China Throws down the Gauntlet & Other Economic News

Week Ending 4-19-21

Week in Review

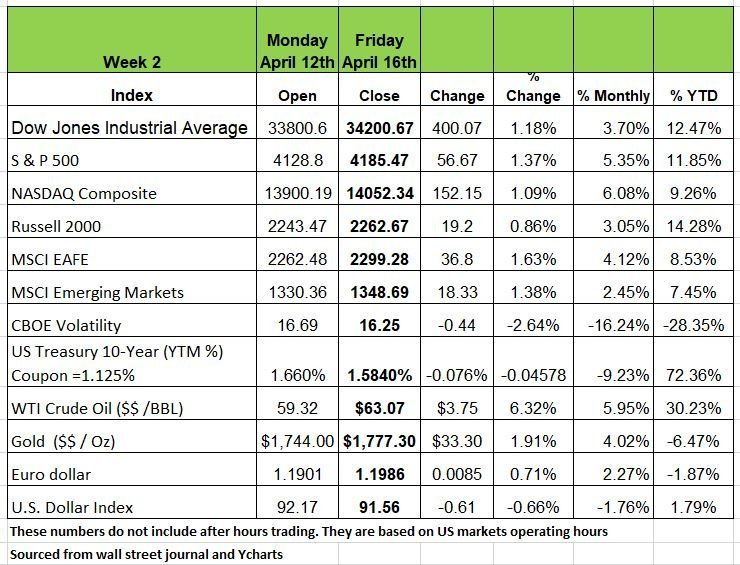

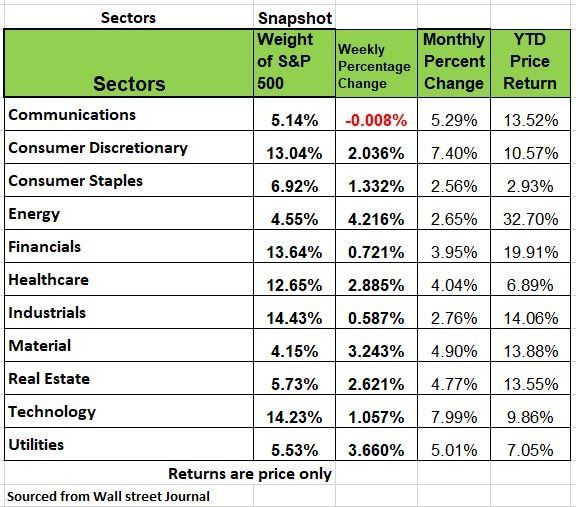

Markets were up again last week as all indices and sectors hitting new highs, this may be looked at as great news, as investors see all upside to the economy. But we also need to keep an eye on few areas before we start celebrating. With interest rates so low and many Americans still not back at work, we have a lot of debt to be aware of. According to Barons the forbearance on loans has topped $2 trillion dollars, this is almost 3 times the amount of what caused the crisis 2008.

Forbearance is not forgiveness and these loans need to be paid back. Mortgage loans can be paid back by adding the past due amount to the back end of the mortgage, however back rent needs to be paid back now. Most landlords are small business owners that don’t have the cash flow or reserves to float renters. Texas has overruled the moratorium on evictions, so people need to use their stimulus money to catch up and not go out and buy goods, especially luxury goods. If you have been to any of the outlet malls or walked down Michigan avenue you may have noticed the long lines to get into Louis Vuitton or Gucci, this is how stimulus money is being spent, and until they get on a payment plan to keep their residence, and take responsibility to pay their rent, we may have a dark cloud looming over many areas of our country. Only time will tell this outcome

Stanford University observed that 60 million people missed debt payments in Q1. That’s 23%(!!) of the adult population, and this was with the helicopter money drops in January and March. While the IC (initial claims) numbers are looking better they are still not great and with many American’s having stocked up on stuff last year, We don't see consumer spending continuing on discretionary items, maybe the service sector will get some of the growth.

President Biden also announced retaliatory measures against Russia for election interference and cyberattacks. Oil prices rose 6.4% as the strong economic reports led to a higher forecast in global oil demand.

China and the US

China’s Q1 GDP headline was +18.3% Y/Y. This is a seemingly high number and in line with the “Roaring 20s” narrative. What wasn’t much discussed was that the Q/Q GDP number was actually -3.3% (annual rate) lower than that of Q4. But what made the headlines last week was the meeting in Alaska between the two countries. Chinas has basically told the US that they were no longer America’s subordinate, that Beijing sees itself as our Equal and with that America needed to stay out of the way of China’s pursuit to bring Taiwan under China’s Sovereignty

But in a show of arrogance one Chinese official gave a 16-minute lecture to U.S officials about America’s racial problems as well as our democratic failures. This seems like a challenge and China trying to intimidate us. Have we become too dependent on China for manufacturing and technology chips, perhaps a real economic conflict is on the horizon? Source : https://www.wsj.com/articles/america-china-policy-biden-xi-11617896117?mod=searchresults_pos1&page=1

Labor Market

The health of the labor market is the key ingredient of the economy’s health and, there is finally some good news on this front. Initial Jobless Claims were 576k, which was well below analyst expectations of 700k, though continuing claims remained flat. We thought that the rapid fall in the Pandemic Unemployment Assistance (PUA) Initial Unemployment Claims (ICs) would translate into lower state ICs. (PUA claimants are mainly small business operators while state claimants are laid off employees of businesses that pay into the state systems, many of which are such small businesses.)

We were a bit concerned for the last few weeks when state ICs actually rose for a couple of weeks after the PUA ICs had fallen. PUA claims fell significantly the week of March 13, continued mildly downward, and then fell hard again in April. Small businesses are reopening. Looking just at restaurants, Open Table reservations in the first third of April were at 82% of their pre-pandemic norm vs. 52% in February.

But the numbers for CC still seem to be high, while many industries have plenty of jobs needing to be fill many others are still struggling or feel that going to work for is not enough of an incentive if the Government is paying them 80% of their income.

Banks Loans

This past week, the major banks reporting earnings all beat Wall Street estimates significantly. However, the beats were on the backs of their capital markets, trading, and investment banking functions. Not on making loans. Their loan books contracted -9% Y/Y.

We feel that loan expansion is also a necessary ingredient for an economy to grow organically. While Mortgage Loan Applications are down six weeks in a row, and in nine of the last 10. (Housing supplies are low so understandable)

Over that 10- week period, the index fell -31.9%. The purchase sub-index fell -16.5%, and refis -38.6%.

Ok we can address this that the supply of hones is low with so much demand and supply lower than needed banks can only write so many loans but businesses are not expanding either and until that happens, we should not get overly zealous. Source Bob Barone

Economic Outlook

Earnings season for Q1 of 2021 is upon us and it looks like equity investors are banking on some good results. As of April 5th 2021, the Bloomberg’s consensus year-over-year (y-o-y) earnings per share (EPS) growth rate projection for the S&P 500 Index for Q1’21 stood at 23.44%. That is an amazing number considering all we have been through. If achieved it will likely reassure investors that the market has some more momentum left and is being driven by more than just speculation.

The projection for Q2 came in a 50.45% more than double Q1, however keep in mind that Q2 of last year we witnessed the lowest drop in decades and this increase is based on a very low number. The full year 2021 project EPS growth rate estimate (y-o-y) is 25.33%, this is still a large number and many have conflicting views but everything will depend on a microscopic virus and collective human behavior, remember we still have a large number of unemployed people that are living off the government.

Housing prices have soared in the past year as has the price of lumber. The national Case-Shiller index is up 11.2% in the past twelve months, the largest gain since 2005-06. The FHFA index is up 12.0% in the past twelve months, the largest on record (going back to 1991).

Lumber has risen as the demand has increased and the supply has stayed the same, home prices are up as inventories are down and new construction has not kept up.

Given these gains, some are wondering whether housing is back in a 2000s-type bubble. We are not seeing this as a bubble that would pop like last 2008, unless we see more financial stress. But we do believe that once this pandemic is behind us, and employees have to commute back to the office, we may see a shift back to the cities, especially with younger single individuals whose entire social life is based on after work /late night activities.

The NY Fed Weekly Economic Index exploded to the upside in late March and early April. Retail Sales were up an amazing +9.8% M/M in March! That number is not Y/Y. The Y/Y number was +27.7%, but was greatly influenced by depressed Retail Sales last March when the economy was brought to a screeching halt. April’s Y/Y number will be even higher, as April 2020 was the first full month of shut down from the pandemic.

The Consumer Price Index (CPI); soared to a +2.6% Y/Y reading. While many in the media are looking for something to add sizzle to and pushing for a boom scenario “Roaring 20’s repeat”

“Systemic Inflation” doesn’t look to be on the horizon until wages take a big jump. But regardless of what the fed or the market states about inflation, many are already feeling the pinch to their budgets. Housing rent is what is keeping the numbers down, but rising prices in other sectors as well as taxes are impacting many people.

Drug makers Go on Trial Over Opioid Epidemic

Since 1999 nearly 500,000 people have died from opioid related issues, this according to federal data. Today in California several drug makers go on trial for running misleading marketing campaigns that downplayed the risk of opioid addiction. This is the second trial out of thousands filed against the drug makers as well as those companies in the supply chain. Back in 2014 when the concept was first thrown around of blaming the pharmaceutical industry for the problem seemed like a long shot, but since then nearly every state as well as more than 3000 counties as well as native American tribes have joined the joined the effort. The first trial resulted in a $465 million settlement in 2019 against J&J which the company is appealing. The others have been pushed off due to the shut down from the pandemic Source: https://www.wsj.com/articles/drugmakers-go-on-trial-over-opioid-epidemic-11618758002?mod=hp_lead_pos4

Week Ahead

Fed chair Powell remarked last week that most officials do not see interest rates rising until 2024, but the front end of the curve is telling a different story. For now, the market seems comfortable with this disagreement, as the velocity of the ascent in rates has slowed. However, the U.S. NFIB Small Business Optimism report showed that small businesses are struggling to find qualified workers, which may put upward pressure on wages and stoke more inflation (and higher interest rate) concerns.

Fed officials continue to push expectations of inflationary pressures being temporary, but with commodity prices rising, and squeezes on the supply chain and labor markets due to the accelerating vaccination pace, how long will it be until the market forces the Fed’s hand?

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/