Economic Outlook

Week Ending Nov 13th, 2020

Week In Review

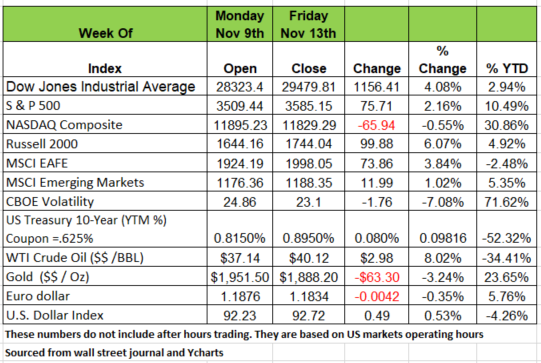

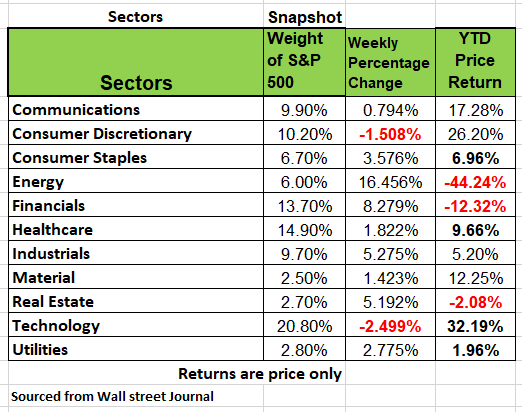

All of the major indices, except the NASDAQ, ended the week on a positive note with the Dow closing up 4.08% for the week. Most of this movement came on the news that Pfizer and BioNtech released information about a vaccine they had with a 90% efficacy rate. Today Moderna release information that they also have a vaccine with a slightly higher rate. However, amidst all of the excitement many are failing to see a slight issue and that is in the area of logistics for these vaccines. The vaccines need to be shipped throughout the country at a temperature of -70 degrees Fahrenheit. This presents a bit of a challenges as the US does not have any systems in place to go cross country with temperature controls at such levels. In addition, the vaccines will not be available until mid-April at the earliest. Leaving much of the nation to deal with the increase of COVID cases during the winter months especially in the colder northern climates. The biggest mover in the markets was in the international sector as hopes of easier trade between Europe Asia and the USA looked promising.

From The Fed Chairman

The Covid-19 pandemic brought the economy to its knees this year, and while it has started its long road to recovery, the economy as we knew it is probably a thing of the past, this was the sentiment of Federal Reserve Chairman Jerome Powell last Thursday.

"We're recovering, but to a different economy," Powell said during a virtual panel discussion at the European Central Bank's Forum on Central Banking.

While the pandemic has accelerated existing trends in the economy and society, including the increasing use of technology, telework and automation, it will have lasting effects on how people live and work in the future.

Technological advances are generally positive for societies over the long term, on a short-term basis it creates disruption, and as the market adjusts to the new normal the pain isn't shared evenly.

It's likely that lower-paid workers, as well as those in jobs requiring face-to-face interactions, such as retail or restaurant workers, will shoulder most of the burden of this shift. These groups, heavily skewed towards women and minorities, have already been among those most affected by pandemic layoffs. The post-pandemic economy is also at risk of being less productive: women have been forced to quit their jobs due to child care responsibilities during the crisis, and children aren't getting the education they deserve, Powell said.

"Even after the unemployment rate goes down and there's a vaccine, there's going to be a probably substantial group of workers who are going to need support as they're finding their way in the post-pandemic economy, because it's going to be different in some fundamental ways," Powell said.

Washington has spent trillions of dollars to boost the economy in the wake of the pandemic. But jobless workers are still in a tough spot: some benefits have already dwindled and more are set to expire at year-end. Economists are hopeful that the next administration will manage to pass another stimulus bill to help workers and businesses as the recovery continues.

More work needs to be done. Source https://www.cnn.com/2020/11/12/economy/economy-after-covid-powell/index.html

Longer-term Treasury yields started last week significantly higher, pushing the yield curve to its steepest level in three years, but fell for the remainder of the week. Monday’s news that Pfizer’s Covid-19 vaccine showed better-than expected results in its latest trials which sent Treasury yields surging on hopes for higher economic growth. However, multiple days of record coronavirus cases in the U.S. as the week progressed offset some of Monday’s yield increases on concerns that more lockdowns and economic restrictions would be imposed. The University of Michigan’s Consumer Sentiment Index fell in early November, coming in below expectations. The decline in sentiment was due to the recent surge in coronavirus cases

Benefits will expire unless Washington gets it’s act together

Two key programs Congress passed this year to expand and enhance unemployment insurance expire on Jan. 1, leaving millions of people without benefits unless lawmakers can break a month’s long deadlock over a fresh round of pandemic relief. However much of the problem for this situation does come from the fact that those who received assistance spent the money on items that may not have been necessary to purchase. Many did not think their unemployment situation would last very long. Spent money they were given and now face financial hardship.

The risk of jobless workers who missed payments on mortgages, rent and auto loans may face foreclosure or eviction. Economists warn—just as a rising tide of coronavirus infections threatens to undercut the economic recovery. Source