Economic Landscape &

Weekly Market Review

for January 16th 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

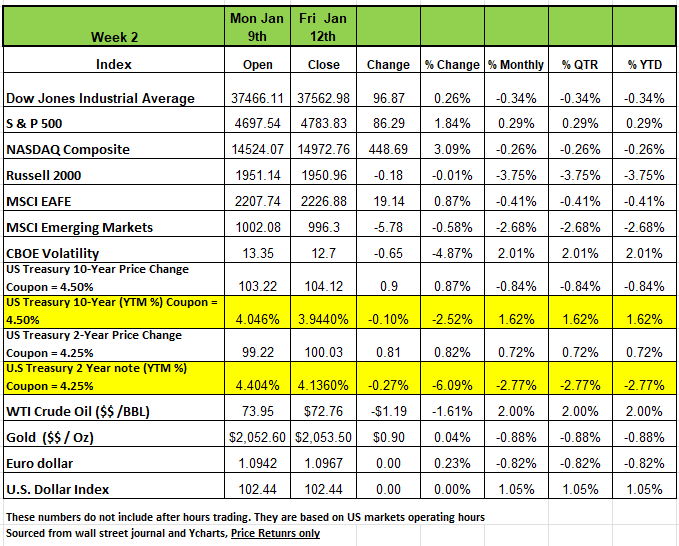

Three of the 4 major Indices posted positive returns last week, ending Jan 12, with the NASDAQ posting the largest return on the week with a +3.09% gain followed by the +1.8% return on the S&P 500 and a + 0.26% move on the DOW. The Russell 2000 was the lone decliner on the week with a -0.1% drop

Last week's climb came as the first round of Q4 corporate earnings reports arrived mixed but somewhat better than anticipated. In addition, an unexpected month-over-month drop in December US producer prices helped to ease investors' inflation concerns after December's US consumer prices rose more than expected.

JPMorgan Chase (JPM) kicked off the Q4 earnings season with the report of 2023 being its most profitable year ever. Its Q4 adjusted earnings came in at $3.97 per share, surpassing analysts' mean estimate, while its revenue for the quarter also topped the Street view. Bank of America (BAC) reported adjusted earnings per share above expectations, although revenue missed. Citigroup (C) swung to an unexpected quarterly loss and unveiled plans to cut 20,000 jobs.

On the inflation front, government data showed the US seasonally adjusted consumer price index rose slightly more than expected in December. However, core CPI, a closely watched inflation measure that excludes food and energy prices, rose by 0.3%, as expected, and was steady with a 0.3% gain in the previous month. Also, producer prices unexpectedly slipped month over month in December while annual wholesale costs grew less than expected.

Treasury yields fell across the board last week, with markets still suggesting that the Fed will be cutting rates several times in 2024. We are not so convinced about the number of cuts and the amount by year end. Other economic data that came in last week, November’s trade deficit in goods and services came in at $63.2 billion on Tuesday, which was below the consensus expected of $64.9 billion. The total volume of trade fell significantly in November, falling 11% and up only 0.2% from a year ago. Applications for home-purchased mortgages increased by the most since June of 23, as borrowing costs have hovered over a seven-month low.

The big news last week was the consumer price index, which rose 0.3%, above the consensus of 0.2%. The twelve-month CPI is up 3.4% from a year ago, which is still far away from the Fed’s long-term target of 2.0%. So, if CPI continues to have legs the probability of rates cuts are low. Initial jobless claims remained relatively unchanged last week, falling 1k to 202k but were well below the consensus expected of 210k. The labor market continues to remain healthy, although several employers announced jobs cuts with Citibank having the largest with a 20K reduction in labor expected this year. Many other employers have opted to cut back on hiring instead of laying off workers. But hours worked may drop significantly for some sectors especially if we see an economic downturn.

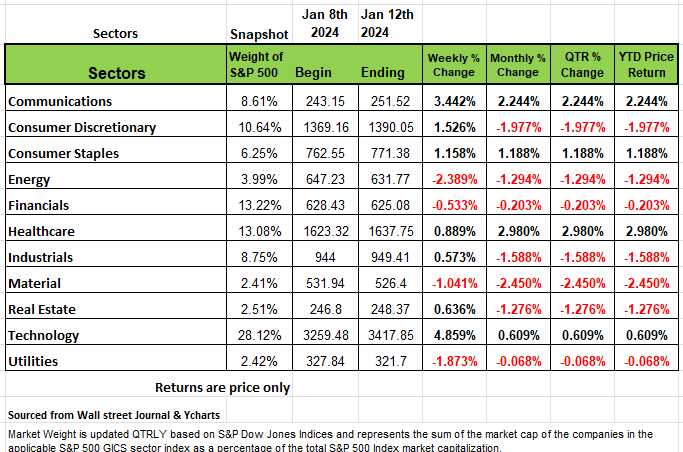

By sector technology led the gainers last week, up +4.9%, followed by a +3.4% climb in communication services. Other sectors in the green included consumer discretionary and consumer staples as well as health care, real estate and industrials.

On the downside, the energy sector fell -2.4%, followed by a -1.9% drop in utilities and a -1% decline in materials. Financials dropped -0.5%.

The technology sector's gainers included shares of Juniper Networks (JNPR), which jumped 25% as Hewlett Packard Enterprise (HPE) said it agreed to buy the networking gear vendor fort $14 billion.

In communication services, shares of Omnicom Group (OMC) rose 3.4% as analysts at UBS launched coverage of the stock with an investment rating of outperform and a price target of $117 a share.

The energy sector's drop came as crude oil futures slipped. Decliners included Baker Hughes (BKR), down 5.7%.

Next week, a number of large companies will release quarterly results, including Morgan Stanley (MS), Goldman Sachs Group (GS), Prologis (PLD), Charles Schwab (SCHW) and Alcoa (AA).

Economic data will include December retail sales, industrial production and capacity utilization on Wednesday, December housing starts and building permits on Thursday and December existing home sales on Friday.

What’s your comfort Zone

2022 was a down year for the markets the S&P 500 index posted a -19.44% return the NASDAQ a -33.10% making many investors weary about how much risk to take on and where to put their money. But 2023 with all of the negative chatter about a recession did a 180 degree turn around, and it looks like we are going to have a “soft landing”. The S&P posted a +24.23% return and the NASDAQ a whopping +43.42% return. AI led the charge last year and a handful of stocks reach extraordinary highs (NVIDI posted a +258% return) It’s enough to give any seasoned investor an ulcer. The last few years have been unique to say the least. We had a global pandemic that shut the world down, unemployment spiked to the highest level since the great depression of the 1930’s, supply chains were disrupted with so much manufacturing being done in China making it impossible to get goods and the U.S. government felt it necessary to give Trillions of dollars to citizens to cover living expenses. What was puzzling to us is that these professionals that are employed by the U.S. government such as Treasury Secretary Janet Yellen “saw no signs that inflation was building, even with all this money was being handed out. It seems that any first-year economic student could have seen that coming. These same experts are also promoting a soft economic landing in the U.S., and a year of interest rate cuts that will support growth and a return to normalcy. This seems to be the upbeat conventional wisdom about the global economy for 2024. But this is all contingent on everything going well throughout 2024

The hard part about calculating economic outcomes is predicting human behavior, specifically consumer behavior and right now we have a number of issues that present potential issues throughout the world and the U.S.

What could possibly go wrong? Hmm, let’s think about that for a minute

After year marked by war in the Mideast, 2 years with Russia and Ukraine, a global pandemic a few bank collapses, and U.S debt whose interest obligations alone are a problem, we tend to focus too much on the here and now, so lets take a quick look at a few issues that may effect both the economy and your portfolio

The Middle East Is On the Brink

After more than three months, Israel’s war in Gaza has brought the region to the brink of a wider conflict with the potential to choke off oil flows, take a chunk out of global growth, and push inflation higher. Keep in mind we still have not reach out target of 2% inflation. This kind of energy-supply disruption hasn’t happened yet, and markets are betting it won’t. But the risk is rising

The Fed Could Get Burned

That would be bad news for the Federal Reserve, and for investors betting on an early and aggressive pivot to rate cuts.

Back in the 1970s, then Fed Chair Arthur Burns pivoted too early. The result was a resurgence of inflation, requiring extreme measures from his successor Paul Volcker to bring prices under control. There’s two ways 2024 could see a repeat. One involves a supply shock — a real possibility if an escalating Middle East conflict hits oil prices and shipping lanes. The other would stem from looser financial conditions – with the five-year Treasury yield down more than a percentage point from its October high.

According to Bloomberg if you plug a one-percentage point drop in yields into Bloomberg Economics’ model of the US economy, and it nudges inflation in the year ahead up by half a percentage point, keeping it closer to 3% than the 2% target. If that happens, the Fed might have to rethink its dot plot, pause the pivot—which would change market expectations of an easier policy stance.

China Looks Wobbly

The world’s second-largest economy enters 2024 with growth already heading south. The post-pandemic recovery has fizzled, and a steady drip of stimulus has failed to fill the vast hole left by a slumping property sector. China has a real problem with its Real Estate investments with so much money borrowed to build cities that are basically empty

According to Bloomberg Economics’ base case is that Beijing will ultimately deliver enough support to stave off collapse, with growth for 2024 forecasted at 4.5%. This would be down from last year, and far below the pre-pandemic norm, and if it drops more, it could be a disaster.

A Property Meltdown in China will Leave a Hole in their Economy, remember 2008 and the U.S. issue?

Ukraine at a Tipping Point

After the failure of Ukraine’s counteroffensive, Western backers warn the country risks outright defeat especially if US military aid were to dry up, handing Russia a decisive battlefield advantage. The media has provided some inaccurate information on the Ukraine situation and the reality is Ukraine has a very slim chance of defeating Russia which would give Putin more control over Ukraine resources

Game-Changing Elections in Taiwan The Global Risk of a Taiwan War

Last weekend’s presidential vote saw Vice President Lai Ching-te win by a narrow margin, granting his ruling Democratic Progressive Party (DPP) an unprecedented third term. Mainland China's immediate reaction was muted, stopping short of major military exercises or economic measures.

Beijing may see the DPP's failure to secure a legislative majority as constraining Lai's administration, allowing a less intense reaction. However, deep Chinese skepticism of the president-elect as a "separatist" and "troublemaker," despite his pledge of cross-Strait policy continuity, means trust is low, opening the door to a potential escalation in tensions in the months ahead. In addition, if China’s economic issues continue to decline it may force Xi Jinping’s hand to make a move on Taiwan

It is possible a Taiwan war could have a bigger impact on global GDP than other recent shocks

Especially in the US

U.S Debt

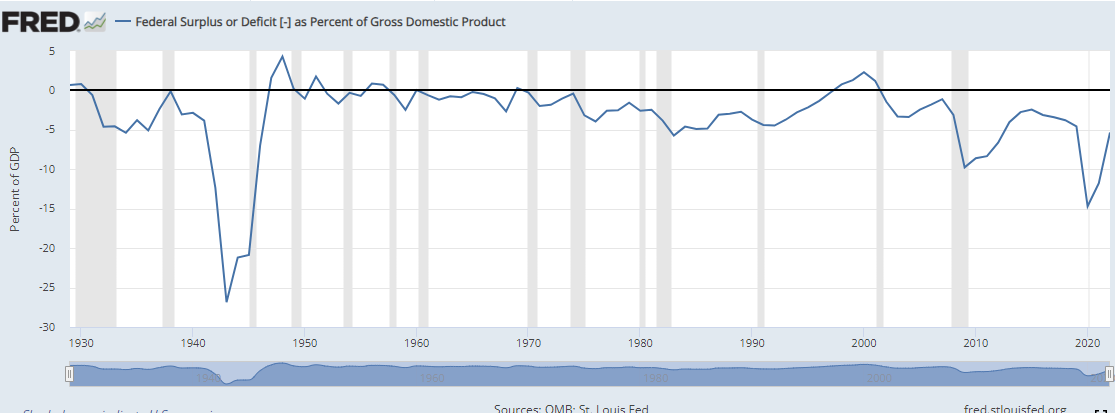

The rising Debt is the U.S. is a concern for both consumers and businesses. In the chart below you can see that US debt to GDP has risen to 120%. Interest payments alone on the debt are reach a 1$ trillion dollars.

In addition, the Fed’s deficit continues to go in the wrong direction, while it is lower than it was in 2020 our government continues to spend more than it can afford

Non-defense spending by the federal government (including entitlements like Social Security) has climbed dramatically.

10% of GDP in the 1960s

14.8% of GDP in 2001

15.2% of GDP in 2007

17.8% of GDP in 2019

And now, projected at roughly 22% of GDP over the next 5 years, after peaking at 27.7% in 2020

In other words, non-defense spending now consumes more than twice as much GDP every year as it did 60 years ago. It’s share of GDP is up 45% from just before the Great Recession, and it’s up 24% from the year before COVID. Government continues to take more and more of what the private sector produces, and it is heading for annual deficits of about $2 trillion. I wonder why the unemployment rate is so low no one has an incentive to work.

U.S Commercial Real Estate Market

The push to return to work has no quite happened the way businesses had hoped. With advances in technology working from home has become a lot easier but probably not a productive. Some of the long-term issues with remote work have long term effects.

Business do not need as much office space and are either reducing their cost for rent of eliminating it

Leaving landlord’s / Investors in the Real Estate market in a difficult position. Banks have been lowering the quality of their loans but have not yet place delinquencies into foreclosure. Many of these short-term low interest rate commercial mortgages will expire in the next 18 months and with valuations lower and balances higher the probability of refinancing is unlikely. This however may present an opportunity for some companies that are flush with cash and buy the real estate and huge discounts, but someone will get stuck and most likely it will be the smaller regional banks.

In addition to the Banks and landlords’ municipalities are being impacted, Tax revenue on these buildings is now going to drop significantly leaving local governments with budget deficits. Fewer public transportation workers mean more layoffs or higher fares or those still using public transportation. This could cause municipalities to raise taxes to cover the short fall.

November Elections

The most important election of 2024 could upend calculations around the world. November’s US presidential vote is shaping up as a rematch between Joe Biden and Donald Trump, who is currently taking an early poll lead in swing states.

Trump’s return to office could bring sharp policy reversals in 2025, and markets might price them earlier. He’s promised a tariff of 10% on all imports. If trade partners retaliate in kind, that would shave 0.4% off US GDP. This may cause more trade tension with partners like Europe and rivals like China.

So, what does all this mean, nothing really if you have a large appetite for risk and can afford to see your portfolio drop in value for a short period of time. Before you make any decisions on reallocating your assets be aware of your comfort level for a risk. If you have been in the markets for a while and have increased the value of your original investment basis, being content and protective is not a bad thing if you are close to retirement and on track with your financial plan. If you feel like you’re missing out on making a lot of money maybe you need to be a little more cautious, unless you have plenty of time before you need to access those assets.

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Markets are still extended following the parabolic run-up experienced late last year. While markets sold off in the first week of the new year, which we stated was likely, the “Magnificent 7” stocks led a bounce last week. Stocks, like Nvidia, Meta, and Microsoft saw the most significant rises. Keep in mind that these stocks saw some of the largest rises in 2023, that preceded substantial losses in 2022. So, these stocks could be more prone to seeing some pullbacks after being extended.

Market sentiment was unchanged last week, with nearly 50% of individual investors holding bullish outlooks on the market. This is according to the AAII investor sentiment survey. Sentiment is a contrarian indicator, meaning markets tend to do the opposite of what the herd expects. Right now, a significant number of investors are bullish.

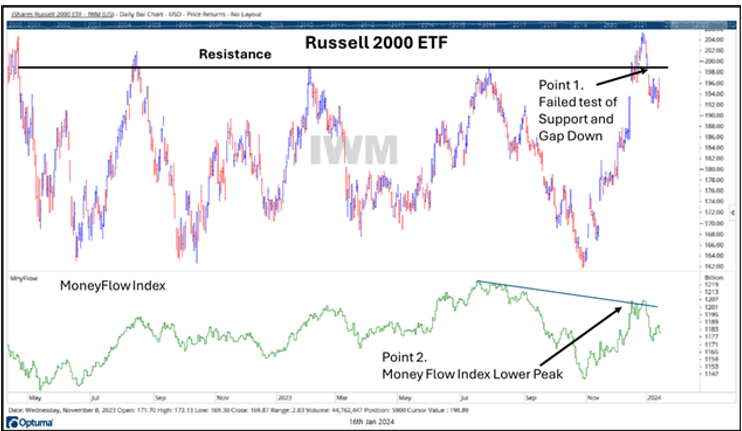

Chart (1) of the week: Small Cap Stocks

One of the more interesting areas of the market right now is small cap stocks, (typically less than $2billion of market capitalization). Small cap stocks are represented by the Russell 2000 index, which is an index composed of 2000 small cap companies.

The Russell 2000 index attempted to break out of some long-term resistance but appears to be failing. Refer to the chart below and its corresponding numbered points.

The black line drawn across the index’s peaks represents longer-term resistance. This has been a point of contention where sellers have typically taken over and forced the index lower. In December, the Russell broke above resistance, but only briefly. The Russell 2000 then tested the resistance level for support, but failed, and “gapped” down through the level. This is a negative.

At the Russell’s recent peak, the Money Flow Index (lower half of chart) put in a lower high, which is called a “negative divergence.” Money Flow is a volume-based indicator which measures where “smart” money is flowing. At the Russell’s recent peak, there was less “smart” money flowing into the index than there was at prior peak levels.

Not shown in the chart, but the Russell has been volatile during the first few weeks of the new year. The index’s volatility, as measured by the Canterbury Volatility Index, is twice as much as the S&P 500.

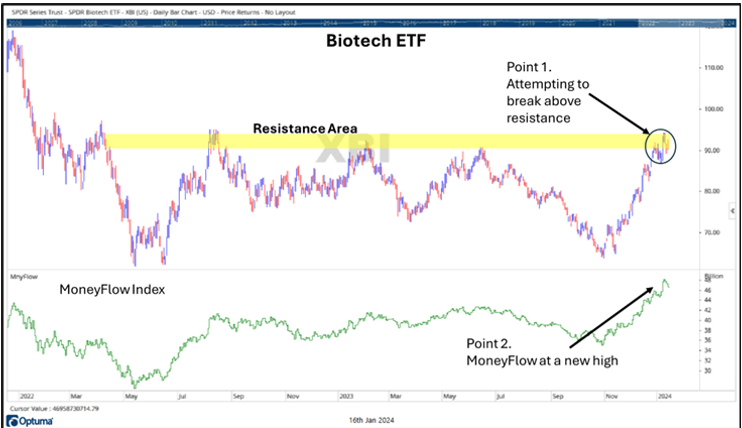

Chart (2) of the week: BioTech

Biotech stocks have been some of the better performers recently. The chart below shows the Biotech industry ETF XBI, refer to the chart and its corresponding numbered points.

Biotech is attempting to break out of a trading range, after experiencing a large run-up. The industry has shown positive relative strength in 2024 but is at a zone of resistance. We will see if it can break through and hold this level.

Unlike the Russell 2000 index, which showed a negative divergence with the Money Flow index, Biotech’s Money Flow has been strong and is at a higher level than it was at the previous peak. The volume in the ETF has been higher, and to the upside.

Not shown in the chart, but many individual Biotech stocks are highly rated and ranked on our technical lists.

Technology Stocks

Technology-related stocks, and more specifically the Magnificent 7, continue to lead the markets. Depending on your comfort level you may consider some of the more heavily weighted stocks in tis sector

Small Cap Stocks

There are some technical concerns with small cap stocks, such as the higher volatility of the Russell 2000 compared to other indexes, the negative volume characteristics, and the failed break of resistance. From a portfolio management standpoint, you might consider owning an inverse position in the Russell 2000, which moves in the opposite direction of the index. Diversified portfolios are meant to hold positions that have low correlations to each other. Right now, stocks and bonds are correlated, and a balanced portfolio of the two asset classes would not feel very diversified. The position in the inverse Russell 2000, and some other weaker areas, provide a little more risk management in the current environment.

Biotech

Biotech has been one of the stronger industries recently. The industry ETF is near some resistance, but the Portfolio Thermostat holds some positions in some individual Biotech stocks. These stocks are Vertex and Amgen. The Portfolio Thermostat has held these positions since late October, and both stocks are now at new highs. They have had low correlations with the market indexes.

Keep in mind that markets are dynamic, and conditions are always changing. Some believe that a Portfolio should have a more adaptive strategy, designed to move in concert with the shifting market environments. If your portfolio is static, you will feel more pain during market declines. Keep in mind that observations are made in this update are based on current conditions. These conditions will eventually change. If they do, your portfolio should have the ability to rotate both its holdings and allocations when things change. Source Brandon Bischoff

The Week Ahead

This week is shortened due to Monday’s holiday for Dr. Martin Luther King Jr. but there is plenty of action packed into the remaining days. In the U.S., the main data points of interest will be the December retail sales report on Wednesday, along with the early January consumer sentiment and inflation expectation readings on Friday. Retail sales have only fallen in three of the past 12 months, but the U.S. consumer’s resiliency may be in jeopardy following last week’s credit numbers. This week also brings the monthly U.S. housing data dump, which includes the NAHB Housing Market Index, housing starts and building permits, and finally existing home sales. Regional manufacturing

surveys and industrial production figures round out the U.S. agenda, and a solid set of results may reset rate cut expectations. Finally, earnings season starts to pick up, with announcements from numerous large and mid-sized banks. Overseas, the annual World Economic Forum began yesterday in Davos, Switzerland, where world leaders have gathered to discuss issues such as global security, climate initiatives, and AI development. On the economic calendar, China’s Q4 GDP, industrial production, and retail sales will be closely watched later tonight. GDP is expected to rebound to +5.2% annually but only +0.9% from Q3 as the country grapples with weak domestic demand. In the UK, employment and average earnings numbers were released earlier today, while December’s inflation report arrives Wednesday and retail sales on Friday. As long as pay growth remains above 7%, the Bank of England is unlikely to budge on interest rates.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/