Economic Outlook

Week Ending Nov 6th, 2020

Week In Review

Another crazy week. Last week the markets took off after dropping considerably the previous week ending Oct 23rd. Many will give you the narrative that it was because of Joe Biden’s victory over Trump, others will say we are a step closer to a stimulus. But the previous week did end on the 30th and with that came a flow of contributions from 401K plans, buy side transactions boosting up prices.

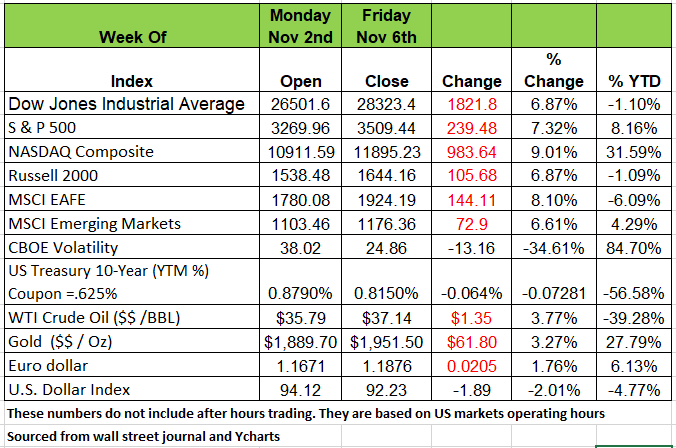

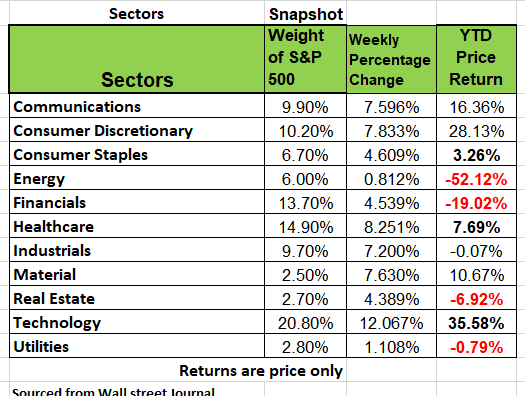

U.S. equity indices soared 7-9%. The Nasdaq Composite (+9.01%) led the charge, while the Russell 2000 (+6.87%) or small caps index underperformed. All 11 S&P 500 sectors finished in positive territory. Technology (+12.067%), health care (+8.25%), and materials (+7.63%) paced the peloton, while energy (+0.73%) was the notable laggard. Gold (+3.27%) and oil (+3.77%) saw gains despite some contradicting fundamentals.

Positive Economic data furthered investors’ appetite for risk. The unemployment rate dropped to 6.9%. although we still believe that the rate is higher with many people having expired their benefit period ISM manufacturing and services PMIs remained in expansionary territory.

On the Illinois Horizon

While American’s were focused on the Presidential elections, Illinois had another very important internal vote going on, that the Governor was trying to push. The Amendment to the Illinois constitution that would allow politicians to change the states internal tax code from a flat tax as it is now to a progressive tier tax rate. You may have seen a lot of the misleading ads calling it a “Fair Tax” initiative. It failed to pass. However, the state still faces a monumental challenge of servicing its debt. Currently the state runs an annual budget deficit of $6 billion. This does not account for all the lost revenue from the COVID Pandemic.

Illinois is not lacking money. State residents already pay among the highest combined state and local tax burdens in the country, with Illinois consistently ranking among the top 10 highest taxed states. Research from the Institute of Government & Public Affairs at the University of Illinois shows from 1998 to 2018 revenues grew in real terms by 47%, but were outpaced by a 57% increase in spending.

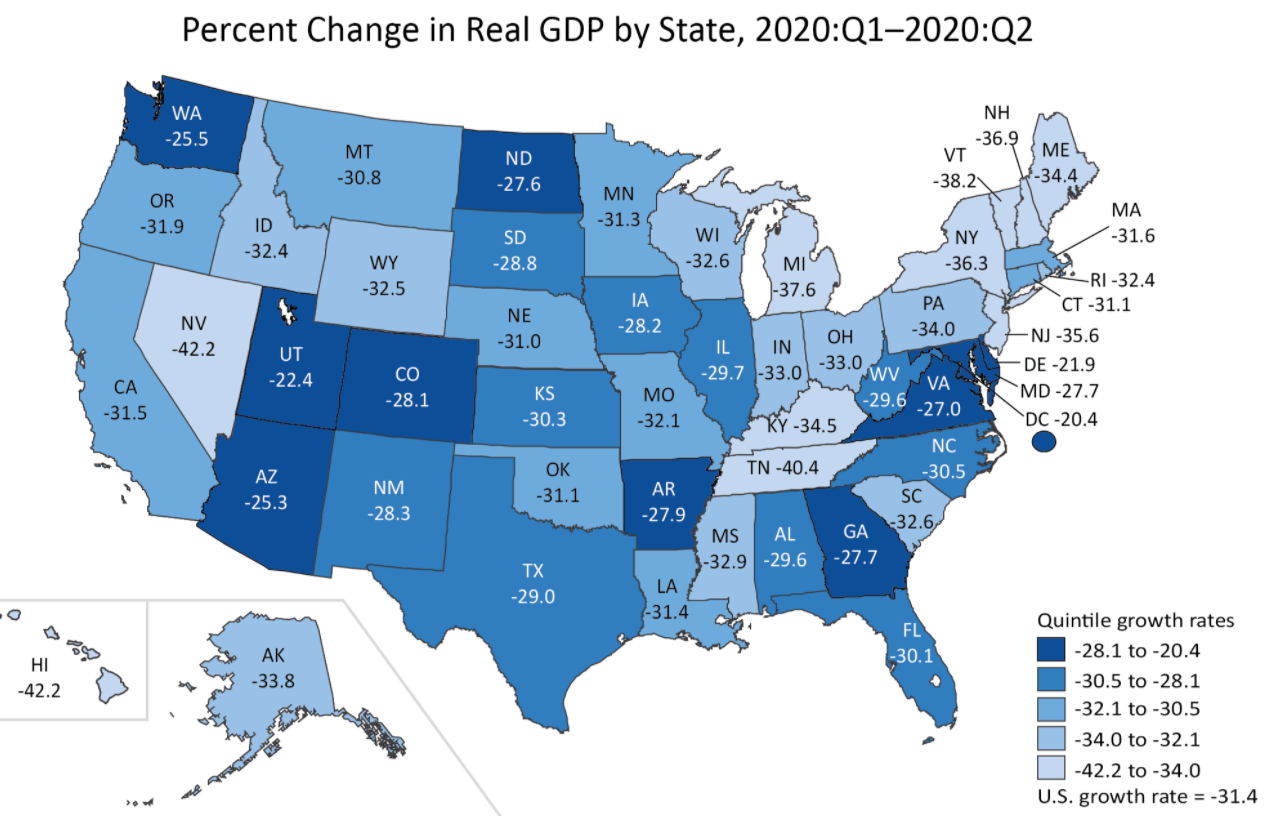

The debt obligation puts tremendous pressure on Illinoisans. The bond rating agencies have put all state municipal bonds at the lowest rate in the country. Just above junk bond status. What does that mean? We pay higher interest rates on bonds we sell which translates to more debt. Bankruptcy laws do not apply to States, we have to dig ourselves out of this mess. Until the pension issue is addressed meaning that retired state employees that have been receiving a 3% cost of living increase (compounded) while inflation has been below 2% for the last decade and the state curbs its reckless spending. In the meantime, all residents of IL should brace themselves for an overall tax increases to make up for the short fall and the debt obligations. The map below shows how much GDP in IL. has dropped during the pandemic. Translating to lower revenue to the state.

How fast will the recovery take?

How do you feel about going out to a restaurant? Taking a flight to go somewhere for vacation. How about going back to your gym? These are just a few of industries that will take a long time to recover, but will also take companies that service those industries time. With the news of a vaccine by Pfizer looking promising, it will not happen overnight. We have created an impatient society, one that expects immediate gratification, when it wants results right away. There are over 330 million people in America and the system is not equipped to handle servicing all of them at the same time.

Bankruptcies and foreclosures will come at a much quicker speed than the vaccine can be distributed and with that economic turmoil and pain. We should have a glass half full outlook and America will bounce back. We just need to be prepared for some financial challenges while we do and keep expectations in check. Back in 2008 during the great recession the worst week in jobless claims was 655K. Back them it took us 18 months to come out of the recession. Todays we have much higher unemployment rates week ending 10/31 had IC at 738K but had reached as high as 898K the week ending 10/10. There are more than 20 million American out of work and until the actual employment rate gets back to a healthy level. Our economy will not snap back.

Bullet Points on Economy

- New and existing home sales appear to have plateaued;

- State and local governments laid off -130K in the recently released employment data. This sector employs more than 19 million people. Without a stimulus that sends financial help, and pronto, we can expect more layoffs here;

- The Census Bureau’s most recent small business pulse survey shows nearly 30% of the businesses surveyed have declining operating revenues. That number is rising from prior weeks. In addition, more than twice as many are reducing hours as are increasing them, and 1.5 more are cutting jobs than are hiring;

- Same store sales (Redbook), restaurant bookings (OpenTable), air travel, and hotel accommodations have all rolled over in October;

- ZipRecruiter has indicated that holiday related job postings are down -18.5% from a year earlier;

- Challenger, Gray and Christmas says layoffs were the highest for any October since 2008 and are up 60.5% Y/Y.

Trade deficit

The U.S. monthly international trade deficit decreased in September 2020 according to the U.S. Bureau of Economic Analysis and the U.S. Census Bureau. The deficit decreased from $67.0 billion in August (revised) to $63.9 billion in September, as exports increased more than imports. The previously published August deficit was $67.1 billion. The goods deficit decreased $3.1 billion in September to $80.7 billion. The services surplus increased less than $0.1 billion in September to $16.8 billion.

Behavioral Economic

Recency Bias

Head or Heart?

Recency bias is cognitive. It describes the tendency to overemphasize the importance of recent events.

It is the tendency to place too much emphasis on experiences that are freshest in your memory—even if they’re not the most relevant or reliable.

Would you want to go for a long ocean swim after watching Jaws? Probably not and many did not when the film was released back in 1975, even though the actual risk of being attacked by a shark was infinitesimally small and still is.

Consider the cost of chasing hot investment trends:

In 2016, energy was the best-performing sector in the S&P 500 Index, delivering an annual return of 27%. A client who subsequently loaded up on energy stocks may have been disappointed that the sector returned -1% in 2017, while the rest of the S&P 500 Index returned nearly 19%.

Just because information or an experience is fresh in your mind does not necessarily mean that the conditions and probability are the same.

"Top 10 Superbowls", Greatest of All Time (G.O.A.T.), and sports awards (such as MVP trophies, Rookie of the Year, etc.) all are prone to distortion due to recency bias. Sports betting is also impacted by recency bias. Such as "Winning Streaks"