Inflation Narrative & other Economic News

Week Ending February 19th 2021

Interest Rates

Rates have continued to spike upward on the Treasury yield curve (not so much in the corporate world, though they will undoubtedly follow if Treasury rates remain elevated).

Perhaps one of the reasons is the market’s view of the economy will soon boom and inflation will balloon.

But inflation is a process, not a single event. The economy has a long way to go before the demand side consistently outpaces supply; that’s what really causes inflation.

Now consider how far away we are from that with the following situation:

· 3.4 million home-owners delinquents on their mortgages;

· 10 million renters many months behind on their rent;

· 20% of the S&P 500 companies showing “zombie” characteristic, unable to pay debt service (principal) at current interest rates out of cash flow

Surely, there will be a spike in prices, in segments of the economy and we are currently observing that in the commodity space where transportation, not production, is the issue with 18+ million un- or under-employed, and 7+ million labor force dropouts;

The underlying assumption here is that people will return to their pre-pandemic spending patterns.

No doubt restaurants, hotels, airlines and theme parks will rebound somewhat toward pre-pandemic sales. But, given the unused capacity that currently exists in these industries, supply won’t become inadequate and hence prices will not rise significantly.

In addition, survey after survey suggests that savings (precautionary) will rise, just as it did after the Great Recession of 2008. Consumption will not return to its pre-pandemic levels quickly, nevertheless, that’s what underlies the rise in Treasury rates.

Bank Loans = Confidence

One of the indicators of a good or recovering economy is bank lending, it is a barometer of the economy’s health. The Y/Y growth of bank loans and leases by month beginning in January 2019, were growing at a 4%-6% rate pre-pandemic.

When the pandemic hit and politicians forced business closures, a significant portion of companies with lines of credit (LOC) drew those lines down and put the cash on their balance sheets for fear that the banks would rescind those lines.

There was spike in March/April of 2020.

However, since then, lending growth has deteriorated. No doubt, when we get March, 2021 data, it will show significant negative Y/Y results.

The deterioration of bank lending goes hand in hand with business’ outlook. If business owners do not feel confident that the economy will grow, they will not borrow.

We look at the National Federation of Independent Business’ (NFIB) Optimism Index for some direction. The 11-year period beginning in 2010 the index was 87.5 it spiked in 2016 to 105 in 2019 it climbed to 107.5, the highest level of confidence in years. When the pandemic hit it dropped to 91, then jumped to 102.5 by year end. It has since receded back to 95. Consumers and business owners will spend when they feel confident in the economy.

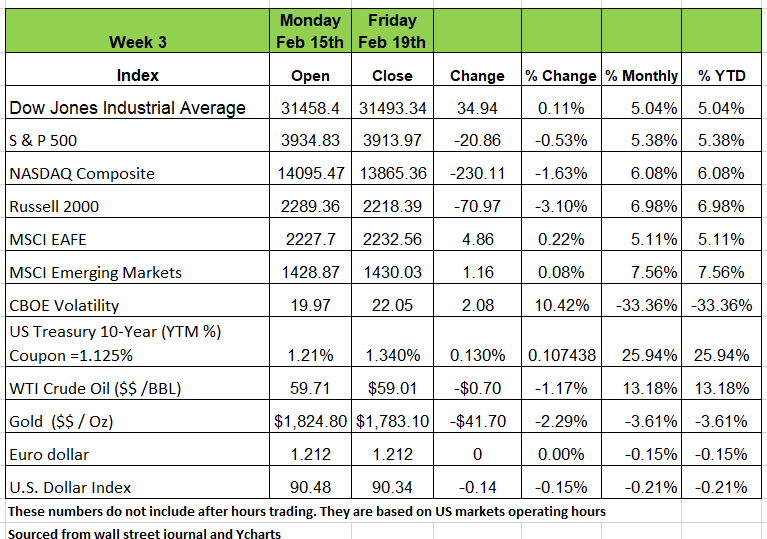

Week in Review

Retail sales rose 5.3% month over month in January after being in a downward trend for 3 months straight. It appears that the government checks for $600 contributed to the movement. The Atlanta Fed projects that their GDP model will put the first Qtr growth at 9.5% (annual rate) Industrial production was up close to 1% in January. Infection and hospital rates for COVID are dropping and it appears maybe we will reach herd immunity faster than expected.

But the markets did not respond to the good news, 7 of the 11 sectors were down for the week with technology and healthcare having the largest decline. Of the four major indices only, the Dow had a positive return with a .11% increase over the previous week. So maybe the markets are not impressed with the economic activity since much of it may be attributed to government payments to the public instead of a strong underlying economy.

Herding and the Stock Market

There is a behavioral term known as “Herding” It is a cognitive error that that leads human beings to be greatly influenced by the behavior of a group. It is often used as a tactic to manipulate people to commit to an idea or movement. If you’ve ever seen people at a Tony Robbins seminar or a political rally cheering & getting all excited you know what I mean. Very often there a people planted in an audience to start the wanted response.

It happens in the markets too, especially when we see steep rapid changes in one direction. We spoke about Game-stop and the other movements started by Reddit messages. But sometimes it’s not planned.

Back on Jan 6th Signal Advance (a medical device company) was selling for 56 cents/share on January 11 it was $70.85. But those that dove in and bought the stock did so on the wrong company.

Following a tweet from Elon Musk “use signal” caused the frenzy. But Musk was referring to an App to use for text messages that offered users privacy from big Tech giants. Not the medical device company.

Back to “Herding” Why does it happen?

Because humans think that the masses may know something they don’t. It seems safer to follow the crowd, but it’s not. All too often we respond to a trend that is nothing more than speculation and the knee jerk reaction to jump on board too quickly may be extremely costly. Take the time to investigate before you buy or sell something.

Labor Markets

As we have mentioned numerous times the most important measure of the economy’s health is the health of its labor market. If people do not work the economic engine will eventually cease. And, here, we continue to be disappointed. Since the CARES Act, we have 2 measures of employment. The first is unemployment claims and the second is the PUA. Pandemic unemployment Assistance.

PUA provides benefits to people not eligible for regular unemployment programs, such as the self-employed and gig workers

Combined claims from regular state and PUA programs—not adjusted for normal seasonal fluctuations in the data—have consistently registered above 1 million per week.

Applications for unemployment benefits rose during the first half of February, changing a downward trend that had pointed to an improving labor market Claims increased to 861,000 last up by 55K from the prior week.

However, there are segments of the economy that are booming and producing a lot of jobs. They are mostly for Blue collar workers. Housing construction is in boom environment as demand for single family homes continues to rise, so do the jobs to help build those homes, as are transportation, e-commerce and many manufacturing jobs. So why are there such high unemployment numbers, because it seems that the majority of those filing are making more money at home, not working than they do working and we need to also consider that some of the PUA money may be attributed to fraud since the self-employed are not paying taxes on a weekly basis.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/