Economic Outlook Week Ending Sept 18th 2020

Market recap

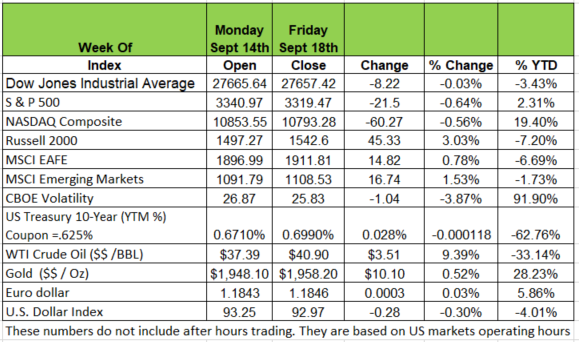

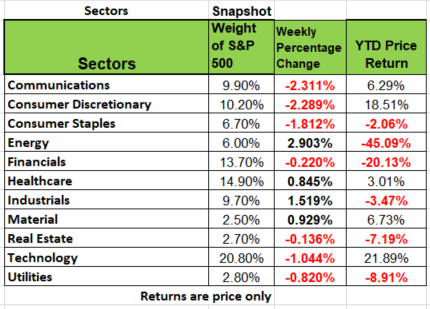

3 of the 4 major indices were down last week except the Russel 2000 which closed the week up 45.33 points. The Dow was down -8.22 S&P 500 was down -21.5 and the NASDAQ closed down -60.27 Of the 11 sectors, Energy Healthcare Industrials and material all closed on positive territory.

The latest FOMC meeting, updated economic projections from the board showed policy remaining at the zero-lower-bound through 2023. Growth estimates were slashed for 2021 and 2022 as expectations for inflation increased, albeit still below the committee’s 2% objective. Growth expectations for the economy (GDP) have been slashed for 2021 & 2022. Keep in mind as we have discussed in previous newsletters, that the baseline has changed and it will be a while before we get back to pre-pandemic production numbers.

The key to any economy’s health is always its ability to employ its citizens. In the U.S. for the past few weeks, the results have been “mixed.” I would lean toward “disappointing.” For the week-ended September 12th, initial claims (IC) in the state unemployment programs (Not Seasonally Adjusted – NSA) were 790K, and while lower than the 866K of the week before, that 790K is higher than any IC number ever produced outside of the Covid-19 era. And, it looks like huge layoffs are continuing.

One might feel better after seeing a drop of 1.1 million in continuing claims (CC) in the state programs from 13.4 million in the week ended August 29th to 12.3 million the week of September 5th. That is, until the eligibility weeks are recognized. Yes, it has been six months since all of this began, and eligibility for some appears to have run its course. A drop in continuing claims may just be a function of eligibility, not of re-employment.

Of relevance, too, is the Pandemic Unemployment Assistance Program (PUA), the CARES Act Program for the self-employed and independent contractors not eligible for the state programs. PUA ICs have grown significantly every week in August (re-opening reversals in some states in July mainly impacting small businesses like salons, restaurants, gyms, bars…). Surveys show that small business closures may rise as high as 40% or 50% before some semblance of normality returns.

Where’s the Focus

The government failed to agree on a stimulus to help those out of work and the passing of Supreme Court Justice Ruth Bader Ginsberg, now has both Congress and Senate focusing on a replacement before the elections. However, one can argue about government’s involvement in artificially propping up the economy. The reason why the market has rebounded so much since the shutdown was due to the transfer of payments. The government gave out more money than the GDP shrank. Now that all of that money has stopped, we will see where we really are in Q4.

Be prepared for a rocky November as the estimated large number of mailed in ballots may bring more uncertainty to the markets as the election day results will be push out for several weeks until those ballots are counted and validated.

It’s no secret, Illinois is in serious financial trouble. The state has several issues. The most prominent is the pension deficit. This started back in the early 70’s when the government wrote into its constitution that state employees could not have their benefits changed once they were hired with specific promises. Back then the wages of state employees were low $13K a year. Then in the mid 80’s State of IL employees received 2 significant raises to meet the basic standards of living. This amounted to approximate $10-$15K each time.

Then the state took what is referred to as a pension holiday (meaning they did not make contributions into the pension fund). Currently the State of IL has a cash short fall of some $243 billion dollars, just for funding the pension obligations. IL is the only state that had to borrow from the Federal government to make payments. It is also the only state to give pension recipients a 3% COLA (Cost of Living Adjustment) each year, while the rate of inflation has been below 2% for some time. This is a compounded number not a flat amount based on initial pension benefit. In addition, the state runs its annual budget with a -$ 4 BB.

The Fair Tax initiative is basically designed to change the state constitution to go from a flat tax rate to a progressive tax rate. This will impact more than the 2% of the population that advertising is stating, because companies will have their tax rates increase too, leaving less money for companies to give to their employees in the form of a raise or other benefits such as healthcare or retirement contributions. In addition, it gives the government the power to increase the rates across all tax tiers in the future. This is not a political commentary, just an economic one. What will happen in your company if more money is paid out in taxes? In an economic environment that has caused many businesses (small and large) to close and many more to struggle to just stay in business. While we agree that IL needs a solution, we do not think this is it. Tax increases will do more harm than good. The COVID shut down has been costly to many and the effects of an increase may have long term consequences to the state’s economy Source https://www.chicagotribune.com/politics/ct-cb-illinois-pritzker-graduated-income-tax-20200820-g3lrqjqp2ne7rkjxkjammf2ub4-story.html

Social Security recipients are likely to get a 1.3% cost of living adjustment (COLA) in 2021, making it the second lowest ever paid, according to a forecast released today by The Senior Citizens League (TSCL). “Our forecast is based on CPI data through August, and there is still one more month of consumer price data to come in before we get the official announcement in October, says Mary Johnson, Social Security policy analyst for The Senior Citizens League who has a history of accurately predicted the next year’s COLA before it becomes official.