Is the Economy at a Tipping Point & Other Economic news for Week ending April 9th

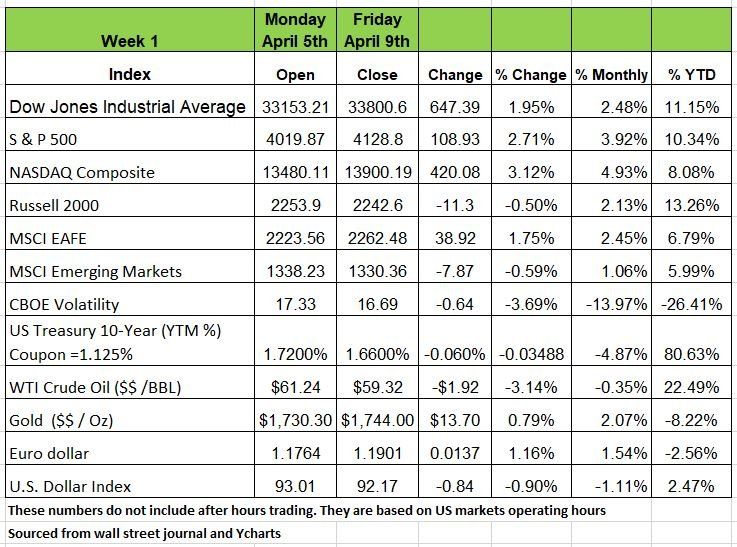

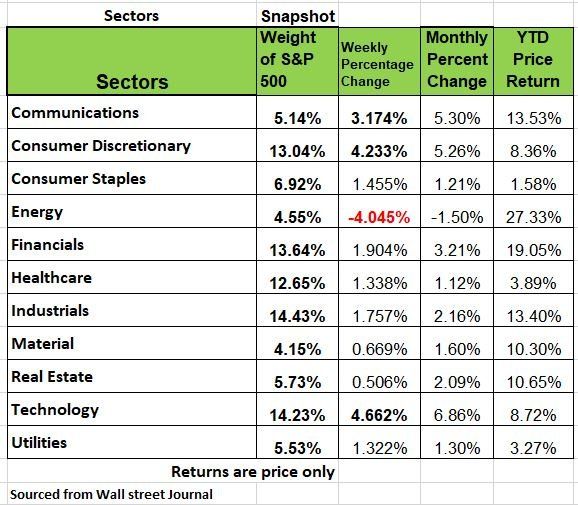

Stocks continued to hit new highs last week. All of the market indices were up last week except for the Russell 2000, which closed the week down a half a percent from the previous week. The S&P and NASDAQ posted 2.71% and 3.12% price gains respectively. The only sector down was Energy which dropped -4.045% on the week but still has the highest return for the year at 27.33%.

Consumer Discretionary was up 4.233% as we are seeing how the governments stimulus money is being spent. The leisure /hospitality sector is a big contributor to this as more areas reduce restrictions and consumers get out of their homes. Despite the reopening’s, State Initial unemployment claims spiked at the end of March. Either there is a disincentive from the generous benefit payments or the reopening’s are lagging longer than we thought.

Mixed economic data and commentary from the Federal Reserve reinforced the case for prolonged policy support giving investors a fallback plan for uncertain growth. PPI (Producer Price Index) has shown inflation taking a bigger jump than anticipated

If recent history is to give us guidance, only part (25%) of the stimulus cash will be spent on consumption, the remainder saved or used to reduce debt.

One of the biggest indicators to a healthy economy is measured by Business, consumer and real estate loans, which have fallen recently.

Slow vaccine rollouts outside the U.S. and U.K. are negatively impacting U.S. exports and world tourism and may delay the recovery promised by today’s optimistic world GDP forecasts which appear to already be priced into world financial markets.

Treasury yields fell last week across the yield curve, reversing a recent surge. The trade deficit widened to a record $71.1 billion in February, as supply chain disruptions and a widespread blackout in Texas led to a decline in exports

Is the economy at a tipping point?

Fed officials and private forecasters think the U.S. economy is positioned for its fastest year of growth since the early 1980s. Economists surveyed by The WSJ in recent days said they expect economic output to expand 6.4% in 2021 and private-sector payrolls to rise by 7.06 million. In last night 60 Minutes interview, Fed Chair Powell said “We feel like we’re at a place where the economy’s about to start growing much more quickly and job creation coming much more quickly” But in another article from the WSJ another survey sees that 4.2 million Americans are not going back to work for fear of catching the virus, in addition for many of those getting paid to stay at home makes more sense as they continue to collect benefits from the government. The media can spin a story any which way it wants but if Americans don’t go back to work the economy wont hit those grow numbers projected by the Fed. Source: https://www.wsj.com/articles/powell-sees-economy-at-inflection-point-11618164495

New Borrowed Money

Is there a problem when Investors start borrowing huge sums of money to buy stocks?

When interest rates are low, especially as they are now, humans begin behaving a little foolishly. The “everything rally” that started in stocks last year has been boosted by investors betting heavily with money they have borrowed. From a finance perspective if price returns are expected to be X and the interest rate is Y is the spread is positive, it makes sense to borrow right? NO!!

Both small players like the day traders on Robinhood Markets Inc. and heavyweights like Archegos Capital Management, use leverage to increase returns. But when prices go in the opposite direction

We see the consequences of what bad behavior can do.

As of late February, investors had borrowed a record $814 billion against their portfolios, according to data from FINRA, Wall Street’s self-regulatory arm.

This was up 49% from one year earlier, the fastest annual increase since 2007, during the insane period before the 2008 financial crisis. Before that, the last time investor borrowings had grown so rapidly was during the dot-com bubble in 1999.

This doesn’t necessarily mean that investor borrowing has fueled the S&P 500’s epic 53% rally over the past 12 months, but it has contributed a lot to the upward movement. There are many other factors behind those gains, including the U.S. economy’s rebound and the Federal Reserve’s easy-money policies. But at some point, the balloon will lose air as a sell off is inevitable. Question is when? Source:https://www.wsj.com/articles/investors-big-and-small-are-driving-stock-gains-with-borrowed-money-11617799940?mod=hp_lead_pos4

Our Week Ahead

Earnings season has arrived, but a slew of critical economic data looms large. The largest financial institutions like J.P. Morgan, Goldman Sachs, and Bank of America will report later in the week, while investors will weigh the latest consumer inflation data on Tuesday and retail sales on Thursday.

Fed chair Powell has repeatedly stated the FOMC believes rising price pressures will only be transitory and the labor market still has significant slack, thereby they are nowhere close to removing support or changing their dovish stance.

This one CPI report is unlikely to change their view, especially considering the base effects, but if the reading is materially hotter than expected, bond vigilantes will likely press their positions to test the Fed’s tolerance for rising yields, specifically in the front-end. Demand for longer duration government paper will be gauged today and tomorrow in the 10-year and 30-year Treasury auctions. Keep an eye on the indirect bidder categories as this represents foreign buyers, often central banks. Thursday offers plenty of market-moving potential with U.S. retail sales, which are expected to rebound sharply, as well as weekly unemployment claims and Chinese growth data that evening. Lastly, Friday’s building permits and housing data will be closely watched for whether the recent weakness tied to rising yields continues to filter through the sector.