Economic Outlook

Week Ending Nov 20th, 2020

Week In Review

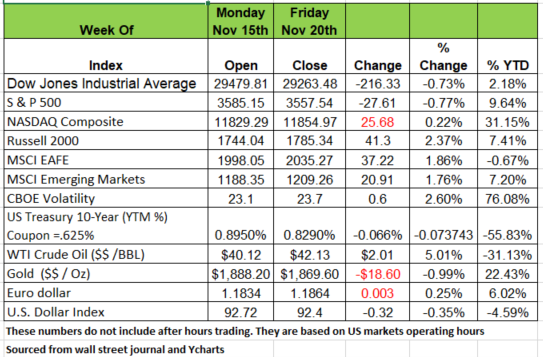

Despite Monday’s positive vaccine news from Moderna, U.S. equity indices mostly treaded water amid surging coronavirus infections and the U.S. The Russell 2000 had the only real positive change of 2.3%

Treasury’s announcement that various emergency Federal Reserve programs will expire at the end of the year. While risk wavered at a broader level, rotation from growth to value continued, evidenced by the Russell 2000’s gain.

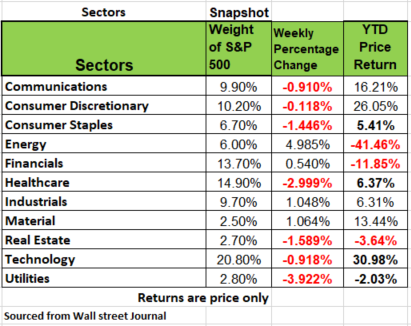

Sector performance sang the same tune, with 5 of 11 S&P500 sectors higher, led by energy (+4.98%), industrials (+1.05%), and materials (+1.06%). Utilities (-3.9%), health care (-2.9%), and consumer staples (-1.4%) underperformed, while the moves in technology (-0.9%) and discretionary (+0.11%) were fairly flat. Housing data continued to impress. Housing starts and permits beat with permits posting +2.8% year-over-year gains. Existing home sales hit its highest annualized rate since 2006. Rock bottom rates and stronger household balance sheets for those still employed continue to support the sector, but key consumer data shows signs of plateauing. U.S. retail sales disappointed across the board. The number of Americans filing for unemployment benefits increased to 742k from 711k last week. Gold fell (-0.9%) , and crude oil prices (+5.01%) rallied firmly.

A Decade of Poor Policy

Since the Great Financial Crisis, much of the “wealth creation” in the U.S. has been via financial engineering and debt creation. Much of corporate policy has been aimed at the company’s stock price with new debt used for stock buy-backs instead of for organic growth via investment in plant and equipment and expansion. Fiscal and monetary policies have been used to save “zombie” companies instead of the “creative destruction” that has been a trademark of U.S. capitalism for the past 150 years.

Zombie Companies, those that can’t cover debt-service payments from internally generated cash flows, now comprise 17.5% (527) of the largest 3,000 companies (Bloomberg), up from 11.2% (335) at the end of 2019. These companies, with the aid of the Fed, added $1 trillion of debt since the beginning of the pandemic and their total debt now stands at $1.36 trillion (vs. $378 billion as of 12/31/19) or 3.6x larger. No wonder the bankruptcy cycle has flattened. And while the Fed has supported such zombies, a WSJ (11/18/20, A3) headline reads: “Federal Dollars Couldn’t Stave off Bankruptcy for Hundreds of Firms.” The article says that 300 companies that received $500 million in pandemic related government loans filed for BK, and that many other that also received funding didn’t file, they simply shut down.

Jobless Claims on the rise

At present levels, initial jobless claims are still higher than they were in any other recession on record.

“Momentum in the economy, all else equal, should continue, but the virus might cause a rise for a few weeks,”. This from Michelle Meyer at BoA economic Global Research

Initial claims for jobless benefits, rose to a seasonally adjusted 742,000 last week, up from the 711,000 filed a week earlier. That level is more than three times higher than the roughly 210,000 typically filed each week in the first two months of 2020, though it is down sharply from a peak of nearly seven million in late March.

Employers have continued to expand head counts in recent weeks. The number of people collecting unemployment benefits through regular state programs, which cover most workers, fell to 6.4 million for the week ended Nov. 7 from 6.8 million a week earlier, on a seasonally adjusted basis, according to the Labor Department. Continuing claims declined throughout the summer and into the fall, as many laid-off workers found jobs or exhausted their state benefits. The number of people collecting these benefits has now fallen below levels reached in 2009, during the last recession. Source https://www.wsj.com/articles/weekly-jobless-claims-coronavirus-11-19-2020-11605753615

Homes Sales up to all-time highs

U.S. home sales rose to a 14-year high last month, a rare bright spot for the economy as ultra-low borrowing costs and the sudden shift in living preferences during the pandemic power the market. But the downside is the number of vacancies in apartment rentals. NYC once was impossible to find an apartment now has so many vacant apartments are available that landlords are giving incentives to attract renters.

October’s gains marked the fifth straight monthly increase and one of the best stretches for the housing market in several years. While home sales showed some signs of life before the coronavirus outbreak, they are running much hotter now. The question now becomes will this reverse once employees find a need to go back to their office for work and move closer to avoid commuting. Source:https://www.wsj.com/articles/home-sales-rise-to-14-year-high-in-october-11605798326

Wave of the new entrepreneur

It was only a few months ago that many economist and finance professionals were stating that we would see a V shaped recovery, a sharp rebound from the sudden economic halt created from the virus.

While some industries have managed and thrived many have not. But employees from those industries have taken survival into their own hands. To adapt to the job loss, more Americans are becoming their own bosses, setting up tiny businesses to work as traveling hair stylists, in-home personal trainers, boutique mask designers and chefs. A man in Maryland started a mobile car-washing business.

Many new entrepreneurs that previously worked in salons, gyms and restaurants, in the kind of face-to-face jobs erased when state orders closed sectors of the economy in the spring, have adapted and used their ingenuity to find ways of surviving. However this applies to a small segment of the population. Many Americans with limited skill sets have more difficulty adapting and will continue to struggle until the economy recovers, which may be several years away. Source:https://www.wsj.com/articles/in-the-covid-economy-laid-off-employees-become-new-entrepreneurs-11605716565

PPP Payback

There is no doubt that the government is taken advantage of by many. When the PPP loans were first offered, we saw a number of business owners from large companies apply and get large loans. Some have given them back because of the bad PR that they received. Now the Small Business Administration has begun asking some Paycheck Protection Program borrowers to document why they needed the loans, drawing concern from advocacy and trade groups that say such disclosures weren’t required when the businesses applied for aid.

This Loan Necessity questionnaire is aimed at borrowers that took loans of $2 million or more under PPP, the federal government’s main coronavirus-aid initiative for small businesses. It directs them to answer questions about business activity and liquidity. PPP loans are forgivable if borrowers meet certain criteria, and the questionnaire makes clear borrowers might be ineligible for forgiveness if they don’t complete it. Borrowers are receiving the questionnaire via the lender that issued them the loan, at the direction of the SBA.

A borrower who is found not to have had an economic need for the loan after a multipronged review process that includes the questionnaire and other steps would be ineligible for forgiveness and would have to repay the loan. Source:https://www.wsj.com/articles/ppp-borrowers-are-asked-to-justify-need-for-loans-over-2-million-11605903702

Asia Economy

While the rest of the world continues to struggle economically and deal with increase outbreaks of the COVID virus, foreign money is pouring into the Chinese economy, not into their real estate market, as in the past, but into their IT, communications, and e-commerce sectors. As far as economic growth is concerned, China and Asia are seeing significant bounce back. They are largely over the virus because they implemented effective controls, some what draconian, but none the less effective.