Does Monetary Policy cause all of our Economic Problems & Other Economic News for the Week Ending April 1 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com

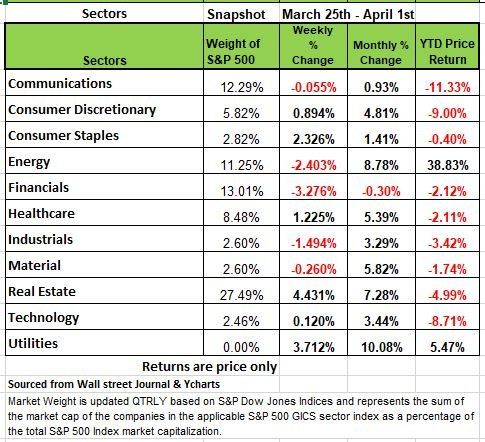

Last Thursday marked the end of the month and more importantly the end of the first Quarter for the 2022. Needless to say, the last 2 years have been somewhat of a challenge for many of us yet the market seemed to behave like nothing happened. Why, because the Federal government threw so much money into the system that it had no choice but to be positive. But all this money is now being pulled back in with Quantitative tightening (helicopter money ceased last September 2021. The month of March finished in positive territory with all of the 4 major indices up between 1.08% and 3.58%. Only 1 of the 11 sectors (financials) finished in the red for the month down -.30%. However, all of the indices are still down for the year and the only sectors that are not down are Energy and Utilities. The sectors that impact consumers most next to consumer staples which is almost flat down -.40 basis points for the year.

The big news in the Bond markets last week was the inversion of the yield curve. This happens with the yield on the 2-year treasury (2.46%) is higher than that of the 10-year treasury (2.39%). How does this happen? Prices are prices go down the yield goes up, so in this case the price of the 10-year treasury dropped significantly. This is the markets way of saying we are not comfortable in the future of the economy. Historically a recession has followed this inversion 100% of the time. In addition, several of the FOMC board members expressed an interest in raising the fed’s rates by 50bps increments throughout the year. How many times is unknown and we also do not know how long it may take for a recession to occur. What we do know is this, interest rates are going up, the fed is tightening the money supply (QT), inflation is hurting the consumer right now. The labor market is tight but only because so many working adults have not returned to the workforce yet. We want to hope for the best but also want to prepare for the worst. Ignoring the possibility could be costly.

This is where Close articles go New Paragraph

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/