Volatile Markets, Economic Obstacles ahead

& Other News for the Week Ending January 28th 2022

Volatile, that is the best way to describe the environment the markets are in and maybe be a condition we get use to for the rest of 2022. This doesn’t mean you should get out of the market just that a passive investing style is mostly likely not going to be good for your portfolio this year.

U.S. equities rallied late on in the week as investors agonized over the Fed’s policy, rising interest rates, and high inflation. While GDP number came in a lot higher than expected 6.9% in Q4.

2 of the 4 indices finished the week in positive territory with the Russell 2000 being the only one to have negative return of just under 1%. The NASDAQ finished the week flat. The price of crude (WTI) jumped 2.9% and gold dropped -1.75%

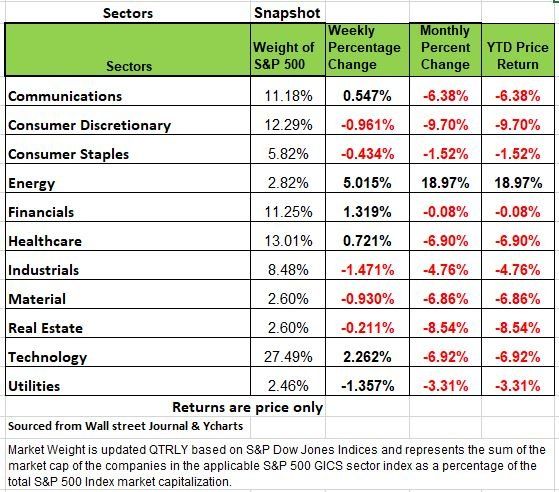

5 of 11 S&P500 sectors were higher with Energy, Technology and financials showing the strongest positive movement. However only Energy is up for the month with an 18.45% price return

Volatility (the VIX) jumped to the highest levels in a long time with a 60% increase this month

The Charts above and Below show month end numbers reflective of Market close on January 31st.

The yield curve flattened considerably after the FOMC signaled intentions to begin hiking interest rates in March while offering less clarity on shrinking its enormous balance sheet. The yield on 2-year Treasuries soared 17bps to 1.18%, while the 10-year note inched up to 1.77%.

Inflation data underscored the Fed’s impetus to raise rates, as the U.S. Core PCE (Personal Consumption Expenditure) Price Index increased 4.9% in 2021, the highest annual level since 1982. This again was on the heels of the strongest annualized GDP pace since 1984, as the Q4 2021 reading of 6.9%. However much of this was due to increased orders to stock up on supply so we do not believe this pace will continue and in fact may recede significantly as demand starts to wane

January Flash PMIs slipped more than forecasts, with the composite index falling from 57.0 to 50.8. Consumer confidence also receded slightly even as consumers planned to buy more big-ticket items, and the revised UoM consumer sentiment survey fell throughout January, posting a cumulative drop of 4.8%,

Durable goods declined 0.9% in December, while the U.S. trade deficit exceeded $1T in 2021 for the first time ever. Homebuyers faced worsening inventory challenges as pending home sales fell 3.8% in December.

Internationally, the IMF downgraded its 2022 global growth forecast to 4.4% from 5.9% in 2021, citing reductions in the two largest economies, the U.S. and China. Europe’s biggest economy showed positive signs, as German PMIs grew better than expected in December and the if Business Climate Index rose to 95.7 from 94.8, both boosted by manufacturing gains. Australia’s core consumer prices advanced 2.6% in Q4 2021, sending bond yields higher and raising rate hike expectations ahead of next week’s RBA meeting. Finally, the Bank of Canada surprised some by not hiking rates but may start the process in March

Economic Growth??

“U.S. Economy Grows as Fourth-Quarter GDP Shows Strongest Year in Decades” This was the headline on Thursday’s (Jan 27,2022) Wall Street Journal. Yes, it is an accurate number and it is adjusted for inflation but the numbers are a bit misleading. 71% of the growth or 4.9% of the 6.9% growth number came from excess inventory accumulation, this as fear of prolonged supply shortages leaves business owners in fear of getting product over ordering.

This is very much like last November & October when the shortage narrative pulled demand forward with shoppers purchasing Christmas gifts so far in advance that December retail sales were negative-1.9%. This is not a healthy sign. As a result, both wholesale and retail inventories skyrocketed as 2021 came to a close.

Some of these inventory spikes may be desired, as manufacturers and retailers move away from the “just-in-time” inventory model, as it failed dramatically during the pandemic. So, at least for a while, higher desired inventory levels may be in place for some retailers

However, we feel that it is highly probable that a significant portion of the inventory spike is unwarranted, and we expect Q1/22 to show inventory drawdowns. Watch for companies dumping products not moving off the shelves. We believe this will result in a negative Q1 GDP growth report. But as always predicting consumer behavior is the challenge. Source: https://www.wsj.com/articles/us-economy-bounced-back-q4-gdp-11643235508?mod=hp_lead_pos1

The Cloudy Forecast

We have discussed the inevitable slowdown occurring in the economy several times over the last few months. Our expectation is that the January payroll report will be very weak, and some economic forecasters are now calling for a significant decline in the Payroll Survey (maybe -200K!) when January data is released (on February 4).

In the senate committee meeting last week, Jerome Powell characterized the labor market as “very very strong.” We do not agree. If only look at it from the demand side (unfilled jobs and the official unemployment rate), this may seem like valid information. However, the economy is still 2.3 million jobs short of where it was pre-pandemic, and now we have a 9% absenteeism rate among those who are employed. The 2.3 million are not counted in the unemployment rate these are mostly women (mothers) at home that have left the workforce. So, our point is how can consumption continue to pre pandemic levels if households have reduced income.

In addition, most of those who are absent from work do get paid, only about 20% do not. Business owners are telling employees to stay home if they feel the slightest bit under the weather. This could put a small crimp in Q1 retail sales! It is clear to anyone paying attention to the data that Q1 GDP growth will be lucky to avoid a negative sign. For example, since Thanksgiving, there has been a dramatic fall in restaurant patronage. The strong correlation between workers and diners foretells of a dive in the food and beverage employment data.

The Recent “volatility” in the financial markets has occurred because the future has become even more difficult to view, more so than it was in 2021, at least then the U.S. government had many Americans on the tax payer’s payroll. Will the economy strengthen in Q2? It depends on the path of the pandemic! The media and everyone’s behavior

We know that there will be more variants but will they be dangerous? The media has the ability to scare everyone and point the finger at someone else. In 2001 everyone was afraid to go into a high rise building in fear it would be blown up. We soon got over those fears and continued with our lives, but this time the media is taking advantage of the sizzle and the fear is lingering on a lot longer.

The Fed, on the other hand, appears to think that “normalcy” will return in Q2. While they could be correct, we think this is a low probability event. The path to “normal,” we think, will be slow and rocky. The spike in absenteeism, the slow return for many to the labor force, will not happen overnight. We have adopted new behaviors and those behaviors are not going to change immediately, and they are averse to a healthy economy. So, until people burn through their savings or some other event occurs, we see a bit of an uphill climb

Other Economic Obstacles

We have been writing about this for a while. One of the biggest issues for the equity markets include the record high valuation metrics, especially in the face of such growing uncertainty. From the March 2020 market lows to the recent record highs, 75% of the run-up in the S&P 500 has been the expansion of the Price/Earnings (P/E) multiple. Only 25% of the rise in the index levels can be attributed to rising corporate profits.

One can argue that record low interest rates have been responsible for the P/E expansion. That is, the future cash flows are being discounted with lower rates which makes those cash flows more valuable. But, now that rates are rising, those P/E ratios should be contracting. That means lower valuations and lower priced securities

But, perhaps, the biggest impact the Fed has on markets has to do with market liquidity. The Fed reduces the amount of liquidity in the market when it starts reducing the size of its balance sheet, which Powell has now said is under consideration. To do this, the Fed sells its balance sheet assets into the market and takes the resulting funds it gets out of circulation. (Financial institutions are buying as opposed to selling to the Fed which increases their cash) Markets always contract when liquidity is withdrawn.

Then we have the geopolitical issues. The most imminent one is the threat of a Russian incursion into the Ukraine – markets always react poorly when such military type events occur. Furthermore, lurking in the background is China’s ultimate intention regarding Taiwan.

The Fed’s artificial suppression of interest rates for more than 12 years has also created a behavior expectation. Companies are used to cheap money and taking more risk, with 20% of the S&P 500 considered zombie companies (not having enough money to pay principle), higher interest rates will put added pressure on them. Source Bob Barone PhD Economist.

Pay Attention to your portfolio

As the stock market begins sliding it is sending a wake-up call to older Americans that maybe they shouldn’t invest like they used to. However, many are unlikely to pay attention to that warning. If they do expect a lot of problems

We have had a long bull market that surprisingly rose and rose through the pandemic, plus more than a decade of low yields for bonds, from the fed artificially suppressing interest rates, many older Americans have a lot of money in the equity side of the market. Data from Fidelity Investments’ 20.4 million 401(k) investors shows that almost 40% of 401(k) investors age 60 to 69 hold about 67% or more of their portfolios in stocks. Among retail clients at Vanguard Group between ages 65 and 74, 17% have 98% or more of their portfolios in stocks. Typically, when you are older you want a more conservative portfolio, less risk, but with as much volatility in the fixed income market with lower returns many ignored the more traditional allocation model and moved all in to equities. In addition, those who have used index funds with lower fees and self-manage their portfolios may begin to feel the pain of a correction most.

Using Index funds may have been rewarding over the last decade but that does not mean it will continue to satisfy you moving forward. Its your money and hence your responsibility to know where it is invested. We have discussed in previous newsletters the concerned of market cap weighted index funds. They are great in an up market but can be more devastating in down markets, If you don’t have the experience to understand the potential economic forecast find someone that does. Of course, this only pertains to those that care about their money. Source:https://www.wsj.com/articles/older-investors-have-a-lot-of-money-in-stocks-how-to-check-if-its-too-much-11643215304

Municipalities are heading into troubled Waters

Burned out, we have all experienced it at one point or another in our lives. In fact, many of us are burnt out from the pandemic and all of the negative and political crap associated with it. But if you think this will end, smoothly think again.

First seasoned Police officers started retiring earlier than expected leaving fewer qualified officers to train younger officers. Then we started seeing younger officers with 5 years or less years on the force quit. The push to defund the police and the added stress of being hassled by the public and the media in the wake of the George Floyd incident have left many municipalities shorthanded. So much so, that the response time to an emergency is “no response”

We have made being a Police Officer the least desirable job in America and now with crime on the rise

Many people are taking to arming themselves, especially since many larger cities are not prosecuting criminals that they do catch.

A survey of nearly 200 police departments last year by the Police Executive Research Forum, a Washington, D.C., think tank, found that the resignation rate per 100 officers was up 18% between April 2020 and March 2021 compared with the prior-year period, while the rate of retirements rose 45%. https://www.wsj.com/articles/police-departments-are-losing-officers-and-struggling-to-replace-them-11643288401?mod=Searchresults_pos1&page=1

But it doesn’t stop with Police Officers, teachers are now leaving the classroom for jobs in the private sector, where talent-hungry companies are hiring them—and often boosting their pay—to work in sales, software, healthcare and training, among other fields.

The rate of people quitting jobs in education rose more than in any other industry in 2021, according to federal data. Many of those are teachers exhausted from toggling between online and classroom teaching, shifting Covid-19 protocols and dealing with challenging students, parents and administrators. Teachers started leaving classrooms in 2020 when the pandemic upended education and child care, and the number of educators who quit accelerated last year, with nearly 550,000 people resigning from their school jobs between January and November. According to LinkedIn, the share of teachers on the site who left for a new career increased by 62% last year. These are large numbers; they are not something to ignore and there will be both short- and long-term economic consequences. Parents may be forced to home school, so retuning to the workforce may not be an option, in addition the long-term impact is having a population ill prepared for college or even a trade. https://www.wsj.com/articles/teachers-are-quitting-and-companies-are-hot-to-hire-them-11643634181?mod=hp_lead_pos5

The Week Ahead

Investors may be looking for some relief after a bumpy January, but another busy week of data awaits. Three central bank meetings are on the calendar along with the monthly U.S. jobs report. The Bank of England is expected to raise rates for the second time to 0.5%, which may trigger a start to shrinking the balance sheet. The ECB is not anticipated to make any new policy changes with economic growth and wage inflation lagging the U.S. Now that the market is pricing in at least 4 rate hikes and the dollar has had its not-surprising reaction (see chart below), Friday’s U.S. NFP report could give the greenback further momentum. The wages component could produce additional volatility given investors’ hypersensitivity to inflationary data. The JOLTS job openings and ADP private payrolls add color to the labor market conversation. This week also brings U.S. manufacturing and services PMIs along with Chicago PMI. A handful of key Q4 earnings announcements remain, notably Amazon, Advanced Micro Devices, and General Motors. Internationally, OPEC meets mid-week and is expected to stay with gradual production buildups, likely supportive for oil’s current uptrend

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/