Economic News

Week Ending February 5th 2021

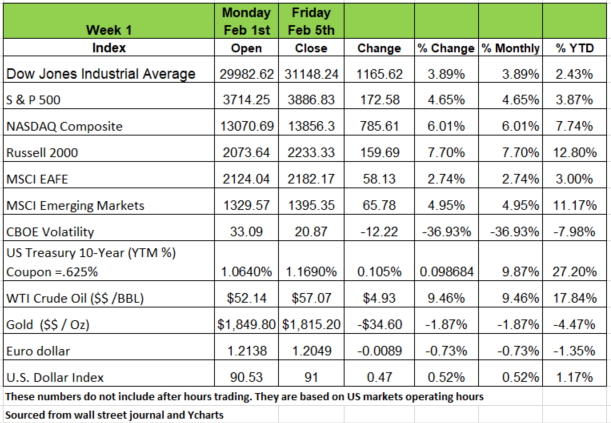

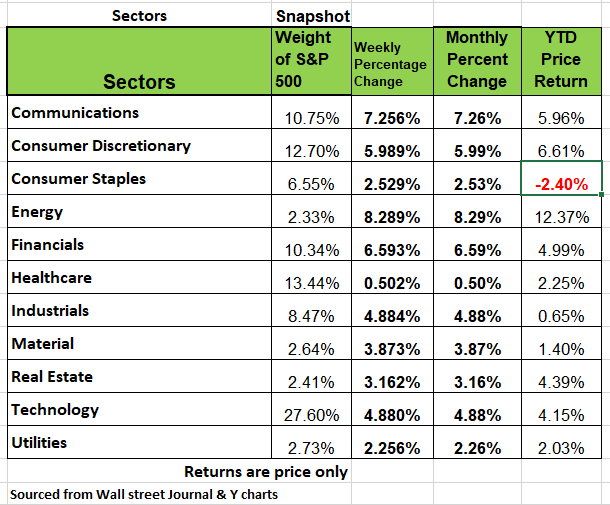

The markets bounced back with a vengeance last week after closing the last week of January down significantly. All of the major indices were up considerably with the Russell 2000 leading the pack up 7.7% and the NASDAQ 6.01%. The energy sectors lead the week with prices increasing 8.29% followed by communications 7.26% and financials 6.59%. Distribution of the COVID vaccine is now the main priority as so much focus was place on development, that the country now faces logistical challenges. The NFL has announced that municipalities across the country can use stadiums to set up vaccinating centers.

Last week’s highlights

Last week, the steepening yield curve trend continued with shorter-dated US Treasury bond yields down and longer dated US Treasury bond yields higher. The two-year Treasury note yield matched record lows on Friday, while the 10- year US Treasury bond yield hit year-to-date highs.

Monday’s ISM Manufacturing Index survey missed the consensus expectation but signaled manufacturing expansion. Most notably, the manufacturing employment index and supplier deliveries increased. Tuesday’s ISM Non-Manufacturing Index survey came in stronger than expected, while signaling further expansion.

New orders hit a six-month high and the non-manufacturing employment index increased.

Employment data continues to be a challenge, with the number of people collecting unemployment has come down most of this is due to expiring benefits.

Does the Fed think Money really Grows on Trees?

Should the Federal government get involved in boosting the economy & if so, at what cost? Some economist believe that government involvement is necessary to stimulate growth & some people really need help in this environment. But how much is too much?

There is an economic theory called the Ricardian equivalence, that basically states that financing government spending out of current taxes or future taxes (& current deficits) will have equivalent effects on the overall economy.

Basically, this means that attempts to stimulate an economy by increasing debt-financed government spending will not be effective, because people understand that the debt will eventually have to be paid for in the form of future taxes. In this environment the money received will pay off credit card debt & past due rent or be saved. Not spark new purchases.

But what is really at stake here is that each infusion of Federal assistance results in massive debt increases that weaken the U.S. dollar. A continuation of this fiscal policy puts the U.S. dollar at risk of being the reserve currency to the world. A loss of this status would be highly inflationary on imports & foreign sourced raw materials.

The Week Ahead

The VIX or volatility index has closed above 20 for the last 242 trading session. So much has transpired in in that time good and bad, but volatility has refused to subside. Its inevitable normalization may be the missing piece to investors’ calculations.

Many believe the current prices resemble 2008-2009, and if history is any guide, equities may keep moving upward until mid-to-late April before hitting some turbulence. The $64K question is whether it will be long term or temporary. We tend to see pockets of volatile, speculative trading activity which improperly illustrate the current state of market affairs.

The economy is continuing to recover, both at home and abroad, as vaccination efforts spread, and if a stumble comes, fiscal and monetary policy will undoubtedly offer an arm to stabilize. This remains supportive to equities and government bond yields as well as credit markets.

Roughly 59% of the S&P500 has reported earnings, and 81% have beaten EPS estimates. Per FactSet, the blended EPS growth rate is +1.7% y/y versus December 31’s estimate of -9.3%.

For now, investors will continue economic implications of the race between vaccination and virus mutations. Where consumption will increase, and the likelihood of inflation across the economy.

This week’s consumer price index report will offer insight into the economy’s price pressures, while the Treasury auctions on Wednesday and Thursday will gauge investor’s appetite for government paper. Lastly, an updated look at consumer sentiment emerges on Friday

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/