Economic Outlook

Week Ending January 15th 2021

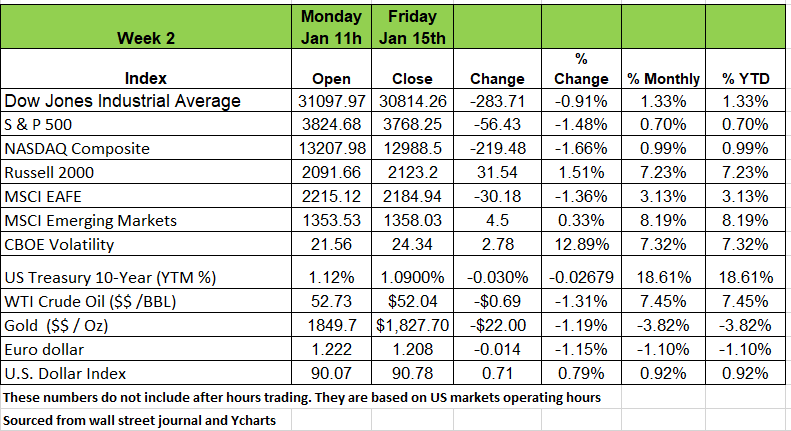

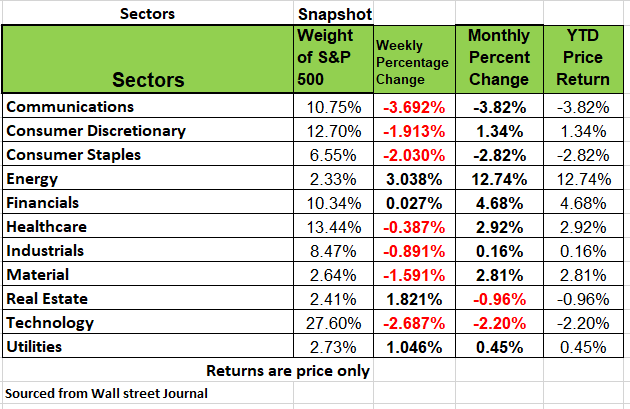

The 2nd week of 2021 showed a bit of a sell off with 3 of the 4 major indices in negative territory. The Russell 2000 (RUT) was the only index with a positive return of 31.54 points. Weak economic news continues to flow in about the US economy as the markets seem to shrug off negative information. Of the 11 sectors 4 had positive gains with the energy sector seeing an increase of 3.038% which is up 12.74% for the month /year. This increase is a result of the Saudi’s decision to reduce oil production in order to keep demand up. Last week market levels put the value of all common stocks (Market Cap) at 185% of GDP. While many are predicting that US GDP will grow this year as will company profits, we need to remember that these predications are based on lower numbers due to the pandemic. None of these forecasters are basing predictions on pre-pandemic levels.

Are we in a Teflon Market?

Do you remember John Gotti? He was given the nick name as the Teflon Don because he seemed invisible to prosecution. But eventually his arrogance & over confidence caught up with him.

Many professionals think that the Stock Market will continue its path to growth in 2021 as it continues to shrug off poor economic news. Last week’s jobless claims rose by 181K to a high of 965K and the market barely flinched. The Fed Chair Jerome Powell stated” We are a long way from maximum employment”.

If you have an investment portfolio perhaps you should have a conversation with your financial advisor to discuss a strategy when the inevitable happens. Not doing anything and waiting for the market to rebound from a correction is not a strategy. Source : https://www.wsj.com/articles/weekly-jobless-claims-coronavirus-01-14-2021-11610573648?mod=hp_lead_pos1

What Recovery?

The equity markets have ignored the underlying recession as the economy is now reliant on cash subsidies from Uncle Sam, which is being borrowed from future generations.

The narrative in the financial markets is justifying a large “V”-shaped recovery because there is so much “pent-up” demand.

So, let’s look at that theory of Pent-Up Demand: We all know that the economic pain is in the services sector; that’s where consumption has been lost. So, Ask yourself:

Will you “make-up” for all those missed restaurant meals?

Will you go to the amusement park more often than usual because you didn’t go this past year?

Are you going to fly twice as much as you used to because you didn’t fly at all since March?

The lost consumption in services is gone it isn’t going to be “made-up.”

While consumers may go back to something close to what they did before, they aren’t going to “make-up” for the missed services. In fact, many may not go out al all if they lost their jobs and accumulated debt or borrowed from their 401K plan because of lay-offs.

Famed economist David Rosenberg argues that since consumers have invested a lot in their homes (remodeled kitchens, purchased new equipment, appliances, & cookbooks & most importantly learned to cook), they are not likely to eat out as much as they pre pandemic

Similar for many other services, i.e., the “new normal” will be different with more savings and self-reliance. Source Bob Barone PhD economist

A Matter of Trust

People have more faith in their own employer than leaders in government and business, according to a new study released Wednesday. Overall, trust in institutions remains low, but business earned the highest marks, said the annual survey by the public-relations firm Edelman. More than half of U.S. respondents, 54%, said they trust business, which was more than was said for nongovernmental organizations, government or media. Nearly three-quarters of U.S. respondents said their own employer, in particular, was a mainstay of trust. The findings continue a trend. Last year’s poll also showed crumbling trust in institutions amid anxiety about corruption, future employment prospects and the wage gap between the rich and middle classes. Job loss remains a significant fear for workers, with more than three-quarters of the general population indicating concern.

Source:https://economics.cmail20.com/t/ViewEmail/d/6E214A36828168662540EF23F30FEDED/CC5219D6F17C4A9214399806BE9B4083

Junk Food Sales

Economist are always curious about relationships between people and their money. What behaviors can they analyze to determine a cause and effect. In a recent report published in Economics and Human Biology, Michael Baggio & Alberto Chong wrote on the correlation between Recreational Marijuana Laws (RML) and Junk Food consumption. Does anyone want to take a guess on the outcome? Apparently, there was an increase in junk food consumption in areas of the country that allowed recreational marijuana use. Who would have thought? Junk food sales increased by 3.2% and 4.5% when measured by volume in those states that had RML. Source Economic and Human Biology.

NYC Renters owe a lot of money

2020 was not exactly a good year to be in the real estate business in NYC. Manhattan is one of the most expensive real estate markets in the country. Most of the housing are in small 3 or 4 flat building that are owned by small business people with big mortgages. These building house a handful of people. Rent pre pandemic was extremely high with rates going upwards of $4000 a month for a small studio apartment in some neighborhoods. However, since the pandemic there has been an exodus from the area as well as a large number of unemployed that have not paid their rent. According to an article in the WSJ approximately 185,000 households owe more than $1 billion in back rent. Approximately $6,000 per/ unit in back rent. While many are relying on the Federal government to cough up money, this is just a fraction of the debt owed around the country. Source: https://www.wsj.com/articles/new-york-city-renters-owe-more-than-1-billion-in-unpaid-rent-survey-finds-11610622000?mod=hp_lead_pos11

Several big Issues for Technology Companies in 2021

Dependency on Big Tech soared in 2020 as homebound Americans & businesses turned to online shopping, software & cloud-computing services & to their smart devices & video streaming. Some smaller companies built for a pandemic world also saw skyrocketing growth such as Zoom communications video conferencing system. However, many companies such as Facebook and Google face many other issues. The sectors saw a 40% plus return last year and the question of continued performance is vague in 2021. To top the list are the antitrust lawsuits file against them by the Department of Justice and Federal Trade commission. With Congress concerned about the results of the riots that broke out at the Capitol we will see and attempt to bring tighter regulations to these social media companies. While many of these tech companies witness extraordinary growth in 2020 fuel by both the lockdown the question of continued subscriptions comes into play once the virus has been controlled and we see how many workers go back to their offices. After the breech of Federal agencies computer systems last year and by many cloud services Cyber security will be big on the list of issues to control for these big companies. Source : https://www.wsj.com/articles/the-five-biggest-issues-for-technology-companies-in-2021-11610816401?mod=hp_lead_pos10

China’s good fortune

While the U.S. and Europe struggle to get its economies back to “normal” Chinese exports rose to a record $2.6 trillion last year as more evidence of China’s growing economic might: The strong export momentum, along with its industrial recovery that fortified it, became a central pillar of China’s economic rebound in 2020. More than 40 cargo ships with tens of thousands of containers aboard were lined up waiting to get into the ports of Los Angeles and Long Beach last week in a new sign of unyielding backlogs that are hampering U.S. importers at Americas main gateways. Source: https://www.wsj.com/articles/china-exports-boom-to-record-year-while-covid-19-ravages-global-economy-11610610939

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/