Economic Outlook

Week Ending Oct 23, 2020

Week In Review

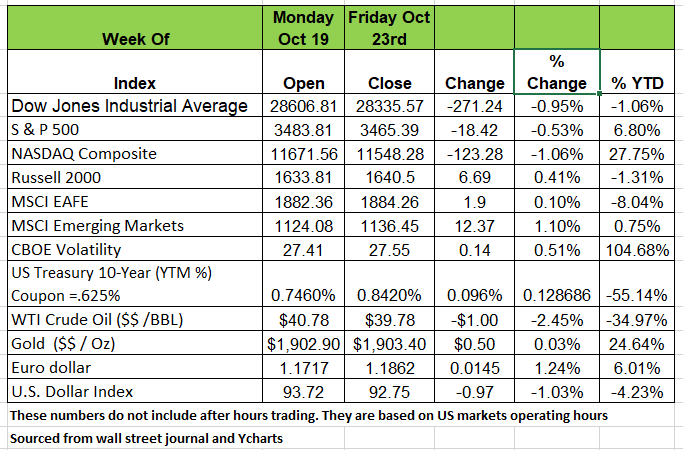

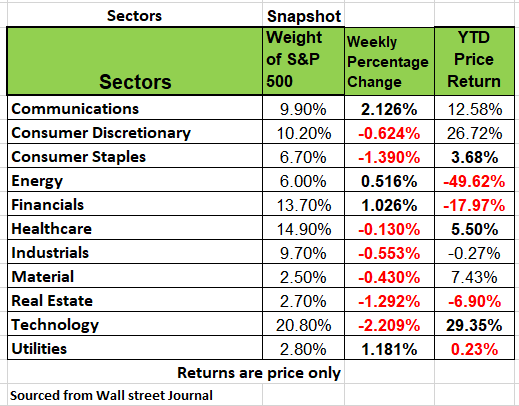

Stocks ended the week slightly lower than last week reversing consecutive weekly gains for the S&P 500. Technology was the laggard sector in the index returning -2.21% versus -0.53% in the S&P 500. Small cap stocks bucked a longer-term trend by outperforming their large cap peers. The Russell 2000 posted a gain of 0.41% last week on the strength of positive earnings results.

In Washington, renewed talks of a stimulus package had the market pointing upward on Friday. Coming off Thursday’s final presidential debate. A surge in positive Covid tests in the Midwest, at a rate three times worse per capita than the Northeast, coupled with rising positivity rates and hospitalizations signaled the outbreaks possible expansion outside of the region. Covid hospitalizations in New York topped 1000, the highest total since June. Hospitals in counties bordering the emerging hot spot state of Pennsylvania were among the notable datapoints.

Treasury yields also rose as investors are expecting Joe Biden to win the Presidential election and the democrats to possibly have more control in Congress, leading to more government spending and higher inflation pressures. On Thursday, the job market showed more strength as initial jobless claims fell to 787k compared to expectations of 870k and continuing claims fell to 8373k compared to expectations of 9625k

Looking ahead to this week, the largest names in tech are set to report quarterly earnings. Investors will have the companies outlooks on their radar as the largest technology names have driven market sentiment over the past few years. On the economic calendar, new home sales and durable goods are set to hit the tape today and tomorrow.

Out of Stock

U.S. factories are rushing to keep up as Americans spend on their houses and vehicles. Production of consumer products has largely recovered after shutdowns this spring related to the coronavirus crippled manufacturing across the country. But as companies rush to restock, buyers are snapping up some items at an even faster pace. Five months after vehicle production restarted, car dealers are still seeing their stockpiles dwindle as public transit-averse buyers flock to the new-car lot and more people relocate to the suburbs. A surge in home-improvement projects has left paint producers with not enough cans and appliance makers short on parts to produce refrigerators, kitchen mixers and washing machines. Some executives say it won’t be until early next year before stock levels return to normal. Source: https://www.wsj.com/articles/factories-rush-to-keep-up-with-post-lockdown-shopping-11603627201

Someone has to pay

Nobody wants to live in a rundown unsafe building. In America we strive to give even those less fortunate some quality of safety in the homes people reside in. That is why we have laws that govern landlords. In NYC new rules about rent control and pricing went into law prior to the pandemic. The laws restrict what landlords can do even when a tenant leaves their residence. But what happens if the landlord is squeezed. Property taxes continue to increase yet rents remain flat. Now add the pandemic and forbearance on monthly rent, and problems begin. Landlords cannot afford to make their mortgage payments and repairs necessary to maintain a safe and presentable living condition. Tenants get further upset and go on strike. Not going to pay for unsafe hazardous conditions, makes sense, right. Now multiply this issue 1000-fold where multiple landlords that received loans for gentrification of neighborhoods, like Harlem and then the wheels stop moving. Those loans were bundled and sold off in bonds So, you might think that’s the landlord or banks problem. But what happens when those loans came from Wall Street and managers of pension funds? They invested your retirement money in commercial real estate or regentrifying neighborhoods. Who ultimately pays? Some landlords are just bad people as the picture painted in the article from the WSJ. However, when looking at economic situations you have to be aware that while some of us may not be directly affected, we are all probably indirectly impacted and just not aware of it yet? Source: https://www.wsj.com/articles/wall-street-funded-plan-to-gentrify-affordable-housing-crumbles-in-harlem-11603618203?cx_testId=3&cx_testVariant=cx_2&cx_artPos=0#cxrecs_s

Pandemic Fatigue

Winters are long in Chicago, no argument on that and this year will seem like the longest ever. It’s bad enough Chicagoans are couped up for months with little sunshine cold and sometimes snowy weather. But this year we will have another challenge to deal with. Collective exhaustion—AKA known as pandemic fatigue—has emerged as a formidable adversary for governments around the world that are counting on a high degree of public cooperation with the latest rounds of restrictions to flatten the infection curve. Too much pandemic fatigue, can fuel a vicious cycle: A tired public tends to let its guard down, triggering more infections and restrictions that in turn compound the fatigue. In addition, attitudes about the virus and the seriousness of it vary. To make things even worse it has become part of the political landscape. Pointing fingers like little children on who’s to blame. But the biggest danger to all of this is the short fuse that everyone has developed and the response we may have to any number of triggers could be dangerous. Last week the mayor of Chicago announce that the 3 day increase of new virus cases reached 6.5%. The mayor increased stricter rules about social gathering bars and restaurants could not stay open past 10 pm. No alcohol sales past 9 pm. Restaurants are already challenged to generate enough revenue to keep their doors open and staff employed. The next step according to the Mayor is a possible shut down if the new case number rises to 8%. Can Chicago and the rest of the world sustain another shut down. Why are guns and ammunition virtually impossible to find. What is the reason for the need to stock pile arms? Are we being pushed to the brink of insane behavior? As tension mount, the economic consequences may be long lasting. Economic destruction does not repair itself over night and whatever may happen over the next few months pay close attention to your portfolio, communicate with your advisor and be prepared to shift to cash should a downturn occur. Source: https://www.wsj.com/articles/pandemic-fatigue-is-realand-its-spreading-11603704601