Economic News

Week Ending January 22nd 2021

Technology stocks drove most of the markets last week as more reports on the new strain of the virus might lead to longer recovery. President Biden was sworn into office to a more subdued inauguration ceremony. His main priority is to get 100 MM Americans vaccinated in the first 100 days of his Presidency. His expectations seem a bit unrealistic as a study in NY times showed that 25% of New Yorkers will not get the vaccination and other studies show that mathematically we won’t achieve herd immunity until June of 2022.

Markets continued to ignore economic reality and continue to be focused on a rosy set of assumptions about a rapidly approaching post-virus period with demand so pent-up that GDP and corporate profits explode. It’s hard to understand this with some much of main street shuttered. Remember much of Corp America depends on main street.

The week wrapped up with the release of data supporting the continued strength of the housing market. Housing starts increased 5.8% in December, while existing home sales increased 0.7% in December, good for a 22.2% increase versus existing home sales YOY

British Economy, Post Brexit and Pummeled by Covid, Is Worst in G-7

The U.K.’s economy shrank more last year than any of the G-7, in what the Bank of England says will be the country’s biggest economic slump in more than 300 years.

What went wrong? Shutdowns caused greater pain for the U.K. than other members of the Group of Seven advanced economies in part because it is especially dependent on consumer spending, which evaporated amid one of Europe’s deadliest Covid-19 outbreaks.

The economy was already weak after the four years of negotiations over Britain’s exit from the European Union, during which business investment sagged and households held back on spending.

This is the starting point for Britain’s new relationship with the EU, which began Jan. 1 with a loose free-trade agreement. Earlier this month, Prime Minister Boris Johnson announced another nationwide lockdown to fight a new, more-contagious variant of the coronavirus. That puts the U.K. economy on course to shrink again in the first quarter of the year, when businesses must also get to grips with new European trading arrangement. Source: https://www.wsj.com/articles/british-economy-post-brexit-and-pummeled-by-covid-is-worst-in-g-7-11611589082?mod=hp_lead_pos5

Week ahead of important Data

A lot of important news will be released this week starting with Wednesday

China’s industrial profit growth is expected to register modest gains for the full year, compared with a 3.3% annual fall in 2019. China’s industrial sector led its economic recovery from Covid-19 shocks and was buoyed by global demand for protective gear and work-from-home electronic devices.

In addition, U.S. durable goods orders likely rose for the eighth consecutive month in December. The manufacturing sector has been resilient through much of the pandemic as businesses make modest investments and consumers shift spending away from services and toward goods.

The Federal Reserve is expected to leave policy unchanged. Chairman Jerome Powell is likely to underscore the central bank’s commitment to supporting the economy with low rates and continued bond purchases for the foreseeable future.

Thursday we will see the actual numbers on the U.S. economy for 2020. Gross domestic product advanced at the fastest pace on record in the third quarter as the economy reopened from Covid-19 lockdowns and consumers regained confidence.

But the fourth quarter won’t be nearly as strong after the virus reemerged, fiscal support faded and the labor market lost momentum. While economists expect another quarter of growth, the economy will still end the year smaller than it was in 2019.

U.S. jobless claims have held at an elevated level in recent weeks, a sign that layoffs remain high as Covid-19 cases increase, governments impose new restrictions and consumers show caution about venturing out.

On Friday we will how see U.S. consumer spending ended. It’s expected to decline for the second straight month after Covid-19 cases increased, a worrisome sign the economy lost momentum at the end of the year

Can Massive Deficits Really Be Financed

The budget deficit for fiscal year 2020, ended 9/30/2020, It was a whopping $3.1 trillion over budget. the highest ever on record in dollar terms, and the highest relative to GDP since World War II. This year the deficit is expected to be even larger.

Before the bipartisan “stimulus” compromise passed in December, congressional budget scorekeepers estimated the fiscal year 2021 budget deficit at $1.8 trillion. Now, with that additional $900 billion in spending, and the Biden Administration promoting an additional $1.9 trillion stimulus early this year, we expect the budget deficit for FY21 to be at least $4.0 trillion. The debt of the U.S Government is growing at staggering rate. At some point we will hit a wall and have to reconcile this debt. If the U.S. dollar is no longer viewed as the world currency, we may have a rude awakening.

Fixed Income

US Treasury bond yields were mixed last week. Based on Janet Yellen’s confirmation as Treasury Secretary and President Biden’s inauguration. The shorter-dated yields pulled back a bit while the longer-end of the yield curve gained over the course of the shortened week.

The long end of the yield curve steepened on Tuesday in reaction to Yellen stating she was open to the idea of adding a 50-year Treasury bond.

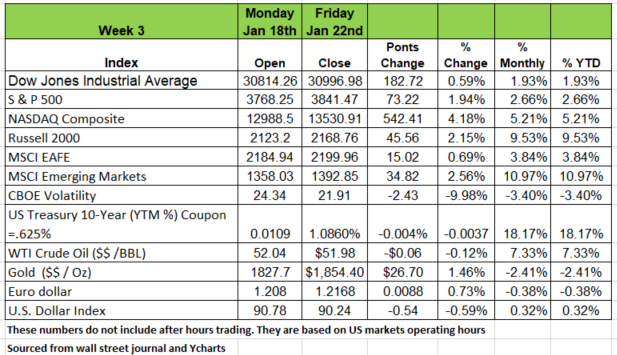

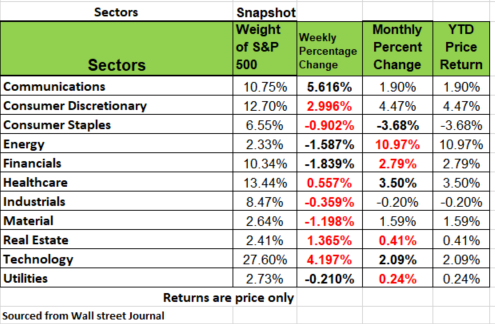

Equity Markets

Investor sentiment has been seemingly impervious to mounting macro risks. Bipartisan support for President Biden’s $1.9 trillion stimulus plan is currently lacking, and investors seem to be questioning whether the new administration can meet projected vaccination targets over their first 100 days. Further, it is expected that Speaker Pelosi will send articles of impeachment against former President Trump to the Senate, which is likely to delay any fresh coronavirus relief efforts among lawmakers.

Euphoric trading activity persists. As swarms of retail traders on trading message boards are putting heavily shorted, fundamentally challenged companies in their crazed crosshairs.

The parabolic rise in equity options trading continues to exacerbate and support volatility. Nearly 30 million equity options were traded daily in 2020, which was a record, and in 2021 so far, the OCC shows an average of 43 million equity options traded daily. For now, the punchbowl seems full…and spiked

What Happens When?

One of the most important aspects of a Financial plan is planning for the “What if”. But those “if’s” are often ignored because no one really wants to think of them or they believe those “If’s” will happen to them.

Insurance is like a seat belt that just cost a lot of money. Some look at it as a waste of money until its needed. Then it becomes the best money ever spent.

But this isn’t insurance, it’s a about sharing responsibilities with your partner. I often find that one person is usually responsible for the finances. One person will handle everything. Yet, if something happens to that person the other partner has to jump into the fire & learn everything. That person is often overwhelmed, not just with grief but with the task of understanding their finances, from placement of assets (portfolio’s, retirement savings & all accounts, Life ins. policies) to liabilities & their payment due dates. Even finding passwords can cause issues. If the couple did not have a financial plan or advisor, the surviving partner usually needs to seek one out. I have always believed that It’s a good practice to take turns doing the finances or to do them together, so nothing is left to learn or be surprised about.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/