Economic Outlook

Week Ending Nov 27th, 2020

Week In Review

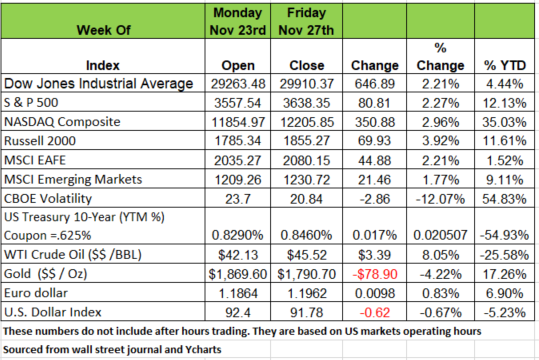

Last week was a short week for the markets with only 3- and one-half days of trading with Friday trading activity closing at noon. The big news last week was that the DJIA passed the 30,000 mark. However, it quickly retracted the next day but closing the week just under the 30,000 mark. All of the other indices were up for the week with the Dow up over 600 points followed by the NASDAQ at 350 and the S&P. Telsa has been added to the S&P 500 so this will put a large buy side pressure on the stock when all indexes rebalance and reconstitute its holdings.

Equities and Bonds

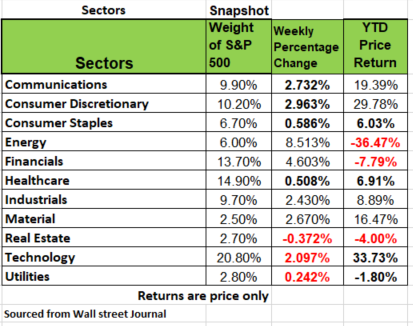

News of a 3rd vaccine last week added more confidence to the market with some stocks having the largest move in many years. Especially the oil industry which has been hit hardest by the pandemic. Remember back in May when oil was selling in the negative dollar range when inventories were so high no one had any place to store crude. The optimism of a fast recovery has impacted equities and bonds, even junk bonds have seen a jump in value, but treasuries are not rallying so much. The bet is that the economy will quickly rebound so the appetite for risk is higher now and moving away from safer instruments. If we look at the sectors hit hardest this year energy was down -50% through the month of Oct and in November the sectors jumped +37%. The Financial and Industrial sectors have seen similar bounces. Fast grow usually means higher inflation, higher yields and lower treasuries. What happens to equity values if the consensus Wall Street view becomes one where the economy takes much longer to heal Source: https://www.wsj.com/articles/stocks-say-covid-recovery-is-nigh-bonds-tell-a-different-story-11606572182?mod=hp_lead_pos3

Have the markets dismissed Economic Reality?

For most of the market’s history, at least until the new monetary policies adopted during the Great Recession, financial markets were somewhat tied to the underlying economy. Not that they didn’t deviate; they often did. We called these “bubbles.” Eventually, the bubbles burst and markets, once again, reflected economic reality. But since the Great Recession, central bank intervention into financial markets has suspended true market price discovery. And, now, it seems, even the Fed believes that it, alone, doesn’t have the tools to keep the economy afloat. For at least the past two months, Fed Chair Powell has asked the Congress to enact additional stimulus programs, and we now find that the policy making arm of the Fed, the Federal Open Market Committee (FOMC) is of the same view. Here is an excerpt from the FOMC November minutes:

...several participants expressed concern that, in the absence of additional fiscal support, lower- and moderate-income households might need to reduce their spending sharply when their savings were exhausted…

And: …households appeared to be rapidly exhausting funds they received from fiscal relief programs…

While markets have pinned hopes for a quick return to “normal” on the rapid distribution of the vaccine and acceptance of it by the American public (both of which remain a question mark), they have ignored the potholes between today and that herd immunity. Source Bob Barone Fourstar wealth inhouse economist

Unemployment

The increase in corona virus cases have spiked with an average of new daily cases reaching 175,000. This has put stress on the healthcare system in the U.S and has also caused more shutdowns in different parts of the country. The week ending Nov 21 had new unemployment claims at 778K about 45K more than the market had anticipated. The state of IL showed the largest jump in claims with an increase of 39%. It is evident that this recession is different from those in the past. While many smaller businesses are closed or had a significant reduction is sales (restaurants, boutiques etc.) many other businesses are flush with cash and operating with a much thinner labor force. So the question becomes will those industries rehire people? Will they go back to operating from an office? The markets seem to be brushing off the unemployment numbers thinking the labor force will come back quickly once the vaccine is distributed. But the probability of a quick rebound in the labor force is low, as we still have over 20 million people unemployed and struggling since their benefits have expired. A stimulus package may weaken the U.S. dollar and cause inflation to rise faster than we want.

Source: https://www.cnbc.com/2020/11/25/us-weekly-jobless-claims.html

Commodities were rather active last week. Gold dropped; copper jumped; and oil prices rose. Economic data was generally disappointing and pointed to a slowing recovery, dented by recent restrictions due to rising coronavirus cases and hospitalizations. Consumer confidence missed expectations, falling flat in October, while the expectations index dove sharply. The number of Americans filing for unemployment rose to 778k from 748k last week, but durable goods orders expanded quicker than expected, rising 1.3%. October new home sales beat expectations, while the prior month’s reading was revised up. The VIX briefly dipped below 20 on Friday before closing the week above the key level. Keep an eye on the U.S. Dollar if it continues to drop imports will rise in price and the recovery will be longer than expected.