Economic Climate & Other Market News

for the Week Ending July 8th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

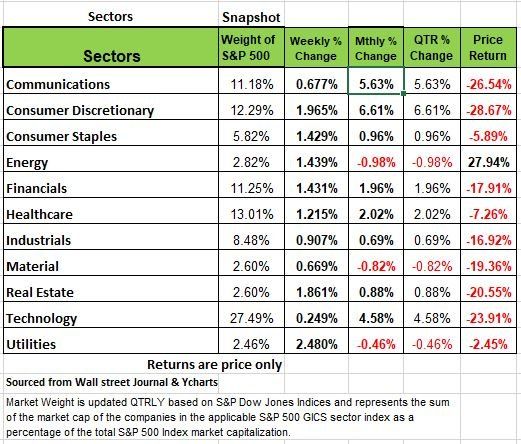

All 4 of the major indices ended in positive territory for the week ending July 8th. This comes off a short week with the Independence Day holiday last Monday. The NASDAQ had the largest rally of +4.56% followed by the Russell and the S&P 500. Oil dropped -3.6 /a barrel and was even lower during the week. This may be a signal that oil production may be meeting the demand or that consumers are driving less. The U.S. Dollar is gaining strength meaning that our exports are costing other countries a lot more. This could result in a drop in what we export.

U.S. Treasury bond yields rose across the yield curve over the holiday-shortened week. Treasury yields fell at the beginning of the week, continuing the trend from the prior week, as the fears of a weakening economy garnered the focus of investors. Investors saw the 2-year, 10-year yield curve invert last week, a perceived leading indicator of a recession. The yield curve inversion came in response to the perceived hawkish meeting minutes released by the Federal Reserve from June meeting.

The meeting minutes indicated a policy rate increase of 50 to 75 basis points despite the downside risks imposed by restrictive monetary policy on the economy. The week wrapped up with a perceived stronger-than-expected jobs report released Friday morning, which we will discuss in this newsletter.

Monetary Policy Mistakes

Monetary policy is one of the driving forces of an economy. What a countries central banks do can have a huge impact on the overall health of an economy. When decisions are made based on politics rather than rationale trouble eventually emerges and often with significant ramifications.

The bond market took a temporary dive. Yields have been temporarily halted and then reversed about 33% (from a high of 3.48% on the 10 Yr. Treasury to 2.89% on July 1, closing at 3.08% on Friday July 8). Keep in mind that prices of bond work inversely to yields. As prices rise Yields drop and vice versa.

There are several reasons for this. The first was what the market considered the “hawkish” minutes from the Fed’s June meetings (released last week). In other words, the market believes that the Fed will continue with an aggressive interest rate agenda. After the June 75 bps rise, the largest increase in decades, what other conclusion could the markets come to other than a more “hawkish” monetary policy.

Second was Friday’s supposedly “strong” jobs report, which theoretically justifies an additional 75 bps rate hike at the Fed’s July meeting. We think they will raise that much (and so do the markets), especially if the upcoming CPI numbers are still uncomfortably high (which is likely).

The problem here is that, since the Fed’s last meeting, the economic data has rapidly deteriorated and the focus on the employment and CPI numbers are the wrong indicators, because they are lagging economic indicators not leading one.

So, let’s look at what has occurred since the last Fed meeting in June:

A Bear Market in Equities has emerged, all indices expect the DOW have dropped +20%.

The dollar’s continuing strength implies weak economies worldwide; and it is obvious that Europe is going to have a significant economic depression.

Credit spreads are widening meaning that there is a flight to quality.

The yield curve has inverted. The 2-Yr Treasury closed Friday (July 8) at 3.105%, while the 10-Yr Treasury closed at 3.080%, This is a classic sign that Recession is upon us and while it has happened earlier this year, we expect it to continue.

Commodity, agricultural and metals prices are dropping, implying falling future inflation pressure.

The Fed seem to be very slow in responding to the economic data and they are focused on the wrong information. Granted they have a lot more experts than we do but we feel that the Feds track record is not all that great and the longer it takes to respond to the warning signs the more painful it will be for the rest of us.

Avoiding the Obvious

As we have written about in the past “Framing” is a term used in behavioral economics to address a cognitive bias in the way we process information based on how it is presented to us. Last week employment report for June was released and many ran with the narrative that the economy was still strong. On Friday the BLS released June’s jobs report stating that +372K jobs were added last month which was above the consensus of +265K, not bad right? This led the markets to believe that the economy could handle another 75-basis point increase next week when the Fed completes is July FMOC meeting. So, let’s look a little closer at these numbers. Keep in mind that the BLS does not include small businesses in its payroll summary so they make a manual assumption based on historical experience. This is often referred to as the birth / death model for small businesses in June this number was over 80K so the actual number of jobs added was closer to +290K. This does seem like a big deal until we keep looking. For the last several months ADP had been reporting negative numbers for small businesses so the +80K increase each month is really off base. Unfortunately, ADP did not report June’s numbers yet due to reworking their system being retooled and they will not be releasing information until end of summer. https://adpemploymentreport.com/ But it’s a high probability that it would be a negative number. One reason we think this is that the BLS own household survey came in with a -315K for June. This survey also reports on full-time and part time. So here is some of the info left out Full time jobs dropped -152K last month. Non-Agriculture wage and salary employment fell -109K and most importantly the average work week contracted -.3% to 40.3 hours and overtime slumped -3.0% a few other indicators on a weak employment environment

Junes ISM Manufacturing Survey, employment sub-index was 47.3, in contractionary territory for the second month in a row (50 is the demarcation between expansion and contraction), and the ISM Services Survey also showed falling employment (47.4). https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/june/

Challenger’s Gray & Christmas June report showed rising layoff announcements, up 57% M/M and 59% Y/Y. Hiring announcements fell -18% M/M, negative in three of the last four months and -6.5% Y/Y. https://www.challengergray.com/blog/job-cuts-surge-in-june-2022-up-57-from-may-59-from-june-2021-highest-quarterly-total-since-q1-2021/

The latest JOLTS report (BLS’ Job Openings and Labor Turnover Survey) corroborates the Challenger report. Job openings fell -427K in June and layoffs rose +77K. https://www.bls.gov/news.release/jolts.nr0.htm

Initial Jobless Claims, too, have risen, now up +62K from their early April lows. Historically, a rise of +60K has often coincided with a Recession.

Continuing Claims (unemployment for more than one week) rose to +1.375 million in the most recent t report from the week ending July 1 is up from +1.305 million less than a month ago.

Call us the contrarians but the information we are seeing does not paint a picture of a strong economy.

While we acknowledge that much of this is up to interpretation and the official arbiter of the country’s economic condition is the NBER we find it hard to believe that so many are avoiding the obvious. We have significant concerns on the Fed’s monetary policy. In order to try to correct the mistakes made prior to and during the pandemic, the Fed is now reducing the money supply while the country is in a recession. It should be increasing, but the Fed got a little crazy during the pandemic by infusing too much money into the system too quickly. Perhaps again because of political or media pressure the Fed is just focused on inflation and unemployment numbers, but these are lagging indicators. Most of the leading indicators are deteriorating. The Fed seems to be failing with its policies. It has become reactionary to the economic climate of the country. This is a bad way to approach the situation. As Jamie Dimon stated back on June 1st that he was bracing for an economic hurricane. Our concern is that the Fed will continue to react slowly and that this will cause larger problems down the road that will take longer to correct. Source Economist Bob Barone Ph’D

Technical Perspective

Overbought/Oversold Conditions

There is a function in technical analysis that many traders use to predict the movement of a security or the market. It is referred to as the overbought oversold condition.

Bear markets are full of volatile fluctuations. That means there will be both significant run-ups and drawdowns. This year, the S&P 500 has seen a +11% run-up in 11 days back in March, as well as a recent -12% drop in 11 days in June. Technology stocks have been even more volatile, experiencing a +15% run-up and -14% decline in those same two timeframes. As the markets fluctuate, we look to overbought/oversold conditions. When the market becomes oversold, a rally is more likely to occur, and when it is overbought, there is more likely to be a decline. As a disclaimer, it is very difficult to predict the timing and extent of those rallies/declines.

A few weeks ago, we discussed that the we believed the markets were 99% oversold, meaning a short-term rally was more likely to occur. From its low point on June 16th, the S&P 500 has run-up +6% through Friday. Looking at overbought/oversold conditions (using AIQ Trading Expert Pro’s proprietary expert rating), the market is now 50% oversold. In other words, there is an equal probability of a rally as there is a decline. Source Brandon Bischof

The Week Ahead

The big news everyone is waiting for this week are inflation numbers. Die to be released on Wednesday. If it continues to remain hot the market will be expecting a higher rate increase. as the committee has made it clear on decelerating growth to temper prices

PPI numbers are out on Thursday. The core CPE index (Personal Consumption Expenditure) and producer prices have been trending lower, but the Fed will need to see a similar pattern in consumer prices.

On Friday, U.S. retail sales are expected to rebound from last month’s negative print, which might be surprising given that consumer sentiment is forecast to linger near record lows.

Earnings season for Q2 gets underway with late-week reports from the major U.S. banks. Other events of note include industrial production figures, Treasury auctions, and the Empire State Manufacturing Index release.

Overseas, the UK’s monthly GDP report arrives Wednesday on the heels of the 0.3% contraction in April. Canada’s central bank may raise rates more than the anticipated 50bps to combat inflation. China’s GDP numbers are likely to fall far short of its 5.5% growth target as Q2 was most affected by pandemic lockdowns

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/