Economic Landscape &

Weekly Market Review

for January 22nd 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

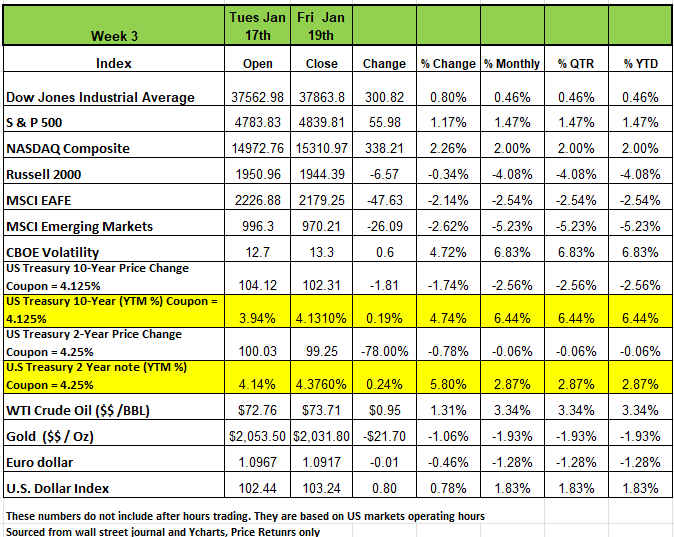

Last week 3 of the 4 major indices landed in positive territory on a short week of trading. The NASDAQ posted a +2.26% return and the S&P +1.17% the DOW was +.80% and the Russell 2000 a -0.34%. Last week. The S&P 500 rose to a record close amid strong gains in the technology sector and a bullish outlook from a chip-industry bellwether. Taiwan Semiconductor Manufacturing said it expects full-year revenue growth in the low-to-mid-20% range. The outlook is considered a key indicator of chip industry health as the company's chips are used in Apple (AAPL) iPhones as well as Qualcomm (QCOM) mobile chipsets and Advanced Micro Devices' (AMD) processors, among others.

Treasury yields climbed last week as solid retail sales caused the market to scale back expectations of aggressive Fed rate cuts this year. Retail sales rose 0.6% in December, which was better than expected and higher than November’s 0.3% gain, while holiday sales in November and December set a record. Adjusted for inflation, retail sales grew a more modest 0.2% in December. Federal Reserve Bank of Atlanta President Raphael Bostic also reiterated last week that he does not expect the Fed to cut interest rates until “sometime in the third quarter,” saying he wants to see more evidence that the Fed is on track to reach its 2% inflation target.

The University of Michigan Consumer Sentiment Index increased sharply in January, well above expectations, following a sharp increase in December. The report showed broad-based improvements in consumer sentiment across demographics as inflation has cooled while the labor market has remained strong, strengthening income expectations. Both year-ahead and long-run inflation expectations also improved. Existing home sales last year dropped to the lowest level since 1995 amid high mortgage rates and limited inventory.

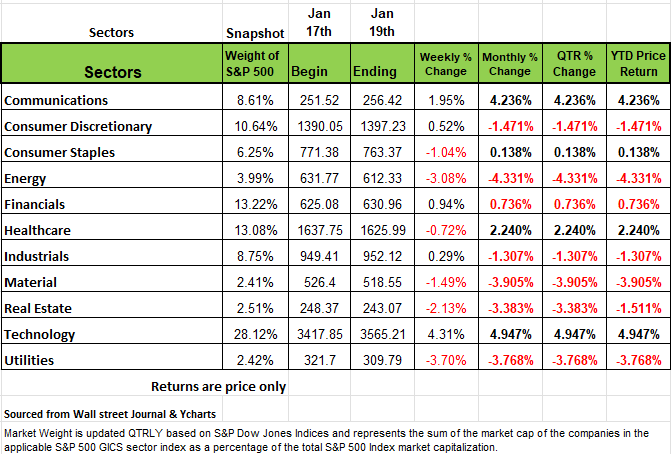

On the Sector side, six of the 11 sectors posted positive returns. The technology sector led the week's climb with a +4.3% increase, followed by a +1.9% rise in communication services. Other gainers included financials, consumer discretionary and industrials. The sectors that posted negative returns last week including Utilities -3.7%, Energy -3.08%Real Estate -2.13% , Materials,-1.49% and Consumer staples -1.04%

The technology sector's gainers included chip industry companies Advanced Micro Devices, up 19%, Western Digital (WDC), up 9.5%, and Applied Materials (AMAT), up 11%.

In communication services, shares of Walt Disney (DIS) rose 3.0% as the entertainment company's board rejected the nominations by activist shareholders Trian Fund Management and the Blackwells Group, and endorsed 12 nominees for directors.

Decliners in the utilities sector included Eversource Energy (ES), down 6.1%, and NextEra Energy (NEE), down 6.2%. NextEra plans to release its Q4 results on Thursday.

Other companies scheduled to report quarterly financial results next week include United Airlines Holdings (UAL), Johnson & Johnson (JNJ), Procter & Gamble (PG), Netflix (NFLX), Tesla (TSLA), Abbott Laboratories (ABT), International Business Machines (IBM), Verizon Communications (VZ), AT&T (T), Visa (V), Intel (INTC), Union Pacific (UNP), American Express (AXP) and Colgate-Palmolive (CL).

Will the Magnificent Seven Continue the Charge in 2024

The primary driver of U.S. index returns in 2023 was the emergence of AI as a significant market driver and the resulting charge of the Magnificent Seven: Apple, Amazon, Alphabet, NVIDIA, Meta, Microsoft, and Tesla. As of mid-December, these Seven stocks had contributed about two-thirds of the S&P 500’s return which as a reminder was +24% last year. But keep in mind until November of last year the S&P was on track for a 10% return on the year which was mostly achieved in January of 2023 As of mid-December, the top 10 stocks in the S&P 500 made up 37% of the weight of the index, a new high for the period of U.S. outperformance. The comparable numbers for the MSCI EAFE and ACWI ex USA indices are approximately 15% and 11%, respectively.

ChatGPT emerged a little over a year ago, on November 30, 2022. With that announcement and the emergence of other AI platforms, these seven stocks fueled AI mania.

The Magnificent Seven began 2023 with a price-to-earnings ratio of about 20x and are wrapping up the year with a PE in line with their long-term average of about 28x. So in short, these companies began 2023 at a steep discount. Of their year-to-date return, more than half derived from the increase in their PE ratio and the remainder from robust earnings growth anchored in the explosion of interest and adoption of AI.

U.S. Equities Face a Conundrum with the Fixed Income Market

Heading into 2024, we see a disconnect between the U.S. equity and fixed income markets. As of late 2023, U.S. equities were priced at approximately 20 times earnings, which is 33% more expensive than the historical average of about 15 times earnings. Moreover, the financial markets anticipate earnings growth of about 12% this year. So, this means that overly optimistic equity investors are willing to pay a premium with above-average valuations in anticipation of above-average growth.

The fixed income market is pricing in about 125 basis points of Fed easing in 2024 in anticipation of slower economic growth and perhaps the delayed recession that many thought was going to happen in 2023. Market expectations for rate cuts were boosted in mid-December due to the dovishness surrounding 2023’s final FOMC meeting.

This just does not make a whole lot of sense to us and find it a little difficult to reconcile these two outcomes: Think about it, a robust economy supporting solid earnings growth and expensive valuations, but not an easier monetary policy. Or you have a weakening economy and likely recession that supports about 125 bps of Fed rate cuts but not robust earnings growth and historically expensive valuations. You can’t have it both ways.

This is just a contradiction to us; equity markets are calling for growth and fixed income markets for recession. The markets need resolve this soon and our concern is that no one is paying much attention to the global climate and potential issues at hand (we discussed a few last week). We think most of our readers / Investors may want to seek some stable returns until this situation settles.

This mixed messaging from markets, leads us to believe that quality and cash flow will be key for equities, and we favor businesses with solid business models with the ability to navigate an environment with elevated levels of uncertainty and recession risk. Focus on a company’s fundamentals.

Since the cost of capital is higher, we expect dividends to play an enhanced role in total return in 2024. Keep in mind that the inexpensive capital of the past decade was a tailwind for many companies with less cash flow, but higher potential growth rates. That is not the environment we are in now. The rapid rise in interest rates that began in March 2022 will cause many problems for poorly run companies and those whose prices relied solely on growth or stock buy backs from borrowed money. This theory we believe should support a shift to more mature companies, ones that produce consistent cash flow, strong moats and have the ability to self-fund future growth. Those companies that survived on cheap money will struggle more.

So, if we are correct, we expect, income will likely play an even more significant role than usual in total equity returns. As the markets continue to process a more normalized cost of capital environment, we expect that there will be more of a shift to favor steadier income-generating stocks. Because investors are emerging from a period of significant inflation for the first time in several decades In addition to the poor performance in fixed income over the last 10 years, its highly likely that equity income portfolios that have produced growing income streams will be an excellent hedge against stubborn inflationary pressures in the U.S. and overseas. Source Thornburg Investment Mgmt.

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

The Nasdaq-100 Index (NDX) has been the clear outperformer since the October 2022 lows, rising 64% to new all-time highs, versus a 38% increase for the S&P500 over the same period. Although technology companies tend to recover better than most after a downturn given their early cyclical nature, there is a more specific theme this time around: artificial intelligence (AI). AI has been around for decades, but only recently has the computing power advanced to a point to launch a new level of technology. Many investors have become familiar with the “Magnificent Seven”, the leading mega- cap stocks, which were covered extensively in our webcast last week. Those seven companies

account for 40% of the market-cap weighted NDX, and they’ve all jumped into the AI pool with both feet. All except Apple (+53%) are up at least 75% since the October 2022 low, with Nvidia leading the pack at +440%—and this doesn’t even include Taiwan Semiconductor, which makes 85% of the top tier chips for AI companies. The Nasdaq-100 Equal Weight Index (NDXE) performance has been much closer to the S&P500, showing how impactful the Magnificent Seven have been. Some research companies project that spending on AI software will grow at a 42% annual rate into 2030, at which time it would represent a $14 trillion industry. For comparison, AI software’s total market value in 2021 was barely $1 trillion. The future is coming fast, and it’s going to look very different than today.

The Week Ahead

Central bank decisions, global flash PMI surveys, inflation readings, and U.S. fourth-quarter GDP are all part of a busy economic calendar this week. Things kick off later tonight with the Bank of Japan’s monetary policy decision, though consensus expects rates to remain unchanged until at least March or April. However, investors will scour Governor Ueda’s statement for clues indicating when rates may move out of negative territory. On Wednesday, the Bank of Canada will have to factor in high wage growth and shelter costs that may keep inflation risks elevated and push potential rate cuts to later this year. The European Central Bank meets on Thursday and has also singled out wages as the biggest impediment to bringing down inflation. Economists expect the ECB’s first rate cut to arrive in Q2, but the actual timing remains very much up in the air. In the U.S., the first estimate of Q4 GDP growth arrives on Thursday, while December’s Core PCE Price Index follows on Friday. Both numbers should influence the probability of a rate cut in March, which currently sits near 50/50, according to CME fed funds futures. GDP is expected to come in around +2%, well below the +4.9% of Q3, but still indicative of a healthy economy. Other U.S. data includes durable goods orders, new and pending home sales, and personal income and spending figures. Netflix, Tesla, Intel, American Express, and Procter & Gamble are some of the corporate earnings announcements to watch throughout the week.

The flash PMI surveys released late Tuesday into Wednesday should provide a pulse for global business conditions at the start of 2024. Other international data of note include German business and consumer sentiment, Japan’s BOJ Core CPI, and EU consumer confidence

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/