Economic News

Week Ending January 29th 2021

Double bubble Toil & Trouble

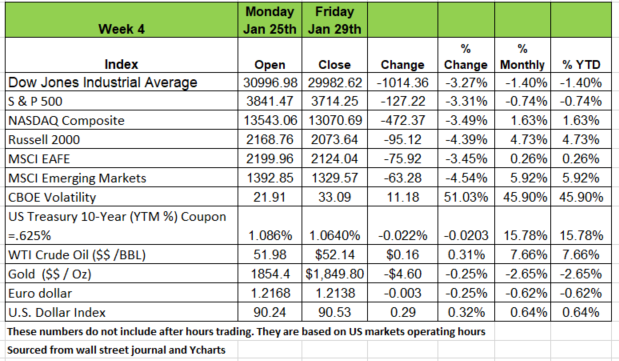

The first month of 2021 ended on a wild note. Last week all of the market indices were in the red with the Russell 2000 down the most at -4.39% and the other 3 down -3+% for the week. All 11 sectors were in the red as well. Last week also marked the end of the first month of the year. The Russell 2000 and the NASDAQ were the only 2 indexes with positive returns for the month and Energy was the big sector winner with a price return of 3.63%

Most of the news last week was the rise of GameStop (GME) and a few other struggling stocks that were targeted by a group of individual investors on platforms such as Robin-Hood that collectively banded together to drive the price of the stock up over 1600%. This was done as a retaliation to hedge funds that had short positions on the company.

Short-sellers sell shares of companies they don't own, (they borrow at a cost) with a promise to buy the shares later so they can complete the transaction. In general, if the price of the stock goes down after they short it then they make money; if it goes up, they lose money. Sometimes shorting can overwhelm a security and send its price well below fair value.

At that point, investors who short a security become vulnerable. Remember, being short a stock means there will be future demand, so when buyers push up a stock price it can set off a stampede sending the price even higher. Shorts rush to unwind their positions while other investors, knowing the shorts are vulnerable, rush to bid the stock price up even higher, because the short position has sold at a lower price and now has to buy at a higher price.

The behavior demonstrated last week was loaded with malice and that is dangerous.

The elephant in the room is whether or not these short squeezes, partially driven by weaponized gamma, will continue. If they do, it seems likely it will be to the detriment of large-cap technology, the darlings of the hedge fund industry. There’s an old saying: “never let a good crisis go to waste”.

Management of these targeted companies have a unique opportunity to greatly improve their company’s financial condition with little impact on debt loads: issue shares to raise funds. Don’t be surprised if you see more than a few of these announcements.

Does the 4% rule work?

Back in 1994, a #financialadvisor named Bill Bengen, came up with the 4% rule for #retirement spending. Basically, the rule states that if you want to make sure your #retirementsavings last as long as you do, you should budget to spend no more than 4% of the balance in the first year, then adjust the withdrawal amount each year in line with inflation.

In order for this to work, there are multiple variables that can impact the model.

1St your liabilities, the rule assumes you will have $0

2nd that your spending habits are linear

3rd that stocks will average 10.3 % growth per year & Bonds 5.2% (Historical averages)

Interest rates are much lower now than ever before & having a portfolio that is mostly in Fixed Income will generate much lower returns

We believe that once you enter #retirement you should consolidate your #portfolios, move it away from any #401K vehicle, into an #individual-IRA, so that you can turn off your dividend reinvestment function. At #retirement, your portfolio should be generating income for you in the form of interest payment & dividends. So regardless of the value of the portfolio the income portion is at least consistent & reduces liquidation of holdings.

When examining other asset allocations, its important to keep in mind that interest rates have been at all-time lows for the last decade. While typically considered a conservative investment when this study was conducted the average yield on fixed income was over 5%. Since this type of return is difficult to find in the bond market, you should consider a mix that is closer to 50/50 or 60/40

Another important component in order for this theory to work is based on the time of your retirement and the Sequence of Returns Risk

For the purposes of the 4% rule, sequence of returns risk is the possibility that adverse market returns in the early years of retirement could deplete a portfolio well before 30 years pass. Alternatively, sequence of returns can substantially increase a portfolio value if one happens to retire at the start of a bull market, leaving a retiree who follows the rule with a sizable balance even after 30 years.

The main challenge for retirees, whichever strategy they choose, is that you can’t predict the future performance of markets. A person retiring in January 2008 would have no idea that a massive stock market crash ushering in Great recession was just several months away. Likewise, a person retiring in January 2009 wouldn’t know that the market hit bottom, and lead to one of the longest bull markets in history. It is also not just the year that matters but the time of year they make their withdrawals. Early in 2018 as well as the end of 2018 had extreme lows, 2020 had similar extremes.

When investors forget Fundamentals, the market is broken

Sometimes it’s hard to argue that market capitalism has any chance of correctly allocating money to the companies that can use it best. Case in point: #Stock-market performance this year has been driven by the raw share price, with lower-priced #stocks doing better and higher-priced worse.

Forget a careful evaluation of future cash flow, valuation, brand power, management skill or even political sensitivity. The best explanation for how stocks performed so far this year is the price of the stock, an almost meaningless number.

#Stocks priced below $1 have performed the best, followed by those between $1 and $2, and so on up almost perfectly. The worst performers have share prices above $100. It looks remarkably like investors are treating a low-price share as an indicator that the stock is a bargain, and a higher price as a sign that it is worse value for money.

The share price on its own carries virtually no useful information: It depends entirely on how many shares the company has issued. A company can split a high-priced stock to create more at a lower price, without making any difference to the intrinsic worth of the company. Equally, it can consolidate its shares to reduce the number, increasing the share price but again without any effect on how much the company should be worth. Source :https://www.wsj.com/articles/when-investors-forget-fundamentals-the-market-is-broken-11611055800?mod=searchresults_pos6&page=1

Economy Stumbles

The final numbers for GDP in Q4 came in last week and were lower than what was hoped for While economic growth was still positive 4% for Q4. It is still based on lower base number. Total GDP for 2020 was -3.5% lower from 2019. Even with a new surge in the virus and a mutation more areas of the country have begun to open up. Chicago lifted its restrictions to allowing restaurants to operate at 25% capacity and health clubs to conduct reduced exercise classes. Chicago Public Schools battle with the teachers Union to get kids back in the classroom. The Fed has said that it will hold rates at near zero in hopes of stimulating the economy. However, consumer habits have changed and will take some time before they re-adopt new consumer spending habits. It won’t happen overnight as some hope until employment is really addressed. Currently the unemployment number is just over 11% based on 18 MM people unemployed on a work force of about 165MM. Source: https://www.wsj.com/articles/fed-federal-reserve-fomc-rate-policy-meeting-january-2021-11611702870

Other Economic info

Recent NY Fed data indicate that 71% of “Stimulus Money” is expected to go into debt repayment (credit card balances are down 10% Y/Y) or other forms of saving (including playing in the stock market).

Recent data also shows that average wages are rising while the median measure is falling. This has occurred because job losses are concentrated in the ranks of the lower wage earners, thus raising the average. Of course, when this occurs, income inequality widens. Also realize that it is the lower wage earners who consume their entire paychecks, while upper wage earners save some. This fact plays poorly in the pent-up demand narrative.

There are a few bright spots. One is manufacturing (<15% of GDP). Core cap-ex orders (non-defense capital goods ex aircraft) were up 0.6% in December after rising 1.0% in November. Expenditures on tech equipment rose a very significant 10.5% Y/Y in December.

Treasury yields were little changed last week despite several economic developments. The U.S. economy continued its rebound in the second half of last year, with real GDP growing at a 4% annualized rate in the fourth quarter after growing at a 33.4% rate in the third quarter. Despite rebounding in the second half, the U.S. economy contracted 3.5% in 2020, which is the largest annual decline on record dating back to 1948.

The Fed left rates unchanged last week, as expected, keeping monetary policy loose in an effort to boost the economy. Fed Chairman Jerome Powell cited a moderating recovery in recent months and said, “The pandemic still provides considerable downside risks to the economy.”

Household income grew well above expectations in December, reflecting increases in government stimulus, compensation, and dividend income. Consumer spending fell in December for the second straight month, which combined with higher household income boosted the personal saving rate to 13.7% in December, well above pre-pandemic levels.

Crude oil closed at $52.20 per barrel on Friday, declining 13 bps for the week. All sectors were down for the week with energy putting in the worst performance.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/