The Inflation narrative, Labor Market & Other Economic News for the

Week Ending May 14th 2021

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue.

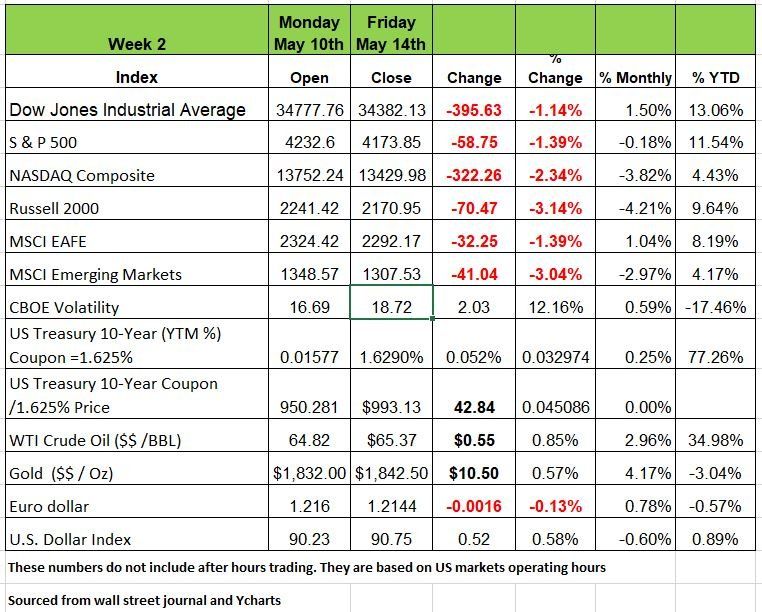

If ever there was a week that disproved the Efficient Market hypothesis, last week was the week. The markets started the week at 34,785.27 (DOW) and dropped to a low of 33,555.21 or -3.54% before settling the week at 34,382.13 or -1.14% for the week. The reason for the drop was the April CPI YOY inflation rate came in at 4.2% the highest in 13 years but that number again is based on last year prices when the economy was still in shock from the pandemic and shut downs. The narrative about inflation has been circulating since last November and we all new we would have spikes in prices, however the probability of inflation staying at this rate for the long term is low unless of course the U.S government continues to subsidized Americans with unearned income to stay out of work. Then we will see how high wages will have to go to attract the much-needed help companies are seeking.

All of the indices rebounded but still ending the week down with the Russell 2000 dropping the most at 3.14% and the NASDAQ at -2.34% The coupon on the 10 yr Treasury at Auction went from 1.125% to 1.625% stemming from downward pressure on yields. We will see how the markets react the rest of the week as the inflation narrative continues.

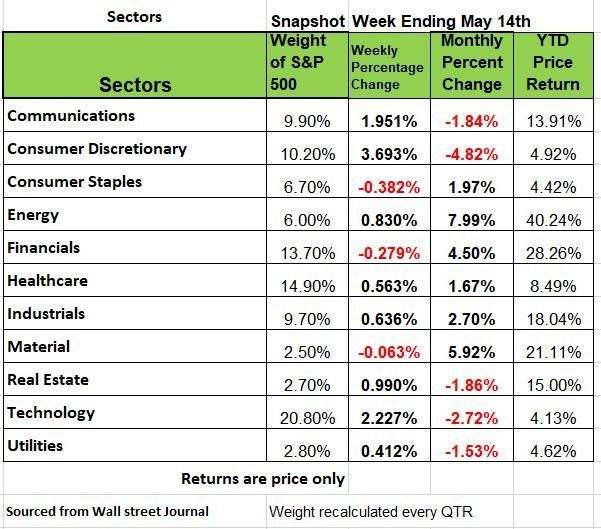

3 of the 11 sectors were down last week with the Financial sector leading the pack, however in the 2nd week of the month we see that 5 of the 11 are down with consumer discretionary leading the way. But keep in mind for the year all 11 sectors are in the black and have relatively healthy price returns

Inflation up strongly, Why??

As we started this newsletter off, the Producer Price Index (PPI) for final demand increased 0.6% in April, double the consensus of 0.3%. Food prices rose 2.1%, while energy prices fell 2.4%. Excluding these two components, core PPI for final demand increased 0.7%, also above the anticipated number of 0.4%.

About 2/3 of the increase in the headline PPI was attributed to a 0.6% gain in services, led by portfolio management fees, airline passenger services, food retailing and other trade margins, as well as higher transportation and warehousing costs.

Goods PPI also rose 0.6%, but that was the smallest gain in five months. A major contributor to the goods PPI advance was an 18.4% jump in steel mill product prices. On a y/y basis, final demand PPI surged 6.2%,

While PPI ex-food and energy climbed 4.2%. Both were the most since data started in 2010, reflecting a base effect from the price collapse last spring, stronger demand as the economy reopens, rising commodity prices, and persistent shortages amid ongoing supply chain challenges.

Intermediate prices are also rising at record y/y rates, implying pipeline pressures across the production flow. The final demand personal consumption PPI, which correlates strongly with the CPI, surged a record 5.8% y/y. But remember when supply is down demand is up prices increase. Those thinking that staying at home collecting money from Uncle Same is a good thing is just contributing to the problem. We can produce a lot quicker if we all just get back to work, in short we don’t think these number are systemic, unless we continue to pay people to stay at home.

The Labor Market

As we have been stating for months the key to a real recovery will be with people returning to work. Jobless claims continue to decline, Initial claims (IC) for unemployment insurance dropped 34,000 last week to 473,000, the lowest level since the start of the pandemic, and below the consensus of 514,000. In the special Pandemic Unemployment Assistance (PUA) programs, there was a slight uptick in ICs from 102K to 104K.

But the JOLTS report earlier this week showed job openings jumped 7.9% in March to a record 8.1 million, raising calls that generous unemployment benefits are dis-incentivizing people from looking for work. There is some validity to this argument, which is true for any government transfer program. Unemployment benefits likely raise the reservation wage for some workers. In a perfect world, the 8.1 million job openings would be filled right away. But in reality, there are always mismatches related to skills, industry, location and unfortunately fraud. When we look at the IC numbers, the JOLTS data, the numbers just dont add up. Our system is vulnerable, many states are not validating the claims and hence the taxpayers are footing the bill for this abuse

Additionally, with schools not yet fully open, many people cannot look for work due to child care and health care reasons. Nevertheless, a number of states have announced an early end of federal unemployment benefits, before the scheduled end in September 2020.

Consumer comfort is up. The Langer Consumer Comfort Index edged up 0.2 points last week to 54.6, led by a more positive assessment of personal finances. Although still below its pre-recession peak, the index is now near its best level since April 2020. Improving consumer attitudes bode well for the outlook for consumer spending.

Credit is easier to get

When the pandemic hit, banks reacted by tightening credit limits and requirements. But now that the worst of this pandemic seems to be behind us, many banks are loosening the purse strings for consumer borrowers. Is this a good thing? Now those people with poor credit history in need to credit cards, auto loans and other personal loans are all getting easier to come by. Banks make the majority of their income on loans, and with many businesses shuttered, short term lines of credit has been reduced and banks need to lend. Most responsible paid down their loans during the pandemic, credit scores have increased, but the need to spend has not quite hit the habit level it was pre pandemic.

The Federal Reserve conducted a survey of loan officers, it appears that majority of banks loosened underwriting requirement for credit cards and hit a high for new approvals in Q1. The net share of banks relaxing underwriting on other consumer loans such as installment loans also notched a record. For auto loans, that share was the highest level in more than eight years. However, what was not disclosed is the rate on these loans.

Typically, those with a poor credit history must pay a higher interest rate which often makes borrowing money a challenge. Credit cards with high interest can often be misleading to the average individual with little financial background, interest is calculated on the balance so in terms you are paying interest on the interest each month.

But then the government stepped in with expanded unemployment benefits and stimulus checks, and the expected flood of defaults never happened. Now banks have a different problem: Loan demand is down. Many people are even paying off their credit-card balances. And while that signals that Americans are faring well even in the pandemic, it is problematic for lenders looking to boost revenue. Source

The IRS Is Coming for Crypto Investors Who Haven’t Paid Their Taxes

The original concept behind Bitcoin was to create a currency that governments could not trace or tax. But that only works if every transaction you make is with cryto. Going back and forth between the two worlds will lead to a world or trouble, and for some trouble may be knocking on your door

With the explosion of Cryptocurrencies the Internal Revenue Service is in pursuit of Americans who aren’t paying taxes on them. With Tax Day approaching, it’s a good time to clean up your act if you’ve been lax about taxes on crypto. Not doing so could compound future tax problems, especially if you have traded a lot, have more than a small stake or worse made large purchases with them.

Two new IRS efforts to find crypto tax cheats stand out:

In April, a federal judge in Boston approved an IRS summons to the payments company known as Circle and its affiliates, including Poloniex, to turn over customer records to the agency.

In early May, a federal judge in San Francisco approved another IRS summons for records to the crypto exchange known as Kraken. In both cases, the turnover applies to customers who had more than $20,000 in transactions in any year from 2016 through 2020.

Buying a Home? Don’t Lose Your Head in a Crazy Market.

Buying a home is a big decision, and number of factors come into play one being emotions. Such as how much do you want the house. In this particular market with a shortage of inventory many people are willing to pay more for a home than what the seller is asking. Just because you can make the mortgage payments on a loan does not necessarily mean you can afford the house. All too often people will stretch themselves financially to buy something they “need”. In March, there was 28.2% less housing inventory versus a year earlier, according to the National Association of Realtors. At the same time, super low mortgage rates and a desire to get out of high rise living spaces are spurring more demand for homes, sparking bidding wars that send prices higher. However, this is not going to last forever and when business realize that they need employees to come together at a central location “the office” many of these new home owners will have to deal with a commute that may/will take them away from their families.

A general rule of thumb is to spend only between a quarter or a third of your monthly gross income on your mortgage payment, and between 35% to 45% of your monthly gross income if you include maintenance, taxes and insurance.

“There’s this idea from a balanced investment perspective, you don’t want to be house rich and cash poor, so that you can’t afford anything else, including retirement. In addition, if we experience the same real estate devaluation as we did in 2008, you won’t even be house rich. Source https://www.wsj.com/articles/buying-a-home-dont-lose-your-head-in-a-crazy-market-11620984601

On Average a million evictions take place in America in a normal year

Evicting a person from their home is no easy or joyful task, let alone when you have to do it to a family and children are involved. The process can take a long time, giving notice to the tenant, filing legal documents with the courts then getting the sheriff to evict. The process can take anywhere from a few weeks to months depending on where the property is located and the backlog on the sheriff’s department.

Before covid-19, evictions were a hot topic, thanks to the publication of “Evicted”, a rare wonk-bestseller by Matthew Desmond of Princeton University. The book follows eight families turfed out of their homes in Milwaukee, their possessions unceremoniously dumped on the pavement.

Desmond estimates that there are approximately 1MM evictions a year in America, seems like a small number until you consider the number of people affected (about 2.3MM adults and children) or .66% of the population.

When covid hit, an experiment took place. The Trump administration issued an order pausing evictions, the policy continued by order of the CDC & Biden. On May 5th a judge struck down the federal moratorium, apparently ending the experiment. What were the results?

In this particular study the focus was on the number of cases of COVID that increased in states compared to the states that kept the moratorium. Yes, those states that allowed evictions had a rise in cases. Unfortunately, the study left out the information about landlords, most being small business/property owners, being force to sell off properties to meet their financial obligations and in most cases at a loss.

When tenants received funds from the government and used that income for reasons other than rent. the problems begin. A large part of our population either don’t understand or worse don’t care about financial obligation. The challenges in situations like these is the balance of compassion and consequence for irresponsibility.

It is wrong to make a generalization about any group and when reading a narrative, framed to show one point of view only, we need to keep, something in mind, that there is usually a lot more to a story/study. Source the economist

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/