Market & Economic Climate

for the Week Ending September 2, 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

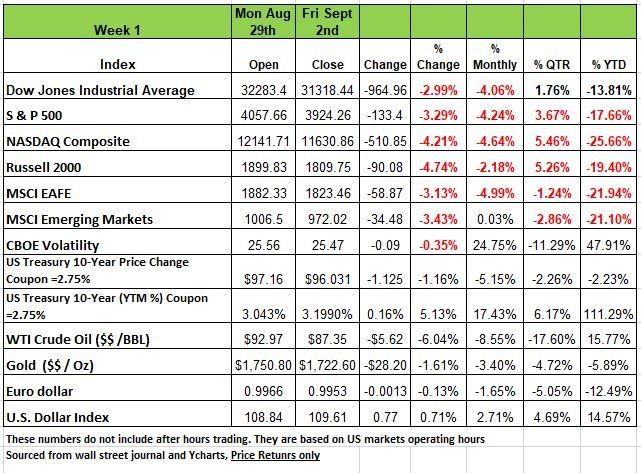

All 4 of the major indices were down again last week with the Russell 2000 having the largest decline -4.74% followed by the NASDAQ -4.21% the S&P 500-3.29% and the DOW -2.99%. U.S. employment growth slowed but remained solid, keeping upward pressure on interest rates, and sending equities lower for a third straight week.

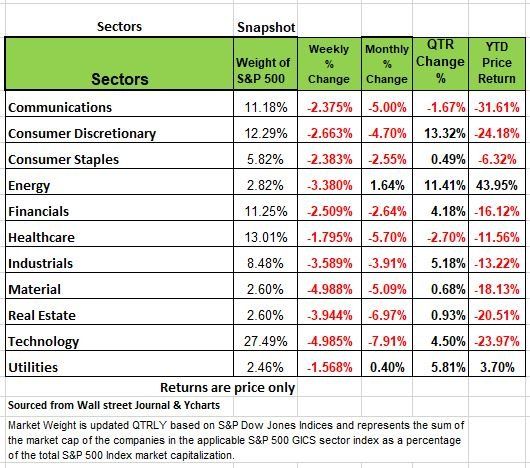

All 11 S&P500 sectors finished lower, with technology sliding 5% after the U.S. government levied export restrictions on certain semiconductor sales to China. Commodity prices fell across the board on economic slowdown fears, as crude oil sank 6.5% while gasoline and copper plunged 8%.

U.S. employers added 315K jobs in August, and the participation rate increased as rising wages and plentiful opportunities led more people into the market. The JOLTS report reflected the persistent tightness, with job openings unexpectedly rising to 11.24M in July. Quits dropped slightly but stayed near relative historic highs, while jobless claims declined to 232K. The newly revised ADP report tallied 132K private payroll gains for August, but more importantly now includes wage information. Annual pay soared 7.6% for the month, adding to inflation worries and the Fed’s burden.

The 10-year Treasury yield rose 18bps to 3.2% and 30-year mortgages jumped back above 5.5%. The rise of the yield curve last week particularly at longer-dated maturities was the market’s response to hawkish sentiment from the Federal Reserve. (Remember when prices drop yields rise)

On Monday of last week, the two-year Treasuries notched their highest levels since 2007 following Federal Reserve chairman Jerome Powell’s higher-for-longer messaging in Jackson Hole on August 26th. U.S. economic data released during the week was fair. Tuesday saw Consumer Confidence surprise to the upside on the back of lower energy prices. ISM Manufacturing and PMI surveys were also higher than expected. Employment data was mixed for the week. Oil fell over 6% last week as U.S. recession fears regained momentum and around more constructive sentiment around global supply. Russia continues to cut natural gas supply to Europe sending European leaders scrambling to deal with the deepening energy crisis.

Markets & Economy

Summer is quickly drifting away, but volatility isn’t, and it looks like it’s going to stick around for the fall season. The world has many challenges from the European energy woes to China’s COVID-19 zero policy to the Russia/Ukraine conflict to the U.S. recession narrative, investors have a lot to manage.

The only real certainty is that global central banks (including the Fed) remain laser focused on taming inflation and are willing to make some sacrifices in the economy and labor market to do so. Against this backdrop, investors should be prepared for near-term volatility by focusing on defensive positioning and valuations that could favor value stocks and income-generating alternatives over more aggressive often volatile investments.

Market reaction and direction is focused on the employment numbers. At first glance, the +315K from the BLS’ Payroll Survey looked “solid,” and equities rose more than 1% in Friday’s early going. But, as further analysis occurred, markets ended the day significantly in negative territory. Apparently, the details below the headline were less than “solid.”

Here are some of those details:

The prior two months totals were reduced by -107K. BLS “adds” a number every month to the Payroll Survey for “small businesses” because the survey only captures large businesses. In August, that automatic “add” was about 90K. So they really didn’t count +315K, it was more like +225K. In the ADP survey on Wednesday, the reported number for small business was -47K. (ADP uses its payroll processing business for such data.) ADP has been reporting negatives in the small business space for several months. If one uses ADP’s small business count, then the BLS number would fall further to somewhere around +175K; so, the +315K number is misleading.

The Household Survey, the sister phone survey of households, was +442K. This was the first real positive after three months of flat or negative data. Again, looks strong on the surface, but it was composed entirely of part-time jobs. In the BLS surveys, both part-time and full-time jobs are counted equally, i.e., as a “job.” Full-time jobs fell by a rather large -242K. Part-time job gains were +684K, not a very good economic signal. The way things are counted could be very misleading. If one loses a full-time job and takes two part-time jobs to make ends meet (likely making less total income), that’s still counted as +1 in the job count. There was a significant amount of that in this report, as multiple job holders increased by +114K.

Part-time “for economic reasons” (no full-time available or the business reduced its hours) rose +225K in August after increasing +303K in July.

The workweek contracted -0.3%, never a good sign. It has been flat or down for five of the past six months. Such a contraction is equivalent to -150K jobs.

On the positive side, the Labor Force Participation Rate (LFPR) rose +0.3 points to 62.4% from 62.1% in July, is at the highest level since March 2020, and is a sign that either the pandemic fears are finally subsiding, or inflation is requiring employment for some lazy people.

The LFPR for females aged 25-34 (typically young mothers) rose +0.6 points to 78.6%, the highest level on record. Perhaps the tight labor market is finally loosening – good news, especially for the service sectors.

The unemployment rates (both U3 and U6) are based on the Household Survey. So, while employment there rose, the re-entry of applicants into the labor forced raised both U3 (to 3.7% from 3.5%) and U6 (to 7.0% from 6.7%).

Wages grew at 0.3%, a slower pace than in the recent past. As a result of the contraction in the workweek discussed above (-0.3%), average weekly earnings were stagnant.

Inflation

Inflation is the headline leader and the focus of central banks around the world. The Fed seems to be focus on the YOY number which is a lagging indicator but the number the media keeps pushing. If we look at some of the more recent number such as the month /month rate for July was negative at -0.19%. But as you know that is not enough sizzle to lead the headlines, so the focus was the =9.1% YOY

If we look at the current inflation trend, we can calculate that inflation should hit the Fed goal of 2% by next April 2023. However, if the Month over Month inflation number continues to drop and is -1% or more we expect that the inflation number will be at 2% by the early part of 2023. As a note beginning next year the BLS will change the math on the way it calculates inflation, mostly by changing the weight of the various measures. With housing having such a large influence on CPI we expect it will change significantly. Source Economist Bob Barone Ph"D

Thinking about Retirement

For many Americans retirement is something to look forward to, not having to deal with rush hour commute, getting out of bed early, or performing a job one does not really like. For many it’s one of life’s milestones.

But the meaning of retirement has been reshaped over the last few decades as medical advances help people live longer, healthier lives. While building a nest egg is essential, that alone isn’t the same thing as mapping out what to pursue in your post-career decades. How will you fill your day? According to some retirement coaches one should put in the work of setting priorities and boundaries for the future This can often help prevent some of the common stumbles made by new retirees.

New retirees who neglect to plan can flounder without the structure of their careers, unsure how to fill their days. For many their social connections may dwindle suddenly, and those endless rounds of golf or hours spent babysitting the grandchildren turn out not to be as relaxing or fulfilling as envisioned.

Some Professionals that specialize in this area say it can take about two years to settle into retirement.

According to a study this year by retirement think tank Age Wave, Those who have been retired less than two years, 46% struggled to find their new purpose. Among the challenges they face, 36% said they mentioned the difficulty in learning how to organize their time, while 27% reported feeling out of sync with their unretired partner or friends. Think about a big vacation that you had taken in the past and the amount of planning that went into it? For many they probably put a lot more time and energy in to planning that trip than they did retirement.

Perhaps you may be one of the many that are quasi retired and helping your company transition a new person into your old role. Be careful to set boundaries and limitations on what you will give of your time. It may be easy to be taken advantage of or give more than you need just to feel needed.

Taking up a hobby should be done so with balance, jumping into something, and spending all your time may lead to burnout. Source https://www.wsj.com/articles/retirement-planning-means-more-than-saving-in-your-401-k-11661906591?mod=hp_listc_pos3

Labor Shortage is not the only Challenge for Businesses

The labor shortage has created a lot of headaches for companies large and small. Not only is finding help a challenge but finding quality employees is even more difficult. Things may look good on paper, as many companies’ staffing needs are close to pre pandemic strength or have even surpassed their early-2020 head count, mostly due to part time employees. However, companies are thrusting many workers into roles they aren’t entirely ready or qualified for just to satisfy demand for goods and services that range from making burritos to travel and healthcare. Companies have been laser-focused on filling job vacancies for most of the past year. They have raised wages, lowered barriers such as experience requirements and retooled hiring practices to make on-the-spot offers in an effort to fill positions needed to fill orders and service customers. But this practice has led to other issues, led by quality of work output. It seems that companies have been forced to hire unseasoned, under qualified and above all employees with an attitude, just to fill a job vacancy. Panic decision making has never yielded positive results, and this holds true for hiring. While this environment is providing opportunities for many less qualified employees to prove themselves, but most of them are not able to reach the bar that many companies have traditionally set for performance. Part of this reason is the lack of seasoned employees available to train or mentor new hires. For example, hospitals have hired nursing graduates right out of school that have never touched a patient to manage their care. Airlines have inexperience ground crew works, earlier this summer two planes clipped wings due to an inexperienced worker misjudging the distance between planes. The issues range from lost luggage to slow service in a restaurant to long hold times on the phone. Companies must rework their training programs to create better competency from their employees this may take some time and increase the cost of hiring a new employee. Source https://www.wsj.com/articles/employment-jobs-labor-shortage-inexperienced-workers-11662041163?mod=hp_lead_pos10

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Security Markets will fluctuate that is just a fact about investing. Different market environments will experience different levels of volatility. In a low volatility bull market, you are more likely to experience marginal fluctuations that might lull you to sleep. But that is not the environment we are in now. Bear markets tend to be a lot more volatile than Bull markets, what we are currently experiencing in both the broad equity markets and bonds is unusually high even for a bear market.

The S&P 500 is trading below both its 50-day and 200-day moving averages. According to our indicators, volatility, as measured by a Volatility Index, measures VI 111. As a reference, volatility above VI 75 for the market is considered high. The current volatility of market is below its high for the year, 141 but has started to tick back up as the market has fluctuated downward over the past few weeks.

Here are some quick market (S&P 500) statistics for 2022 that you may find interesting:

There have been 171 trading days this year (through 9/2/2022). Of those days, 75 have been up (43%) and 96 have been down (56%).

The average trading day has resulted in -0.11% for the S&P 500, and average “up” day has actually been greater than the average “down” day. On average, a day that has ended positive has been up about +1.2%. A day that has ended with the market going negative has been -1.13%.

Intra-day volatility has also been high. On average, the difference between the daily high and daily low has been 1.84%. That is nearly double what we saw in 2021. In other words, on a daily basis, the market may have gone from being down almost 1 percent to being up almost 1 percent or vice versa.

So far in 2022, we have seen 9 swings of at least +/-6.00%. In other words, the market has had a run or decline of at least 6% nine different times this year. For reference, through this point in the calendar year 2008, the market had 8 of those swings. In 2021, the market had no drawdowns totaling -6%.

The market’s swings in 2022 have been large. So far, the S&P 500 has seen a few declines of -9%, -15%, -12%, and most recently -8.85%. It has also seen a few rallies of +11%, +7%, and +17% .

Source: Optuma Technical Analysis Charting Software

What about Bonds and Conservative Portfolios?

What about the bond markets? Bonds are supposed to be the safe asset that will cause a balanced portfolio to be less volatile than stocks. Historically there has been an inverse correlation between equities and bonds, but with artificially low interest rates for over a decade, the bond market has been more volatile than the equities, as bond price have dropped with rising interest rates, those investors with a 60/40 portfolio have felt the pain with no place to hid. The 7 to 10-year treasury ETF (IEF) is down -12% so far this year. The 20-year treasury ETF (TLT) is down nearly -24% on the year. From their peaks in 2020, they are each down -18% and -36% respectively.

The Short-Term

Given the market’s recent fluctuations, the S&P 500 for the short-term is currently oversold. The index has seen nearly a -9% decline in just 13 trading days. The equity market’s leadership has been defensive. According to a risk-adjusted rankings, the top sectors in the market right now are Utilities, Energy, Consumer Staples, and Industrials. Communications and Financials are ranked at the bottom of the sectors.

It is during times like this that an investor needs an actively managed portfolio, Indexing or having an over diversified portfolio that is on autopilot will not help you. Remember if your portfolio is down 25% on the year you will need a 33% return to break even next year, not to mention the lost returns while your portfolio is playing catch up. If your financial plan is requiring a specific yearly return think how many years of appreciation may be lost while trying to get back to where you need to be.

The Week Ahead

U.S. markets are closed Monday for the Labor Day holiday, but there is plenty happening globally to kick off a busy week. The UK announces the new Conservative party leader and prime minister Liz Truss as the pound and British stock market are being crushed under the weight of high inflation. Additionally, OPEC meets amid rumors of production cuts, but so far traders have faded crude prices on demand concerns. The G7’s plan to cap Russian oil prices adds more potential volatility to the mix. Central banks in Europe, Australia, and Canada are set to announce further rate hikes this week. The ECB may be forced into more aggressive action despite the threat of recession, as added euro depreciation only worsens the energy crisis. In the U.S., the typical slow data flows following the employment numbers are highlighted by ISM Services PMI and consumer credit updates for August. Apple’s annual launch event on Wednesday will reveal the new products available for the important upcoming retail sales period. Elsewhere, China releases trade balance and inflation figures as domestic demand struggles under lockdowns and real estate worries.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/