Does the Fed Really know what's going on? other Economic News

Week Ending March 19th 2021

The Fed and the Economy

I am going to start off this opinion by stating the the Federal Reserve, is supposed to be independent, objective and free from political influence. Last week Fed Chair Jerome Powell spoke at a press conference after the FOMC(fed open market committee) and made some comments that were puzzling to say the least. The Fed has upgraded its economic forecast from 4.2% GDP growth in 2021 to 6.5%. Remember we have 18 million people still out of work and that the next rate hike is forecast into 2023. He tried to convince the audience that the do-plot forecast by all 18 members is not what the Fed will do until the get the actual data. Inflation is rising in sectors on the economy but held down because housing rentals is holding it down, all other areas have seen increases in prices, plus the GDP forecast does not seem realistic since most of the spending was done last year on consumer discretionary products, we will not spend that money again on items just purchased. So what happens will simply depend on what you and I do with our money. How will we spend it. no one knows for sure and the forecast on GDP growth seems a bit over zealous. It feels like the Chairman is playing to politics rather than the numbers so that he will get reappointed next year when his term expires. I guess we will just have to wait and see how things evolve.

Recap of last week

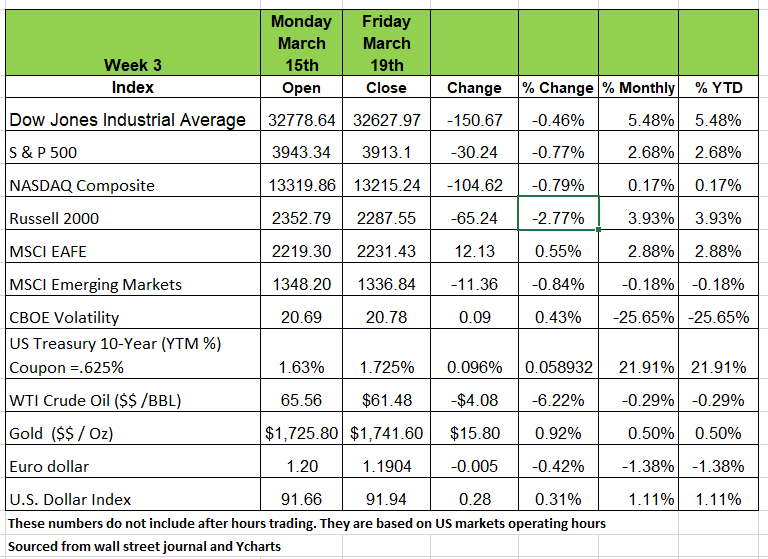

All the major indices were down for the week ending 3-19-21 with the Russell 2000 have the largest decline of 2.77%. As well all of the sectors returned negative numbers with Energy and Financials having the largest decline

Market sentiment wasn’t high enough following the passing and signing of the $1.9 trillion-dollar Covid relief bill. While the population is getting vaccinated at a higher pace than projected 100 million people, we still have a high unemployment number. The question on how the stimulus money is going to be spent is now becoming clear as many are putting it away as savings, others are putting it into the stock market hoping for significant gains and the remainder pf the recipients are paying down debt. So, the economy may not have the influx of spending many projected. Many sectors

Treasury yields continued their rise even as the Federal Reserve met and committed to using its tools to keep monetary policy accommodative. In the FOMC statement it noted that inflation continues to be under 2 percent and that it expects to maintain an accommodative policy until inflation is at 2 percent over the longer run and maximum employment is achieved.

Going into the meeting market participants were looking for any change in stance particularly as to the forecasted expectations for forward rate changes – but the officials continued to project interest rates remaining near zero into 2023, at least. We think this will change

Labor Force

Powell made it clear that the Fed won’t tighten until the labor market “heals.” We feel that the US is far from that. While the official U3 measure of unemployment stands at 6.2%, the Employment/Population ratio has fallen to 57.6%. That ratio was 61.1% pre-pandemic, and the difference between its level then and its level today is a measure of how many people have “dropped out” and are no longer counted in the denominator of the unemployment rate. More than 9 million people have dropped out of the work force. This is a significant number

If you count those as unemployed, the official U3 would be closer to 11.5%. The U6 unemployment rate which takes into the account “part-time for economic reasons” (i.e., want a full-time job but can’t find one)) is currently greater than 11%.

The number of “permanent” job losses (these are the ones that started out as “temporary” job losses in the early months of the pandemic) has soared. These are the reasons why the Fed doesn’t see any tightening until 2024 or more than “transitory” inflation.

The weekly state Initial Unemployment Claims (ICs) also disappointed, rising to 746K (Not Seasonally Adjusted) the week of March 13 from an upward revised 722K (March 6) (revised from 709K).

The total rise was +37K from the 709K that was in the market just prior to the data release. That doesn’t look promising. But, as usual, the market ignored the Pandemic Unemployment Assistance (PUA) numbers. While the state numbers rose +37K, the PUA data fell by a huge -197K, from 479K to 282K.

PUA recipients are those that aren’t covered under state programs (entrepreneurs, self-employed, gig workers, and yes, the pizza delivery guys/gals).

One would expect that, as the economy reopens, the PUA IC numbers, i.e., the self-employed, would lead state ICs.

So, perhaps, this is a sign that the state numbers will soon dramatically improve. After all, the economy was only 43% open at the end of January, but that number grew to 67% as February ended. And has continued to rise into March.

Still, the Continuing Unemployment Claims (CCs), those receiving benefits from more than one week, remained at more than 18 million. The Fed, of course, knows all this, and data like this are the source of Powell’s “still a long way to go” and “we’re going to wait to see the ‘actual’ data” comments. We think that these numbers are not going to change too much in the near future as too many people have no incentive to go back to work

Inflation Narrative

Inflation is still, and always will be, a monetary phenomenon. It generally occurs when "too much money chasing too few goods and services" – but that doesn't mean every period of higher inflation is going to look exactly the same.

How is inflation calculated? The fed measures Month on Month changes in prices in different parts on the country for different expenses an individual’s needs in the cost of living

Below is the weighted categories

Housing (rentals) makes up 23% of the calculation, Food and non-alcohol beverages 16%,

Recreation and Culture 13% Transportation 11%,

Furnishing and equipment 9%, Alcohol and Tobacco 8%

Healthcare equates to 6%, Insurance & Financial services 6%,

Education & Childcare 4%, Clothing & footwear 3%

Communication 2%

Today's case for higher inflation is related to supply. The M2 measure of the money supply is up about 25% from a year ago, the fastest year-to-year growth in the post-World War II era. And while measures of overall economic activity such as real GDP and industrial production are still down from a year ago (pre-COVID), Americans' disposable incomes are substantially higher, boosted by massive payments from the federal government with more "stimulus" on the way.

Right now, the consumer price index is up 1.7% from a year ago. But, this year-ago comparison is set to soar to 2.5%, or higher, as we drop off the big declines in prices we saw during February - April 2020. The extent of this increase will likely be held back by the government's measure of housing inflation (which only focuses on rental values, not home prices).

Excluding rents, inflation will be more like 3.0% this year, and will likely move up by about another percentage point in 2022.

Producer prices are already up 2.8% from a year ago, with much faster growth in prices further up the production pipeline. Remember we have a lot of jobs not being filled because of the amount of money people are getting from the Fed, so production output is lower

Could this mean we are heading back to double-digit inflation of the 1970’s? If you’re old enough to remember, bell-bottoms, disco balls, and stagflation

GDP Growth and the Savings Rate

While the Fed did raise its GDP forecast from 4.2% to 6.5% as a result of the $1.9 trillion “stimulus” bill, the Q/Q sequence is of significant interest. Economist David Rosenberg traced the Fed’s quarterly forecast and found that:

1) there is a growth relapse in the Fed’s Q4 forecast as the stimulus fades,

2) there are only very slight forecasted changes to the Fed’s GDP growth forecast for 2022 and 2023. This is because the “stimulus” is “transitory,” i.e., no multiplier impacts.

If the savings rate rises, which seems likely and always usually occurs after an economic shock (the tech bubble, the housing collapse), then demand fueled inflation is nearly impossible. People who need the stimulus money (the 18 million unemployed) will spend it on essentials like food, rent, utilities, etc.

But those who don’t need the stimulus funds built up their purchases of “goods” in 2020, so there is no pent-up demand for things that normally drive recoveries. W are not going to redo our homes that we just completed last year.

The Parenting Trap

For some parents, life is a rat race, they want their children to win at all cost. For others it’s a race they’ve already lost, or think they have. Why does economics play a role?

Families are in their own world, operating in ways that can seem crazy to outsiders (& often inside), yet it’s the sum of these various & mysterious spheres that makes the world what it is.

The way families function has important economic implications on society. Today’s economy stems from many personal choices about marriage, children, where & how to raise them, education & political beliefs & most importantly values.

The influence runs the other way too, economic factors shape a person’s choices on parenting.

A study by Doepke & Zilibotti in their book, Love, Money & Parenting. How economics explains the way we raise our kids.

They address the rise of the helicopter parent, responsiveness, demandingness. Parenting styles such as authoritarian vs permissive, involved, uninvolved, work ethic, independence, value differences, & income levels.

While income inequality was the central theme, I found it interesting that nothing was addressed about happiness. The pressure we put on kids & how we define success is money central.

Week Ahead

Global PMIs are slated for mid-week, presenting investors with the latest picture on economic activity in the Eurozone and the United States, but investors must first consume Fed chair Powell’s speech and testimony alongside Treasury Secretary Yellen to the House Financial Services Committee on Tuesday and Wednesday. Such appearances by Powell seem like a campaign tour to further engrain into the market’s mind that the Fed does not intend to raise rates until at least the end of 2023. It’s important to remember that it took nearly 7 years after the Great Financial Crisis to lift off the zero-lower-bound.

On a technical basis, equity markets look like a sailboat waiting for wind. Near-term breadth momentum, measured by the McClellan Oscillator, remains flat to slightly negative both the NYSE and the Nasdaq, illustrating the stalemate between bulls and bears.

Longer-term breadth, measured by the McClellan Summation Index, remains positive, and typically, larger corrections don’t unfold without this measure going into negative territory.

The S&P500 and Russell 2000 found support at their 21-day exponential moving averages amid Friday’s rout, so that level should be initial support. The Nasdaq Composite remains below both its near- and intermediate-term moving averages, which offer resistance, but an inverse head and shoulders pattern is forming on the index (click here), a pattern that technicians consider quite bullish. On the correlation front, the market’s desensitization to higher yields seems to be slowly increasing, but if oil remains under pressure or at least consolidates, it might create a headwind for the 10-year yield, which would likely be warmly welcomed by the Nasdaq indexes, specifically high-growth technology names. On the data front, will U.S. housing data suffer as a result of the surge in rates? After all, the U.S. 30-year mortgage rate closed at its highest level since 2018.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/