded heightened concerns about the state of the economy. The following passage is from the minutes.

“While the risk of another broad economic shutdown was seen as having receded, participants remained concerned about the possibility of additional virus outbreaks that could undermine the recovery. Such scenarios could result in increases in bankruptcies and defaults, put stress on the financial system, and lead to disruptions in the flow of credit to households and businesses. Most participants raised the concern that fiscal support so far for households, businesses, and state and local governments might not provide sufficient relief to these sectors.”

It appears that the Fed’s concerns about increases in bankruptcies loan defaults and stress in the financial system are beginning to come to fruition. Look in particular at the part of the passage from the Fed minutes that is emboldened. Besides this passage, Fed Chair Powell said: “The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side…”

So, Let’s think about that for a minute. The Federal Reserve Act of 1913 created the current Federal Reserve system (Central Bank) It was established to implement economic stability by having a central bank oversee monetary policy. Independently of fiscal policy. The Fed is not a political institution, its officers are appointed, not elected.

Never has monetary policy been driven by fiscal policy and this particular attitude can/will have long term impact on America.

The Fed is worried about the faltering economy so much so that it has publicly promised to monetize any debt Congress creates, thus straying far from their 107-year role as “independent” from the fiscal process.

Wall Street loves this because it promises excess liquidity (“The Fed has our back”) and this seems to be why equity prices have responded so positively. But how long can this last?

Because the employment numbers continue to show a (stalling) economy, there appears to be no end in sight for the Fed’s largesse.

A market correction and /or a significant down turn is inevitable. The question for any investor is what plan do you have in place when it happens. No one knows exactly when a downturn will occur, but waiting for it to happen can be costly. Have a plan in place to move assets to cash as it happens, not after

401K plans

Retirement plans are governed by ever-changing laws and regulations imposed by Congress, the IRS, and the Department of Labor (DOL). To remain in compliance and current with those laws and regulations, plan documents must be updated from time to time.

Some of these changes may be reflected through plan amendments, but it is impractical for plans to amend their documents for every new law or regulation. So, every six years, the IRS requires all qualified retirement plans to update their plan documents to reflect recent legislative and regulatory changes. Some updates are made during the normal course of business through plan amendments, but others require more substantial rewriting of plan documents through a formal process known as a “plan restatement.”

A restatement is a complete re-writing of the plan document. It includes voluntary amendments that have been adopted since the last time the document was re-written, along with mandatory amendments to reflect additional legislative and regulatory changes.

This upcoming mandatory restatement period for defined contribution plans is referred to as “Cycle 3” because it is the third required restatement that follows this six-year cycle.

The IRS recently announced that the current two-year restatement window will begin on August 1, 2020 and close on July 31, 2022. Plan restatements are required by the IRS and not optional. Those who do not comply may be subject to significant IRS penalties. We are bring this to your attention as many employers may have bundled plans with their recordkeeper or have a TPA that automatically makes the change/update. With the economic conditions we are experiencing from the COVID pandemic you may want to give some thought to what plan design allows you the most flexibility so you do not have to pay twice for changing your plan document. Source: https://www.irs.gov/retirement-plans/401k-plan-fix-it-guide-you-havent-updated-your-plan-document-within-the-past-few-years-to-reflect-recent-law-changes

COVID

A recent survey by Cisco of 1,569 business executives, knowledge workers and others who are responsible for employee environments in the post-Covid era concluded that working from home is the “new normal” with over 90% of respondents saying they won’t return to the office full time even after the pandemic is over. Source: https://www.bloombergquint.com/technology/companies-to-shrink-offices-as-work-stays-remote-after-pandemic

Behavioral Economics

This is our second segment in our series of articles on behavioral economics.

Consider the following problem

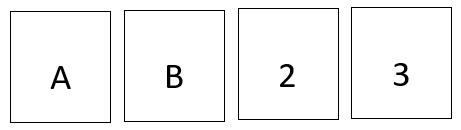

Below are 4 cards Your task is to turn over as few cards as possible to verify whether the following statement is true

Every Card with a vowel on one side has an even number on the other side. You must decide in advance which cards you will examine (you cannot pick one then decide on what to pick next)

Did you pick 2?

Richard Thaler from the University of Chicago presented this problem to his students, the typical ranking of cards from most to least turned over was A,2,3, B

It is not a surprise that nearly everyone participating in this problem chose A first. Did you? If the card does not have an even number then the statement is false. However, the second most popular choice was the card with a 2. This choice seems to be pointless according the objective.

Let’s examine

While the existence of a vowel on the other side will yield an observation consistent with the hypothesis, turning the card over will neither prove the statement correct nor refute it.

In order to refute the statement, one must choose to turn over the 3, a far less common choice. As for the least popular choice, the B, that one must be flipped over as well, since a vowel might be lurking on the other side. (The problem, as stated here, did not specify that numbers are always on one side and letters on the other—although that implicit assumption is commonly made by solvers.)

Two lessons emerge from this problem. First, people have a natural tendency to search for confirming rather than disconfirming evidence, as shown by the relative popularity of the 2 over the 3. This tendency is called the confirmation bias.

Second, the confirmation bias can be accentuated when unwarranted assumptions make some kinds of disconfirming evidence seem unlikely, as illustrated by the unpopularity of turning over the B.

Confirmation bias is a term from the field of cognitive psychology that describes how people naturally favor information that confirms their previously existing beliefs

This fundamental principle applies to investors in some many ways. Because investors seek out information that confirms their existing opinions and ignores contrary information that refutes them.

It will skew the value of their investing decisions based on their own cognitive biases. This psychological phenomenon occurs when investors filter out potentially useful facts and opinions that don’t coincide with their preconceived notions

- It occurs when people seek out or evaluate information in a way that fits with their existing thinking and preconceptions. Never has this been more apparent than in politics today. But this is not about politics it’s about investing. Even academics whose pursuit of the science, where theories should advance based on both falsifying and supporting evidence, have not been immune to this bias, which is often associated with people processing hypotheses in ways that end up confirming them.

- It impacts how we gather information, but it also influences how we interpret and recall information. For example, people who support or oppose a particular issue will not only seek information to support it, they will also interpret news stories in a way that upholds their existing ideas.

- It can make people less likely to engage with information which challenges their views. ... Even when people do get exposed to challenging information, confirmation bias can cause them to reject it and, perversely, become even more certain that their own beliefs are correct.

- t often leads to the creation of self-fulfilling prophecies that occur when we act in accordance with beliefs and expectations that we are attached to, and unknowingly create results affirm those beliefs, thus reinforcing our prejudices.

This particular bias can lead an investor to be overconfident and maybe explain why the bulls tend to remain bullish, and the bears tend to remain bearish regardless of what is happening in the market. Confirmation bias helps explain why investors do not always behave rationally and perhaps supports arguments that the market behaves inefficiently.

Suppose a trusted friend tells you about a company which has a low P/E ratio and has a very high dividend. But you ignore the information that their payout ratio is over 100% of earnings and that their Debt to Equity ratio is also very high. You may risk losing you investment. Source Mishaving Richard Thaler University of Chicago

Here are a few good ways to overcome confirmation bias to expand your mind.

1. Don't Be Afraid. ...

2. Know That Your Ego Doesn't Want You To Expand Your Mind. ...

3. Think for Yourself. ...

4. If You Want to Expand Your Mind, You Must Be OK with Disagreements. ...

5. Ask Good Questions. ...

6. Keep Information Channels Open

Seek Contrary Advice:

The first step to overcoming confirmation bias is to have an awareness that it exists. Once an investor has gathered information that supports their opinions and beliefs about a particular investment, they should seek alternative ideas that challenge their point of view. It is good practice to make a list of the investment’s pros and cons and reassess it with an open mind.

Avoid Confirming Questions:

Investors should not ask questions that confirm their conclusions about an investment. For example, an investor who wants to buy a stock because it has a low price-earnings (P/E) ratio would be confirming their findings if they only asked their financial advisor about the company’s valuation. A better approach would be to ask the broker for more information about the stock, which can be pieced together to form an unbiased conclusion.

ew Paragraph