The Market & Economic Climate

for the Week Ending Sept 9th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week in Review

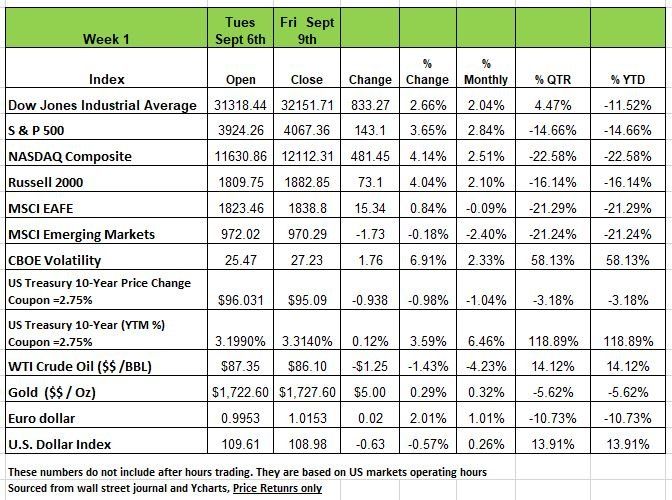

A positive week in the markets for investors as we anticipated with markets being over sold the previous week ending Sept 2nd. All the major indices ended the week in positive territory with NASDAQ leading the week with a +4.14% return followed by the Russell 2000 +4.04% The S&P +3.65% and the DOW at +2.66%

This was a much-needed change of direction for the market benchmark after tumbling -8.3% in the previous three weeks.

Many believe that the weekly climb in US stocks was a result of investors growing more comfortable with the idea of another 75 basis-point rate increase by the FOMC next week in its commitment to wrangle inflation. This realization as many Fed governors have voiced comments in recent weeks indicating a rate increase of that size is highly probable. Tuesday’s CPI release will give us some clarity on this but as mentioned earlier, the market was oversold so money was flowing back in the markets.

All eyes will be on CPI release tomorrow as investors brace for another 75-bps rate increase. The European Central Bank raised interest rates from 0% to 0.75% last week in an its attempt to curb inflation. A rate increase that large is rare for the ECB and the most it has ever raised interest rates in a single hike. Eurozone inflation is higher than in the US, increasing 9.1% in August as energy prices are surging and the Euro dollar is falling.

Shorter-term yields climbed last week (prices dropped). St. Louis Fed President James Bullard said that Wall Street is underestimating a scenario in which interest rates must stay higher for longer to bring inflation back to 2%. The market expects rate cuts beginning in the middle of next year

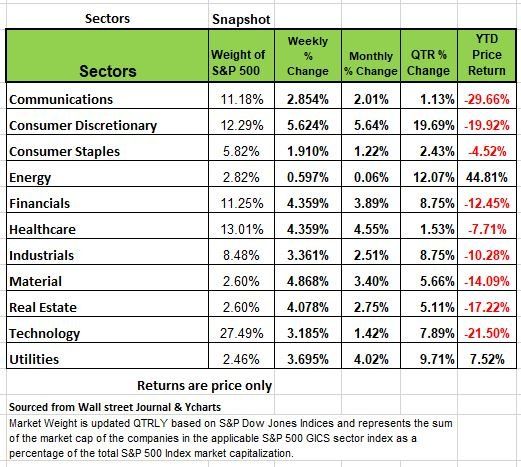

Every S&P500 sector finished positive, led by +5% gains in consumer discretionary, followed by basic materials +4.86%, Financial, Healthcare and Real Estate all 3 at +4%, consumer Staples and Energy pulled up the rear with +1.9% and +.6% respectively. Treasury yields continued to climb as Fed chair Powell firmed expectations of a third straight 75bps rate hike next week. OPEC+ decided on a small production cut, viewed largely as a symbolic move that signaled the alliance is set to defend oil prices near current levels. Crude ended the week slightly lower as traders weighed the demand outlook.

In the UK, a tumultuous week included the passing of Queen Elizabeth II, new prime minister Liz Truss planning for a freeze in energy bills, and the pound hitting a 37-year low. Finally, China’s trade fizzled in August as global inflation curbed demand, while lockdowns and heatwaves interrupted production. Domestic inflation remained low Month / Month, keeping the door open for additional monetary policy pivot.

Economic Climate

The two past two years were anomalies to say the least. The markets performed extraordinarily well considering the issues and challenges we faced, but all of this was a result on the government handing out massive amounts on money to people and removing any incentive to work or contribute the production of the economy. So many unseasoned investors entering 2022, expected that a healthy consumer would power the economy at an above-trend pace. Big mistake. Geopolitical tensions, raging inflation, and increasingly active central banks have rattled markets throughout the year. The meltdown spreading across all asset classes—fixed income (FI), equity, commodities—has left investors looking for a place to hide.

While the economy looked healthy during the pandemic, it was artificially inflated so heading into 2022 a series of idiosyncratic factors pushed aggregate growth into negative territory. Companies were stuck with excess inventory, consumers stopped spending, interest rates gas prices and rents skyrocketed. Hence the economy began to recede.

In looking toward, the last quarter of the year and into 2023, the “excess savings” thesis that was carried into the beginning of 2022 is now being dismissed as consumer financial health has deteriorated meaningfully from the start of the year.

Let’s start with the personal savings rate falling from a level of 8.5% at the end of 2021 to a level of 5% today, and revolving credit use has steadily increased (credit cards). Middle income consumers are now carrying higher credit card balances and experiencing lower wage growth relative to hourly employees in lower income groups. This group also benefited less from government stimulus. They also exhibit lower excess savings relative to higher income bands. So this is why the consumer is softening is the largest portion of the economy.

There is still a big debate as to the condition of the economy, are we in a recession or not. Those that are readers of our newsletter know our position, we are in a recession, but until the NBER officially declares the state of the economy, the debate will continue, and the recession will most likely be over. It seems like earning for most companies will be much lower than they have been over the last few years, more specifically during the pandemic. You cannot expect abnormal growth to maintain itself indefinitely and earnings must revert to the norm. With higher interest rates we will see an abundance of poorly managed companies struggling to stay afloat. The days of the massive stock buybacks which helped fuel the rise of the markets over the last several years are going to be far and few in 2023.

One major concern is that Macroeconomic volatility will remain higher than its pre-pandemic level, geopolitical issues will translate into continued volatility across interest rates, currencies, and equity markets. Further complicating the macroeconomic picture is the energy situation in Europe that looks set to require a meaningful fiscal response, and a U.S. housing market which will contribute to the stickiness of core inflation in 2023. As you look ahead to managing your portfolio expectations, keep them within reason. Don’t be too aggressive and try to make up for the losses that are occurring this year remember a decline in market value requires a larger increase to get back to breakeven. If your financial plan is going to be impacted significantly by this year’s declines be cautious, going into 2023. Go back to basics, do not over diversify (indexes & ETF) look more toward income producing securities from financially healthy companies.

Time for Yellen to leave the Treasury

There is no question that Janet Yellen is a distinguished economist, academically at least. But her track record at both the Federal Reserve and the Treasury have been less than stellar. We are not looking to criticize Ms. Yellen, but perhaps make a point that when it comes to economics, politics should be kept on the sideline. Ms. Yellen has a poor track record in seeing the obvious. The housing bubble in 2008, the current inflationary issues as well as the causes, and the current condition of the U.S. economy are just a few examples. Ms. Yellen is a bright person and a well-schooled economist, but when politics enter the equation and a respected expert, ignores the obvious or is more focused on managing the politics, bigger problems arise, poor decisions are made, and eventually jobs are lost.

Her reputation seems to be tarnished from the recent streak of economic blunders. It appears that she no longer has influence with President Biden and is unable to stop bad policies (student-loan cancellation). But the White House is still using her this election season to portray the U.S. economy as a healthy environment of growth, fairness, and optimism. Not sure which economic data she is looking at, but it appears to be more of a fantasy economy than reality. Source https://www.wsj.com/articles/janet-yellens-fantasy-economy-biden-administration-inflation-wages-dearborn-michigan-11662674409

Health Insurance

Most Americans work for small businesses and the past two years have been more than challenging for most of them. Just look at how many restaurants closed permanently. While many received some support from the Federal Government, they are still struggling to regain sales, especially in this economic environment.

Now small business owners have another curve ball thrown at them Premiums for many Affordable Care Act health-insurance plans are set to rise sharply in 2023, a sign of how rising labor costs and other expenses are starting to ripple through the economy.

Consumers, who generally sign up for plans on Nov. 1, probably won’t feel much impact because of enhanced federal subsidies, but for small employers and their employees they will likely have face the brunt of higher rates because they don’t get similar government help. Rising wages, shortage of quality workers and now higher health insurance cost are squeezing the small business owner.

Insurance rates are controlled by each state, Insurers generally propose rates to state regulators, based on claims to premium ratios but all states have very different timelines for reviewing and approving increases. The rate increases we are going to see in January of 2023 were filed back in 2021, there is a lag. This also includes plan designs which include out of pocket maximums which the federal government typically certifies in early October.

The increases reflect many factors such as higher prices for medical services, which hospitals and other healthcare providers are seeking so they can cover their own growing labor and other costs. Since the ACA was passed there has been a consolidation of healthcare providers, many quality physicians (general practitioners) have moved to a concierge model of service (subscription based) the rest now work for big medical organizations which have given providers more leverage on claims reimbursement for services provided to in network facilities. The issues is that the higher the claims the more premiums need to increase which puts a burden on small business owners and their employees share of the premium. Again, do politicians ever think things through? Source: https://www.wsj.com/articles/affordable-care-act-health-plan-premiums-set-to-rise-11662671934?mod=hp_lead_pos7

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Last week we discussed market fluctuations plain and simple it’s a fact, they always have and always will fluctuate. At the beginning of last week, the S&P 500 had declined -8.3% from the mid-August peak. This move had occurred over 15 trading days. Last week, the market saw an upward reversal, with the S&P 500 bouncing off some technical support and rallying +3.6%.

One indicator we often rely on in Technical Analysis are a combination of indicators that provides an overbought/oversold reading. When markets are over bought you can expect a sell off and when they are over sold you can expect a buy in.

After the market’s decline between August 16th & September 6th, our signals indicated that the markets were 97% oversold. A reading above 95% is considered extreme, and therefore the market would most likely be due for a rally. Which we saw last week. After the rally last week, the indicators still show the markets to be 94% oversold. So not accounting for any shocks to the system, (like CPI coming in too hot) the market rally might still has some legs.

Of course, even if the rally continues, these short-term fluctuations in either direction are all a small part of the broader bear market. Bear Markets are characterized by high volatility and large swings that occur quickly and in both directions. We have shared this chart before, but the chart below shows the various large swings over short timeframes that the S&P 500 has experienced this year.

The bottom third of the chart shows the Volatility Index, which currently measures VI 109. While volatility has come off its peak, it remains high. As a reminder, volatility less than VI 75 is considered low/safe. So, regardless of any potential upward move, this remains a bear market.

Currently, the number one ranked sector, on a risk adjusted basis, in the universe of ETFs, is the Utilities sector. The Utilities sector, which only makes up 3% of the S&P 500, is near an all-time high.

Fundamentally, this may sound surprising. Investors generally buy Utilities stocks for their high yield. Because of their yield, Utilities can have a high correlation to the bond market, where rising rates would have a negative impact on Utilities since the higher rates would make a Utility stock’s yield less attractive.

We know that rates are up, and bonds are in a bear market, with 20-year treasuries off more than -20% year-to-date and more than -30% from their 2020 peak. Yet, the Utilities sector is at a high, and has not been correlated to bonds in intermediate term. I am sure there is a “reason” for it, after all, Utilities are considered “defensive”, but then again, bonds are also considered “defensive,” yet are in a bear market unlike Utilities. This goes to show that correlations change over time, and supply & demand is the only law in markets.

The US markets may look bleak, but the broader markets have been worse off this year. The EAFE index, which tracks developed regions of Europe, Australia, Asia, and Far East, is down more than -20% year-to-date. Emerging Markets, which has most of its exposure in China, India, South Korea, and Taiwan is also down -20%.

The US dollar is currently at the top of our alternatives list, indicating that the dollar has been stronger than virtually every other global currency. Right now, the Dollar’s value relative to the Euro is at its highest level since 2002. The Dollar’s value relative to the Pound Sterling is at its highest level since 1985. It might not be a bad time to consider taking that European vacation.

The top three sectors right now on a risk adjusted basis, are Utilities, Energy, and Consumer Staples. Collectively, these sectors account for a whopping 14% of the S&P 500. On the other hand, the bottom three ranked sectors are Communications, Information Technology, and Financials. Those three sectors make up 46% of the market index.

Expect large swings in the market to continue to happen. The recent uptick we have seen over the last week may have some momentum left in it, considering the broad market is still largely oversold, but do not let large upward fluctuations trick you into thinking the market is out of the woods just yet. Per the previously shown chart, the S&P 500 has seen rallies this year of both +11% and +17%, but also subsequent declines of -16%, -12%, and -9%. Source Brandon Bischoff Canterbury Investments

The Week Ahead

Inflation is the theme of the week, with the U.S. set to announce August’s CPI and PPI readings, on Tuesday 9/13 before the Fed’s meeting next week. With the slide in gasoline, consumer prices are expected to ease MoM, but the data may not be likely to alter the FOMC’s intended path. The economy’s much desired soft landing seems to be shaky with the underlying issues in the labor market. Thursday’s retail sales report will provide an update on consumer spending in the face of high food prices and shrinking personal savings.

Other events of note include Treasury auctions, regional manufacturing updates, and consumer sentiment to close out the week.

Major U.S. industries will be watching negotiations between the freight railroads and union workers, as a nationwide rail strike could cripple supply chains again. Overseas, the UK will also release CPI figures along with monthly GDP and retail sales, but the Bank of England has pushed back its interest rate meeting one week to September 22 as the country enters a period of national mourning.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/