Base Effects, Inflation, OPEC, & Other Economic News

for the Week Ending

July 16th 2021

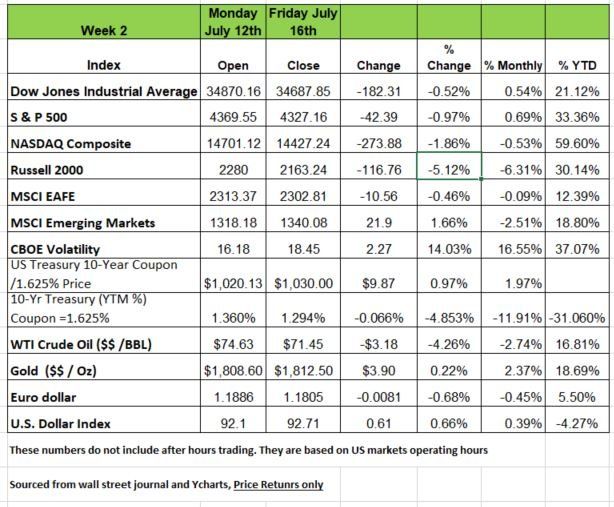

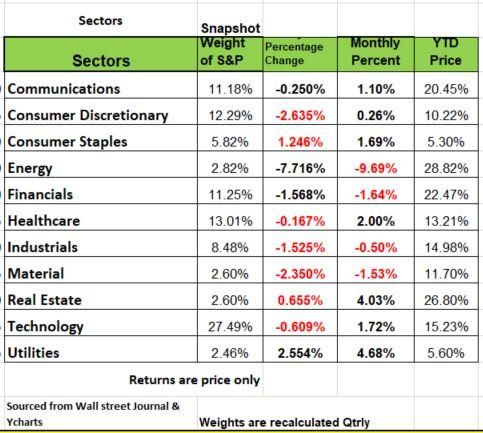

More concerns about deteriorating market pushed all of the equity indexes lower last week, and at the time of this writing they all continued the sell off at the start of the week. The S&P500 and Dow Jones Industrial Average fell 0.5-1.0%, while the Nasdaq slipped 1.86% and the Russell 2000 dropped over 5%. The S&P500 Equal-Weight Index underperformed its market-cap weighted counterpart for a third straight week, while investors flocked to defensive sectors like utilities (+4.68%) and staples. (+1.69%)

Energy stocks plunged 7.7%, with the materials, industrials and discretionary sectors also suffering losses.

Federal Reserve Chairman Jerome Powell spoke to Congress last week and indicated that the central bank would raise interest rates should inflation show any indication of being out of control but he repeatedly stated that he expects price inflation to be transient in nature. This is what made the markets nervous. While admitting that inflation is currently higher and more persistent than expected, he continues to believe the transient nature of inflation and that it will reverse itself once supply chains have been replenished

Powell also addressed the monthly rate of Treasury and mortgage securities purchase, currently at $120 billion, and noted that while some members would like to taper purchases, he didn’t feel it was an urgent step needing to be taken.

The market seems to be on the same page as Powell as 10-year treasury yields fell for a third straight week. (Yields go down as prices rise) The upward price action in bonds has defied expectations of reopening strength leading to a steepening of the yield curve.

Concerns about the delta variant, global reopening, and economic growth mount, there has been a correspondent rise in negative yielding debt. According to Bloomberg, negative-yielding debt rose $730 billion, to $15.2 trillion, for the week ending July 16.

This is where Close articles go New Paragraph

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/