Economic Outlook

Week Ending Dec 4th, 2020

Week In Review

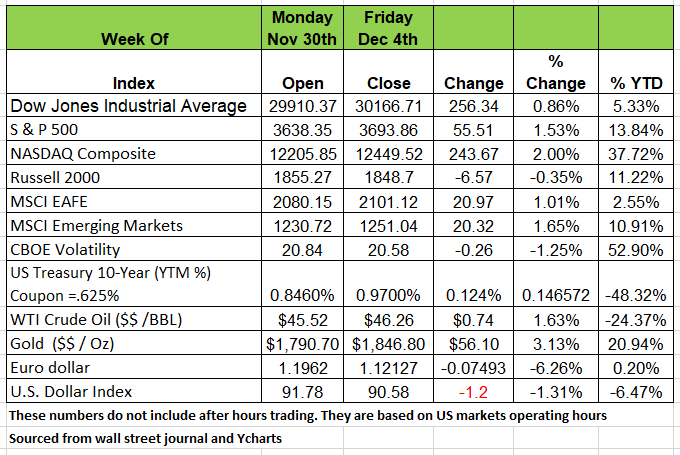

Last week was a week of record breaking numbers in the market. The Dow breeched 30,000 and closed the week at 30,166.71 an increase of 256 points from the previous week. The S&P and NASDAQ also reached record high numbers.

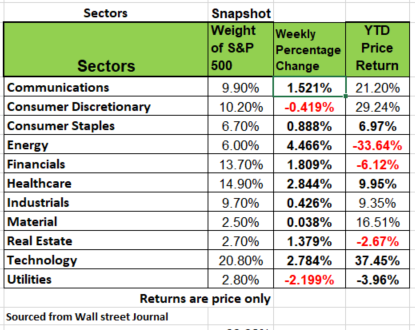

all sectors except Utilities and consumer discretionary were in the black last week with energy rebounding the most with a 4.4% increase. Information technology still is the main driver of this market with a weekly increase of 2.7% and a YTD increase of 37.4% Is there justification for this performance? Will there be a pull back? We think you should be careful and stay on the low side of the greed meter. if you 've made money watch it carefully.

U.S trade deficits widen

U.S. imports and exports rose in October reflecting a recovery in global commerce. China reported a rapid recovery, with a reported 4.9% expansion in its economy in the third quarter from a year earlier, this is what’s helping drive global commerce. The International Monetary Fund projects China will be the only major world economy to grow this year. A bit strange that this global recession started in China. Source:https://www.wsj.com/articles/u-s-trade-deficit-widened-in-october-as-exports-imports-rose-11607089163

Where’s the disconnect?

3 of the 4 major indices hit a record high on Friday with the Dow closing at 30,166.71. The S&P is just below 4000 and the NASDAQ just under 12,500. Yet we still have so many people out of work. While the unemployment data is lower it is not taking into account the number of people that just decided to leave the job force and give up on looking for work. This does not mean that they are retiring. In February the labor force was numbered at 164.2 million. In November it was tallied at 160.5 million a drop in 3.7 million workers since the pandemic broke out. According to Economist David Rosenberg the shrinkage in the labor force is the largest on record (since 1948). In addition, at the end of December the moratorium on evictions and foreclosures will expire. With approximately 8 million people behind in rent with an average of $5,600 that’s approximately $44 billion is losses to landlords, most of whom are small Mom and pop owners with Mortgages. The catch up will be painful. We cannot just allow that money to be forgiven, but we can’t just put so many people on the street. So while the markets seem to be over optimistic about the recovery, we go back to basics, how do we re-employee the labor force.

Source: https://www.wsj.com/articles/covid-shrinks-the-labor-market-pushing-out-women-and-baby-boomers-11607022074

Overview

Recessions are generally the result of bad decision making, both on a government and corporate level. Poor monetary policy, over production creating too high a supply and lower demand are just a few examples. This recession is no different. It's self inflicted (forced government shut down)and I think it will take a very long time to recover. While the market seems to be extremely optimistic right now it generally wakes up to reality, when it comes comes down from its "high".

Most big companies have not suffered significant financial damage, and clearly big tech has allowed much of the economy to operate virtually, but damage to small service industry businesses has been dramatic. What this means is that, while the economy will continue to heal, it will take years to fully recover. Small Businesses owners that lost life savings and leveraged assets to chase the American dream have not hit us yet because so many are staying indoors. Wait until the public gets out of the house and walks down main street U.S.A.

The pace of recovery will depend on more than the just speed of a vaccine rollout. While we watch high frequency data, including TSA checkpoint flow-through, OpenTable reservations, rail traffic, and gasoline usage. These weekly, or daily measures turned up in May, signaling a second half recovery. Now, they have leveled out, and in some cases weakened. "Green Shoots" (an economic term for recovery)are temporarily going dormant due to large state closures. Colder climate states are suffering more as restrictions prevent them from doing business. In addition municipalities are losing money from lost tax revenues, but they can and will increase tax rates which means that the small business owner will have a lower return on their investment for the risk they are taking.

Last week U.S. Treasury bond yields increased towards the long-end of the yield curve. A bipartisan push towards fiscal stimulus made the headlines throughout the week, which pushed long-term Treasury yields higher and steepened the yield curve. On Thursday, House Speaker Nancy Pelosi and Senate Majority Leader Mitch McConnell spoke for the first time since the 2020 election. Encouragingly, both sides expressed a commitment towards completing an omnibus to prevent a government shutdown and a coronavirus relief package before December 11th, the last day of government funding.

Treasury yields fell on Friday, led by the long-end of the yield curve, on a mixed November jobs report. Nonfarm payrolls rose 245,000 in November but were off the consensus expectation by 215,000. The payrolls miss was largely due to a decline in retail jobs, led by softer-than-expected seasonal retail hiring as shoppers avoid in-store shopping, and a decline in government jobs, largely due to the conclusion of the census.

Other Economic Indicators

- The amount of money consumers spent between Thanksgiving and Cyber Monday dropped -14% Y/Y. There was a big shift to on-line sales (+8% Y/Y) but it wasn’t enough to offset the -37% fall in in-person transactions.

- The ISM Manufacturing Index, while still positive at 57.5 in November was lower than October’s 59.3 and disappointed the consensus estimate (58.0). The employment sub-index was 48.4 (Nov.), showing contraction vs. 53.2 (Oct.). (50 is the demarcation between expansion and contraction.)

- The ISM Non-Manufacturing Index also fell in November (55.9 vs. 56.6). Like the Manufacturing Index, this was still positive, but definitely showing signs of deceleration.

- The Fed’s Beige Book, a compendium of business sentiment in the 12 Federal Reserve Districts said that “four districts described little or no growth” and “three of the four Midwestern Districts observed that activity began to slow in early November as COVID-19 cases surged.” Again, remember that these observations are from early November, prior to the renewal of business restraints.

- Even Southwest Airlines, a company that has NEVER had a single layoff, said it possibly could furlough 6,800 to cut costs.

- The Beige Book reported that “Contacts in numerous Districts reported some deterioration of loan portfolios, particularly for commercial lending into the retail and leisure and hospitality sectors. An increase in delinquencies in 2021 is more widely anticipated… many contacts cited concerns over the recent pandemic wave, mandated restrictions (recent and prospective), and the looming expiration dates for unemployment benefits and for moratoriums on evictions and foreclosures.” Source Bob Barone FourStar inhouse economist

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/