Economic Climate & Markets reviewed

for the Week Ending Sept 16, 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week in Review

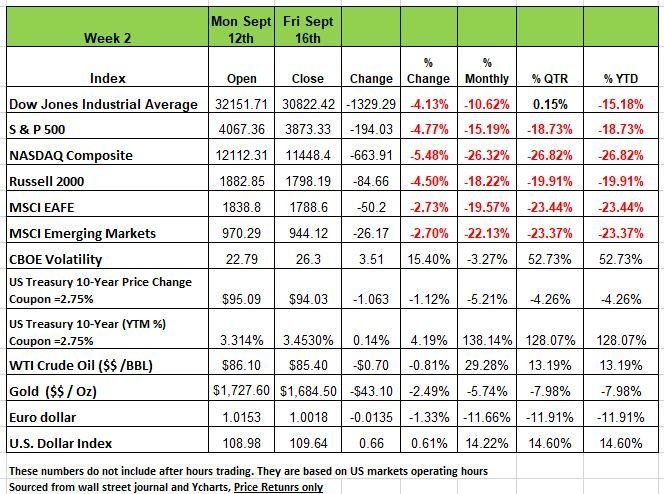

In case you missed it last week’s inflation data came in much higher than expected, 8.3% YOY ending August 31st. The unexpectedly high inflation report, combined with global recession fears sent equities south last Tuesday dropping more than 2% for the day. For the week, all the major indices were down significantly with the NASDAQ falling the most at -5.48% followed by the S&P 500 down -4.77% the Russell 2000 -4.5% and the DOW 4.3%.

Core inflation accelerated more than expected, enhancing expectations that the Federal Reserve would push forward with a more aggressive tightening cycle. The data showed the consumer price index rose 0.1% on monthly basis August over July. This compared with a flat July reading of 0. The consensus estimate was for a -0.1% drop, so it was off significantly. The YOY view was higher than the Street's expectations of 8.1%.

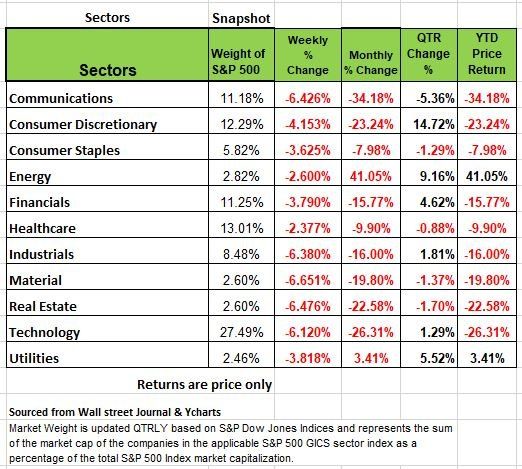

Multiple S&P500 sectors sank more than -6% with Materials down the most at -6.65% followed by Followed by Real Estate, Industrials, Communications and Technology. Healthcare was down -2.37%. All this downward movement regardless that a major rail strike was avoided. On Friday transportation bellwether FedEx rattled markets when it withdrew full-year guidance and offered a gloomy economic outlook along with Nucor Steel.

The U.S. Treasury yield curve continued to invert by the most in decades, as 2-year yields spiked to 3.9%+ after Tuesday’s CPI release. The main driver of CPI last month was rent housing, one of the issues with the data is that the BLS will call homeowners and ask how much they would get for their home if they rented it out. The problem with this methodology, is that homeowners do not have an accurate way to measure the market in their area, so most homeowners will use their mortgage plus tack on extra dollars for a profit. What the BLS should do is use actual rental rates as advertised.

Retail sales numbers came in better than expected but were largely attributed to a bump in automobile transactions. Consumer sentiment rose slightly in early September, but the longer-term economic view declined modestly.

Internationally, British CPI dropped for the first time in a year but remained near 10% YoY as economists still expect inflation won’t peak until October when new energy caps begin. UK retail sales slumped 1.6% in August as the cost-of-living squeeze deepened. In the EU, economic sentiment weakened in September to the lowest levels in 30 years as potential energy shortages loomed for the upcoming winter months.

The big news this week will come on Wednesday when the FOMC announces its interest rate increase. The markets are counting on another 75-bps hike, but some are bracing on a possible 100-bps increase, which we think has a low probability.

The Climate

The GDPNow model put out by the Atlanta Fed is an estimate for real GDP growth. As of Sept 15th third quarter of 2022 is projected to be 0.5 percent, down from 1.3 percent from the September 9 reading. That is a significant drop in just a few days. We expect that the real number will be negative again since the model tends to overestimate economic activity. In each quarter this year, the GDPNOW number was off significantly, with real GDP being negative in each of the last 2 qtrs. We are expecting the trend to continue. This would make 3 consecutive quarters of negative economic growth. A recession in just about every book.

While unemployment remains low, we know that the labor shortage is a large component. The shortage is a result of multiple issues. Typically, in any given year the U.S. would admit approximately 1 million legal immigrants that enter our workforce. Since the pandemic this number has been reduce to about 200K. Since the pandemic our labor force has dropped and left many unfilled positions with just the shortage of legal immigrants, the U.S. has lost approximately 2.4 million workers. Retirement is another factor many older more seasoned workers had left the workforce, taking retirement earlier than planned. In addition, the jobs that many hold especially in the retail sectors are part time employment, so while many are working, they are not working at full capacity.

But some pundits are declaring that the U.S. economy is healthy, because of the unemployment rate. Its not. There is deterioration across all areas of the economy, and we expect it to get worse. As we have penned in previous blogs all recessions are the result of poor decisions, not just one bad decision but multiple poor decisions. While the pandemic was a challenge, the government’s response to send trillions of dollars to Americans for an extended period is the root cause of much of the problems we are experiencing today, Inflation is at the top of the list. But people got comfortable not working or shifted to work that is “off the books” such as a stylist cutting hair in their home or in the home of their clients. Another big issue is one that has been lingering for a long time and that is the artificially low interest rates that have existed for the better part of the last decade. The rise is interest rates will make it more difficult for many companies to operate, home builders for example have reduced the number of homes being built due to the cost of borrowing to build a house. Soon Employers will be forced to cut cost and that means reducing labor, especially the zombie companies (those companies that could barely make payments on loans). When money is cheap and there is an abundance of it, like most things in life its often handled poorly. Now that the Fed has increased the cost of money and is reducing the supply, this is going to force more companies to tighten expenses.

FedEx, a healthy company, announced last week that it is cutting its revenue forecast by half a billion dollars and warned that volumes were slowing down as “macroeconomic trends significantly worsened.” This is a not good sign of where things are heading. The news sparked fears of a global recession.

The Russia Ukraine crisis will continue hurt the European economy and expect it to worsen as we enter the winter months, heating will be the biggest challenge since so much is dependent of Russia. The only glimmer of hope is that Russia has experienced significant losses from the invasion and Putin may soon find out just how much loyalty exist in his cabinet. But this is just speculation.

Retail sales data for August showed, on the surface, a surprising increase from the month before as falling gasoline prices left more room in household budgets for discretionary purchases and meals out at restaurants. But data for July were revised sharply downward. Taken together, the past two months’ readings have been slightly negative, suggesting that the combination of higher prices and tighter policy is dampening consumer demand. Keep an eye on credit card balances they will soon peak and consumers will have few resources to buy staples, let alone discretionary items.

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

The average investor’s appetite for risk appears to be low and rightly so. 2022 has been filled with extreme volatility, currently, the top two sectors we see investors putting their money are Utilities and Energy (which combine for 7.7% of the S&P 500’s market cap), while the bottom two sectors (out of 11) are Information Technology and Communications (which combine for 34% of the S&P 500’s market cap). This is a sign that investors are favoring the smaller, “defensive” sectors.

Historically, bonds have been the go-to vehicle for weary investors. Treasuries are considered safe investments and are often as defensive, but in 2022 they have been anything but defensive. The 10 year Treasury started the year with a coupon of 1.375%, that same $1000.00 bond is now worth $823.27 a -17.67% return YTD. The twenty-year treasury bond ETF (Ticker: TLT) reached a new low for the year and its lowest level since early 2014. That puts that ETF down -27% year-to-date.

For a conservative investor, bonds are supposed to be the risk-off asset. There should be an inverse correlation between equities and bonds, yeah not so much, that theory is worthless. Again all due to poor decision over the last 12 years with artificially low interest rates.

The Short-Term outlook

Given the market’s decline last week, it should come as no surprise that the market is short-term oversold. One point we should establish is that overbought/oversold indicators do not tell us when the market will have a turning point and fluctuate up or down, nor do they tell us the extent of a kickback or drawdown. An oversold market can always become more oversold. During volatile markets, oversold or overbought conditions can hit extremes more often than they would in a normal market environment. These indicators are unconfirmed and very short-term, meaning it is best to act on them after there are some confirmations that the security or index is moving up.

The Long Term & Bottom Line

This is a bear market, and our market Indicators have all turned negative. Those indicators show a long-term trend of Volatility. Bear markets often fluctuate in both directions, having large declines followed by large, short-term rallies. The markets have seen that several times this year. So, the question then becomes “for the long-term, what is the plan?”

Here is the positive: every bear market is eventually followed by a new bull market. That does not mean that your investment plan should be to just buy and hold for long-run, hoping to come out better on the other side. Bear markets can be devasting to investors and cost them years of compounding just trying to get back to breakeven. This is amplified by a falling bond market, where bonds are doing very little to offset portfolio risks.

The key to benefitting from a bear market, rather than being punished by it, is to mitigate portfolio fluctuations. We know that in the short-term, markets are going to fluctuate in both directions. Long-term success requires a series of short-term decisions. Adaptive portfolio management is all about managing the short-term fluctuations and positioning the portfolio to benefit in the long-term. The goal is to adapt the portfolio to manage each of the market’s up and down fluctuations. By limiting risk in the bear market, an adaptive portfolio can be better suited to compound in a bull market.

For those investors that were influenced by advisors using the “passive investment strategy” you are feeling more pain that those with an actively managed portfolio. Having your portfolio on auto pilot does not work. If you are paying an advisor to manage your portfolio then they should be managing it not just picking a handful of funds and allocating your hard-earned money into various index and ETF’s that may work in up markets, but cost you more in down markets. Source Brandon Bishoff Canterbury

The Week Ahead

While three central bank interest rate decisions await this week, global investors will focus squarely on Wednesday’s FOMC meeting. Amid last week’s rumors of a 100bps hike, traders are pricing in 75bps and indications that further substantial increases are coming. Annual inflation remains miles away from the Fed’s intended 2% target, so the markets are expecting increase and that the terminal rate may be 4.5%

While supply chain disinflation is finally emerging, the U.S. labor market is still far too tight to bring demand growth and thus inflationary pressures down quickly enough. After delaying its decision by a week, the Bank of England is expected to raise by 50bps but may consider more after prime minister Truss announced a supportive package to cap household energy bills.

The Bank of Japan may be considering a policy shift after conducting a rate check last week, which is widely interpreted as a potential currency intervention to prop up the sinking yen. But experts see raising the cap on 10-year government bond yields more likely than the BOJ raising short-term rates, as inflation still hovers near just 2.5%. The other main event this week is Friday’s global PMIs, with updates on supply and demand conditions for the manufacturing and services sectors amid recession concerns. Other releases of note include U.S. housing starts and existing home sales, Canada’s August CPI, and EU consumer confidence.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/