Economic Landscape &

Weekly Market Review

for January 29th 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

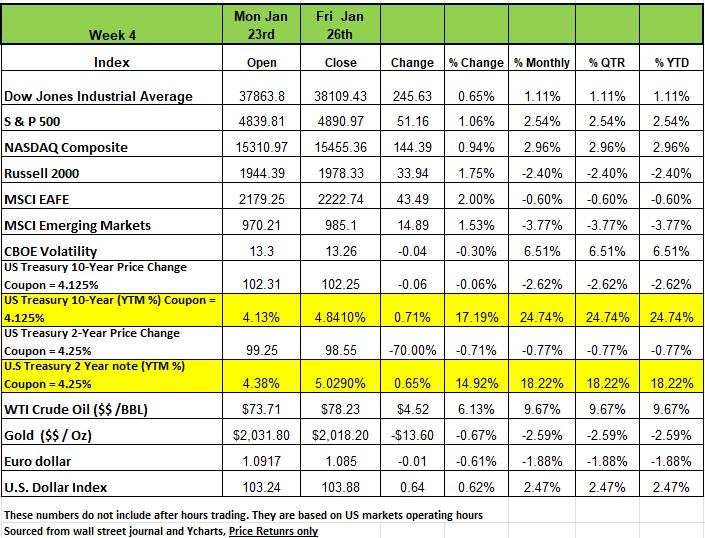

All four of the Major indices ended the week in positive territory wit the Russell 2000 returning +1.75% followed by the S&P 500 +1.06 the NSADAQ +0.94% and the DOW +0.65%. Three of the indices rose for a third consecutive week as the first reading of Q4 economic growth came in stronger than expected and some earnings topped expectations.

The S&P index ended Friday's session at 4,890.97, up from the previous week's closing level of 4,839.81, which was a record at the time. The index continued to reach new closing highs each day this week through Thursday, when it closed at 4,894.16. It set a fresh intraday high on Friday at 4,906.69 but ended just below Thursday's record close. The market benchmark is now up 2.5% for the month.

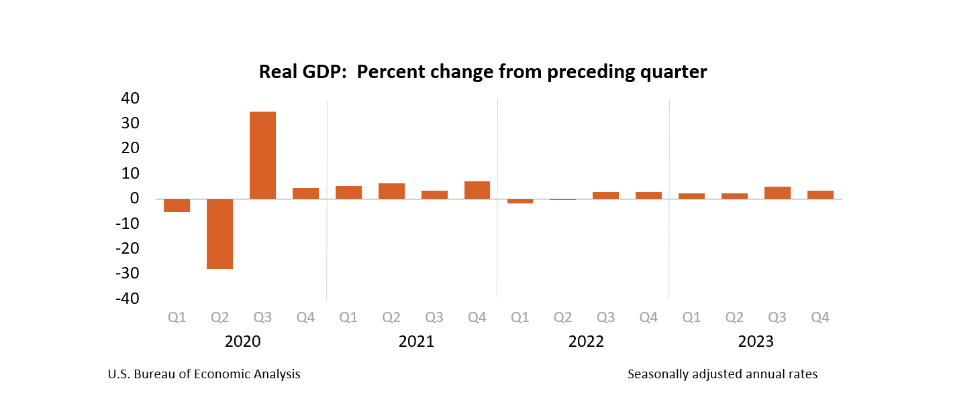

US real gross domestic product rose at an annual rate of 3.3% in Q4, according to an advance estimate by the Bureau of Economic Analysis. The consensus was for a 2% gain in a survey compiled by Bloomberg. In the third quarter, real GDP grew 4.9%. The GDP report came as a number of quarterly earnings reports have surpassed expectations. Companies that posted stronger-than-expected financial results this week included Visa (V), International Business Machines (IBM), Johnson & Johnson (JNJ) and American Airlines (AAL). Its safe to say that the economy is strong and this will be

Treasury yields were mixed last week as short-term Treasury yields fell slightly and long-term Treasury yields rose moderately, causing the yield curve to become slightly less inverted.

The 2-Year and 10-Year US Treasury yields ended last week higher at 4.37% and 4.16%, respectively, the highest level since early December, this despite Core PCE printing at its lowest level since March 2021.

This reinforced investors that the FOMC would hold rates at current levels well past the March meeting Elsewhere, the 10-Year German bund yield fell while UK gilt yields rose, ultimately ending the week at 2.30% and 3.96%, respectively

On Tuesday, the Bank of Japan left rates unchanged while stating that the certainty of achieving projections has increased gradually. On Wednesday, the Bank of Canada also left rates unchanged and signaled that they are finished increasing rates. Short-term yields dropped moderately on Thursday as the European Central Bank signaled that moves to lower rates in 2024 may be earlier than expected.

The market implied probability of a rate cut by the Federal Reserve Bank during The January 31st meeting stayed unchanged at 3%, and the probability of a cut at the March 20th meeting stayed relatively unchanged at 48%. The market implied Federal Funds Rate at the end of 2024 also stayed relatively unchanged at 3.99%. Oil prices rose 6% over the course of the week on geopolitical tensions.

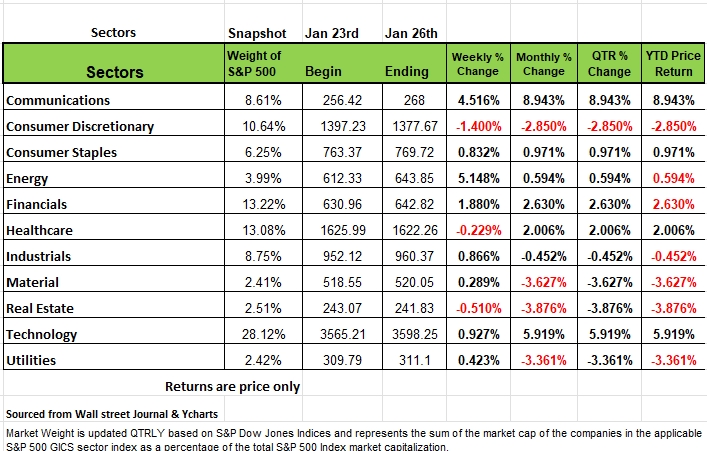

The energy sector had the largest percentage increase of the week, jumping 5.1%, followed by a 4.5% gain in communication services and a 1.9% rise in financials. Other gainers included technology, industrials, consumer staples, utilities and materials.

The energy sector's climb came as crude oil futures rose. Gainers included Halliburton (HAL), which posted fiscal Q4 adjusted earnings per share above analysts' mean estimate despite revenue that was up from the year-earlier period but slightly missed the Street view. Halliburton's shares rose 10% on the week.

In communication services, shares of Netflix (NFLX) jumped 18%. The streaming entertainment company's Q4 revenue exceeded Wall Street's estimates amid stronger-than-anticipated membership growth and the company said it is entering 2024 with "good momentum."

However, three sectors edged lower on the week: consumer discretionary slipped 1.4%, real estate shed 0.5% and health care ticked down 0.2%.

Tesla (TSLA) shares led the consumer discretionary sector's decliners amid weaker-than-forecast Q4 results. The electric vehicle manufacturer's shares lost 14% as the company's Q4 report showed its margin nearly halved year over year. The company also issued a warning that its volume growth this year will likely trail the rate achieved in 2023.

Next week's earnings calendar features companies including Microsoft (MSFT), Google parent Alphabet (GOOGL), Advanced Micro Devices (AMD), Mastercard (MA), Boeing (BA), Apple (AAPL), Amazon.com (AMZN), Meta Platforms (META), Merck (MRK), Exxon Mobil (XOM) and Chevron (CVX).

The focus of next week's economic data will be January's employment figures, with ADP's monthly employment report scheduled for Wednesday and the US monthly nonfarm payrolls and unemployment rate due on Friday.

Soft Landing Narrative

The consumer sector remains the cornerstone of the continued expansion of the U.S. economy. Not much of a surprise, given the continued strength of the labor market. According to the Labor Department, nonfarm payrolls climbed by an estimated 2.7 million in 2023, and the unemployment rate ended the year at 3.7%, which is near a historic low. This situation continues to remained steady so far in 2024, with initial jobless claims in mid-January totaling 187,000, the lowest level since September. Even with all of the publish pending layoffs scheduled by many major companies the tight labor market, which also saw average hourly wages rise 4.1% in December, a rate above price growth at both the consumer and producer levels, has increased the purchasing power of the consumer. Justifying December retail sales increased 0.6%, which is double the consensus forecast.

Current-dollar personal income increased $224.8 billion in the fourth quarter, compared with an increase of $196.2 billion in the third quarter. The increase primarily reflected increases in compensation, personal income receipts on assets, and proprietors' income that were partly offset by a decrease in personal current transfer receipts

Disposable personal income increased $211.7 billion, or 4.2 percent, in the fourth quarter, compared with an increase of $143.5 billion, or 2.9 percent, in the third quarter. Real disposable personal income increased 2.5 percent, compared with an increase of 0.3 percent.

However, Personal saving was $818.9 billion in the fourth quarter, compared with $851.2 billion in the third quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 4.0 percent in the fourth quarter, compared with 4.2 percent in the third quarter. This could be attributed to higher credit card debt.

We don’t know when the Fed will begin lowering rates or how rapidly they will push them down. But we do think that waiting too long, or not lowering fast enough, may exacerbate the an economic downturn. We see debt is either an issue or about to become one. At the federal level, it is now more than 122% of GDP. Worse, a huge amount will have to be refinanced over the next year. With interest costs rising, more and more of the federal budget will be required just to pay interest. The same circumstances are similar in the corporate world where profit margin compression is likely as the debt is rolled over at higher interest rates.

The media will continue to promote the “soft landing” narrative for the U.S. economy, most especially because this is a Presidential election year. The justification seems viable based on Real gross domestic product (GDP) which increased at an annual rate of 3.3 percent in the fourth quarter of 2023, according to the "advance" estimate released by the Bureau of Economic Analysis last week.

In the third quarter, real GDP increased 4.9 percent (annualized). Keep in mind that the GDP estimate released is based on source data that are incomplete or subject to further revision by the source. The "second" estimate for the fourth quarter, based on more complete data, will be released on February 28, 2024.

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

The Technology stocks continue to lead the markets, and as a result, while the market moves higher, the advance decline line has fallen (number of stocks going up versus down).

Weaker Sectors

The weakest sectors so far this year have been Real Estate, Basic Materials, and Utilities. Last week, Utilities wad the only sector to close at new 2024 lows.

Below is a comment form a technician and his opinion on the sector … Utilities are interest rate sensitive and are the best indicator of future moves in the bond market. The complete collapse of the utility sector and the "January Effect" strongly signal that interest rates could be heading higher. With Fed rate cuts on the horizon, it doesn't seem possible. Yet, price is always the final arbiter.

He is right that it doesn’t seem likely that the Fed would raise interest rates considering that there are cuts on the horizon, but it is an interesting observation. Utilities and 20-year treasuries have been almost perfectly correlated for the last year. Both have declined to begin 2024.

Keep in mind that the 3 sectors mentioned above are smaller components weight wise of the markets.

The Week Ahead

The calendar turns from January to February with a full slate of top-tier data. In the U.S., investors will be anxiously waiting for the FOMC statement, monthly labor reports, and a slew of critical technology company earnings to parse through. With real interest rates (adjusted for inflation) having a more restrictive effect on the economy, the Fed may discuss whether to lower rates sooner rather than later to avoid precipitating a recession. A rate cut at the following meeting in March is still seen as a coin flip by the CME Fed Watch tool. The U.S. is expected to have added a still robust 177K jobs in January, but wage growth is forecast to slow further. If accurate, these data points would provide additional evidence of an economic soft landing. Most of the so-called “Magnificent Seven” companies report earnings this week, and investors will be looking for confirmation of those stocks’ recent strength. Other incoming U.S. data include consumer confidence, the employment cost index and non-farm productivity for Q4, factory orders, and ISM manufacturing PMI. Overseas, OPEC is scheduled to meet on Thursday, with no planned changes to oil output policy. Europe will feature January’s preliminary CPI readings

as well as initial Q4 GDP estimates. Germany’s manufacturing sector has been in recession for over a year, and Tuesday’s preliminary Q4 GDP report is expected to show a minor contraction following Q3’s 0.1% decline. The Bank of England meets Thursday, when they are likely to keep rates steady as

wage growth is still stoking inflation concerns. Finally, China’s PMI data will be released late Tuesday, which may reflect Red Sea shipping delays

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/