Does the Economy Hinge on Housing?

Market & Economic Climate

from the Week Ending August 19,2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

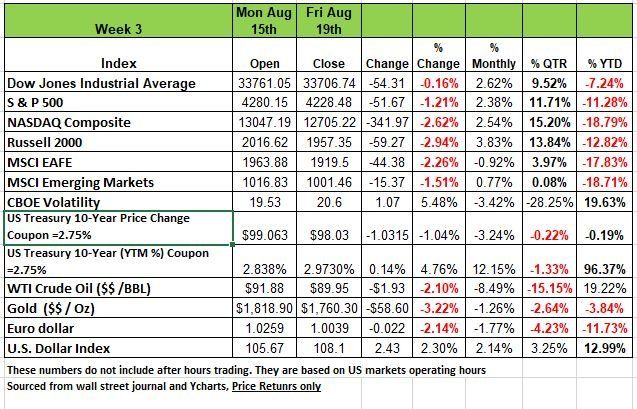

After several weeks of positive returns all 4 indices completed the week down. Both the Russell and NASDAQ had the largest declines -2.94% and -2.62%, followed by the S&P -1.21% and the DOW basically at break even with a -.16%. The declines came as investors tried to make sense of mixed retail earnings and the FOMC minutes released last Wednesday.

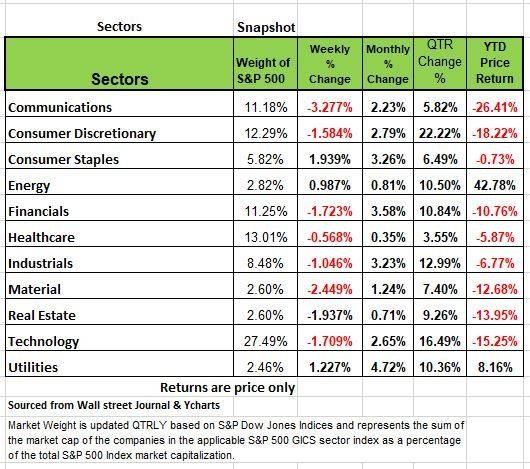

By sector, communication services led to the downside with a 3.27% weekly drop, followed by a 2.4% decline in materials. Other declines included real estate, financials, technology, consumer discretionary, industrials and health care.

Still, three sectors climbed on the week. Consumer staples had the largest percentage increase of the week, up 1.9%, followed by a 1.2% rise in utilities and a 1% gain in energy.

The market will get readings early part of this week on US manufacturing and services sector activity for August as well as new and pending home sales for July, but July inflation numbers to be released on Friday are likely to receive the most attention.

U.S. Treasury yields rose over the course of the week on comments from the Federal Reserve, despite softness from China’s economy. U.S. Treasury yields fell moderately last Monday as many key economic indicators in China missed forecasts and the People’s Bank of China lowered some interest rates. Could the China bubble be close to finally bursting?

Investors construed central bank officials' comments ahead of this week’s Jackson Hole meeting as more hawkish. Last Thursday, Federal Reserve Bank of St. Louis President James Bullard said he would "lean toward" another rate increase of 75 basis points in September’s FOMC meeting.

Short term yields rebounded on Tuesday with long term yields staying flat as investors prepared for the minutes from the Fed released last Wednesday. The Fed’s minutes showed that the committee members see a high probability of tightening the money supply and that the federal funds rate was still below neutral, which caused yields to rise moderately, and rise significantly amongst longer durations. This seems like a big contradiction considering that last month Fed Chair Powell stated that he believed that the Fed Funds rate was at neutral.

Yields pulled back slightly on Thursday and rose moderately again on Friday after Richmond Fed President Thomas Barkin, made comments saying that the Fed would do what is necessary to rein in inflation. The uncertainty with regards to the central bank’s policies is reflected in the market implied probability of a 75- basis point rate hike, at 52%.

A Change in Corporate attitude

As the economy outlook continues to erode, CEOs from many companies are changing their tone toward being overly accommodative to younger employees. The days of the company townhall meeting and softer more empathic leaders are quickly fading. With profits declining CEOs are demanding productivity from their staff, to work with a greater sense of urgency, focus and drive. Its time to get back to basics gone are the days of unnecessary spending of business travel, entertainment, and swag. Companies need to start conserving cash, the cost of it has risen dramatically in just the past few months. Keeping excess inventory on your shelf just got more expensive and will continue to increase as interest rates continue to rise. When money is cheap and business is good companies can absorb mistakes more easily, but when the economy downshifts every mistake can have a more pronounced impact on the company’s financial health. Younger workers who may never have experienced difficult economic conditions, may find themselves in shock as companies continue to increase demand on performance and reduce many of the “fringe benefits” they have been accustomed to.

Does the Economy hinge on Housing

As we have discussed in the past Housing (rent) accounts for 30% of the weight in the calculation of inflation. What we have experienced over the last 2 and a half years is unique. People exited cities and those that stay stiffed their landlords on rent. Landlords raised rents and inflation spiked.

Housing also plays a big role in GDP calculations. New home construction is an obvious contributor to real GDP as it employs construction workers and supports industries that produce the goods and materials necessary to build and furnish the structures.

Even the sale of existing homes plays a large role in GDP, as the new occupants put their personal touches on the purchase with new furniture, carpeting, paint, and other home improvement projects.

The surge in interest rates has impacted the housing market significantly. No other part of the economy has been affected more (ok maybe investments) . The average 30-year fixed-rate mortgage rate rose from 3.0% this time last year to 5.4% this past week. This, along with dramatic home price increases, has boosted the average monthly mortgage payment up by $627 YOY.

This week’s housing data weakened and revealed a further slowdown. July housing starts fell more than expected, contracting -9.6% to a seasonally adjusted annual rate of 1.446 million, the lowest level since August 2020. Building permits (a leading indicator of housing starts) slightly beat expectations, but also fell 1.3% to 1.674 million, suggesting further weakness ahead. In addition, the NAHB’s Housing Market Index, which is designed to measure the pulse of the single-family housing market, dropped to 49 in August, marking the first dip below 50 since May 2020.

Many Investors buying into the narrative that there is a “dovish Fed pivot” coming in the fall, yet this will be largely dependent on how fast inflation cools from here. Will it drop incrementally or drop off the cliff is yet to be seen.

What we think will be key here is to see when this weakness in housing begins to translate to decelerating shelter inflation, which would allow core inflation to decrease more sharply. Shelter costs were up 0.5% during the month, likely stemming from these higher mortgage costs weighing on landlords. According to research from the Council of Economic Advisors, it has historically taken 16 months for weakness in housing to translate to lower shelter inflation, but again the pandemic has created a lot of anomalies, we think it may be quicker this time.

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

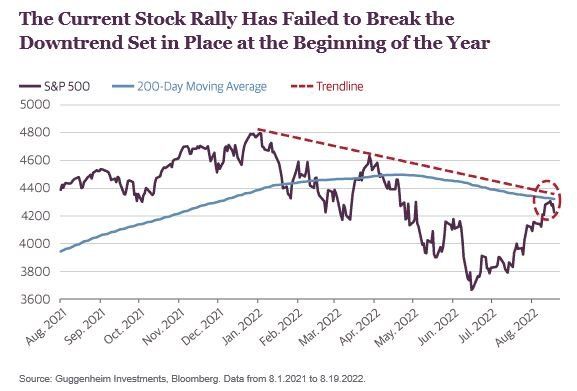

Stocks have seen a strong rally over the last several weeks, since the FOMC meeting in mid-June, but the S&P 500 yet to close above its 200-day moving average. If we look at history of previous bear markets, this level (currently 4,320) is an important one to watch. Because a failure to break the 200-day moving average could indicate much deeper declines for equities in the months ahead. Additionally, it is noteworthy that the current rally has failed to break the downtrend that has been in place since the beginning of the year.

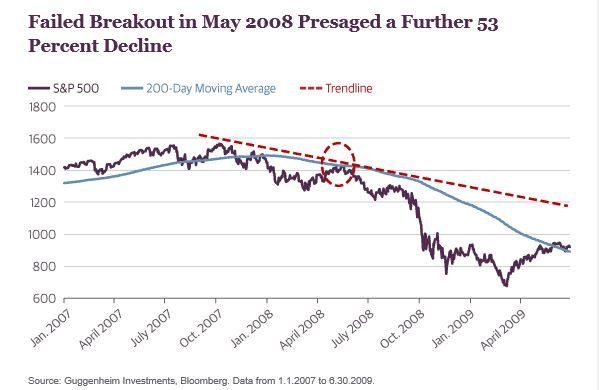

Back in May 2008, the market recovery stalled just shy of its 200-day moving average. The S&P 500 went on to fall another 53 percent before bottoming in March 2009, bringing the peak-to-trough decline to 57 percent.

In a similar fashion back in 2000–2002 we saw several failed breakouts attempts that ultimately resolved in a peak to-trough decline of 49 percent. Also worth noting is that the downtrend was not broken in either of these episodes

It appears as of now that the sectors that have been able to maintain gains over their respective 200-day moving averages are energy and defensive stocks (utilities, consumer staples, etc.). More growth-oriented sectors have led the rebound since June but remain below that key technical threshold, indicating that more problems could lie ahead for growth stocks if the rally is not sustained.

On a fundamental level, Federal Reserve officials appear determined to bring inflation down by causing a recession. While equity analysts’ earnings per share expectations have been marked down slightly since June, we expect an official recession to result in much bigger markdowns to earnings estimates. This, and a cyclical decline in price/earnings ratios, will likely combine to take stocks to new lows before this bear market is over. Source Guggenheim Investments

The Week Ahead

The Thursday is the Fed’s annual economic policy symposium in Jackson Hole WY. All ears will be on Chair Powell when he speaks on Friday morning, which is also when another inflation update arrives with the monthly Core PCE Price Index. Investors will be looking for any additional clues as to the trajectory of future rate increases and the Fed’s quantitative tightening efforts. The anticipation based of comments made from other fed governors leads the markets to brace for more 75bps rate increases

August’s global flash PMIs will also be in focus this week, with Tuesday’s figures offering updates on how weakening demand and high inflation are impacting the manufacturing and services sectors. The busy U.S. calendar also includes new and pending home sales, durable goods orders, and personal income and spending numbers. Revised accounts of Q2 GDP and consumer sentiment are not expected to deviate much from initial readings. Overseas, business and consumer sentiment are on the European docket, along with minutes from the last ECB meeting.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/