Economic Outlook

Week Ending Oct 30, 2020

Week In Review

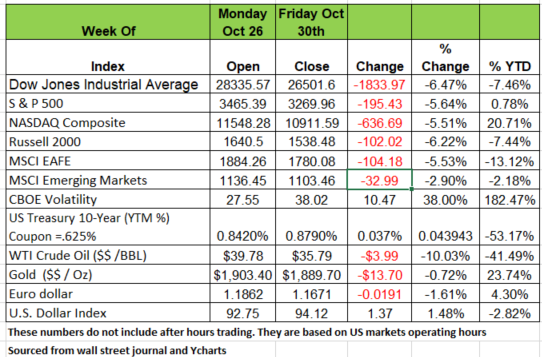

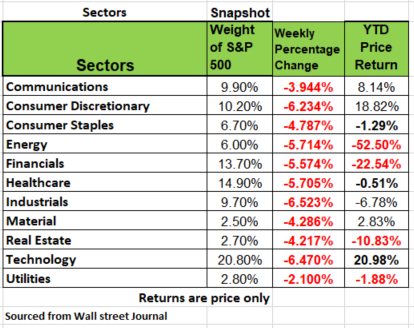

The markets dropped last week. All the major indices were down significantly with declines varying between a low -2.98% in the Emerging markets index to a high of -6.47% in the DJIA. This seems to be a sign that investors are moving to liquidity in the face of uncertainty. While many may be blaming the election outcome as the uncertainty, regardless of who wins the election America will face difficult economic conditions in both the short and long term. Gold prices fell and U.S. Treasury yields rose. All 11 S&P500 sectors finished lower, led by industrials, technology, and consumer discretionary. Utilities, real estate, and materials outperformed on a relative basis as did the equal-weight S&P500 relative to its cap-weighted counterpart. Oil’s decline was vicious as it tested the $35 per barrel level. For the most part, economic data bested expectations. Stronger durable goods orders, solid Chicago PMI, steady consumer confidence, and slumping unemployment claims pointed towards continued recovery, but some housing market data took a breath

Last week the state of IL closed restaurants again. An industry already beaten to a pulp by society’s response of the COVID -19 virus. Right or wrong, the economic consequences are hard to digest. It is not just the restaurants that are hurting. Linen companies that provide table cloths and napkins, food distributors, farmers, the list goes on as each sub sector has a number of providers that are impacted. The same thing applies to the hotel and travel industry. Employment is the key to this recovery. Not helicopter money.

Canary in the coal mine

The term canary in the coal mine has become part of our lexicon as a warning to dangers on the horizon. Originated back in the early part of the 20th century by miners for warnings of poison gas in the mines. Back in 2007 before the crash of the mortgage crisis there were plenty of signs that were ignored. If you saw the movie the Big Short you know what they were. Here are some signals today about debt in fixed income products.

A few weeks ago, we wrote about the emergence of zombie companies, businesses that can barely make enough income to pay down their interest payments on loans, but not principal. So here is the warning sign. Most of these CDS contracts stipulate what a company’s cheapest available bond will be worth at the point of a default. Remember CDS contracts would make an investor whole by paying the face amount of the original bond (generally $1000 per bond) minus the market value of the bond at the time of default. When a company goes bust, these bonds go to auction to determine how much the bonds will get once the company’s assets are liquidated. Over the last 10 years the prices of these bonds have gone between 30-40 cents on the dollar. However, over the last 12 months these rates have an average of 9 cents on the dollar and in come cases as low as 2.5 cents in really bad cases. Why? Because this year capital has been really easy for destressed companies to raise. It has enabled zombie companies to stagger longer. Because bank loans take priority over bonds in bankruptcy this practice has weakened bondholder claims. Too many bond obligations for too little money to be dispersed at liquidation. In addition, a few private equity companies undermined the debt exchanges by transferring assets like intellectual property rights to new lenders. Known as DIP (Debtor in possession) financing is so common now because assets managers are so starved for returns in such a low interest environment that they are taking on more risk. So how does this impact you? Look at your portfolio! Know the under lying investments in your fixed income index or mutual fund. If those underlying investments are filled with too much of this debt. You’re the one left standing when the music stops.

Delinquencies

Moody’s estimates that 12.8 million renters are delinquent with an average of $5,400 owed to landlords. That amounts to $70 billion. The government already gave most of these people an extra $600/ week which was spent on high ticket items they could not previously afford. But we can’t just throw that many people out into the streets, especially since many have no jobs and poor credit. So, will the government step back in? If monies are advanced to landlords, (remember their properties are funded with bank loans or other debt that needs to be repaid) then those dollars will need to be paid back over time. So, renters will now have a larger portion of the income to pay towards rent, which means future consumption for the renters will be lower. And since the marginal propensity to consume of landlords is lower than that of renters, that portion of future economic growth will be lower by that segment of the population.

There are also major delinquencies in the commercial real estate sector (malls, strip malls, department stores…). When those foreclosure moratorium ends, the balance sheets of the banks that hold such paper (mainly the regional banks), REITs, and other forms of such debt (CMBS) will take big hits. This is inevitable. So, will Congress will bail out the holders of such paper? Not unless they realize who the holders are (retirement account funds).

Municipal Markets

The month of October ended with a record-setting amount of state and local government bond sales as municipalities try to take advantage of low rates. Public officials sold over $71 billion of debt last month, which was 22% higher than the previous high in December of 2017, according to Bloomberg. Municipalities face the most pressure from the Virus shutdown. With more than 19 million people employed by state and local governments the amount of lost revenue is staggering and has caused cash crisis. A business owner in this situation would have no choice but to lay off employees. States may be forced to do the same, but also increase your taxes. Source: https://www.wsj.com/articles/bond-insurance-returns-to-the-muni-market-in-a-big-way-11603359014

New 401K law would increase participation across the country

Its not a secret, we all need a nest egg for retirement and over the last several years the government has put policies in place to help motivate Americans to save more. But Americans are far behind in their need to save for tomorrow. Many use the excuse that they can’t afford it and others have no access to a company sponsored plan. But the biggest culprit is engagement. Employers do the minimum to engage their employees to participate. A new bill in Washington is to have auto enrollment a function of the retirement landscape. Auto enrollment would put employees into employer sponsored plans once they met their eligibility. This would help reduce the number of non-participants, only 10% of those auto- enrolled into company plans generally opt out. In addition, some think that the extra dollars from this auto enrollment may keep the market from crashing. As those assets need to be placed on the buy side of securities. Source: https://401kspecialistmag.com/massive-new-retirement-bill-would-expand-mandate-auto-enrollment/

Behavioral Economics

Availability Bias

Also known as the availability heuristic describes our tendency to use information that comes to mind quickly and easily when making decisions about the future. Rarely do we question the accuracy of the information, because it was presented in such a way as to remain in our mind in a positive manner.

Have you ever purchased a lottery ticket? A large number of people do, in fact so many participate in lotteries that it has become a huge source of revenue for local governments. People do it, in large part because lottery organizers spend so much time and energy publicizing those who’ve previously won. When people consider buying tickets, they think about all of those who’ve won in the past (whom they’ve seen in the media), rather than the massive majority of those who haven’t won. Availability bias causes them to rate their own likelihood of winning much more highly. In addition, this flawed thinking has other long-term financial effects. For instance, 60% of the population cannot access $500 in case of an emergency. Yet the lowest income households in the U.S. spend on average $412 /year on lottery tickets. This seems crazy when you think about ti but the reality is they don’t spend it all at once and their thinking is flawed. The same applies to those who invest in index funds exclusively. Has anyone told you that on average the S&P 500 has an annual return of 10%? Not if you enter the market in 2008 or 2018. Be careful of what information is being made available to you and why. Usually someone has an agenda at your expense.