Economic Outlook

Week Ending Dec 11th, 2020

Week In Review

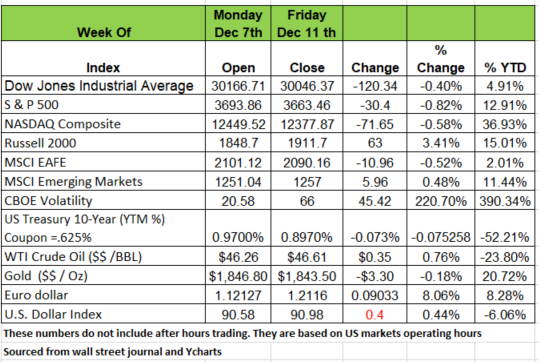

Modest selling pressure crept into large-cap equity indices last week after Congress failed to agree on the coronavirus relief bill, The down dropped 120 points and the S&P was down 30, but the Russell 2000 was up 63 points (+ 3.41%) because the small-caps index continued its rally as optimism grows for a vaccine-related resurgence in 2021 economy.

Despite back-and-forth political posturing, investors seem confident that some deal will be reached before year-end, and a larger package likely looms in 2021. Two IPOs entered the market last week, Door Dash and AirBnB, with the later entering the market at $68/share and reaching a high of $165/share.

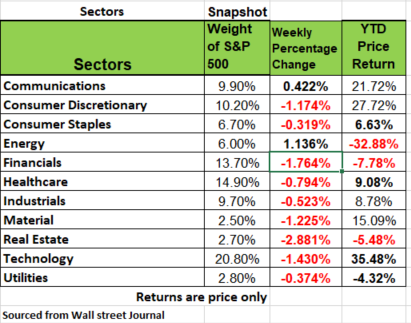

9 of 11 S&P500 sectors fell, led lower by real estate (-2.88%), financials (-1.76%), and technology (-1.43%), while energy (+1.13%) and communications (+.422%).

The Russell 2000’s 15.01% gain in 2020 now exceeds the S&P500’s (+12.91%), which could mark the first time in 4 years the index has outperformed on an annual basis.

On the economic data front, consumer inflation ticked up slightly, and Friday’s consumer sentiment unexpectedly beat expectations, helping support risk into the weekend. Outside of the U.S., the Euro FX rate held near highest levels since April 2018. Investors have remained mostly desensitized to Brexit negotiation, focusing more on the public health crisis, but Friday’s hiccups unsettled both the British Pound exchange rate. Morgan Stanley expects UK equity market to fall 6-10% on a no-deal Brexit.

Longer-term Treasury yields fell more than shorter-term yields last week on new economic restrictions, while lawmakers continued to haggle over a second round of coronavirus aid. The University of Michigan’s Consumer Sentiment Index improved in the two weeks ended December 9, mostly due to a more-favorable long-term outlook for the economy.

The Fed holds its final meeting of the year this week Wednesday Dec 16th. It is widely expected to keep rates unchanged. It caps a busy year in which the Fed cut rates to near zero in response to the COVID-19 pandemic, which has helped push real yields, or what investors earn after inflation, on U.S. government debt below zero.

Last week, the average U.S. investment-grade corporate bond yield also fell below expected inflation for the first time dating back to 2003.

COVID pits squeeze on Pension Plans

Many Pensions and other retirement-benefit programs, especially those in State programs have struggled for years to figure out how to close the gap between the assets they have on hand and the cost of benefits they have promised to pay out in future decades. Their concerns continued to grow as investment returns fall. You may think why since the market has surged so much in the last few years

While the S&P 500 index has surged 15% this year, analysts are projecting weaker long-term stock-market performance than expected. Pension funds typically look for more stable investments to protect assets needed for benefits. However the last several years Bond rates are expected to remain low in the wake of federal stimulus measures, needed to stimulate growth and employment. This means that fixed-income portfolios, the bread and butter of pension funds, will have small returns. Together, those factors are pushing retirement-fund managers across the country to take action to keep shortfalls from growing. Take on more risk or deal with a shortfall. Source: https://www.wsj.com/articles/covid-19-pandemic-puts-squeeze-on-pension-plans-11607509801?mod=hp_lead_pos4

Unemployment Claims

The economy weakened significantly in November, and that such weakness will carry forward to year’s end, at a minimum. The weakness occurred primarily in the services sector as the virus’ resurgence caused some governors to mandate new or additional service business restrictions.

As a result, jobless claims have spiked, travel and hotel occupancy fell to even lower levels, and restaurant and other retail activity faded. Unemployment claims rose 137K to 853K (weekending Dec 5th). When we add in the PUA this number passes the 1MM mark per week.

Yet, despite the economic weakness, and the inability of the Congress to craft a new stimulus package, inflation expectations are on the rise. This will make it more difficult for those unemployed and as we have been stating for months the key to a recovery will be employing the 20 plus million people still out of work many who are no longer collecting benefits. We expect the recovery to be very slow in 2021 at least through the first two quarters of the year. Source: https://www.wsj.com/articles/weekly-jobless-claims-coronavirus-12-10-2020-11607552060?mod=article_inline

Resurgence of Inflation Expectations

The virus isn’t the only phenomenon experiencing a resurgence. Inflation is too! And we see it in the Treasury yield curve. There are two theoretical parts to interest rates; the “real” rate, and the “inflation premium.”

The U.S. Treasury yield curve is the international standard which serves as a reference point when examining yields elsewhere, as it is considered “risk free” as far as the return of one’s principal. Nevertheless, despite the U.S. Treasury curve as the standard bearer, we see that in today’s world, because of the money printing policies of the Bank of Japan (BOJ) and European Central Bank (ECB), nearly one-third of fixed income assets, globally, have negative yields. Yes, you pay them to invest your money in their bonds! These negative yielders include junk credit rated Greek 2-year notes, Italian 5-year notes, and Portuguese 10-years. Indeed, if the latest U.S. CPI (-1.2% Y/Y) is any indication of U.S. inflation, then “real” rates (i.e., inflation adjusted) along most of the U.S. Treasury yield curve, are also negative.

In early August, the nominal yield on 10-year U.S. Treasury Notes hit a low of 0.52% (i.e. 52 basis points – abbreviated 52bps). In early November, as inflation expectations were awakened, that rate nearly doubled to 98 bps, and it was as high as 94bps on December 7th. The rise in this rate is attributable to market expectations that all the stimulus and money printing being contemplated will result in rising inflation. Source Bob Barone FourStar inhouse Economist

Expected this Week

Major economic reports (related consensus forecasts, prior data) for the upcoming week include Tuesday: November Industrial Production MoM), December Empire Manufacturing; Wednesday: December 16 FOMC Rate Decision –December 11 MBA Mortgage Applications November Retail Sales Advance MoM, December Preliminary Markit US Manufacturing PMI and Jobless claims.

Shipment of Pfizer’s vaccine began yesterday, so front-line health care workers and long-term care facility residents may receive it early this week. While some feel the markets are on autopilot until the new year.

While Current options market dynamics hint at a potential equity market melt-up into expiration, fueled by dealer’s negative options positioning. (Options positions expire on the 3rd Friday of each month)

Pfizer news has been powerful. The appetite for those sectors most affected by economic growth is likely to persist into 2021, barring an unexpected fundamental development like vaccine inefficacy or renewed trade tensions. Still, the bridge from here to there or the second quarter is not short, and labor market indicators point towards a plateauing recovery, which should put pressure on politicians to cast aside differences and strike a COVID-19 deal.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/