Be Cautious!! Economic & Market Climate

for the Week Ending August 12th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

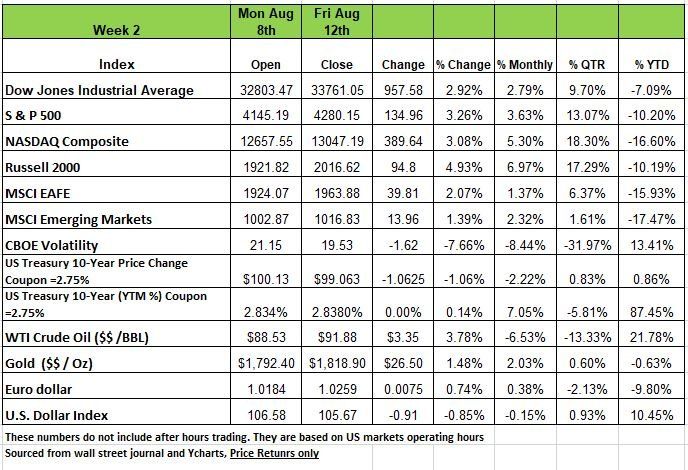

Last week was the 4th consecutive week of positive returns in the market. Returns ranged from +2.92% DOW to +4.93% the Russell 2000. Much of the upward movement over the last four weeks has amounted to quarterly earnings reports proving many companies still did better than expected in Q2 despite rising inflation and supply-chain & labor issues.

The S&P 500 was down -8.4% in June alone as fears over how those challenges would impact companies' bottom lines. Last week’s Inflation data down .6% provided some relief for the market. The Bureau of Labor Statistics said the US seasonally adjusted consumer price index unexpectedly held steady in July versus June while the year-over-year rate slowed to 8.5% from 9.1% in June.

US producer prices for July unexpectedly declined 0.5% last month versus the prior month while producer prices were up 9.8% in July year over year, down from June's 11.3% year-over-year growth.

The coupon on the 10-year Treasury drop to 2.75% from 2.875%. The drop came at the Treasury auction as more money moved into Treasuries over the last few weeks rising prices and lowering yields. Yield drops when prices go up Prices increase as demand for Treasuries increase. The demand increases as fears of economic/market conditions change. But there is another component not often addressed and that is how investors hedge themselves against market swings. When the market moves further in one direction than anticipated investors need to execute their options to minimize losses. This often impact prices. Wednesdays CPI release of 8.5% while down from June is still high enough that the market priced in more Fed rate hikes. The market is currently pricing another .75 bps increase, which will not be known until Sept 21st.

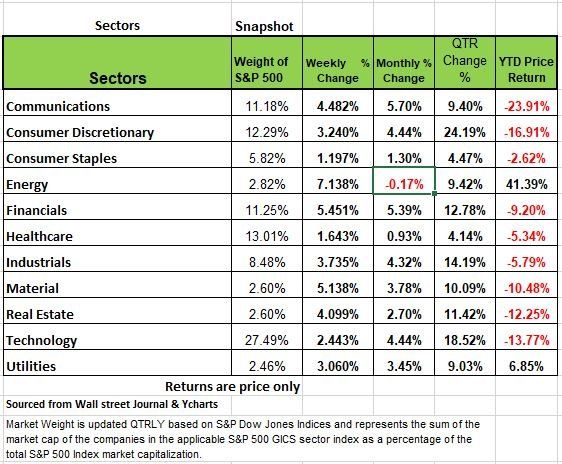

All 11 sectors finished the week with healthy price returns, led by Energy at +7.1%, followed by Financials +5.41%, Materials +5.13%. Consumer Staples pulled up the rear with +1.197%. Economic reports due this week will be focused on housing data while providing additional insight into the retail sector. The NAHB home builders' index for August is expected on Monday, followed by building permits and housing starts for July on Tuesday, and July existing home sales on Thursday. July retail sales will be released on Wednesday

Economic Climate

We seem to be living in unprecedented times. The economic downturn in 2020 due to the pandemic lockdown was perhaps the shortest recession in U.S. history. But it was also the first time the federal Government shut down the country forcing the economy to cease. But in a short time span we went from zero to 100, thanks to the Federal Governments massive injection of capital into the economy. For many Americans they earned more money by not working than they did when they were employed. Then the government turn off everyone’s allowance and demand dropped. So, did the U.S. government prevented a massive economic disaster or just delay it? There seems to be a divide as to the health of our economy. Half the professionals think we are NOT in a recession and that we can avoid one and the other half believes that we are already in it and that it will get worse.

The markets just completed it 4th consecutive week of positive returns, giving many investors the feeling that the worse is behind us. This based on lower CPI numbers for the month of July a high jobs report, a drop in gas prices and profitable Q2 returns from many companies.

While many may feel like it is time to jump back into the market, we believe that the current movement may be misleading as to the direction of the economy.

GDP looks to be on track for a 3rd quarter of negative growth, and that makes sense since all the money that was poured into the economy during the pandemic is no longer being infused. September will be the one-year mark since the government turn off the money faucet. Supply chains have loosened up but much of that is due to a drop in demand, Americans are not spending as much now since inflation took a big bite out of their wallets. One issue does puzzle us and that is with the low number of Americans working and a higher number not in the work force, where are they getting their money. Most Americans live paycheck to paycheck and savings have dwindled. Of course, there is probably a large number of American that are now self -employed and working for cash, off the grid, just how many is still unknown. But the IRS has stated that they will be hiring 85K new agents to begin auditing tax returns. We expect this will take time but those not wise may be in for a big surprise.

As we mentioned a few weeks ago we believe that inflation had peaked in June and will start dropping more significantly over the next 8 months. This of course is contingent on not having any geopolitical event that would disrupt the economy.

The one variable here is the FOMC, it appears that every member has come out publicly to address the Fed position and priorities to continue fighting inflation regardless of how much it may impact the economy. The FOMC has will continue to raise rates and it has not yet begun its tightening of the money supply. The last time the Fed tried to reduce the money supply was back in 2018 at that time the Fed backed away as credit markets froze up. The situation we are in is a result of poor decisions motivated by politics. This never ends well. Next week the Fed has its Jackson Hole symposium which we hope will shed some more light on what and how much longer the fed will continue on this path.

All the forward-looking data says Recession just a matter of how deep, how long and most importantly how painful to most Americans.

Estate Planning

If there was ever an issue that tore families apart, it was the division of estates. Perhaps the one single most difficult event is an individual’s life. Estate Planning difficult on many levels, first as individuals we have to face the reality of our own mortality. The second is a division of assets as we see to be fair. But how we define fair may not be the same as the way our beneficiaries define it. Property can have both intrinsic value and sentimental value and can be assessed differently especially amongst children. We can write a lot on this subject but will just hit one topic for this article that being inherited IRA’s /401K’s

People would most likely split assets in a retirement account equally amongst their children. But the Secure Act of 2019 has made the drawn down of these assets a little more difficult

Consider two adult children—one in the 35% tax bracket, and the other in the 22% bracket. Their mother has $4.25 Million in assets, $2 million in a traditional IRA, $1.25 million in a Roth IRA, and $1 million in nonretirement accounts such as savings and brokerage accounts. Ok we know this may seem high but many families with 2 income working adults very realistic. Anyway, she wants to be fair, so she divides everything 50/50—leaving $2.125 MM for each child. Sounds reasonable right? But after the taxes are taken out the child in the 35% tax bracket receives $1.775 MM of the original $2.125 while the child in the 22% tax bracket ends with $1.905MM A difference of $130K more than the other child. This may seem ridiculous for anyone to complain after receiving that much money but these issues happen on a daily basis. Some financial professional as suggesting that asset distribution be calculated on an after-tax basis, but its not so cut and dry as people tax brackets can vary significantly depending of their profession and type of employment (self v W2). However, one decides to manage their estate perhaps the best practice is to make communication clear and regardless of how difficult the conversation may be, make sure you share your thoughts with your children to avoid potential issues that cannot be addressed once you are gone. Source https://www.barrons.com/articles/inherited-iras-401ks-taxes-inheritance-51656686560?mod=djem_b_Retirement0703

Some American may want inflation to stay high

Social Security recipients are on track to receive the highest cost-of-living increase in more than four decades next year.

Social Security checks get an inflation adjustment every year based on the Consumer Price Index for Urban Wage Earners and Clerical Workers. In determining the cost-of-living adjustment, or COLA, the Social Security Administration compares the average figures for July, August and September to the index’s average level over the same period a year earlier.

The July data, disclosed Wednesday, rose 9.1% during the past 12 months. That is slightly higher than the headline inflation number, measured by the Consumer Price Index for All Urban Consumers, which recorded an 8.5% annual increase. The official Social Security COLA will be set following September’s data.

If inflation remains at the current level, on average, over the next two months, the approximately 70 million retirees and disabled people who receive Social Security benefits could see their monthly checks rise by about 9.6% in 2023, according to estimates from the nonprofit Senior Citizens League, which advocates for protecting and strengthening Social Security and Medicare benefits.

For the government, the higher monthly Social Security checks will mean having to hand over more money. For retirees, however, the increase is welcome news after a year in which the stock and bond markets fell and many retirees on fixed budgets lost purchasing power from rising inflation.

“The increase will be anticipated by millions of retirees, disabled people, widows and survivors receiving Social Security,” said Mary Johnson, Social Security and Medicare policy analyst at the Senior Citizens League.

Next year’s COLA increase is on track to be the highest since 1981, when Social Security benefits rose 11.2% to keep pace with inflation. The highest cost-of-living increase on record was 14.3% in 1980.

Social Security benefits rose 5.9% this year, a pace that failed to keep pace with inflation.

The Social Security Administration won’t announce the official cost of living adjustment for 2023 until October. But today’s inflation data provides a strong clue as to what recipients might expect. Source https://www.wsj.com/articles/social-security-benefits-are-heading-for-the-biggest-increase-in-40-years-11660138256?mod=followperfin

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

The S&P 500 has

rallied 16% since its mid-June

low and

has recovered half of the bear market losses. Its

recent run

has shocked many hedge fund managers who were holding too much cash. No doubt they are buying now for fear of missing out. Historically when we see these strong rallies occur

it is usually

at a time when there is a an exceptionally high level of cash on the sidelines.

There is a positive note. One characteristic you hope to see during a market’s rally is a rising tide that lifts all ships. In other words, you want the market’s rally to be participated in across most of the market’s components. If we look at the Advance-Decline Line, which measures market breadth, or market participation, it appears that the recent rally has seen broad participation. The rising tide is lifting all ships, as opposed to just a few large vessels carrying the rally while the smaller ships fall off. You can see in the chart below that the Advance-Decline Line has surpassed its late-March level, even though the S&P 500 index has not.

The S&P 500 has regained 50% of what it lost from the June low. It still, however, has a way to go before putting in a new high. Remember, large declines require larger advances to break even. The larger the drawdown, the larger the advance needs to be to get back to zero. Compounding is not just a one-way street. Oftentimes, a retracement of 50% during a bear market can act as resistance.

The bottom

line is that the

markets have rallied, and it has done so with broad participation. That is certainly a good sign for the markets, but the market is not in the clear just yet. Bear markets can have several large rallies, just as we saw back in early March before experiencing a -15% decline from the March peak. The market’s rally has been led by stocks that had declined the most this year, which are those technology-related stocks. Remember cash cannot sit idle for long so anytime you have a lot of cash on the sidelines, you’re due to see a large rally. Panic selling often leads to panic buying.

Source Brandon Bischoff Canterbury

The Week Ahead

Traditionally, August’s final weeks are slow as traders squeeze in their final vacations before the kids head back to school. Although the U.S. economic calendar is lighter compared to recent activity, there will be two important releases mid-week. Wednesday’s publication of the FOMC’s July meeting minutes will be scrutinized as committee members have been publicly pushing back against the perceived dovishness from Chair Powell’s press conference. The retail sales report for July is expected to confirm that consumer spending is weakening as personal savings dwindle and credit balances grow. Additionally, Walmart and Target will report earnings after both companies warned last month of shrinking margins and rising inventories. Other events of note include housing starts and existing home sales, industrial production figures, and regional manufacturing updates. Overseas, inflation and GDP data will be in focus. In the UK, CPI may touch 10% YoY, pressuring the Bank of England to raise rates more aggressively. Retail sales on Friday will shed further light on the situation for British consumers. In Europe, economic sentiment and flash GDP readings highlight a sparse docket. Lastly, in Asia, Japan releases preliminary Q2 GDP and July CPI, while China issues retail sales and industrial production reports

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/