Economic Signals &

Weekly Market Review for weekending April 23, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

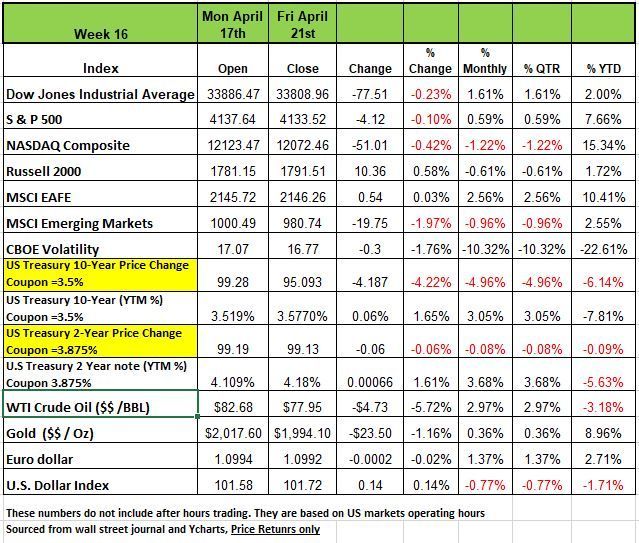

Three of the 4 indices were down last week but just slightly as many companies posted earnings from Q1 and while many beat expectations it was future guidance that weighed on investors. The Russell 2000 was the outlier for thew week with a +0.58% return.

The S&P, the benchmark for the market, ended the week at 4,133.52, down -0.10%, followed by the DOW -0.23% and the NASDAQ -0.42%. All four are still positive territory for the year.

The decline came as Q1 corporate earnings results for many companies have been coming in above analysts' mean estimates, but some guidance has been concerning, as executives have been signaling that they are preparing for challenges ahead which could include a recession.

The downbeat commentary and guidance are being seen by investors as signs that inflation as well as the Federal Reserve's rate increases to tamp down on inflation are weighing on the economy. While investors are hoping the rate increases will help slow down inflation, they are fearful of slowdowns elsewhere in the economy.

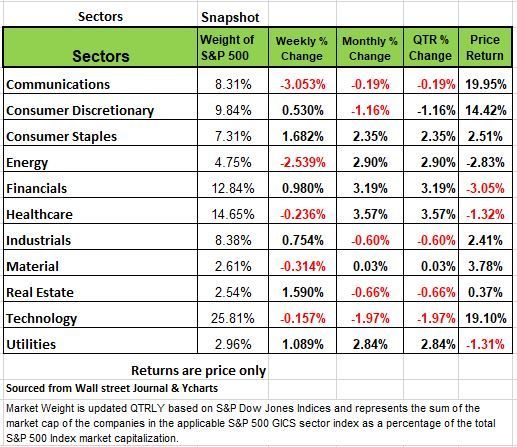

The communication services sector had the largest percentage drop this week, down -3.1%, followed by a -2.5% decline in energy. Technology, Materials and Health care were also in the red.

However, consumer staples led to the upside, climbing +1.7%, followed by a +1.6% rise in real estate and a +1.1% increase in utilities. Financials, consumer discretionary and industrials also rose.

The drop in the energy sector came as crude oil futures fell -5.72%.

This week, earnings reports are expected from companies such as Coca-Cola (KO), Microsoft (MSFT), Google parent Alphabet (GOOG, GOOGL), Visa (V), Pepsico (PEP), McDonald's (MCD), Facebook parent Meta Platforms (META), Thermo Fisher Scientific (TMO), Boeing (BA), Amazon.com (AMZN), Mastercard (MA), Eli Lilly (LLY), Merck (MRK), Exxon Mobil (XOM) and Chevron (CVX).

Economic data will include reports such as March new home sales on Tuesday and March durable goods orders on Wednesday, but investors are likely to be most focused on Thursday's report of Q1 gross domestic product as well as Friday's release of the March personal consumption expenditure price index, a key inflation measure.

Treasury yields rose moderately over the course of the week on strong bank earnings and comments from Federal Reserve officials. Last Monday, Richmond Fed President Thomas Barkin said he wants to see more evidence that inflation is easing before pausing rate hikes, and Treasury yields rose moderately. Then on Tuesday, both Atlanta Fed President Raphael Bostic, who said he favors another rate hike, and St. Louis Fed President James Bullard, said he favors getting the upper bound of the target rate to 5.75%.

Several major U.S. banks reported earnings that beat expectations, leading investors to believe the Fed will be more willing to risk further rate hikes in the coming months. Treasury yields pulled back moderately on Thursday as several economic indicators showed the economy weakening. However, on Friday, Treasury yields climbed moderately again as U.S. business activity climbed higher than expected and Cleveland Fed President Loretta Mester stated she favored raising rates above 5%, because inflation was still too high. Overall, the market implied Federal Funds Rate after the December meeting rose from 4.484 to 4.592 over the course of the week.

Economic Signals

Over the past several weeks we have written about economic concerns as a result of the decision to raise interest rates so quickly after a long period of an abundance of capital with nearly interest-free rates.

Brookfield Corp., one of the largest public real estate companies in the world, defaulted on $161.4 million worth of office building mortgages, this from Bloomberg, as high office vacancy and interest rate hikes have contributed to a string of defaults this year and fueled concerns of a commercial real estate debt crisis. The question on the minds of investors is whether this is a regional problem or potential systemic issue that will impact the financial system.

Brookfield’s mortgage default covers roughly a dozen office assets, primarily around Washington, D.C., and comes roughly two months after the company defaulted on $784 million in mortgages for two other office towers in Los Angels CA..

As interest rates and borrowing costs rise, a shift in our work culture (pandemic-era remote and hybrid work models) have made it difficult to fill offices, in addition to all of the smaller restaurants & retail businesses that survived on those workers have vanished leaving too many vacancies in these buildings and dragging office property values down 25% compared to last year.

Occupancy issues and interest rate hikes had hit Brookfield’s defaulted D.C. office portfolio hard across the 12 properties, based on 2018 numbers when the debt was unwritten vacancies rates averaged between 38%, - 21%. In addition, the increase in interest rates drove the monthly mortgage payments from $300,000 to $880,000 over the past 12 months.

Offices in major cities are still averaging at less than half their pre-pandemic capacity, according to data from Kastle Systems, which tracks keycard swipes.

Brookfield’s default in Los Angeles earlier this year marked one of the first major defaults among big-name real estate companies. Within weeks, Pacific Investment Management Co. also defaulted on $1.7 billion in office mortgages across major cities like Boston, New York and San Francisco, which sent fear through the commercial office industry. It is estimated that between 5 - 10 more office towers may become more at risk of defaulting each month because of low occupancy or maturing debt that would have to be refinanced at a higher rate, with tenants either not renewing, walking away on their obligation or renegotiating at a much lower lease.

Increasing debt default may very well become a major concern for small and regional banks, since they hold approximately 67% of all commercial real estate loans in the country. It is estimated that $1.5 trillion in commercial real estate debt is set to mature over the next two years, meaning that these small banks could face risk of collapse if a large portion of those debts default. Evidence of this was proven when New York-based Signature Bank collapsed in March, roughly half of its lending was to commercial real estate in the area. The magnitude of commercial real estate troubles remains to be seen, however, as loan-to-value ratios are historically low, which would help borrowers afford new loans despite sinking property values and mitigate losses for lenders.

Many city officials have begun efforts to deal with the excess of vacant office space in their downtowns, which can become a burden on local economies. While D.C. has struggled with low office occupancy as the federal government is still not mandating in-office work, other major cities are facing similar concerns. In January, New York City Mayor Eric Adams announced plans to open up a slice of Midtown Manhattan to office-to-residential conversions. D.C. Mayor Muriel Bowser’s plan to add 7 million square feet of residential space in the city’s traditionally office-laden downtown, and Chicago is looking at the same situation to create more affordable housing in the loop area. Source https://www.forbes.com/sites/katherinehamilton/2023/04/18/real-estate-giant-brookfield-reportedly-defaults-on-second-major-office-portfolio-this-year-heres-why-it-matters/?sh=361208424981

Over leveraged companies

Commercial Real Estate is not the only sector facing challenges from rising interest rates. As we have written in the past bad behavior always has bad consequences its just a matter of time before it become apparent. Many U.S. companies piled up on cheap debt over the last several years.

The number of U.S. companies with significant leverage are now rated several notches below investment grade and their outlook seems to have turned bleaker in recent months, and default rates for junk-rated companies could more than double in the next 12-18 months. The media has labeled these companies zombies, basically they are barely hanging on to life.

While fundamentally solid highly rated companies are proving resilient during this post pandemic economic environment, businesses with lower credit ratings and floating-rate debt are increasingly struggling with steep increases to debt-servicing costs and a potential recession becomes more likely with continued interest-rate hikes. Still causing more challenges is steep inflation and softer demand which are expected to reduce many of these companies’ profit margins. Poor management with inefficient operations survived when there was an abundance of cheap money. Now with a reduction in the money supply and a significant increase in the cost of borrowing these companies will need to make significant changes to reduce compensation for top management and cut costs across the board.

The higher costs for risky credit will result in more rating downgrades and an acceleration of defaults. Default rates for lower-rated U.S. companies will likely hit 5-6% in early 2024, up from 2.5% from February of this year and higher than the long-term average of 4.7%. A recession as well as an increase in unemployment and wider credit spreads, or the difference in corporate bonds compared with that of safe Treasurys, could cause defaults to rise further.

What triggers a default is becoming more relevant in 2023, because everything is just worsening.

Many defaults are expected to come from companies working through a distressed-debt exchange, this is typically a path for companies to lessen financial burdens and preserve cash by exchanging some debt. The exchange allows companies to reduce their debt load, but very often the reduction is not enough to lead to positive free operating cash flow and eventually is followed by additional defaults.

The top rating firms Standard and Poor’s and Moody’s classify companies pursuing a distressed-debt exchange as being at risk of a conventional default, with the intention of reviewing their financial prospects after the exchange and potentially raising the rating for lower cost debt. A distressed exchange is just an attempt to avoid a formal restructuring process which comes with other concerns, but those attempts aren’t guaranteed to be successful since management rarely makes the sacrifices needed. Source https://www.wsj.com/articles/more-junk-rated-companies-are-facing-credit-downgrades-and-defaults-31680fed?st=4u48knkfxpgwz4w&reflink=desktopwebshare_permalink

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

As of last Friday’s close, the S&P 500 has now gone 21 consecutive trading days without an “outlier day” (trading day beyond +/-1.50%). This marks the longest streak of consecutive days without an outlier since November 2021. The market is trading more efficiently and rationally than it has in the last 18 months. An outlier or two would not be unusual at this point, but nonetheless, the declining frequency of outlier days is positive for overall market conditions.

The chart below shows the number of outlier days for 2021, 2022, and so far in 2023. Calendar year 2021 was a low volatility, efficient market. As a result, it experienced the expected number of outlier days for an efficient market (about 10 – 20 outliers). However, for calendar year 2022 we experienced a bearish, inefficient market and experienced 75 outliers. So far in 2023, the S&P 500 has had 10 outliers, but the extent of those outliers has been less severe and the frequency of them has declined compared to 2022.

Sector Report

Right now, the top ranked S&P 500 sectors, from a risk adjusted rankings, are Consumer Staples, Information Technology, and Communications. Real Estate, Energy, and Financials round out the bottom ranked S&P 500 sectors

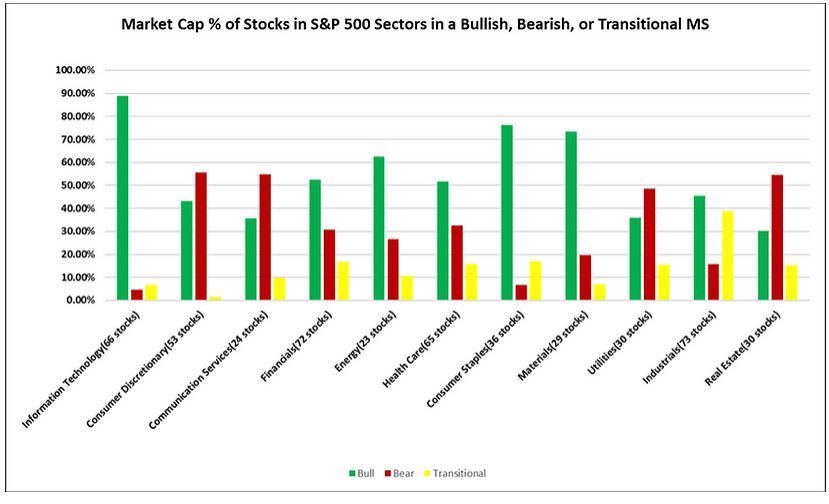

The second chart above shows the percentage of the market capitalization within each sector that is either in a Bull (green), Transitional (yellow), or Bearish (red) Market State. Not all stocks are weighted equal. Stocks like Apple or Microsoft, which are in the Information Technology S&P sector, have a much larger impact on the sector’s movement. In this chart, a larger capitalized stock would be allocated a greater percentage (ex: if Apple is in a bullish state, and represents 20% of the sector’s weight, then 20% of the sector would be bullish).

As you can see from the chart directly above, most of Information Technology’s and Consumer Staple’s market capitalization is in a Bullish Market State. One thing to point out is that Financials, the largest sector in terms of number of stocks, had most of its stocks in a Bearish Market State, (many of these regional banks and debt companies) but most of its market capitalization (the big banks) are in a Bullish Market State. This would imply that while most financial stocks are bearish, a few of the larger financial stocks are not.

Source Brandon Bischof

The Week Ahead

A busy week awaits with the first look at Q1 GDP numbers, inflation updates, Japan’s central bank meeting, and earnings reports. In the U.S., economic growth is expected to slow to around 2% from 2.6% the prior quarter in Thursday’s report as falling retail sales and the banking sector turmoil weighed. On Friday, a slew of key U.S. inflation data arrives, including the Core PCE Price and Employment Cost Indexes, along with personal income and spending figures. These are some of the last puzzle pieces to fit in before the Fed meeting on May 2, with fed fund futures currently reflecting an 85% probability of a 25bps hike. It’s also a big week for corporate earnings, with releases scheduled for technology giants Microsoft, Amazon, Meta, Alphabet, and Intel. Investors will be paying attention not only to top and bottom-line results but also any additional layoff announcements. Other U.S. events of note include consumer confidence, new and pending home sales, and durable goods orders. Overseas, the first meeting for Bank of Japan Governor Ueda convenes late Thursday night, and no surprises are anticipated even as core consumer inflation sits uncomfortably at 40-year highs. Finally, Germany will kick off the first glimpses of Q1 GDP and April CPI for the Eurozone on Friday.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/