Economic Outlook

Week Ending Oct 16, 2020

Week in Review

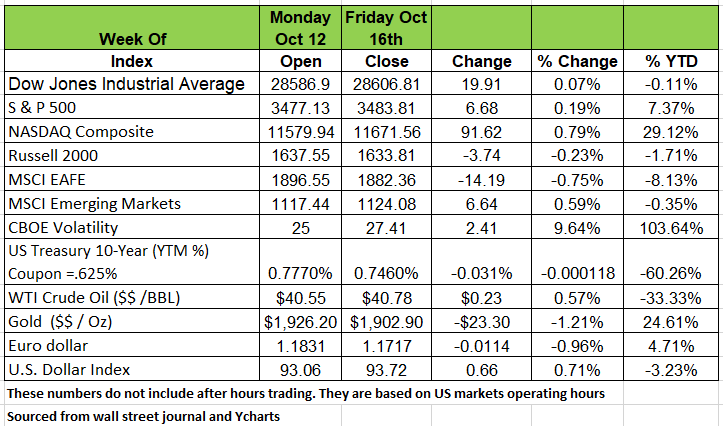

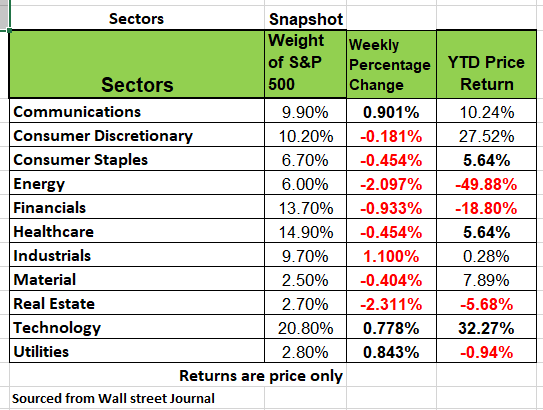

The major indices were relatively flat last week all having movement of less than 1% with the NASDAQ having the largest return of .79% and the Russell 2000 having the lowest of -.23%. 3 of the 11 of the S&P 500 sectors were in positive territory.

Markets struggled for direction last week as global Covid-19 cases rose to their highest levels since summer. The U.S. reported its highest daily infection count in two months and worldwide cases topped 39 million. Limited lockdowns in Europe are being called for amid the increases. Concerns surrounding the use of lockdowns and their impact, coupled with stalled stimulus talks domestically, made for choppy equity markets and (even) low(er) yields. Last week’s Consumer Price Index, CPI, report which was released Tuesday, was up 1.4% on a year-over-year basis. Real hourly earnings declined 0.1% in September. The Producer Price Index, PPI, rose as well in September by 0.4%. Food prices were up but lower energy prices partially offset this. September retail sales were seen rising by 1.9% last week as auto sales soared ahead as they continue rebounding from Q2 lows (this is mostly due to people being afraid to take public transportation and buying a car to commute)

September industrial production was recorded as falling last week and utility output also declined as summer cooled into fall.

Major economic reports for the upcoming week include Tuesday: September Housing Starts; Wednesday: October 16 MBA Mortgage Applications; Thursday: October 17 Initial Jobless Claims, September Leading Index; and September Existing Home Sales Friday: October preliminary Manufacturing PMI.

Mental Health and the Pandemic

The coronavirus pandemic has changed what a normal day looks like for many across the country. And the pandemic has also increased the stress of many Americans. Prioritizing mental health and well-being in the face of a pandemic, which has caused many to lose their jobs or work from home, is something that every single person should be doing, but it often falls by the wayside. More than 1 in 5 Americans have diagnosable mental disorders at some point in their lives, yet only about half of those individuals receive professional mental health treatment. A study from the Mental Health in the Workplace Summit also found that mental illness is the leading cause of disability for U.S. adults aged 15 to 44 and that more workdays are lost to mental health-related absenteeism than any other injury or illness.

- Promote Mental Health Awareness in the Office

- Offer Flexible Scheduling

- Address Workplace Stress

- Evaluate Benefits Offerings

- Train Managers

IRS Announces Maximum EBHRA Amount for 2021

The Internal Revenue Service announced today in

revenue procedure 2020-43 the maximum amount allowed to newly be made available for Excepted Benefit Health Reimbursement Arrangements (EBHRAs) for plan years beginning in 2021. At $1,800, the maximum EBHRA amount remains unchanged from 2020.

EBHRAs were created by the same June 2019 Final regulations that also introduced individual coverage HRAs. Limited in amount, EBHRAs permit employers that offer a traditional group health plan to reimburse additional medical care expenses (for example, to help cover the cost of copays, deductibles, or other expenses not covered by the primary plan) even if the employee declines enrollment in the traditional group health plan. This type of HRA is not permitted to reimburse premiums for individual coverage, traditional group health plans (other than COBRA or other continuation coverage), or Medicare Source:

https://www.irs.gov/pub/irs-drop/rp-20-43.pdf

Coronavirus Tanked the Economy. Then Credit Scores Went Up

In a recent article in the Wall Street Journal the average consumer credit score increased bu.09% The average FICO (Fair Isaac Corporation) increased from 706 to 711 in July Year on Year. So, while the U.S. Economy was heading down the toilet and millions of Americans were losing their jobs, credit scores increased. That makes a lot of sense, NOT. What happened is that most of those that lost their jobs and received the additional $600 /week unemployment support from the U.S government used much of that money to pay down debt. However, what they avoided to pay was their mortgage or rent and since the government allowed forbearance on those obligations the money was used to pay down card debt. The FICO score which includes all debt obligations and calculates debt to income ratios including consistency to make payments, excluded the delinquencies of payments related to mortgages and rent. So, what may look good now will have a horrible impact later. Forbearance is not forgiveness, so if you know anyone that took advantage of not paying their mortgage, they fail to understand the math. Not paying one’s mortgage means that no money went into paying down the principal and that the interest on that loan is still being calculated and added to the overall loan. Rent is still due so the back rent is still owed to the landlord. What will happen to those individuals or families that need to come up with several months of back rent? Even if amortized over a 12-18-month period most will not be able to manage the extra expense and the credit scores will plummet. Source: https://www.wsj.com/articles/coronavirus-tanked-the-economy-then-credit-scores-went-up-11603013402?mod=hp_lead_pos1

Unemployment, the Real Economic Indicator

To gauge the health of the economy, one needs to look no further than the state of the labor market. And, on that front, the news is not good. At the state level, Initial Claims (ICs) jumped more than +76K in the first full measurement week of October and this is without any reporting from California. (The California IC data for the week of September 26th has been used in the October 8th and October 15th data releases covering the weeks ending October 3rd and October 10th. California is due back on-line for the data release on October 22nd, covering the week ending October 17th. Likely there will be significant upward revisions. Unless California found and fettered out a significant number of fraudulent claims, the Disney and airline layoffs probably swelled their IC numbers – we will know soon!

Additional Info

On October 29th, in ten days, we expect a report that says third quarter real GDP rebounded at a 33.4% annual rate. Remember this is from the bottom number that from where we were

We may make some minor adjustments to this forecast when new reports on business investment, inventories, and international trade are released, but the third quarter will still be one of the largest jumps in output the US has ever experienced. However, Q3 will leave real GDP 2.9% lower than it was a year ago. Without the shutdowns the U.S economy would have grown 2.5% versus a year ago. So, this means that the economy will be about 5.3% smaller that it would have been in the absence of COVID.

This gap will take time to recover. However, the big concern on the horizon is the pressure that will be felt once those that were laid off will need to make their rent or mortgage payments. We may see a devastating number of homeless if unemployment does not get resolved. And we do not believe that unemployment will change as long as the public is afraid to re-engage with one another.

So what does this mean? Are the markets overpriced? Is a crash on the horizon? Hard to say, as we are living in a new era with technology. A significant downturn could happen any time, but predicting one is difficult. The financial markets are usually rising or in a bull market about 85% of the time, and then in correction or bear market mode about 15% of the time. How do you protect yourself?

We believe you should have a plan! Be careful if your portfolio is on auto pilot, meaning you are locked into an index or other funds and having your dividends reinvested. Using trend analysis is one way to protect against major declines. Basically, it kicks in as markets start turning down, so it limits how much money is at risk. A decline of major proportions passes through 10-15% down first. That is the territory in which your model should take action. No one can avoid loss absolutely, but we can endeavor to minimize any catastrophic losses. Because if you need money and have to sell you will be taking the actual loss. If you do not have a plan in place you should find out why. Be care how your advisor frames his answer

Behavior Economics

Part 3 in our series

Framing

You are present a choice in buying a product

Choice A is $120

Choice B is to pay $10.00/month for 12 months

This is not a question of which you would prefer but rather whether or not you would purchase the product based on price.

Example #2

Over the last 20 years the S&P 500 has returned an average of 7.08%

or

Over the last 20 years the S&P 500 has had positive returns 75% of the time

Would you invest with the second narrative

Framing is designed specifically to draw you in and sell you. It is a manipulative tool but one that creates a bias in your mind. Framing

In the first example you may think $120 is too much and the product is not worth it

But for $10/ month why not.

Many financial advisors will go back and frame investments returns in a manner that will make you feel like “I wish I had started back then”. Since licensed advisors are not allowed to predicted future results but the emphasis on past returns using the mathematical average will get your attention. By the way using the mean average is also incorrect. Investment industry uses what is known as the geometric average which is a compounded return. Often but not always the compounded return is lower when negative numbers are part of the equation over a specific period of time. However on credit cards when compounded daily, the cost to you is higher.

The Framing effect bias occurs when our decisions are influenced by the way information is presented. Equivalent information can be more or less attractive depending on what features are highlighted.

When a decision based on the way the information is presented, as opposed to just on the facts themselves is when the flaw occurs. The same facts presented in two different ways can lead to people making different judgments or decisions. In behavioral finance, investors may react to a particular opportunity differently, depending on how it is presented to them.

This is particularly evident with Modern Portfolio Theory (MPT). The issue is that it does not take your entry or exit point into account. If you put money into the market on a regular basis over time you end up making money.

We also saw how the news media using Framing to scare people. During the 2008 crisis all the news headlines were focused on how much money was lost in 401K plans. No mention to how much was made over the last previous 10 years and that most people were still ahead. Just the lose component is Framed.

Framing is a manipulative tool that is used the meet the agenda of someone else.

This is happening everywhere right now especially during election season. The only comment we will make regarding the elections is with respect to the “Fair Tax” referendum in the state of IL. The state is spending 10’s of millions of dollars in advertising on framing a message that will impact everyone so IL politicians can try to get out of the financial problem they created. Think it through what happens when your employer has to pay more. There is less to give employees in raises.

Combating Framing

There are a few strategies for reducing the framing effect. Research has shown that people who are more “involved” on an issue are less likely to suffer from framing effects surrounding it. Involvement can be thought of as how invested you are in an issue.

A 2010 study found that More involved individuals were found to be less susceptible to the framing effect, whereas those who were less involved were more susceptible. We can also use our knowledge of framing to flip the script. That’s half the battle. We can do this through educating ourselves about our investments. The other half of the battle is using the power of framing to put a positive spin on smart financial decisions. For example, when the market drops – as we should expect it will – we can frame this positively by saying its time to buy not sell.