A Fund blows up, Marijuana, The Exhausted Majority & other Economic News

Week Ending April 2nd 2021

Weekly Recap

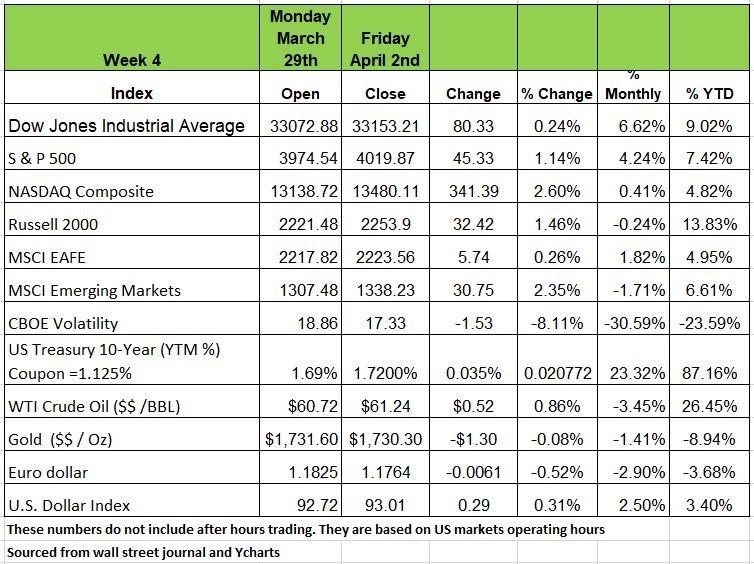

The big news of the week was always going to be the monthly BLS Employment Surveys. It was destined to move markets one way or the other, and since the +916K number from the Payroll Report (+1,072K if the +156K revision to February is included) significantly bested the 660K-675K consensus that was in the market, the equity markets are likely to move higher in the short-term, as is the longer end of the Treasury yield curve.

In addition, last week marked the end of the month and the first Qtr of 2021. With a shorten week due to the holiday, markets ended on Thursday. The NASDAQ had the highest return with 2.6%. Followed by the Russell 2000 with 1.46% and the Emerging markets increasing at 2.35%. Keep in mind these are price only returns. But the DOW and the S&P 500 had 6.62% and 4.24% returns for the month, while the Russell 2000 had the highest return of 13.83% for the QTR.

The big news last week was the blow up of Archegos Capital Mgmt. for playing a game with Viacom and Discovery that blew up, more on this story below.

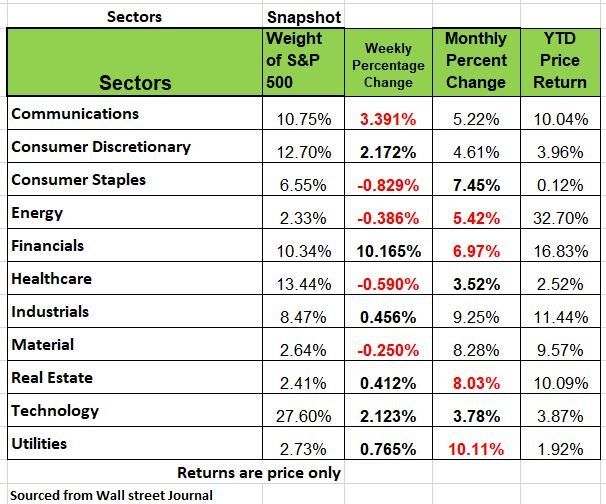

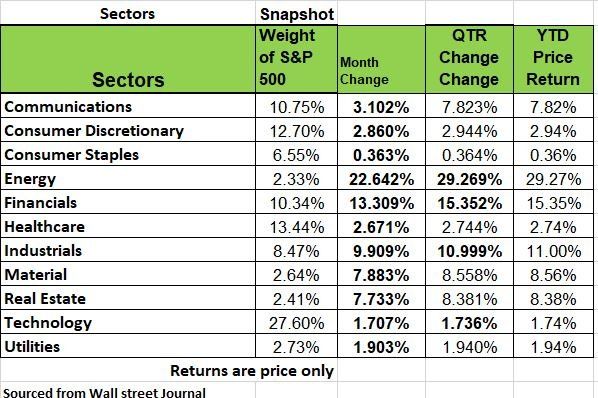

Last year technology and consumer Discretionary were the big winner but looking at the sector break downs this year. Energy and Financials are the leading sectors while Technology and Consumer Discretionary pull up the rear. See charts below

First Quarter Returns

Where to invest

The end of Q1 2021 is behind us and from a price returns perspective we can see the sectors that are leading the market in the chart below

The U.S. economy is strengthening thanks in large part to the trillions of dollars of stimulus brought to bear by the federal government. It has changed the dynamic in the stock market. Investor sentiment has shifted away from growth stocks in favor of value-style sectors that currently tend to be more cyclical in nature. As a result, the cyclicals have rallied significantly over the past two quarters, and the top-performing sectors have changed a bit

One of the most common questions we are asked on an ongoing basis is

Where to invest?

Sometimes the answer is more evident than at other times. You didn't need much of a crystal ball to tout Information Technology in 1998 and 1999 (top-performing S&P 500 sector both years by a wide margin), as was the case with Energy in 2004 & 2005, according to performance data from Bloomberg.

For the first time since 2005, a sector in the S&P 500 Index was able to repeat as the top-performer on a calendar year basis. Information Technology posted the highest total return in 2019 (+50.29%) and 2020 (43.89%), according to Bloomberg.

The top-performing sectors in Q1'21 were as follows (total returns) 30.84% (Energy), 15.90% (Financials) and 11.41% (Industrials).

The total return on the S&P 500 Index was 6.17%. So back to the first question on where to invest is to keep an eye on the sectors that are moving in any given year. Don’t over diversify and keep track of the leaders in each sector or know the best sector etf’s

Will Marijuana legalization mirror the end of Prohibition

On Tuesday March 30th New York legalized the use of marijuana for recreational purposes. This happened 9 years after both Colorado and Washington State became the first states to legalize marijuana.

On December 5, 1933, three states voted to repeal Prohibition, putting the ratification of the 21st Amendment into place. But did Prohibition really end on that day

The ratification of the 21st Amendment marked the end of federal laws to bar the manufacture, transportation, and sale of intoxicating liquors. The 21st Amendment returned the control of liquor laws back to the states, who could legally bar alcohol sales across an entire state, or let towns and counties decide to stay “wet” or “dry.”

One state Mississippi didn’t end its version of Prohibition until 1966. It decided to keep its Prohibition laws for another three decades. As of 2004, half of Mississippi’s counties were dry.

Today, only 17 states don’t allow any of their counties to be dry

It was never illegal to drink during Prohibition. The 18th Amendment and the Volstead Act, the legal measure that included the instructions for enforcing Prohibition, never barred the consumption of alcohol--just making it, selling it, and shipping it for mass production and consumption.

Today, America is still moving slowly to adopting laws on products that impact one’s cognitive abilities. While many people have opposing positions law makers know that legalizing it will bring a lot of revenue in the form of tax from the sale of such products. There will also be abuses, bad decisions while under the influence and unfortunately deaths. How this plays out only time will tell.

Has America lost its ability to be objective?

A lot has been written about America being so divided. Having a difference of opinion has left the space of intellectual conversation and entered the cancel zone. Over the last decade many friendships have been fractured because of disagreements over just about every political and social issue. Last week’s NY Times article the “Exhausted Majority” addressed the issue of a divided America. Based on research done at the University of Maryland. It seems that only 3.6% of the people in their poll fell into the extreme left or right category. The bell Curve had the rest of the other 92.8 % (the majority of Americans) right in the middle. We really are not so far apart in our beliefs.

So why do we feel so dividend? How has our society gone from having open stimulating conversation of learning and growing to just shutting down? We believe there are 3 main contributors to this behavior

First is the media, the news media (mainstream news) has framed information in such a way that we no longer have accuracy of information, 2) technology and social media has delivered information to us quickly and in context that is framed to trigger an emotional response. Its difficult to find out the truth without spending time to learn all of the facts of a particular issue. Lastly, we stopped reading. When we read, we digest information as we take it in and are focused, rather than watch the news while we are doing something else. There is usually an agenda at the hand and we rarely question or notice it. There is no other business that does not know what it will provide its customers on a day-to-day basis, so it needs to add sizzle and trigger your emotions. Source: https://www.nytimes.com/2021/03/24/opinion/Democrats-Republicans-left-right-center.html

The Blow up

As mentioned in the opening paragraph of this newsletter , Archegos Capital Management blew up last week mostly due to swap trades that fueled billions of dollars of losses at global investment banks.

Former regulators and financial-reform advocates say one rule change, in particular, could have prevented the debacle: requiring greater disclosures of the bets that investors such as Archegos place on companies using swaps.

What happened is that Archegos (a family investment vehicle of hedge-fund veteran Bill Hwang) established large, concentrated positions in Discovery and Viacom/CBS Inc., Chinese internet giant Baidu Inc. and other companies. It used a mix of shares and derivative contracts called total return swaps.

Such swaps allowed Archegos to put on huge trades with relatively small upfront payments, but exposed the firm to severe losses when the trades went bad.

Total return swaps are brokered by Wall Street banks like Goldman Sachs. They provide investors with exposure to the profits or losses of stocks or other assets, without the investor actually holding the underlying shares.

Archegos’s strategy backfired in recent weeks after Viacom/CBS and other stocks sold off. Mr. Hwang’s firm was unable to meet its obligations to its banking partners, which in turn liquidated large chunks of stock they had amassed to underpin the trades. Among the banks now facing steep losses are Credit Suisse Group AG and Nomura Holdings Inc.

Q1 Economic Activity

The manufacturing sector was firing on all cylinders in March, rising to a reading of 64.7, the highest mark for the ISM index since 1983.

All the major measures of activity moved higher in March, and growth was broad-based across industries, with seventeen of eighteen reporting growth (one showed no change).

Outlook remains overwhelmingly upbeat, with eight positive comments for every cautious comment. However, this includes increasingly tight supply chain, made worse by the winter storms that is still impacting the availability of raw materials.

These challenges are causing delays in supplier deliveries (the supplier deliveries index rose to 76.6 in March, the highest reading since the mid-1970s.)

While companies report that demand is healthy, the inability of supply to meet that demand is causing price pressures to build. Case in point, the prices paid index reading of 85.6 in March, where all eighteen industries reported increased prices for raw materials. In total, fifty-three commodities (particularly metals like steel) were reported up in price, while not one was reported lower.

Inflation looks likely to be a key topic in 2021, with the M2 money supply up an incredible 27.1% over the last twelve months, at the same time supply chains struggle to catch up to demand.

The two most forward-looking indices – new orders and production – moved even further into the 60s in March, signaling very healthy expansion given that the customers' inventories index stands at the lowest reading on record, while at the same time the backlog of orders index (which show orders rising faster than production can fill them) hit the highest reading on record, the data suggest activity should remain robust for the foreseeable future. We want to be clear that much of this is a result of the economy coming to a screeching halt last year by order of the government which has never happened before.

The employment index also moved higher in March, rising to 59.6, but held back from even faster growth by difficulties finding qualified workers. All-in-all, the first quarter of 2021 ranked among the strongest in decades, and looks set for a strong Q2 as we continue to get back toward "normal."

In other news this morning, construction spending decline 0.8% in February (-0.3% including revisions to prior months), narrowly beating the consensus expected -1.0%.

Nearly all categories of construction declined, led by slower spending on educational and health care facilities. In recent housing news, the Case-Shiller national home index increased 1.2% in January and is up 11.2% in the past year, the largest gain since 2006.

ADP employment report showed 517,000 private-sector jobs gained in March, falling short of the consensus expected 550,000. Meanwhile initial jobless claims rose 61,000 last week to 719,000. Continuing claims for regular benefits fell 46,000 to 3.794 million. We still have a large number of unemployed and this may take a while before we see if permanent job loss is a result of companies becoming more efficient and moving to automation.

DXY

Once in a while we get questions on the strength of the U.S. dollar and where we think it may be headed next. The dollar is still regarded as the world's primary reserve currency. Its relative strength over time can be influenced by such things as central bank monetary policy, geopolitics and trade as well as a country’s debt. We list the DXY on out weekly chart to give you an idea of the dollars strength.

U.S. investors with exposure to foreign securities, commodities and the stocks of U.S. multinational companies are particularly vulnerable to fluctuations in the U.S. dollar.

Predicting the direction of the dollar, or any currency, can be a daunting task, even for professionals who specialize in it. One thing we can provide is some context.

As of 3/26/21, the 10-, 20- and 30-year averages for the U.S. Dollar Index (DXY) carried readings from 89.75 to 91.25, which is a relatively tight range over a span of 30 years.

This includes the index peaking at a reading of 120.90 on 7/5/01, while hitting a period-low of 71.33 on 4/22/08, this information according to Bloomberg.

The U.S. Dollar Index has strengthened in recent weeks largely due to the relatively quick rise in the yield on the U.S. 10-year Treasury note (T-note), according to S&P Global Market Intelligence. The yield on the 10-year T-note rose 61 basis points from 1.07% on 1/29/21 to 1.68% on 3/26/21, a potential signal that investors are becoming more optimistic about the prospects for the economy.

U.S. government bond yields are still lofty relative to most developed nations and that is likely drawing capital from foreign investors looking for higher returns on safer securities, at least this is what we think is happening.

A little info

In March, the 385 dividend-payers in the S&P 500 Index (equal weight) posted a total return of 6.78% vs. 1.47% for 120 non-payers, according to S&P Dow Jones Indices.

There are currently 505 stocks in the index. Year-to-date, payers were up 12.03%, vs. a gain of 9.67% for the non-payers.

For the 12-month period ended March 2021, payers were up 66.64%, vs. a gain of 88.10% for the non-payers.

On a weighted basis, the S&P 500 Index was up 56.35% over that period. Year-to-date, dividend increases totaled 117, down from 125 over the same period a year ago.

One dividend was decreased over the first three months of 2021, down from two cuts over the same period a year ago.

Corporate Bond Basics

A corporate bond is a debt obligation issued by a corporation. Issuing bonds can be an alternative to offering equity ownership by issuing stock. Payments to bondholders have priority over payments to stockholders.

Why Investment Grade?

Within the bond market, there is a category of bonds considered “investment grade.”

Investment grade bonds are rated BBB/Baa or higher by major credit rating agencies.

The designation of a bond as investment grade is based upon an evaluation by a credit rating agency of the corporation’s credit history and ability to repay obligations. This rating of investment grade generally signifies that a credit rating agency considers the quality of a particular bond to be sufficient to provide reasonable assurance of the issuer’s ability to meet their obligations to bondholders. Much like your own credit report.

There is, however, no assurance that the securities selected for the trust will continue to receive an investment grade rating in the future or that such rating will ensure an issuer’s ability to satisfy its obligations to bondholders. Over time a company’s financial strength may change for various reasons

Investment grade bonds generally are a high credit quality asset class with historically low default rates. The average default rates for investment grade bonds have been significantly lower than for speculative grade bonds based on the most recent data available from Moody’s Investors Service. We bring this up so you are aware of any high yield fund must carry a large number of risky assets in order to meet the high yield requirement. Like an individual with a poor credit score much pay higher interest on loans the same goes for Corporate bonds.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/