Do Humans thrive on Drama? other Economic News

Week Ending March 26th 2021

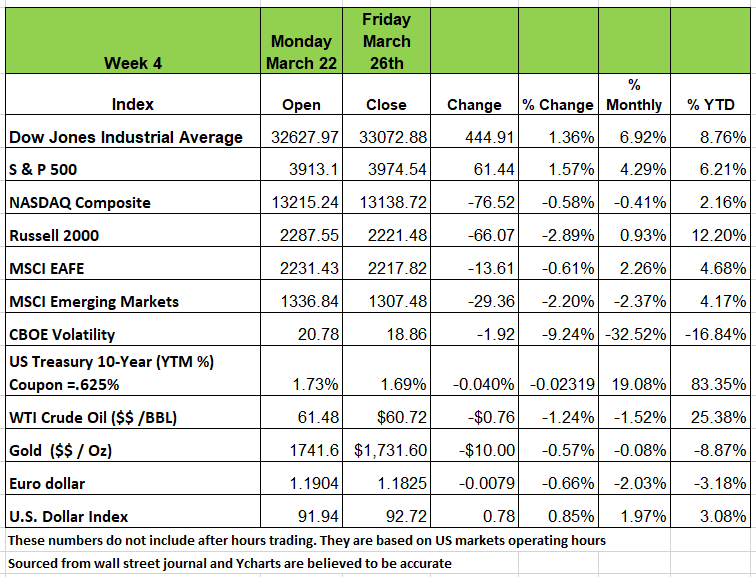

U.S. equity indices fluctuated between gains and losses throughout a volatile week with two of the four major indices finishing the week up more than 1 %. The Russell 2000 stumbled, falling nearly - 3%, as the re-opening trade took a deep breath but is still +35% since the November 9 Pfizer vaccine announcement. While the Nasdaq Composite failed to finish the in positive territory for the week with a -.58% down. Growth outperformed value by 2%, and the equal-weight indices performed marginally better than cap weighted.

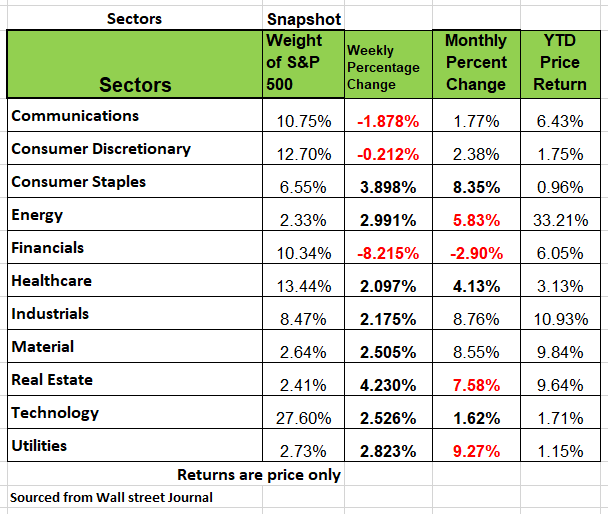

9 of 11 S&P500 sectors advanced, led by the defensive areas. Consumer staples, real estate, and utilities fared the best, while communication services, consumer discretionary, and financials slumped.

Energy dropped precipitously early on but sharply retraced losses after a cargo ship completely blocked passage in the Suez Canal. Precious metals and copper slipped, in line with the re-opening trade’s pause. Fed Chair Powell’s testimony reiterated the FOMC’s belief that inflationary pressures would only be transitory.

Treasury yields modestly declined, while the 2yr-10yr yield curve held near 1.5%. Existing home sales slumped 6% in February, while new home sales dropped 18% MoM, albeit remaining +8.2% YoY. Durable goods orders fell for the first time in 10 months, but manufacturing PMIs improved.

Services activity came in at an 80-month high, supported by the steepest increase in new business in 3 years. Backlogs increased though, while prices surged on unprecedented supply chain disruptions. European PMIs came in much better than expected as well, returning to manufacturing growth for the first time in 6-months. The services sector remains in contraction, hampered by the COVID-19 related lockdowns. Bitcoin fell below $55,000. News of new COVID cases were on the rise effecting younger adults, but vaccines to the older population continues to excel.

Do Humans thrive on Drama?

Are human beings more interested in drama? Are we wired to be more interested in negative information to make life more interesting? An economic professor at Dartmouth (Bruce Sacerdote) noticed something last year regarding COVID 19 television coverage. It always seems negative regardless of the data or information he got from scientist he knew.

When Covid cases were rising in the U.S., the news coverage emphasized the increase. When cases were falling, the coverage instead focused on those places where cases were rising. And when vaccine research began showing positive results, the coverage downplayed it.

So, Bruce did what any economics professor would do, he conducted a study with two other researchers. They analyzed all of the major networks and media publications. They classified all information language into 3 categories, positive, neutral or negative.

The results were grim About 87 percent of Covid coverage in national U.S. media last year was negative. The share was 51 percent in international media, 53 percent in U.S. regional media and 64 percent in scientific journals.

The researchers say they are not sure what explains their findings, but they do have a leading contender: The U.S. media is giving the audience what it wants.

Professor Sacerdote is careful to emphasize that he does not think journalists report falsehoods. The issue is which facts they emphasize. Still, the new study — which the National Bureau of Economic Research has published as a working paper, titled, “Why is all Covid-19 news bad news?” — calls for some self-reflection from those in the media.

“If we’re constantly telling a negative story, we are not giving our audience the most accurate portrait of reality. We are shading it.”

However, we think that there is another reason and it’s all about selling. The more we can engage an audience and make something sizzle the more the audience will be engaged and make it part of their daily dialogue. We can also go back to 8th grade science with Pavlov’s dog? If we condition the public to focus on bad news then the public will want bad news, simply because we’ve been conditioned to.

Source: https://www.nytimes.com/2021/03/24/briefing/boulder-shooting-george-segal-astrazeneca.html

Last Week’s Sell off

How can a fund sell more than it manages? Leverage. And with low interest rates it seems to make sense at times to maximize profitability on positions. This is what happened with Archegos. The hedge fund borrowed money from brokers such as Nomura and Credit Suisse to buy stock. The loans were, essentially, secured with the shares purchased.

Archegos also used swaps. Swaps can help make big leverage possible, and they can hide the ownership of the underlying stocks. In this case, the brokers owned the stocks and there was a contract that said the performance of the stocks belonged to Archegos.

The stocks Archegos owned dropped last week & brokers, worried about their loans, seized their collateral—the stocks—and sold them. When everyone sells at once, prices go down. Viacom CBS stock fell about 30% on Friday. On a given day, the stock can trade 20 million shares. It traded 216 million shares Friday.

The episode isn’t big enough to derail anything. Yes, a lot of Archegos’ capital will be gone, brokers will write off loans, and there will be a lot of discussion about swaps and other derivatives. But it doesn’t look large enough to make a big deal since the losers are a handful of professional firms

Will More Taxes impact the markets?

“A trillion here, a trillion there, a mere bag of shells my friend” ….as Ralph Kramden of the honeymooners would say. The federal budget deficit hit an all-time record high of $3.1 trillion last year and will probably be higher this year. But wait we also have a $4 trillion infrastructure bill hanging in the air to be spent over the next 10 years.

The administration is looking to raise taxes on those families making over $400K per year. If the tax rate for individuals goes from 37% to 39.6%. that would generate about an additional $20 billion in tax revenue. But they could also raise the 35% tax rate to 39.6% both together would generate approximated $681 billion based on 2019 numbers. This would be like filling a swimming pool with one bucket of water at a time. Not very effective

If transportation secretary Peter Buttigieg gets his way of taxing on auto mileage, we may have bigger problems economically. Its almost certain that the corporate tax will go from 21% to 28% and that capital gains and dividends will go to 24% from 20%. What about estate taxes? Should we lower the exemption threshold? Should families that spent a lifetime building up their assets be forced to liquidate 50% of their asset valuation. This does not just apply to the mega wealthy. This would hit middle America the hardest especially farmers/ ranchers and small business owners. Think of a family business worth $6 million in property and equipment maybe it throws off a few hundred a year in post-tax profit. Should that be liquidated to meet a tax obligation? The real issue here is that we make big brush strokes and generalize. Just because we think that someone could afford something, doesn’t mean its right to tax them more.

The Week Ahead

Month- and quarter-end flows hang over the market this week with the last day falling in the middle of the week.

The shortened holiday week features a docket full of Tier 1 economic data. Revisiting As the calendar turns, April offers investors a potential seasonal tailwind. Historically, it’s been the strongest month for the S&P500, higher 74% of the time since 1964 by an average +1.7%.

Rebalancing of portfolios could create a few speedbumps though. Over the last 3 months, 10-year yields have risen 74 basis points, while the major U.S. equity indices have climbed modestly. The S&P 500 and Nasdaq Composite are +4.29% and +2.16% respectively, but equal weight S&P500 is +11.52% as the median stock has performed better than the market-cap behemoths.

The monthly jobs report is on Friday, but markets will be closed in observance of Good Friday. Next Sunday’s futures opening could be chaotic as global investors react to our labor market situation, but they also may place more weight on the ADP report mid-week. Both are expected to show solid job creation, but the Fed remains focused on the slack in the labor sector, which is illustrated through the underemployment or U6 rate.

Tuesday’s consumer confidence is poised to jump sharply given the stimulus deployment and vaccine progress. Keep an eye on Chinese growth data Tuesday and Wednesday night. The Chinese indices have fallen 10%+ in recent weeks, but technical indicators look rather oversold. Lastly, Eurozone inflation data emerges on Wednesday, which will likely drive currency flows for the U.S. dollar.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/